Robo-advisors like Wealthsimple and Acorns have been surging in popularity recently with low fees, simplicity, convenience, and modern apps and interfaces, especially among young, new investors. Here we'll compare Wealthsimple and Acorns.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Wealthsimple vs. Acorns – Summary Comparison

Contents

Wealthsimple vs. Acorns – Commissions and Fees

Neither Wealthsimple nor Acorns has commissions on investments, but you can't really choose your investments anyway so you're not going to be making any trades like you would with a traditional brokerage. You will still have to pay the unavoidable expense ratios on the ETF's (exchange traded funds) in which you're invested with both platforms.

Acorns has 3 tiered account levels with different fees and different features:

- All 3 account levels have an individual taxable investment account called Acorns Invest.

- Their Basic plan at $1/mo. is just a taxable investment account.

- The Plus plan at $2/mo. includes access to retirement accounts – called Acorns Later – in the form of a Traditional IRA, Roth IRA, or SEP IRA.

- The Acorns Premium plan is $3/mo. and adds access to an FDIC-insured checking account called Acorns Spend.

Wealthsimple carries a 0.50% annual fee for their Basic plan. Upon reaching an invested balance of $100k, you qualify for their mid-level “Black” plan that has a reduced 0.40% annual fee and a financial planning session. Once you reach a $500k invested balance, their premium “Generation” plan includes dedicated advisors, in-depth financial planning, and a personalized portfolio made just for you. Acorns does not offer any human advising.

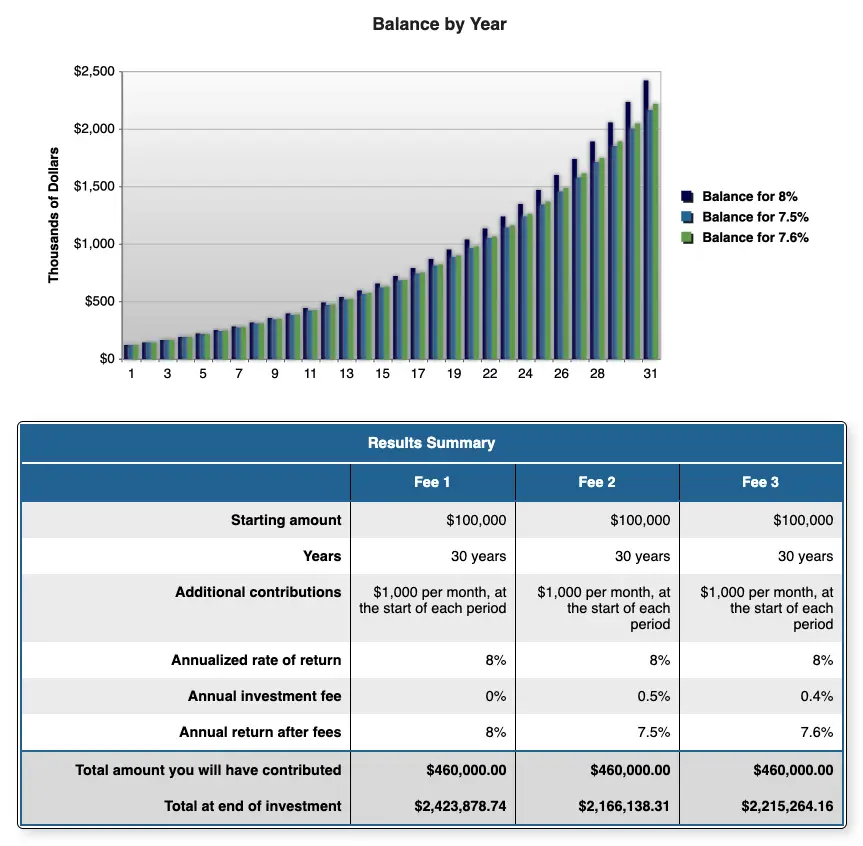

These annual fees from Wealthsimple are based on a percentage of your invested balance, also known as assets under management (AUM). These fees may look extremely low at first glance, but let's examine how they affect a portfolio's value over time:

Using a starting balance of $100,000, $1,000 contributed monthly over 30 years, and an annualized rate of return of 8%, Wealthsimple's reduced 0.40% fee costs you $208,615 in fees.

Notice how the value differences become more pronounced near the end of the investing horizon when the account value is larger. Such is the power of compound interest, in this case unfortunately working against you.

So obviously Acorns wins out on fees.

Wealthsimple vs. Acorns – Account Types

In the United States, Wealthsimple offers these account types:

- Individual (Taxable)

- Joint

- Traditional IRA

- Roth IRA

- Rollover IRA

- SEP IRA

- Trust

Acorns offers most of those:

- Individual (Taxable)

Joint- Traditional IRA

- Roth IRA

- Rollover IRA

- SEP IRA

Trust

Neither platform offers:

- SIMPLE IRA

- Solo 401(k)

- 529

- Custodial

- HSA

- Non-Profit

Wealthsimple offers a broader range of accounts in Canada since they are based in Canada.

Wealthsimple vs. Acorns – Investment Products

As robo-advisors, both Wealthsimple and Acorns have pre-built expert portfolios – comprised of low-cost ETF's – based on one's risk tolerance, allowing you to be completely hands-off in your investing. Neither offers individual stocks.

There's no minimum investment required for either platform.

Wealthsimple offers two special themed portfolios aside from their “normal” ones: Socially Responsible and Halal.

As an aside, I question Wealthsimple's comparatively large allocation to municipal bonds in its low-risk portfolios; it just seems odd when they could use treasury bonds instead. At the same time, with the portfolios from Acorns, I question the inclusion of small-cap growth stocks and corporate bonds.

Wealthsimple vs. Acorns – Mobile App

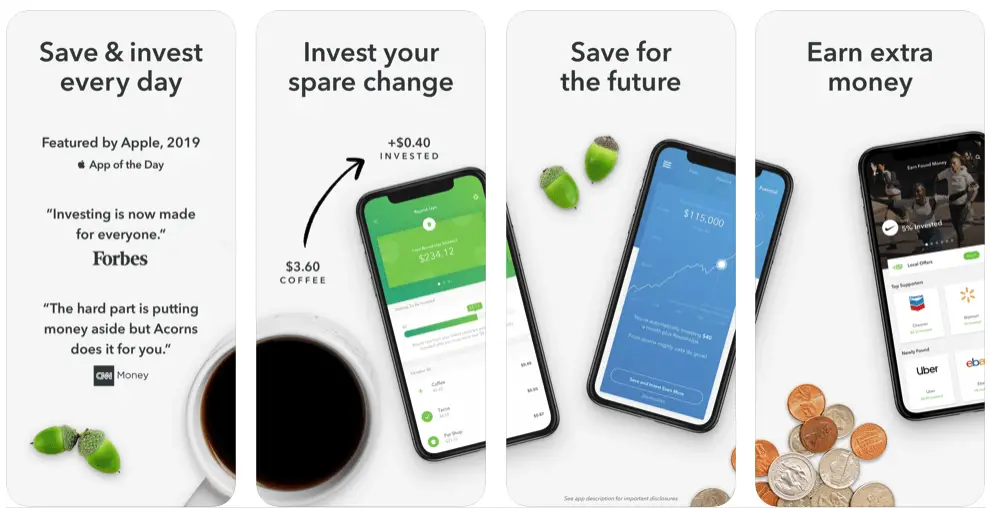

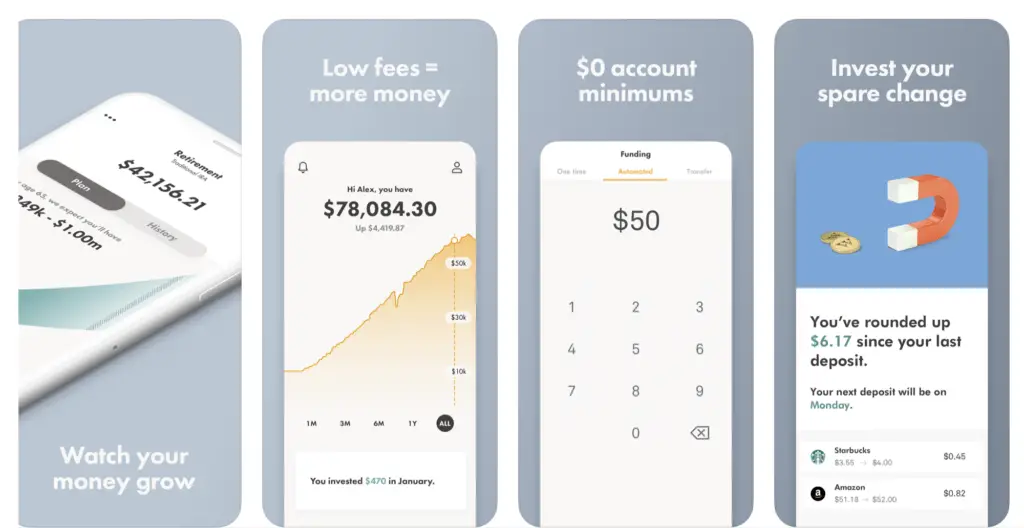

Acorns has a sleek, modern, intuitive, robust mobile app for both Apple iOS and Android. Wealthsimple has a great app too, but Android users specifically seem to complain of problems with the app.

Here are some screenshots of the Acorns app:

Here are some screenshots of the Wealthsimple app:

Wealthsimple vs. Acorns – Extra Features

Acorns is unique in that it allows you to invest “spare change” automatically, letting you “round up” your purchases and invest the difference. This is great for people who have trouble saving. You can choose to apply a multiplier on these round-ups of up to 10x to consciously save and invest more. Acorns also lets you fund a retirement account like a Traditional or Roth IRA like you normally would.

Acorns comes with an FDIC-insured checking account with debit card, making it a suite of financial tools instead of just an investing platform. Wealthsimple has a “savings” account that is still invested in ETF's and is not FDIC-insured but is SIPC-insured as an investing account.

Neither Acorns nor Wealthsimple offers research tools since you cannot choose your own investments, but both do have educational articles and regular tips via their blogs.

Both Wealthsimple and Acorns offer automatic rebalancing that keeps your portfolio's target allocations on track.

Acorns offers fractional shares, a feature that allows every penny to go to work for you faster. This means you can buy a fraction of a share of your investments. For example, if one single share costs $100 and you only have $10 to invest, you can buy 1/10 of a share with your $10 instead of having to wait to buy a whole share for $100. This is especially important for young investors with a small amount of capital. Wealthsimple does not support fractional shares.

Both platforms offer dividend reinvestment. A dividend is just a return of value to shareholders as a periodic cash payment by a company. Dividend reinvestment means that when your investments pay a dividend, that payment can be automatically reinvested instead of sitting idly as a cash balance.

Wealthsimple vs. Acorns – Summary and Conclusion

- Wealthsimple and Acorns are both built for passive, long-term, buy-and-hold, set-and-forget investing, allowing everything to happen automatically.

- Both Wealthsimple and Acorns have a handful of expert-built portfolios in which you can invest. These portfolios are built with low-cost ETF's. They do not allow self-directed investing and do not have individual stocks. If you need the ability to choose your own investments, consider M1 Finance.

- Neither Wealthsimple nor Acorns offers margin loans. If you want access to margin, consider M1 Finance.

- Wealthsimple carries a 0.50% fee for their Basic plan and a reduced 0.40% fee for their premium plans after you reach a $100k invested balance. While they may not look like much, these fees shave off a massive amount of money from your portfolio over the long-term.

- Acorns has small monthly account fees that differ based on your needs, ranging from $1/mo. to $3/mo.

- At this time, in the U.S., Wealthsimple offers a few more account types than Acorns. Wealthsimple has a broader range of account types available in Canada, where it's based.

- Wealthsimple is available to U.S., Canadian, and U.K. investors. Acorns is only available in the U.S.

- Acorns and Wealthsimple both have sleek, modern, intuitive, robust mobile apps and desktop web interfaces. Android users seem to have some complaints about the Wealthsimple app.

- Acorns comes with an FDIC-insured checking account with their Premium plan at $3/mo. Wealthsimple does not.

- Both Wealthsimple and Acorns feature automatic rebalancing.

- Acorns supports fractional shares. Wealthsimple does not.

- Wealthsimple offers expert financial advice. Acorns does not offer human financial advising.

I think the choice between these 2 investing platforms comes down to what account type you need and whether or not you need human advising. Obviously if you need a Joint or Trust account and/or you want human financial advising (or if you're in Canada or the U.K., you'd have to go with Wealthsimple.

After that, I think the most important consideration here is fees. Wealthsimple's 0.50% fee is higher than other robo-advisors, and results in much higher fees over a 30-year period compared to Acorns. Fractional shares from Acorns is a cherry on top. All things being equal, that makes Acorns the clear winner in my opinion.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply