Interested in getting a piece of the fast-growing e-commerce retail giant? Below are the steps for how to invest in Amazon stock with as little as $100.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Introduction – Why Invest in Amazon?

If you've landed on this page wanting to invest in Amazon, chances are you already know the e-commerce retail giant has been a fantastic investment historically, far outperforming the market (see below) and most other stocks.

Amazon has proven its proficiency in disruption and automation since its birth in 1994. The company quickly went public only 3 years later in 1997. With its continual advancement into nearly every corner of society, including its recent acquisition of Whole Foods, its future growth potential looks promising.

While the global pandemic has delivered a major blow to most businesses, Amazon's earnings – and subsequently, its stock price – have soared throughout it, with more people understandably buying online instead of going to a brick-and-mortar store, emphasizing Amazon's resilience to otherwise catastrophic forces. Specifically, in the 2nd quarter of 2020, Amazon's sales were up a massive 42% year over year.

This accelerated shift toward e-commerce will continue to benefit Amazon in a post-pandemic world. Of course this has been their bread and butter all along; it just may be happening sooner than anyone expected, due to the “new normal” which will continue to have more people ordering products online for delivery while sitting on their couch.

Amazon has also made an effort in recent years to diversify its revenue streams. An oft-forgotten, lesser known chunk of its business is from its enterprise cloud solution called Amazon Web Services (AWS), used by companies around the world to keep their websites and digital infrastructure running smoothly. AWS is actually an industry leader in this space.

Amazon has also beefed up its advertising offering. Third-party retailers can now pay for ad space on Amazon; these are the “Sponsored” ads seen in Amazon search results and on product pages. Retailers don't have to sell on Amazon to be able to buy ad traffic. Thus, with both its cloud platform and its advertising service, Amazon makes money even when users are shopping on other websites.

Amazon even recently announced they would begin delivering prescription drugs, potentially immediately stealing market share from the likes of CVS, Walgreens, etc., at a time when the healthcare industry is ripe for disruption. Consumers eager for lower prices and more efficiency may find the perfect solution in Amazon Pharmacy.

Other ventures include food delivery through the aforementioned Whole Foods acquisition, video content through Prime Video, transportation technology, and more.

Amazon CEO and Founder Jeff Bezos announced in early February, 2021 as part of their fourth quarter earnings report that he will be stepping down as CEO in late 2021 and transitioning to an executive chair position. The CEO role will be filled by the Amazon Web Services division CEO Andy Jassy.

Interestingly, the market barely reacted to the news, probably because the business model is clearly solid and Jassy has propelled AWS into a huge cash generator for Amazon that is expected to continue growing massively after already being the world's largest cloud computing provider. Investors clearly still have complete faith in Jassy and the company as a whole. This makes sense; Jassy has already been at Amazon for 23 years and knows the company inside and out. I wouldn't expect much to change.

Effectively, this is also an additional bet on Amazon's cloud computing business, which has grown to be a significant source of the company's revenue. While it still pales in comparison to Amazon's bread and butter, e-commerce, in pure dollars ($45 billion compared to $340 billion for 2019), the profit margins for AWS are much larger.

Amazon shares fell in late October, 2021 after earnings missed forecasts, presenting a potential opportunity to buy the stock in November, 2021 while it's on sale if you believe in the long-term viability of the company. We call this “buying the dip.” This may prove especially fruitful going into the holiday season, which is huge for Amazon as consumers buy gifts. While supply chain issues negatively affected Amazon in Q3 2021, its aforementioned AWS platform kept profits afloat, and there's no doubt it's still the reigning champ in e-commerce.

In fairness, we also saw an unprecedented skyrocketing interest in e-commerce in 2020 due to the pandemic. Thus, expectations are now resetting as things begin to return to normal. Regardless, Amazon's revenue drivers are still poised for long-term growth. In terms of fundamentals, Amazon is also still trading at a lower price multiple compared to other high-flying e-commerce and cloud computing stocks.

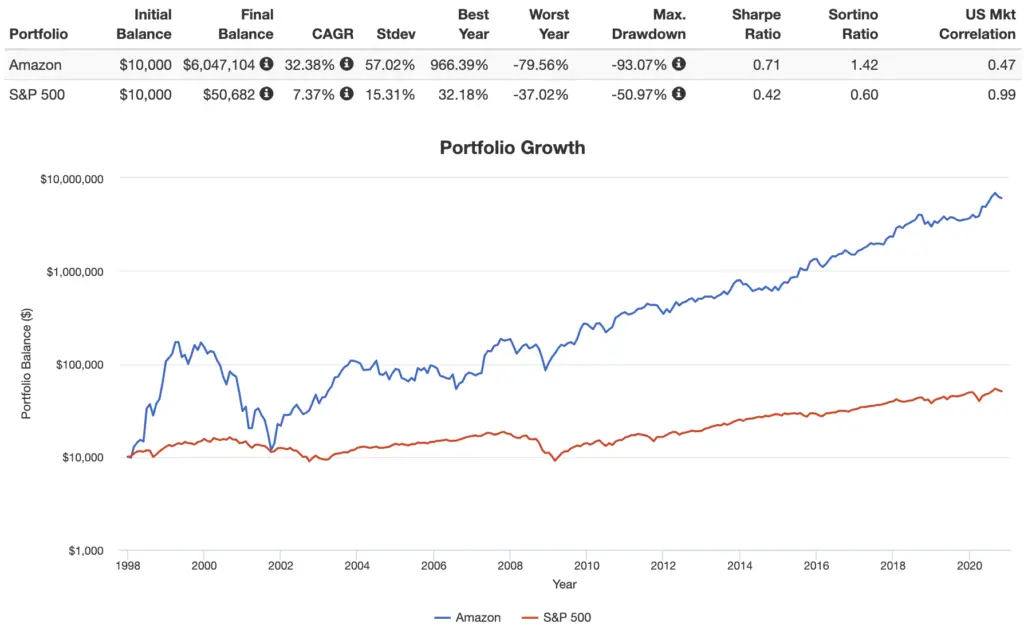

As you can see, Amazon has far outpaced the broader market since it went public in 1997:

How To Buy Amazon Stock

Ready to buy Amazon stock? First you'll need an online brokerage account if you don't already have one. For U.S. investors, I'd suggest M1 Finance. M1 Finance is actually currently offering a 1-year free trial of their premium “M1 Plus” account for users who sign up before February 15, 2021, a $30 bonus for users who fund their account with $1,000 or more during the month of January 2021. The modern broker offers zero fees, zero commissions, dynamic rebalancing, a modern interface and mobile app, and fractional shares. I wrote a comprehensive review of M1 Finance here. Investors outside the U.S. can use eToro.

At the time of writing, a single share of Amazon costs north of $3,000. Thankfully, we can use what are called fractional shares to invest in Amazon with much less than that. Fractional shares allow you to use M1's account minimum deposit ($100) to buy roughly 1/33 of a share of Amazon stock. After the initial $100 deposit when opening a new account, you can buy new shares of stock in the future whenever your cash balance reaches at least $25.

Opening an account with a brokerage will only take about 10 minutes. From that point you can connect your bank account to deposit money into your investment account. Then just type in what's called the ticker symbol – the unique identifying abbreviation for the stock – for Amazon (AMZN) and place the order. It's that simple! You can obviously buy Amazon alongside other stocks in your portfolio, or invest entirely in Amazon.

How To Invest in Amazon Stock – Quick Steps

To recap:

- Sign up for a new account with an online brokerage like M1 Finance. (Canadians can use Questrade. Investors outside North America can use eToro.)

- Connect your bank and fund your account.

- Enter the ticker symbol – AMZN – or the company name to locate the stock.

- Place the buy order. You're done! You can now call yourself an Amazon shareholder.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Hi John,

I’m Sarah and just wanted to say what you are doing is amazing!! Thanks for taking time out for people (like myself) who want to start building something for themselves and no idea how to do it. Much appreciated.

Thanks, Sarah!

Hi John

You are very knowledgeable.

I am interested in purchasing Amazon stock.

I live in Canada. I looked up eToro and it said that they are currently not accepting

customers who are residents of Canada. 😞

Do you have any recommendations for me who I could use for an online broker?

Muchly appreciated

Jackie

Hi Jackie. Admittedly I don’t know exactly which brokers are available in Canada and how good they are. Interactive Brokers should be an option.

Hi John, i would like to invest with Amazon and Netflix. I don’t know where to start. Which company is legitimate, I’m in South Africa but i prefer to invest in the 250 dollars investment for each one of Amazon and Netflix. Thanx

Hi. I don’t know all the broker options in South Africa, but eToro should be available.

Hi,

I am interested in buying Amazon shares via eToro but wanted to know, is t easy to sell my shares and close my account when I need to?

Yes, you can sell your shares and close your account at any time.

If you buy these (100 dollar) shares, do you get the dividends every quarter or everytime shareholders get their dividends?

You’d get your fractional dividend with shareholders, as you’d be a shareholder.

Hello! Jhon, I am from qatar ????????, which app or broker I should install and to start with minimum 100 dollar investing or opening an account,

Hi. eToro should be available.

I was just searching for the best platform to buy a share and I stumble on this educating article, thanks for the insight but I want to find out if I can use etoro in Nigeria.

I also want to know which platform is the safest to buy shares.

Thanks

Unfortunately it sounds like eToro can no longer operate in Nigeria even though they used to: https://www.etoro.com/customer-service/help/66648556/is-etoro-blocked-in-my-country/

Not sure which platform would be considered the “safest.”

I am new here based in UK and want to invest in amazon for about £1500/- initially. Just need your kind guidance how to start with amazon.

Thanks

Asif

Asif, I laid out the steps above. M1 is not available in the UK currently so you’ll need a broker first. I know eToro is available. After you open and fund an account, you just search for AMZN and place a buy order.

Yes, but order for what exactly after opening our account? If shares, how to chose the share? How to follow up our investment after? How to make sure we will be receiving payment? How often we will receive it? Could you please send me more details on my email?

Yes, shares. You type in the ticker for Amazon which is AMZN. You can monitor the value of your position by logging into your brokerage account. You can also simply check Amazon’s share value anytime from any quote website. Amazon does not pay a dividend so there is no “payment” to be “received.” You can sell shares anytime you want to realize any gains you want to withdraw as cash.

Hi! John, I from Malaysia, I asking whether I invest etoro, is same 100 to M1?

Hi Von. eToro is not exactly the same as M1 but they share many features. Your investment in Amazon or any stock/ETF would behave the same though.

Hi.

Based on the queries and comments here on your page, you cannot withdraw your money unless you sell your shares. How can you sell your shares?

Right. This is how it works with any kind of investment. You’d simply choose the number of shares you want to sell and place the sell order. Specifically, depending on your broker, you’ll see your position and there will be buttons like “Sell” and then “Confirm Order”.

Where is E toro based is it in this country ?

USA, UK, EU (Cyprus), and Australia.

Hi there,

As M1 is only available in the US, who would you suggest using here in Britain (United Kingdom) I’d also like them to preferably be able to offer fractional shares in Amazon

Regards

Mike

Hey Mike. Admittedly I’m not familiar with all the options available in the UK, but eToro should be a good bet.

Hi John

I read in one of your comments where you say

“you’re not required to continue depositing regularly, but it’s definitely encouraged, as that’s how you build up your wealth and get your investments growing faster.”

What happens after this do I continue on buying with the money in the account? Or it’s just stays there until decide to use or I get interest?

If you still believe in whatever stocks you’re buying, you’d want to keep buying more, which creates the power of compounding: https://www.ellevest.com/magazine/investing/compounding-returns

Basically, getting more money in the market faster means more growth over the long term.

I don’t know what you mean by “money in the account.” We’re investing in stocks hoping for their share value to appreciate, which grows your investment value. There wouldn’t be any cash on the sideline. Stocks do not pay “interest.” You can sell shares at any time to realize gains and take out cash.

Hope this helps.

Hey John,

This is my first time investing and honestly don’t have a lot of wiggle room to lose my hard earned $$.

I noticed the min deposit on eToro is $200 not $100.?

Also wondering if eToro is the site recommended for Canadians or should we be joining our US friends using M1?

Roxanne, honestly it sounds like you probably shouldn’t be investing at all yet then. Rule of thumb is don’t invest with money you’ll need in the next 5 years. Don’t invest money you can’t afford to lose.

M1 is not available to Canadians. Admittedly I don’t know all the choices for brokers up there.

Hi John, I am a South African citizen. Is eToro the only Brokerage in South Africa to buy shares from Amazon. Thank you.

It’s definitely one but I’m not sure whether or not it’s the only one.

Hi, I am interested, can u guide me into buying Amazon Stock. I am in South Africa. Where do I find broker? From how much can I buy stock. How do I make profits and withdrawals, and after how long?

Hi Patrick, I answered these in the post and in other comments.

Hi John, thanks for the article, it’s super clear for people like me who are new to investing!

Just to have an idea; if I invest $1K in Amazon, how much can I expect to earn and after how long? Is it every month/year earnings?

Also, if I wish to cash my earnings, can I do it simply by transferring them to my account or do I have to sell my share first?

Thank you 🙂

Thanks for the kind words! Glad it was clear enough for you; that was the goal.

It’s impossible to say how much your initial investment will grow. As you can see in the backtest, an investment of $10,000 in 1997 would have been worth just over $6 million at the end of 2020. Such is the power of compounding.

Looking more short term, a $1,000 investment in January 2019 would have grown to $2,168 (a return of 117%) by the end of 2020.

Yes, you would need to sell shares before withdrawing cash, but if you’re using M1, clicking the button for a cash withdrawal will automatically sell the shares for you, so no extra steps.

So in full, the steps would be:

Deposit cash from bank > Buy shares > Sell shares > Withdraw cash to bank.

Hope this helps!

Awesome, thank you for the helpful tips! Wish me luck!

Hi John,

I am living is Saudi Arabia (resident). can I invest in eToro.

Have a nice day

Some cursory Googling is telling me yes, but contact them to make sure.

how and when can you withdraw your money

Whenever you want, by selling the shares you bought.

Good day, Can I use M1 I’m in South Africa

Hi, unfortunately M1 is not available outside the U.S. at this time, but eToro should be.

Can you help me with buying share in Amazon

Hi, I laid out the exact steps in the post.

I live somewhere in Europe.

I hear about Amazon shares and I want to know further.

The steps to take ?

How does it work?

A single amazon share cost?

Can someone deal direct with Amazon on a specific trade platform?

Hi, I laid out the steps in the post above. A single share is about $3,300 USD right now. No, you cannot deal directly with Amazon on a trading platform.

Hi I want to buy stock in amazon but I don’t know what to do first

Hi Anna. I laid out the steps in the post. First you’ll need to sign up for an account with a broker.

Hi I’m thinking of investing in fractional shares with Amazon, I’m in the US-California. Can I use E-Trade or you still suggest in M1. Also if I open the account with $100, then select Amazon. Do I have to put money in that account every month or purchase a share every month, I’m a little confused, can you clarify the process. Do I just put Money in the account one time. I don’t understand

Hi, you can definitely use E-Trade but I’m not sure what their minimum account requirement is, if they have one. But Etrade does not offer fractional shares, so you’d have to pay the full price for a single share of Amazon – about $3,300 right now.

After opening a brokerage account, you’re not required to continue depositing regularly, but it’s definitely encouraged, as that’s how you build up your wealth and get your investments growing faster.

Is it ok to have a broker like investous? Or M1 is available here in middle east?

I’m not familiar with Investous but some cursory Googling tells me that might only be CFDs. M1 is unfortunately currently not available in the Middle East, but eToro should be.

Is this available from Singapore?

Hi Yun,

Do you mean Amazon or M1 or both? I know M1 is not available in Singapore. You may be able to use eToro or Interactive Brokers as a broker. Admittedly not sure about the logistics of buying a US-listed company in Singapore. Best of luck.