Large cap value stocks have outperformed large cap growth stocks due to the Value premium. Below we'll explore the 10 best large cap value ETFs for 2025.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

In a hurry? Here's the list:

- VLUE – iShares Edge MSCI USA Value Factor ETF

- VTV – Vanguard Value ETF

- VOOV – Vanguard S&P 500 Value ETF

- VONV – Vanguard Russell 1000 Value ETF

- MGV – Vanguard Mega Cap Value ETF

- IUSV – iShares Core S&P U.S. Value ETF

- RPV – Invesco S&P 500 Pure Value ETF

- ILCV – iShares Morningstar Value ETF

- EFV – iShares MSCI EAFE Value ETF

- IVLU – iShares MSCI Intl Value Factor ETF

Contents

Introduction – Why Large Cap Value Stocks?

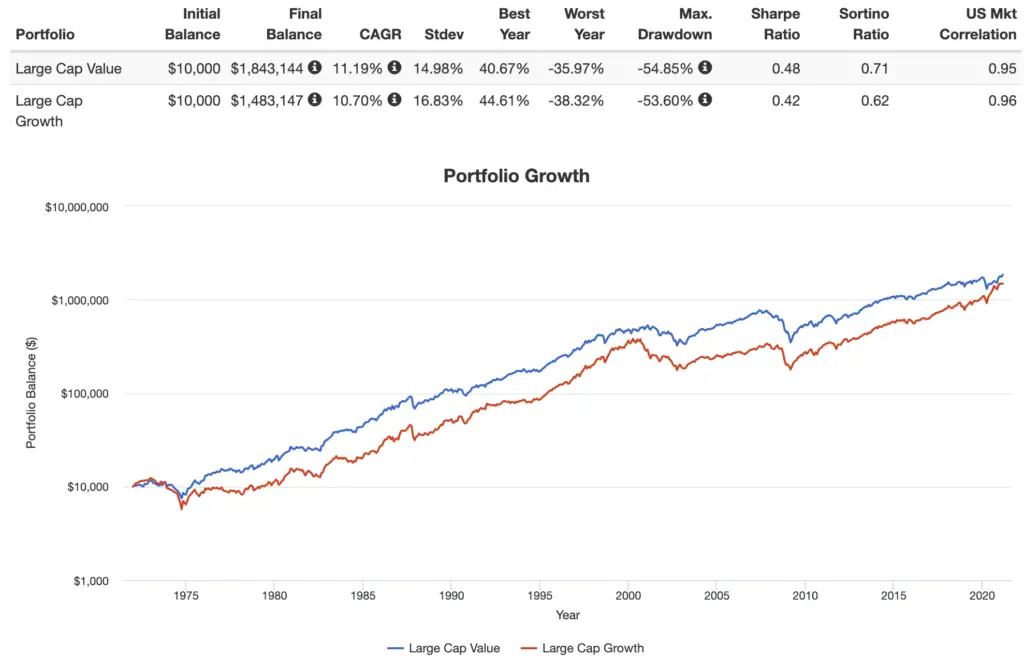

Value stocks are companies thought to be undervalued relative to their market price based on their fundamental book value. Though Growth has had a stellar run recently thanks in large part to Big Tech, large cap value stocks have beaten large cap growth stocks thanks to the Value risk factor premium:

Let's explore the best large cap value ETFs.

The 10 Best Large Cap Value ETFs

Below are the 10 best large cap value ETFs. Different market indices and funds define “value” in different ways, so we'll look at the below funds' comparative exposure to the actual Value factor premium.

VLUE – iShares Edge MSCI USA Value Factor ETF

As the name suggests, the iShares Edge MSCI USA Value Factor ETF (VLUE) specifically emphasizes targeting the Value factor in the United States equities universe. VLUE comes first on this list because it provides the sharpest exposure to the true Value factor. VLUE has a small positive loading on the size factor, meaning its large caps are comparatively smaller than the other large cap funds on this list.

Investors seem to value this reliable Value exposure, as this fund has over $12 billion in assets even though its fee is higher than most other large cap value ETFs at 0.15%.

Interestingly, VLUE is also the only fund on this list with negative loading on the Investment factor, meaning its holdings tend to invest more aggressively.

VTV – Vanguard Value ETF

The Vanguard Value ETF (VTV) is one of the most popular large cap value ETFs, with nearly $70 billion in assets. It is also one of the most affordable, with a fee of only 0.04%. The fund seeks to track the CRSP US Large Cap Value Index. Unfortunately, other funds on this list provide truer exposure to Value.

VOOV – Vanguard S&P 500 Value ETF

VOOV is similar to VTV above but tracks a different index, this time the S&P 500 Value Index. Using the S&P name commands a slightly higher fee of 0.10%.

VONV – Vanguard Russell 1000 Value ETF

VONV tracks a broader index – the Russell 1000 Value Index – that gets some mid cap exposure compared to the above ETFs. VONV has an expense ratio of 0.08%.

MGV – Vanguard Mega Cap Value ETF

Those seeking value within U.S. mega caps – the largest of the large caps – can do so with MGV, the Vanguard Mega Cap Value ETF. The fund seeks to track the CRSP US Mega Cap Value Index and has a fee of 0.07%.

IUSV – iShares Core S&P U.S. Value ETF

IUSV seeks to track the S&P 900 Value Index. It is considered a total market fund, but tilts large cap since it is market cap weighted. IUSV has a low fee of 0.04%.

RPV – Invesco S&P 500 Pure Value ETF

This fund’s name is appropriate. Unlike some of its competitors, it delivers “pure value,” blowing the others on this list (VONV, IUSV, etc.) out of the water in terms of actual Value exposure. However, that superior exposure comes at a cost. RPV has an expense ratio of 0.35%. Still, it would be my choice out of the funds on this list for U.S. large cap value. That's why I included it in my Vigorous Value Portfolio.

RPV seeks to track the S&P 500 Pure Value Index and has nearly $2.5 billion in assets.

ILCV – iShares Morningstar Value ETF

iShares recently slashed fees on a few of its ETFs. ILCV only costs 0.04%, the same as VTV from Vanguard, but provides superior exposure to Value. This would be the budget option of choice for me. This fund has nearly $750 million in assets.

EFV – iShares MSCI EAFE Value ETF

EFV provides large cap value exposure specifically in Developed Markets outside the U.S. The fund seeks to track the MSCI EAFE Value Index.

While they're not exactly the same investments, IVLU and EFV provide almost identical factor loading and can be considered comparable. EFV has an expense ratio of 0.39%.

IVLU – iShares MSCI Intl Value Factor ETF

IVLU is the international (ex-US) version of VLUE. The iShares MSCI Intl Value Factor ETF seeks to track the MSCI World ex USA IMI Value Index, composed of large cap value stocks in Developed Markets outside the United States.

Like VLUE, IVLU has some mid cap exposure. IVLU takes an extra step compared to EFV by incorporating a company's value score into its weighting.

IVLU has an expense ratio of 0.30%. Since EFV is a bit more expensive, I'd go with IVLU to save some on fees. Day traders will still prefer EFV for its greater liquidity.

Where to Buy These Large Cap Value ETFs

All these large cap value ETFs should be available at any major broker. My choice is M1 Finance. M1 has zero trade commissions and zero account fees, and offers fractional shares, dynamic rebalancing, and a sleek, user-friendly interface and mobile app. I wrote a comprehensive review of M1 Finance here.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Hi John,

Recently found your website and I must say it has taught me a lot as a young investor.

A quick question I might have missed the answer to. How come you don’t hold RPV in your ginger ale portfolio (your own)? I see it’s in your vigorous value but not your own. Why is that? Thanks for everything!

Best regards

I just prefer to keep my Value tilt in small caps. RPV would be a fine addition for large cap value and is a great fund.

Avantis just came out with their Large Cap Value ETF, AVLV.

https://www.avantisinvestors.com/content/avantis/en/investments/avantis-us-large-cap-value-etf.html

Thoughts?

Will probably be a good one. Have to wait and see.