The Margarita Portfolio was created by investing writer Scott Burns. Here we’ll take a look at its components, historical performance, and the best ETFs to use in its implementation.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Who Is Scott Burns?

Scott Burns, creator of the Margarita Portfolio, is a finance columnist and co-founder of AssetBuilder.com. You can read more about him here. He also created the famous Couch Potato Portfolio.

What Is the Margarita Portfolio?

Scott Burns proposed the Margarita Portfolio in 2004. The Margarita Portfolio definitely qualifies as a lazy portfolio; it's composed of only 3 assets at equal weights:

- 34% Total US Stock Market

- 33% Total International Stock Market

- 33% Inflation-Protected Treasury Bonds (TIPS)

Burns named it the Margarita Portfolio because he maintains that “the traditional margarita is the best,” the recipe for which he states as “one part tequila, one part triple sec, and one part fresh lime juice.”

Margarita Portfolio Performance Backtest and Review

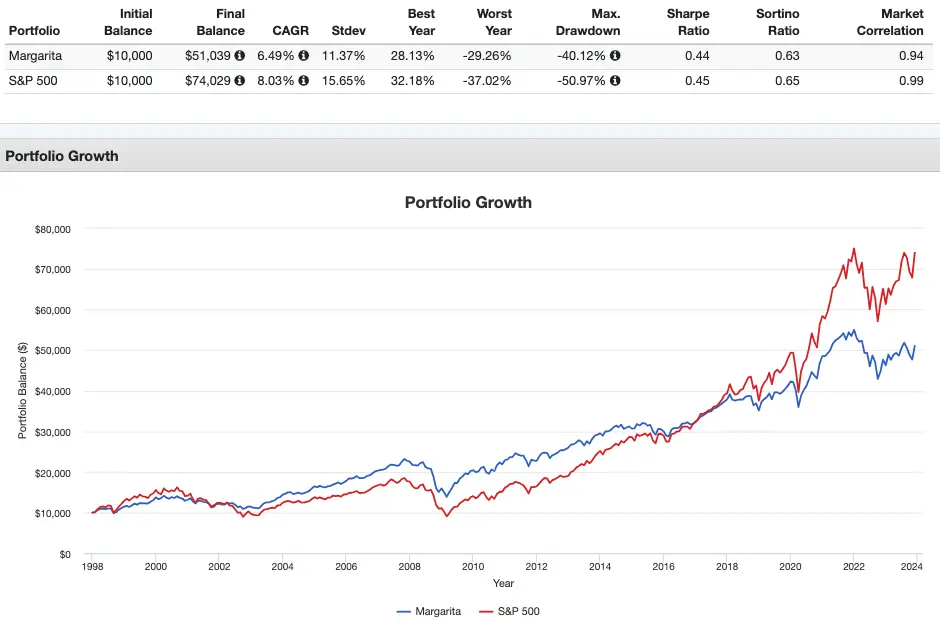

Going back to 1997 when TIPS data begins, here's a performance backtest of the Margarita Portfolio vs. the S&P 500 through November, 2023:

Results have been fairly close for this time period. The Margarita Portfolio delivered a lower return than the S&P 500 index, but with lower volatility and risk and thus a nearly identical risk-adjusted return to the S&P 500 as measured by Sharpe and Sortino.

I like TIPS, but it seems strange and suboptimal to use them as the sole fixed income asset here. I'd prefer nominal intermediate-term treasury bonds. Were I to implement the Margarita Portfolio allocations, I would use intermediate or long treasuries, or split the bonds evenly between nominal and real bonds.

I do at least like that the Margarita Portfolio gives a heavy allocation to international stocks. That allowed the Margarita Portfolio to significantly outperform the S&P 500 in the early 2000's.

Margarita ETF Pie for M1 Finance

M1 Finance is a great choice of broker to implement the Margarita Portfolio because it makes rebalancing seamless and easy with one click, has zero transaction fees, has one of the lowest margin rates in the business, and incorporates dynamic rebalancing for new deposits. I wrote a comprehensive review of M1 Finance here.

Utilizing 2 low-cost funds from Vanguard and 1 from iShares, we can construct the Margarita Portfolio Pie like this:

- VTI – 34%

- VXUS – 33%

- SCHP – 33%

You can add the Margarita Portfolio pie to your portfolio on M1 Finance by clicking this link and then clicking “Invest in this pie.”

Disclosures: I am long VTI and VXUS in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply