Financially reviewed by Patrick Flood, CFA.

Traditional brokerages like TD Ameritrade are slashing fees and adding features to compete with new-age brokers like M1 Finance. Here we'll compare the two. I wrote a separate comprehensive review of M1 Finance here if you're interested in seeing the specifics of the platform.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

M1 Finance vs. TD Ameritrade – Summary Comparison

Contents

M1 Finance vs. TD Ameritrade – Commissions and Fees

M1 Finance and TD Ameritrade both offer commission-free trades for stocks and ETF's, and zero account fees, aside from the obvious miscellaneous fees for things like paper statements, outbound account transfers, etc.

TD Ameritrade does have commissions for other securities types:

- Options: $0.65 per contract

- OTC stocks: $6.95

- Mutual funds not in the No Transaction Fee program: $49.99

- Futures: $2.25 per contract

It's exciting that we're currently seeing a race to zero for brokerage fees and commissions, at least for “normal” stocks and ETF's, which is great for the average retail investor, and even traditional brokers like TD Ameritrade, Fidelity, and Schwab are following suit. TD Ameritrade announced zero-fee trading in October 2019.

Charles Schwab actually announced in November 2019 that it was acquiring TD Ameritrade, but the merger is expected to take at least a couple years to finalize.

TD Ameritrade does offer a robo-advisor option called “Essential Portfolios” with a fee of 0.30% and a minimum investment of $5,000, as well as personalized consultation from professionals for higher fees.

M1 Finance is entirely self-directed, but they do offer expert-built “Expert Pies” that you can invest in for free.

M1 Finance vs. TD Ameritrade – Account Types

M1 Finance offers taxable, joint, Traditional IRA, Roth IRA, Rollover IRA, SEP IRA, Trust, and Custodial (M1 Plus members) accounts. They currently do not offer SIMPLE IRA, 401(k), Solo 401(k), 529, HSA, or Non-Profit accounts.

TD Ameritrade has basically every account type you can think of. They offer all of M1's account types plus Solo 401(k), SIMPLE IRA, 529, Coverdell, and more specialty accounts.

If you need any of the latter accounts, TD Ameritrade would be the better choice.

Both M1 and TD Ameritrade also offer an FDIC-insured checking account.

M1 Finance vs. TD Ameritrade – Investment Products

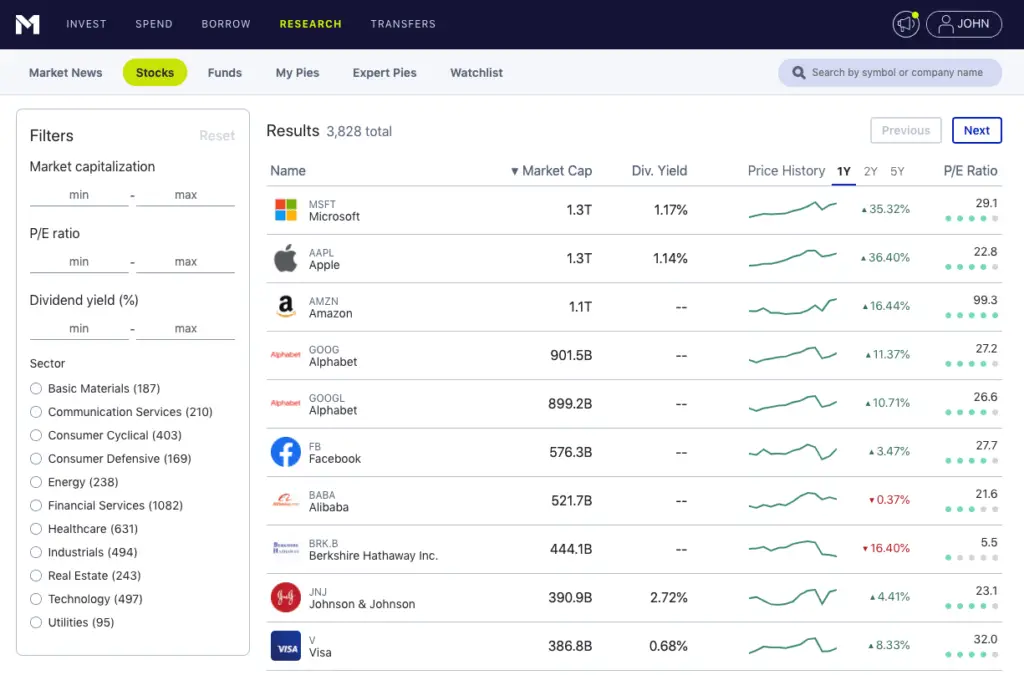

M1 Finance offers most ETF's and individual stocks that are traded on major exchanges.

TD Ameritrade offers every investment product: ETF's, individual stocks, mutual funds, options contracts, over-the-counter (OTC) stocks aka “penny stocks,” cryptocurrency, and forex.

M1 Finance vs. TD Ameritrade – Margin

M1 Finance wins on margin rates. Margin rates are as follows for a $100,000 margin loan:

- TD Ameritrade – 7.75%

- M1 Finance – 3.50%

- M1 Plus – 2.00%

M1 Plus is a $125/year premium membership that gets you access to a lower margin rate as shown, as well as a second afternoon trading window.

Perhaps the most important difference though is the fact that a margin account from TD Ameritrade can only be used to apply leverage to your portfolio (i.e. buy more securities), whereas a margin loan from M1 Finance can be used for whatever you want – refinancing debt, major purchases, unexpected expenses, etc.

M1 Finance vs. TD Ameritrade – Mobile App

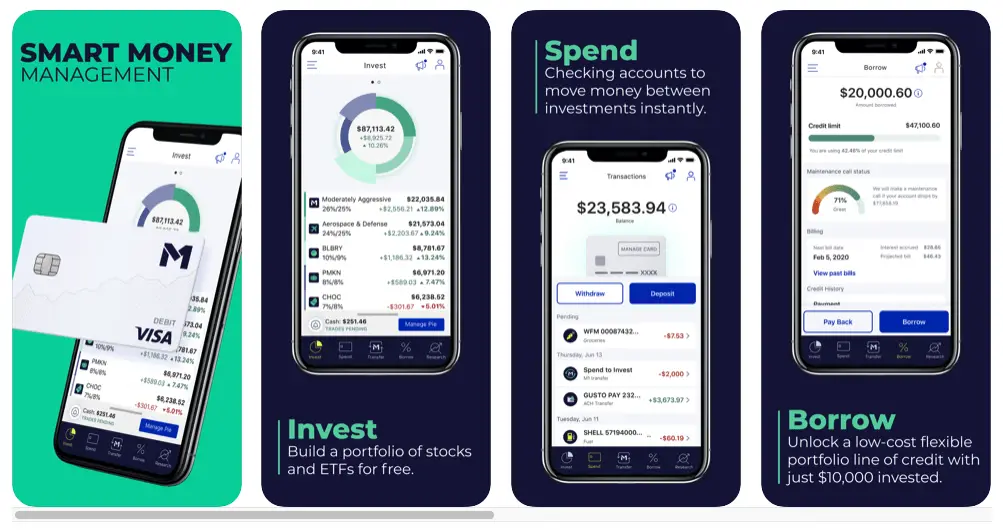

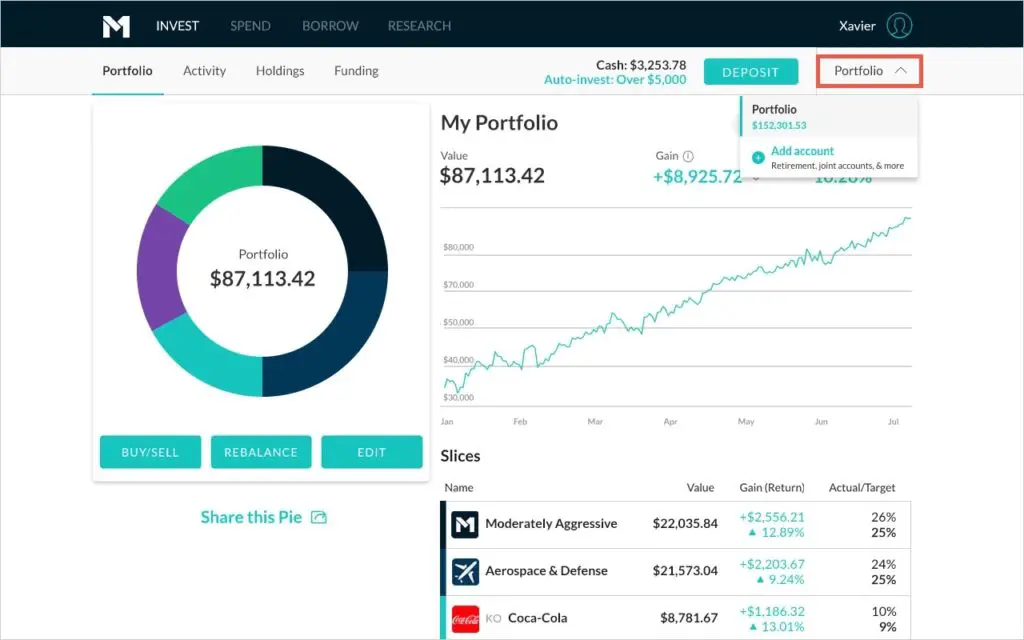

M1 Finance has a sleek, intuitive, user-friendly, robust mobile app for both Apple iOS and Android:

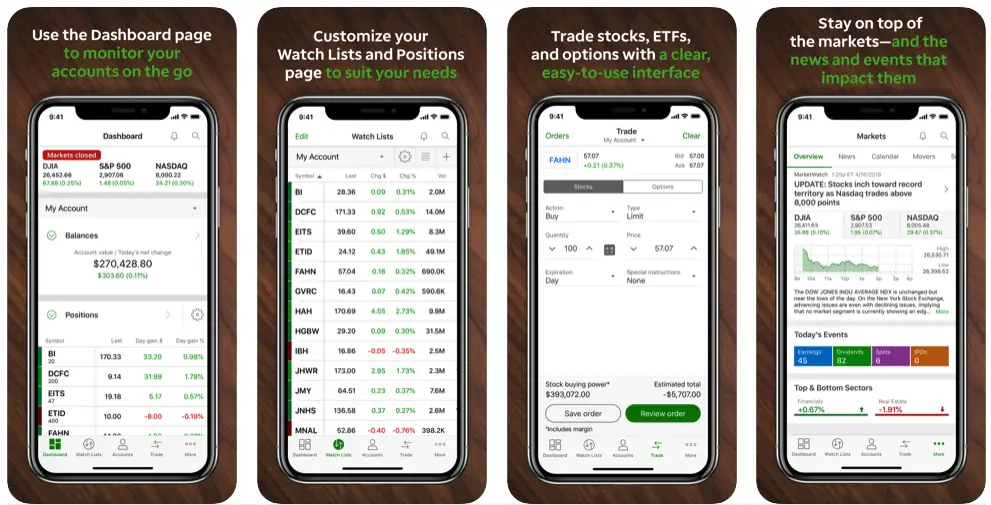

TD Ameritrade has recently overhauled their mobile app, but I still found it slightly less intuitive and more clunky than M1's. Of course we should expect this to some degree, as TD Ameritrade offers more account types, investment products, and research tools, and has order control. According to users, TD's Android app appears to be worse and less well-supported than its Apple iOS counterpart. Here are some screenshots from the TD Ameritrade app:

M1 Finance vs. TD Ameritrade – Interface/Usability

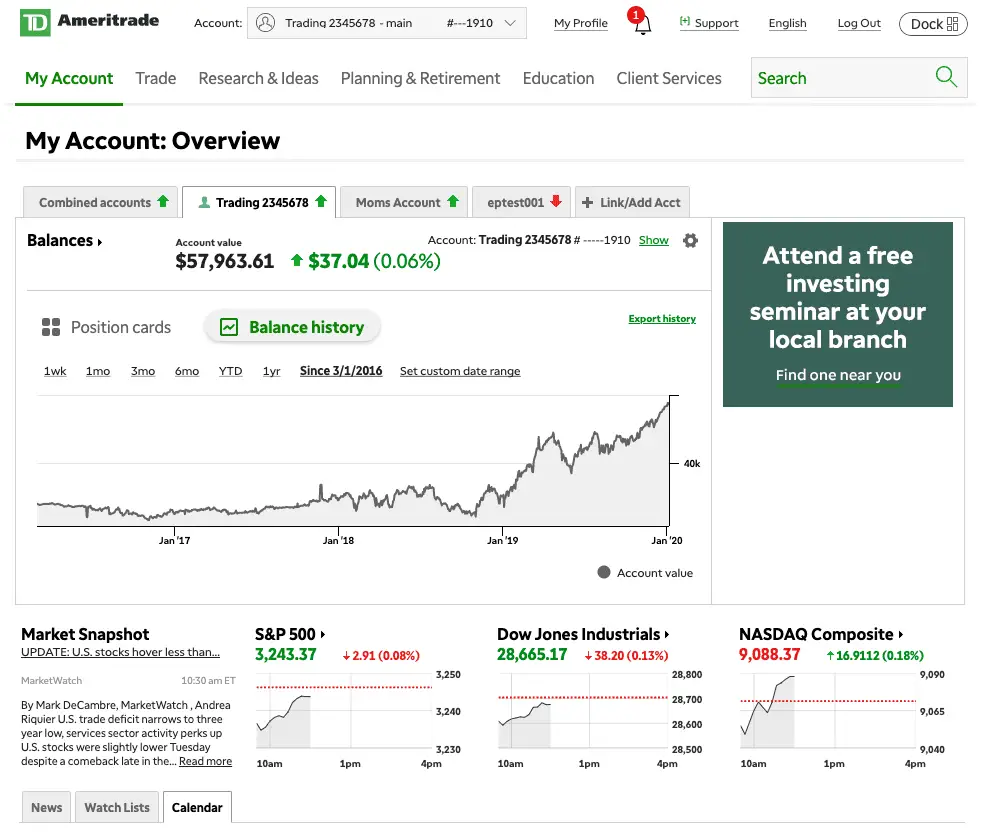

The TD Ameritrade desktop web interface is still somewhat antiquated. Again, we'd expect this to some degree, as they have a much more complex offering and a much larger, broader user base. They did actually update it slightly in September 2018. Ironically, the sheer number of tools and options can make this interface overwhelming and more confusing for new, young investors, an audience that TD is working hard to attract.

I'd like to think they're working on updating it further to reflect their mobile app. I think it would definitely be more confusing than M1's for a beginner investor. The TD Ameritrade user interface looks like this:

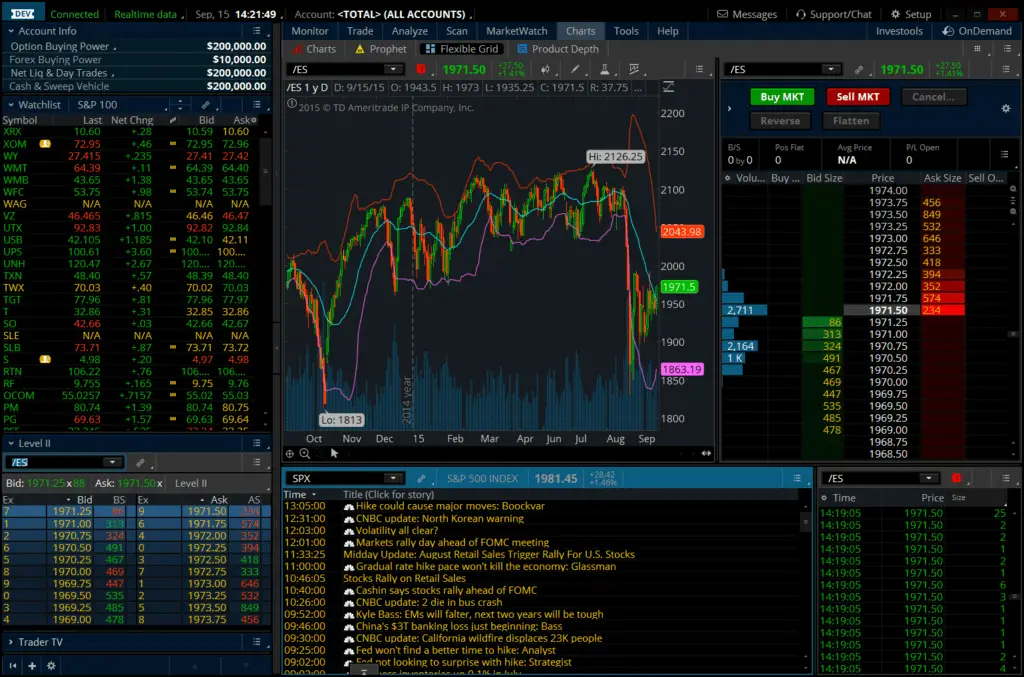

TD Ameritrade also has a dedicated trading application called thinkorswim. While it's likely irrelevant to the audience reading this post, its interface looks like this:

The interface for M1 Finance is modern, simple, and intuitive with its pie-based visualization. With fewer features and tools than TD, it is much easier to navigate. It is great for beginner and experienced investors alike:

M1 Finance vs. TD Ameritrade – Extra Features

As a full-fledged trading brokerage, TD Ameritrade offers much more robust charting, news, education, and analysis tools than M1 Finance. Again, their sheer number of resources can and likely will be overwhelming for new investors.

TD Ameritrade obviously has an all-day trading window and order control. Since M1 Finance is built for long-term, buy-and-hold investing, M1 has a once-daily trading window and no order control.

TD Ameritrade does not employ M1's famous “dynamic rebalancing,” which automatically allocates new deposits to maintain your portfolio's target allocations. TD does offer this feature in their robo-advising service at a fee of 0.30% of your invested balance.

M1 Finance offers fractional shares, which allows every dollar to work for you. This is especially important for beginner investors with a small amount of capital. Trading on TD Ameritrade will result in some fractional shares due to dividend reinvestment (DRIP), but they do not allow you to specifically buy fractional shares through an order.

M1 Finance vs. TD Ameritrade – Summary and Conclusion

- Both M1 Finance and TD Ameritrade offer zero-commission trades and zero fees in the context of stocks and ETF's traded on major exchanges. TD Ameritrade does have commissions on options, OTC stocks, mutual funds, and futures.

- TD Ameritrade has many more account types than M1 Finance, but most average retail investors won't need or utilize that difference.

- M1 Finance offers most ETF's and individual stocks. TD Ameritrade offers ETF's, stocks, OTC stocks (“penny stocks”), mutual funds, futures, forex, Bitcoin futures, and options contracts.

- M1 Finance offers much lower margin rates than TD Ameritrade, and M1's margin loan can be used for anything.

- TD Ameritrade has a more confusing user interface that would be more suitable for seasoned investors and traders. This is to be expected, as TD Ameritrade offers a broader range of account types and investment products. M1 Finance has a simple and intuitive interface.

- Both M1 Finance and TD Ameritrade seem to have great mobile apps. TD Ameritrade's Android app is of questionable quality.

- Both M1 Finance and TD Ameritrade offer an FDIC-insured checking account.

- M1 Finance offers fractional shares. TD Ameritrade does not let you specifically buy fractional shares, but they will naturally happen as a result of dividend reinvestment behind the scenes.

- M1 Finance has automatic rebalancing. The only way to get automatic rebalancing with TD Ameritrade is via their robo-advising program with a fee of 0.30% of your invested balance.

- TD Ameritrade has the typical order control and all-day trading window that we'd expect from a traditional broker. M1 does not offer order control and only uses one trading window per day.

- TD Ameritrade offers robo-advising and professional advising for significant fees. M1 Finance has no advising service but offers its expert-built “Expert Pies” for free. M1 is also probably better if you want to implement a “lazy portfolio” and have it rebalance automatically.

Your choice between these platforms should depend on how you want to invest and what account types, products, and features you need. To some degree, it may also depend on your level of investing experience. TD Ameritrade inarguably offers many more options than M1 Finance in terms of account types, investment products, and research tools. But I maintain that this higher number of resources comes at a cost of increased complexity and decreased intuitiveness, making it potentially overwhelming and more difficult for a beginner investor to navigate successfully, even as early in the process as choosing an account type. Moreover, I would argue that most of these extra account types, products, and tools aren't needed or even wanted by the average retail investor, especially a long-term, buy-and-hold investor.

If you need access to things like options contracts, a Solo 401(k) or 529 accounts, and/or an all-day trading window, for example, TD Ameritrade is the platform for you. If you don't need those things and want access to fractional shares, automatic rebalancing, and cheaper margin, M1 Finance is the better choice. I wrote a separate comprehensive review of M1 Finance here if you're interested in seeing the specifics of the platform.

I commend TD Ameritrade for making strides to improve and modernize its apps and features. The elephant in the room, though, is the fact that Schwab, having acquired TD Ameritrade, will likely begin phasing out certain features or aspects of the platform, which is a potential cause for uncertainty in signing up for a new account with TD Ameritrade at this point.

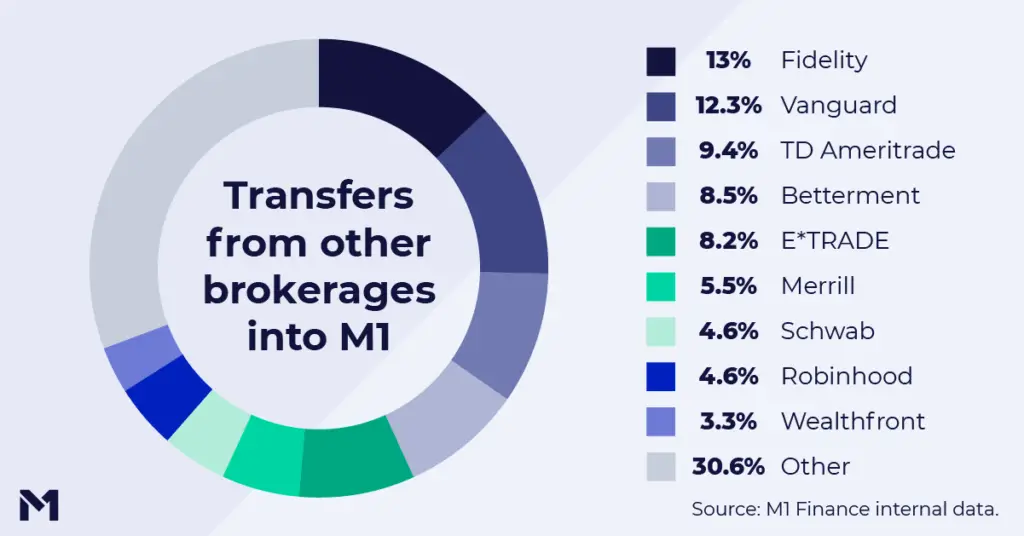

I've actually talked to people who have accounts across both brokers – TD Ameritrade for mutual funds in retirement accounts, and M1 for a taxable account to access extremely cheap margin. TD Ameritrade is also one of the brokerages that M1 Finance sees transfers from most often:

Right now M1 is offering a transfer promotion of a 0.50% payout on settled transfers over $10,000 into Invest accounts before January 31 with a max payout of $25,000. Terms for this promotion are here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply