I designed the Neapolitan Portfolio for those wanting the simplest approach to maximum diversification across asset classes. Below are the details on its components and fund selection.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Introduction – Volatility, Risk, Drawdowns, and Diversification

Volatility is the variability of return of a portfolio. It's the measurement of the degree of its up-and-down movement, denoted by standard deviation as a percentage. Less volatility means a smoother ride. More volatility means more of a roller coaster of peaks and valleys. We can define “risk” in this context as permanent loss of capital. A more volatile portfolio naturally has more risk because when it drops (called a drawdown), it may take a long time to recover from a valley, or it may never recover.

Many investors try to mitigate their portfolio's volatility and risk. Many of those who don't probably should, as investors tend to overestimate their tolerance for risk, only realizing it during a market crash when they panic. Greater volatility and risk require a stronger stomach. The mitigation thereof is done through diversification – spreading the portfolio out across different asset types and areas around the world. I went into detail on how diversification works in a separate post here.

Basically, we want to find uncorrelated assets that tend to move in different directions at different times. A lower correlation coefficient between two assets means a better diversification benefit. These correlations aren't static and can shift over time, but historically and currently, the 3 best diversifiers with the lowest correlations among them are stocks, long treasury bonds, and gold.

The Neapolitan Portfolio

The famous All Weather Portfolio from Ray Dalio was designed for the purpose I described above. It is composed of 5 funds to be well diversified across asset types. But it only uses U.S. stocks, it's a bit heavy on the bonds, and it wastes space (in my opinion) on broad commodities.

We can take the same fundamental idea of that portfolio and simplify it to arrive at 3 funds, one for each of the 3 assets I mentioned: stocks, bonds, and gold.

For stocks, we're keeping it simple with a market-cap weighted global stock market fund to be fully diversified across geographies, styles, and cap sizes in equities. Enough said.

For bonds, we know treasury bonds offer more of a diversification benefit than corporate bonds, you can't beat the credit quality of the U.S. government, and more volatile assets make better diversifiers, so we're maxing out bond duration by using U.S. Treasury STRIPS. I discussed why you shouldn't fear long bonds and delved into STRIPS a bit more here. In a nutshell, we want the greater volatility of long bonds so that it can more effectively protect the portfolio during stock market crashes and black swan events.

Now let's talk about the gold piece. No need to get fancy with metals. Other metals like silver are more correlated with the market, thus a broad metals fund is also more correlated with the market (and happens to be more expensive than just using gold). What about gold miners? Well, they're stocks, so they're also naturally more correlated with the market than the gold itself because their business risks mirror those of other stocks, and commodity producers sell commodity futures contracts to hedge their price risk, which basically cancels out the precise diversification benefit we’re looking for. They, too, are more expensive than a plain ol' gold fund. Just like with the bonds, a more diversified asset class per se does not make a more diversified portfolio.

If you've read any of my other stuff around here, you know I'm not a huge fan of gold in terms of expected returns and its purported inflation “hedging.” However, I can't argue with its uncorrelation to both stocks and bonds that offers a demonstrable diversification benefit, and I fully concede that holding gold is perfectly sensible and desirable for risk-averse investors, retirees, or those simply wanting to limit the portfolio's volatility and drawdowns.

Let me reiterate and be very clear. Gold and bonds have lower expected returns than stocks. We are including them here as diversifiers. The stocks portion will still likely drive most of the portfolio's returns. The primary goal and purpose of this portfolio is to limit volatility and risk using a small handful of assets, and while we hope to not sacrifice too much performance in the process, it is sensible to expect to sacrifice some. If you are attempting to maximize expected returns irrespective of volatility and risk, this is not the portfolio for you. That said, I'd like to think this portfolio will perform better than Dalio's All Weather Portfolio on both a general and risk-adjusted basis (it has historically), and I've also included a leveraged version at the bottom that may appeal to that audience.

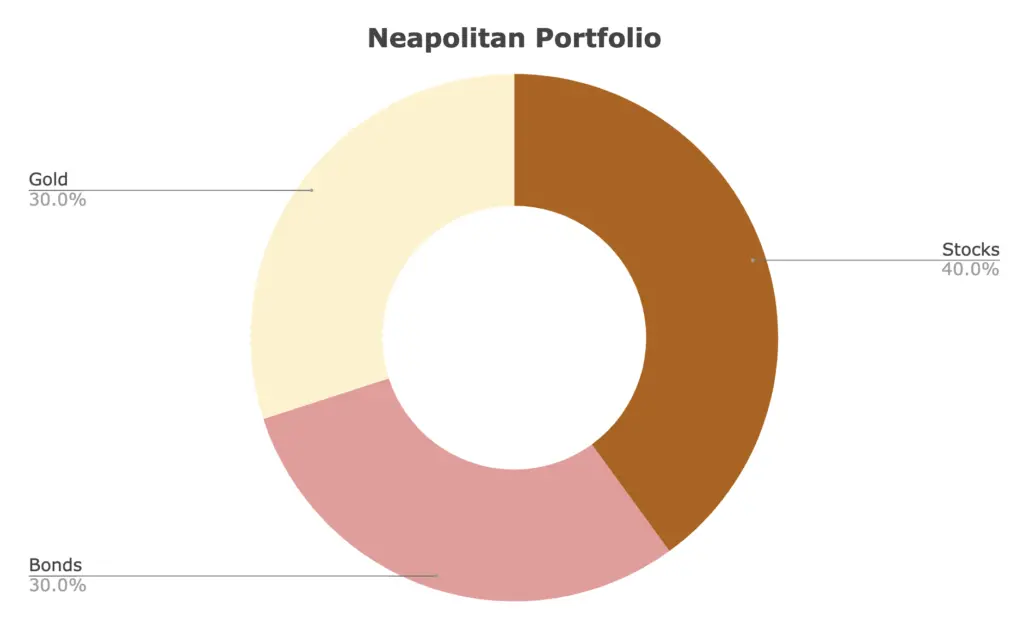

When I was a kid, we always had a tub of neapolitan ice cream in the freezer – equal parts chocolate, vanilla, and strawberry. But I always found myself wanting a bit more of the chocolate. That works itself out here. We can roughly achieve risk parity of the 3 aforementioned assets – wherein each one is contributing about the same volatility to the total portfolio – at these weights to arrive at the Neapolitan Portfolio:

40% Global Stocks

30% U.S. Treasury STRIPS

30% Gold

The colors I used look much more appetizing in ice cream form; less so in a pie chart.

Neapolitan Portfolio – Historical Performance

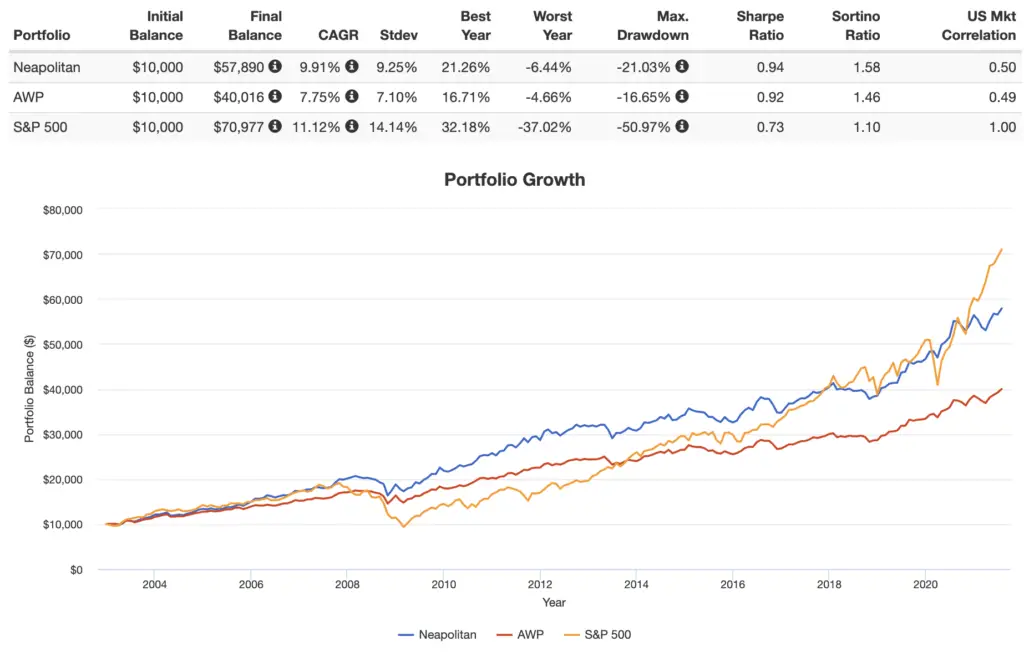

Here's a backtest showing the historical performance versus the All Weather Portfolio (using global stocks) and the S&P 500 from July, 2002 through July, 2021:

Granted this is fairly short time period, but notice how the Neapolitan was able to squeeze out more return – albeit with slightly greater volatility – for a higher risk-adjusted return (Sharpe) than the All Weather Portfolio. This is likely due to the All Weather Portfolio having a lower allocation to stocks, having a shorter average bond duration, and being dragged down by its 7.5% broad commodities position.

Remember past performance does not indicate future performance, and the backtested time period was great for long bonds.

Neapolitan Portfolio – ETFs to Use, and Pie for M1 Finance

M1 Finance is a great choice of broker to implement the Neapolitan Portfolio because it makes regular rebalancing seamless and easy, has zero transaction fees, allows fractional shares, and incorporates dynamic rebalancing for new deposits. I wrote a comprehensive review of M1 Finance here.

Using mostly low-cost Vanguard funds, we can construct the Neapolitan Portfolio like this:

VT – 40%

EDV – 30%

SGOL – 30%

You can add this pie to your portfolio on M1 Finance by clicking this link and then clicking “Save to my account.”

You'll want to rebalance regularly. I'd suggest quarterly at the beginning of the month, unless you're using this in a taxable account, in which case you'd want to try to wait. M1 may prove even more useful for a taxable account, because it uses automatic rebalancing wherein new deposits flow to the underweight asset.

Leveraged Neapolitan Portfolio

If you want to minimize volatility and risk, stop reading here. For those others who want to try to beat the market using leverage, it's still more important than ever to diversify across asset types to limit harmful drawdowns. Well we already did that to a substantial degree, so we can lever up these assets with the following funds:

UPRO – 3x S&P 500

TMF – 3x long treasury bonds

UGL – 2x gold (no 3x gold funds available)

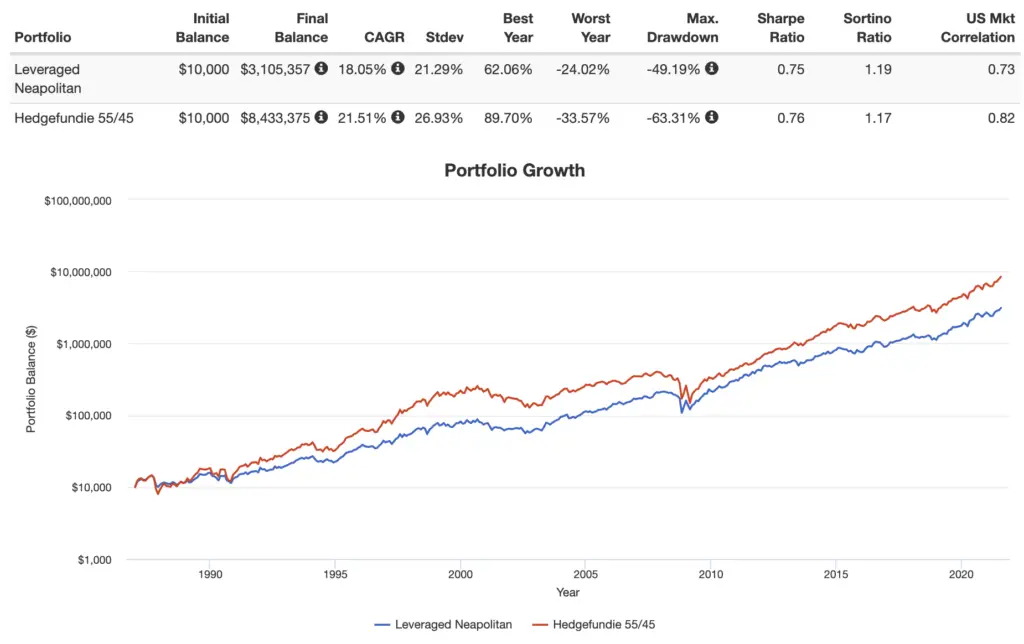

This is basically the famous Hedgefundie Adventure with a chunk of gold for those who can't stomach enormous drawdowns. I've compared it to the HFEA below from 1986 through July, 2021.

Remember that using leverage – especially in the form of leveraged ETFs – increases portfolio risk and the potential for greater returns, but also the potential for greater losses. Do your own due diligence before blindly buying leveraged funds. They can potentially be extremely dangerous. I talked a bit more about leveraged ETFs and how they work here.

Sharpe was close. This basically comes down to your view on bonds and whether or not they'll offer the same protection in the future. Adding gold takes some pressure off the bonds.

Allocations look the same:

UPRO – 40%

TMF – 30%

UGL – 30%

You can add this pie to your portfolio on M1 using this link.

Questions, comments, concerns, criticisms? Let me know in the comments.

Disclosure: I am long UPRO, TMF, and EDV in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Hi John,

I like the recent posts on your new portfolio designs. I’m definitely learning a lot.

I’m trying to decide on an appropriate portfolio for my taxable, non-emergency account. My goal is for it to provide decent returns while dampening drawdowns and reducing risk so that I can tap it when needed for large purchases. I think I can tolerate some volatility, say a historical worst year drawdown of 20% or so. I’d have some heartburn if drawdowns were much greater than that. These are my top contenders:

1. Global golden butterfly

2. Your “NTSX + diversification” portfolio

3. 100% SWAN

4. Your “SWAN + gold” portfolio

5. Global 60/40 via Vanguard Life Strategy Moderate Growth fund.

6. Neapolitan portfolio

7. Or just go 100% NTSX, like I believe you do, and call it a day.

I know you can’t provide investment advice, but I’m definitely having some analysis paralysis and cognitive dissonance with all the options! Are there any comments or pieces of information you might be able to provide that could help steer me in the right direction? I imagine other folks might be in the same position of having to decide between many options that appear appropriate.

Thanks!

Thanks Jed. The main factors here are whether or not you know the time horizon of these large purchases and whether or not you’re flexible on that timing, i.e. being able to wait for a market recovery from a major crash and not having to withdraw at the bottom. I’d say don’t go Neapolitan for this purpose. To keep the risk low, I like the idea of some gold and TIPS in there for this circumstance, as there’s a small chance stocks and nominal bonds go down together if we see high inflation and rapidly rising interest rates. After that, I think just look at historical volatility and max drawdown – preferably through the ’08 crash – to make your decision. Maybe a slightly more aggressive version of my emergency fund design would make sense here – very low vol, low risk.

Why not the All-Weather (with maybe the Utilities swapout) – that’s what i’m thinking about doing.

The pie chart colors are genius!

Had a good laugh, well done 🙂

Keep up the good work, I really like your blog!

-Robert

Thanks, Robert!