Interest in ESG investment products has skyrocketed in recent years, particularly among young investors. Let's explore what ESG investing is, why you might be interested in it, and how to implement it in your portfolio.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links. Read more here.

Contents

What Is ESG Investing?

ESG investing – also referred to as socially responsible investing, sustainable investing, and impact investing – means investing in companies that align with specific criteria related to Environmental, Social, and Governance issues. Specifically, ESG investors aim to invest in companies that match their personal values and goals. Examples include clean energy tech companies, companies that pay and treat their employees well, and/or companies that help protect the environment.

Environmental criteria include:

- energy usage and conservation

- renewable energy usage

- emissions goals and policies

- natural resources and land use

- water usage and recycling

- waste production and disposal

- pollution

- treatment of animals

- etc.

Social criteria include:

- labor standards

- community impact

- employment opportunity

- employee health and safety

- employee treatment and pay

- workplace safety

- training and development

- production quality

- ethical sourcing

- consumer protection

- customer service

- etc.

Governance criteria include:

- transparent accounting and taxation

- executive pay and bonuses

- shareholder voting rights

- political involvement

- business ethics

- board diversity

- relationships with regulatory bodies

- etc.

Notably, outcries and protests over social issues in recent years have driven massive interest and investment in ESG-focused corporations and funds. It has also driven investment from controversial companies like firearms manufacturers, with investors stating that they don't want their money exacerbating any potential problems.

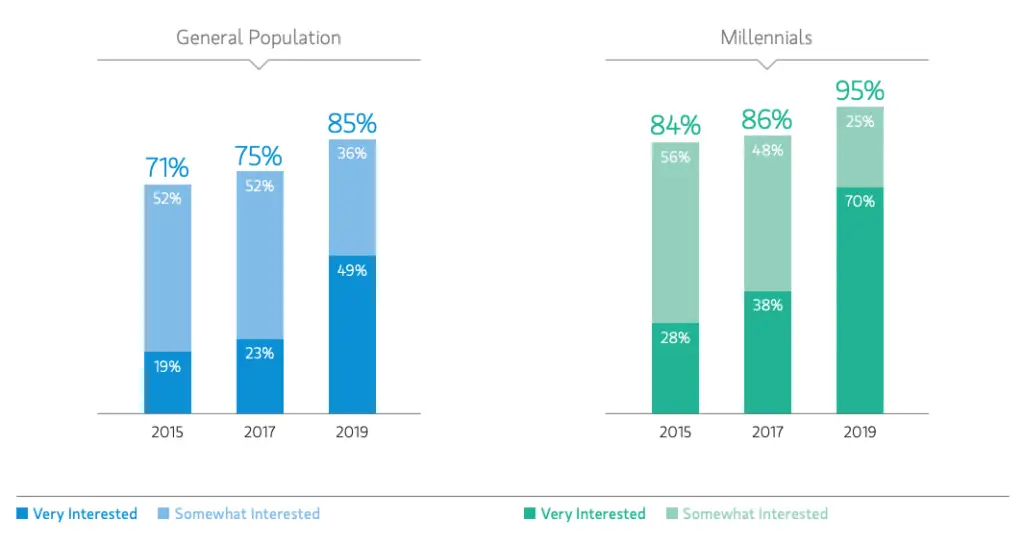

Morgan Stanley's Institute for Sustainable Investing found in a 2019 study that among individual investors, 85% are interested in sustainable investing, up 10 percentage points from 2017. For millennials specifically, that number is 95%, up 9 percentage points from 2017.

A range of ESG indexes and subsequent funds have arisen to satisfy the increasing demand, most with lower fees than we might expect for a specialized fund such as these. Investors also seem to be willing to pay a small premium to be able to quickly and easily access exposure that more effectively matches their personal values than a total market index fund. These indexes and funds are excluding controversial industries and are then ranking and weighting holdings by their ESG scores, a proxy for essentially how ethically a company operates.

ESG Investing vs. “Traditional” Investing

ESG investing is an alternative to the long-held “traditional” approach of focusing purely on shareholder value by maximizing short-term profits. As we might expect, and as we've seen in many examples, maximizing short-term profits usually sacrifices things like employee well-being, company culture, and production quality. Arguably more importantly, attempting to maximize profit invariably leads to engaging in riskier, potentially illegal behavior related to manufacturing, waste disposal, pollution, etc.

This toxic approach and environment trickles down to employees trying to please management as well. Ironically, for shareholders, these sorts of practices actually increase the risk from investing in these companies, as they are opened up more to lawsuits, regulations, investigations, employee turnover, and societal blowback. Famous examples are BP's oil spill and the wildfires that caused PG&E to go bankrupt.

Investors are waking up to the fact that corporate policies directly affect employees, neighborhoods, the environment, and society as a whole, and are thus demanding ethically superior practices than those we've seen in the past. This idea has specifically been referred to as “conscious capitalism.” Research has also overwhelmingly showed that happier, more engaged employees result in increased productivity and improved brand ambassadorship and customer service.

Some believe that high-ESG companies may outperform the broader market due to things like improved efficiency, forward-thinking management, consumer preference, and arguably more importantly, avoiding the aforementioned risk factors associated with low-ESG companies. If this is indeed the case, it means that not only is there not a tradeoff for ESG investors, but those investors may also be rewarded with greater returns by investing in more ethical companies. That's a win-win.

But only time will tell. Others believe that higher ESG corporations by definition have lower expected returns, as investors in more sinful, low ESG companies may demand greater returns for the greater potential risk, at least in ESG criteria terms, and that surging popularity in these funds – and subsequently, prices – will invariably lower their expected returns. Moreover, the time it takes for a company's ESG efforts to pay off may exceed the investor's time horizon, or the factors that explain ESG returns may also underperform for long time periods.

Experts do tend to agree that high ESG companies do seem to at least exhibit less downside risk than low ESG companies, meaning investors buying traditional funds and stocks may experience greater losses than ESG investors. In any case, an ESG investor will feel better about investing more ethically in their portfolio. That emotional aspect – and any subsequent positive social outcomes – may be worth the cost of potential underperformance for the investor.

How To Be More Socially Responsible in Your Investment Portfolio

So how exactly do we go about implementing socially responsible investing?

A range of funds have arisen to satisfy the demand for ESG investment products. Popular options are ESGV and VSGX from Vanguard and SUSL and ESGE from iShares. I delved into these ETFs and others here. Investors can use funds like these to essentially get market-index-like exposure with an ESG focus or tilt. Note that all the funds in a socially responsible portfolio do not need to have “ESG” in the name. Think of ESG as the grading scale. Clean energy funds like ICLN, for example, also fit the bill for sustainable investing.

An important thing to note, however, is that no constituent stock within an ESG-focused fund is going to score perfectly – or even highly – across all ESG criteria. Investors may find that many companies within an ESG fund are still companies they don't want to invest in. Because of this, it is important that the investor decide which values and criteria align with their personal interests and invest in companies and/or funds that most closely match them. Be sure to read the prospectus and selection methodology of any fund you're interested in. Different ESG funds have different exclusion and inclusion criteria. You may choose to simply exclude certain industries entirely such as weapons manufacturers, or also actively seek out companies engaging in positive ESG activity.

More narrowly focused or actively managed ESG funds invariably carry higher fees. The next best option is to pick your own individual stocks, essentially creating your own ESG ETF. After researching the socially responsible initiatives of companies you want to invest in, you can create your own basket of stocks and set a target allocation for each. Admittedly I prefer index funds, but you could also choose to purposefully overweight individual companies whose policies you admire. You'll also want to decide if you want to go all in on an ESG philosophy as a framework for your entire portfolio, only investing in ESG-focused funds and companies, or only dedicate a piece of your total portfolio to tilt toward ESG-centric investments.

A broker like M1 Finance and their pie format makes all this easier to implement than other brokers. M1 then automatically directs new deposits to keep those allocations on target without you having to manually rebalance the portfolio. This is called automatic or dynamic rebalancing. The ability to buy fractional shares also allow you to put a small amount of money into a large number of different stocks. Going this route would be the cheapest option, as M1 has no account or transaction fees. M1 also has some expert-built portfolios related to ESG (and other styles) that you can use for free if you don't want to lift a finger. I wrote a comprehensive review of the broker here.

M1 currently has a promotion for up to $500 when initially funding an investment account:

Conclusion

ESG investing may be right for you, provided you use funds and/or stocks that do indeed align with your own personal moral compass. The jury is still out on whether ESG-focused funds will outperform or underperform the broader market. In either case, high ESG companies should reliably have lower downside risk than low ESG companies.

This new type of shareholder activism is rapidly increasing as new, young investors demand more social responsibility from companies, fundamentally reshaping the approach to investing. It will be interesting to see how it all plays out going forward.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. All examples above are hypothetical, do not reflect any specific investments, are for informational purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Don't want to do all this investing stuff yourself or feel overwhelmed? Check out my flat-fee-only fiduciary friends over at Advisor.com.

Leave a Reply