Research Affiliates recently released their model portfolios for advisors. I review them here, along with some ETFs to use to replicate them.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Who Are Research Affiliates?

Research Affiliates, or RAFI for short, is the research and advisory firm founded in 2002 by Rob Arnott. They're very well known in the financial services industries thanks to their mounds of groundbreaking research in the form of hundreds of research papers, many of them recently surrounding factors, as well as their accumulation of awards within the industry.

Rob Arnott and Research Affiliates literally wrote the book on “smart beta” and fundamental indexing using globally diversified portfolios. Their investment strategies rest upon their own research. Arnott wrote a book for retail investors titled The Fundamental Index: A Better Way To Invest.

What Are the Research Affiliates Model Portfolios?

Research Affiliates recently published their model portfolios for advisors. You can get the PDF here. In their own words, these portfolios are described as being:

- Robust: An evidence-based framework grounded in academic rigor

- Adaptive: Portfolios weights that dynamically respond to changing yields

- Disciplined: A systematic process institutionalizing a contrarian approach

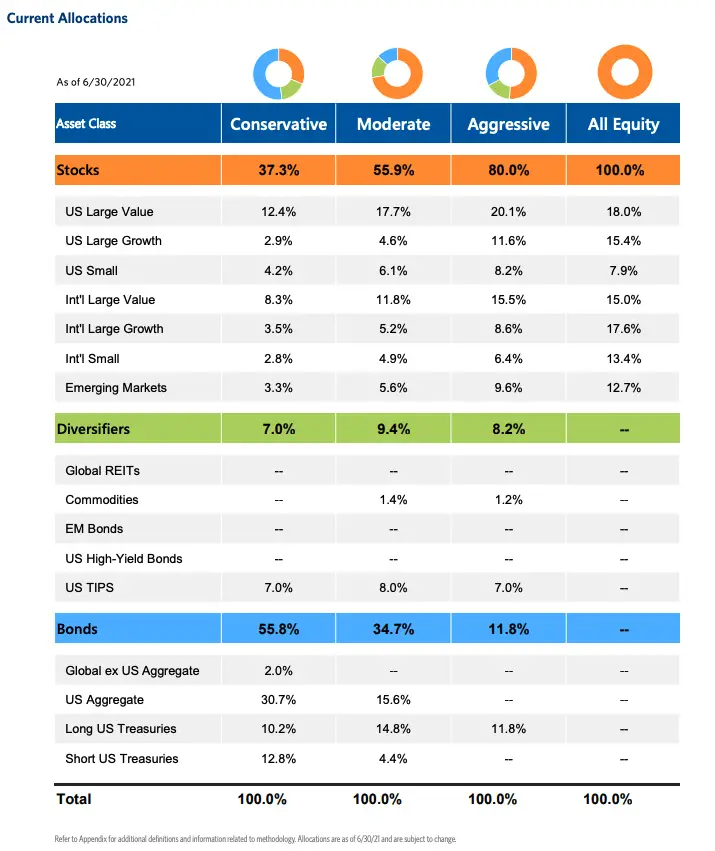

There are 4 of them with different asset allocation benchmarks based on different risk tolerances:

- Conservative – 40/60

- Moderate – 60/40

- Aggressive – 80/20

- All Equity – 100/0

Note that the portfolios below are the static asset allocations from the PDF as of July, 2021. They may not reflect the dynamic asset allocation strategy used by Research Affiliates if you pay for their management service. This is all for informational and recreational purposes only, for retail investors who may want to mimic RAFI's investing approach, which is essentially global diversification underpinned by “smart beta” fundamental indexing and factor tilts.

All the performance and allocation data below are lifted straight from the PDF from Research Affiliates.

Here are the allocations at the time of writing:

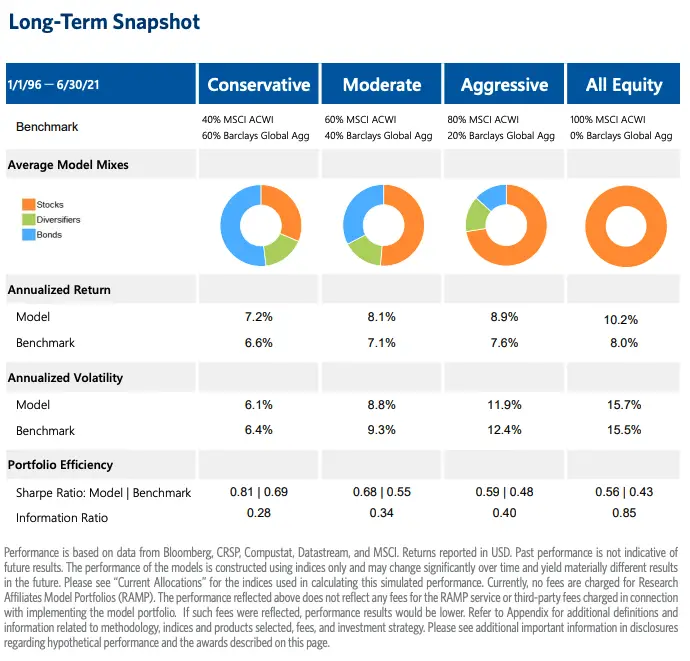

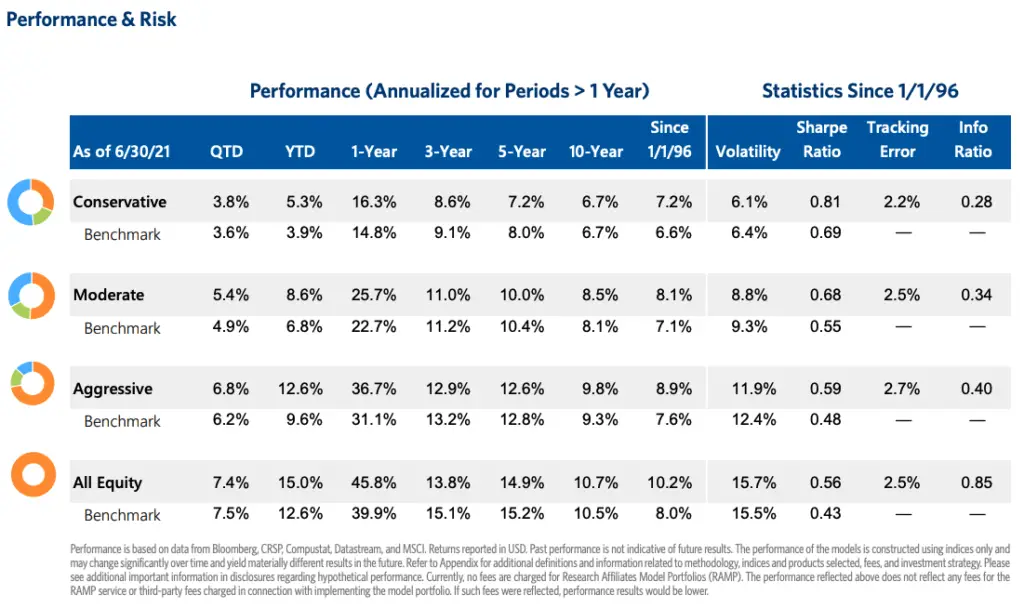

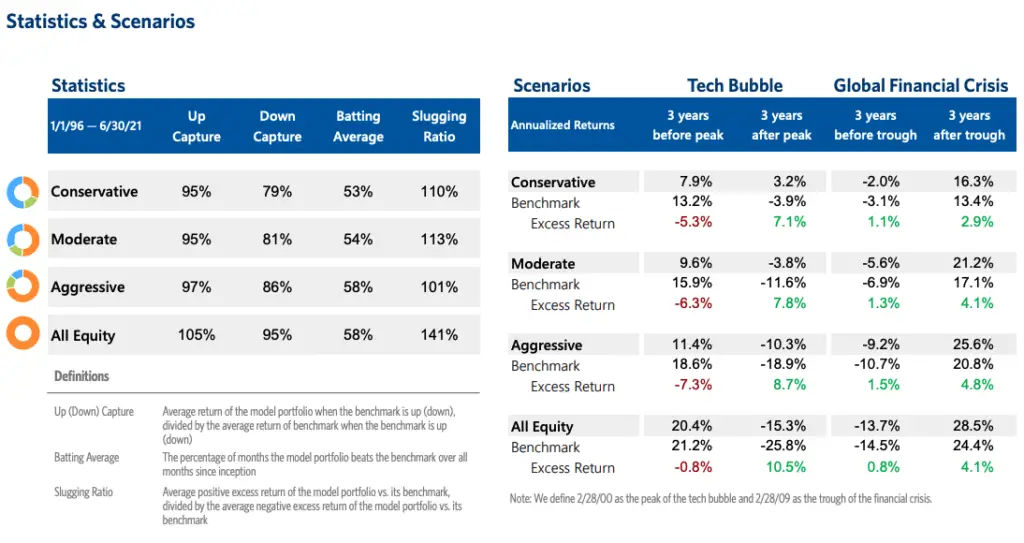

Rob Arnott Portfolio Performance Statistics

Research Affiliates Model Portfolios ETF Pies for M1 Finance

M1 Finance is a great choice of broker to implement any of these RAFI model portfolios, because it makes regular rebalancing seamless and easy, has zero transaction fees, and incorporates dynamic rebalancing for new deposits. I wrote a comprehensive review of M1 Finance here.

Again, in staying as true to the source as possible, I'm using the prescribed funds straight from the PDF from Research Affiliates themselves where applicable. I haven't altered them. They are mostly multi-factor funds from RAFI and PIMCO. They may or may not be the optimal choice. Where there's not a specific fund prescription, I'm using low cost Vanguard funds wherever possible.

The 4 different versions are below.

Conservative

- MFUS – 19%

- MFDX – 15%

- MFEM – 3%

- SCHP – 7%

- BNDX – 2%

- BND – 31%

- VGLT – 10%

- VGSH – 13%

You can add this pie to your portfolio on M1 Finance by clicking this link and then clicking “Save to my account.”

Moderate

- MFUS – 29%

- MFDX – 22%

- MFEM – 6%

- SCHP – 8%

- PDBC – 1%

- BND – 15%

- VGLT – 15%

- VGSH – 4%

You can add this pie to your portfolio on M1 by clicking this link.

Aggressive

- MFUS – 40%

- MFDX – 30%

- MFEM – 10%

- SCHP – 7%

- PDBC – 1%

- VGLT – 12%

You can add this pie to your portfolio on M1 by clicking this link.

All Equity

- MFUS – 41%

- MFDX – 46%

- MFEM – 13%

You can add this pie to your portfolio on M1 by clicking this link.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply