The Tim Maurer Simple Money Portfolio is a research-backed, optimized version of a traditional 60/40 stocks/bonds portfolio. Here we'll review its components, historical performance, and the best ETF’s to use for it.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Who is Tim Maurer?

Tim Maurer is the Director of Advisor Development for Buckingham Strategic Wealth and the BAM Alliance. He is a Certified Financial Planner.

Maurer is a regular contributor for CNBC, Forbes, and TIME/Money. He wrote Simple Money and co-wrote The Ultimate Financial Plan: Balancing Your Money and Life. You can read more about him on his website here.

What is the Tim Maurer Simple Money Portfolio?

Tim Maurer's portfolio shares the same name as his book: Simple Money. I have to say the Simple Money Portfolio is perhaps my favorite lazy portfolio. While its implementation can indeed be lazy for DIY retail investors, only requiring a handful of ETF's, its design was definitely not.

Maurer took some of the most robust research in modern portfolio theory (from the legendary Eugene Fama and Kenneth French) to essentially create a 60/40 portfolio with Value and Size factor tilts. Think of this as a more optimized, evidence-based 60/40 portfolio.

Maurer takes an approach not unlike Paul Merriman, walking you through each step of picking the portfolio's components to optimize its expected return. Moreover, the factor tilts resemble those often espoused by Larry Swedroe. Essentially, we're using the following premises in the construction of the Simple Money Portfolio:

- Stocks tend to have higher returns than bonds.

- Small-cap stocks tend to have higher returns than large-cap stocks. (Size factor)

- Value stocks tend to have higher returns than Growth stocks. (Value factor)

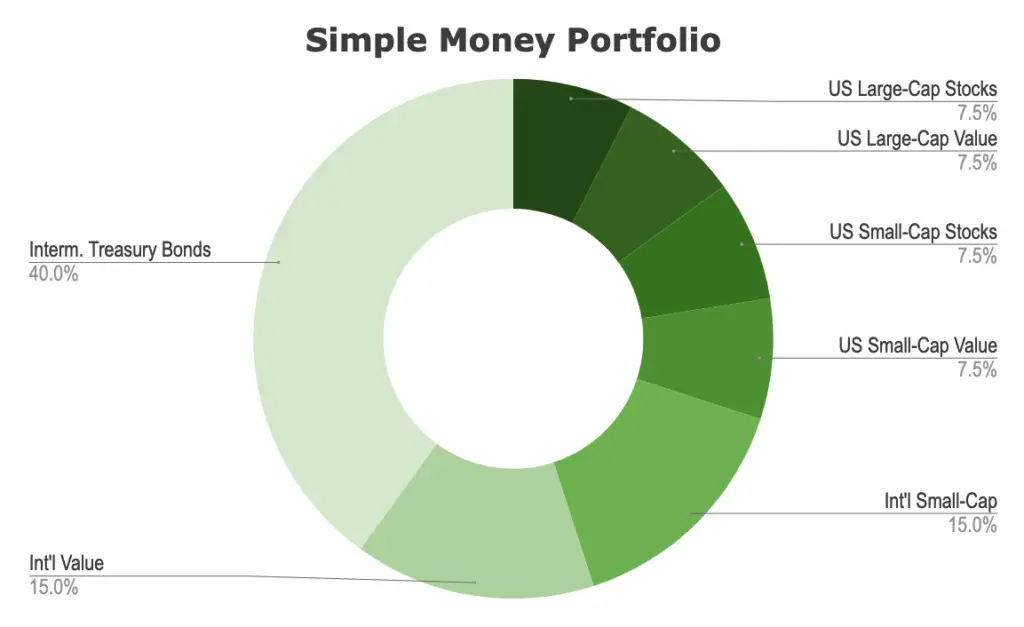

A tilt simply means we are purposefully overweighting specific things – in this case, small-caps and Value stocks – inside the portfolio. Considering these things, the Simple Money Portfolio is as follows:

- 7.5% U.S. Large-Cap Stocks

- 7.5% U.S. Large-Cap Value

- 7.5% U.S. Small-Cap Stocks

- 7.5% U.S. Small-Cap Value

- 15% International Developed Markets Small-Cap Stocks

- 15% International Developed Markets Value Stocks

- 40% Intermediate Treasury Bonds

I like that Maurer chose to incorporate a healthy allocation to international stocks, improving diversification; most lazy portfolios have home country bias for the U.S.. I also very much like that Maurer specifically prescribes treasury bonds instead of a total bond market fund, since we know treasury bonds are superior to corporate bonds.

Tim Maurer Simple Money Portfolio Performance Backtest

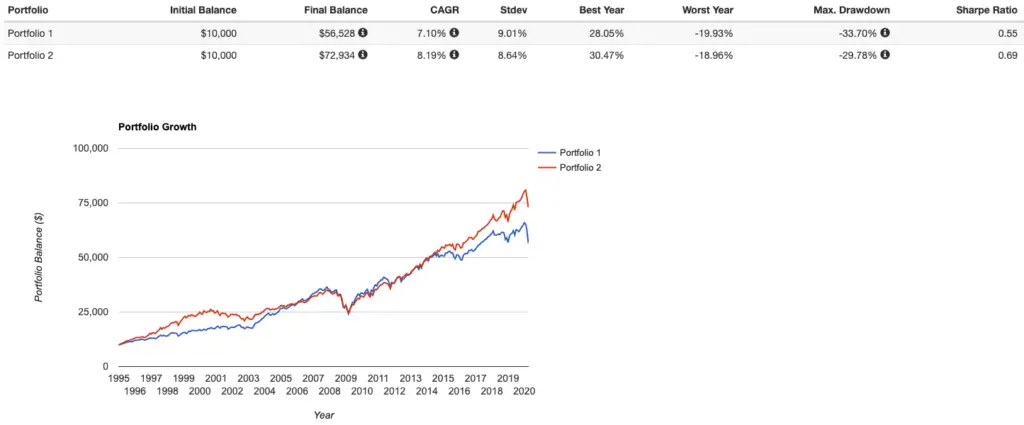

Going back to 1995, here's a comparison of the Simple Money Portfolio vs. its 60/40 benchmark:

So what's with the underperformance?

Unfortunately, both the Size and Value factors and international stocks all suffered for the decade 2010-2020, perhaps from the dreaded “curse of popularity” and/or “publication effect,” when factor premia seem to drastically decrease or disappear after being investigated and published in the academic literature.

Fama and French maintain that no conclusions can be drawn on whether or not the Value premium declined or disappeared following their initial 1992 paper, due to its high monthly volatility.

AQR submits that Value is basically the cheapest it's ever been right now, suggesting that now may be the worst time to give up on the factor, and that it's due for a comeback. Value stocks beat Growth stocks in 2021 and 2022, so that comeback may indeed be happening.

I think too many people succumb to tracking error regret – giving up on a strategy after its underperforming the benchmark for some period of time. Usually those time periods are drops in the bucket of one's investing horizon, and especially of time overall. Maurer's and Swedroe's clients and followers are perhaps the perfect example of this, because their prescribed portfolios heavily utilize Small Cap Value stocks.

Factors are simply unique or independent sources of risk. A typical 60/40 portfolio has more risk than one might realize at first glance. Due to the comparatively greater volatility of stocks compared to bonds, over 80% of the portfolio's risk is market beta. Conveniently, diversifying across factors actually leads to a “stronger” portfolio in terms of reducing the risk of black swan events, but you must be able to live with tracking error regret, a term for giving up on a strategy after its underperforming its benchmark for some period of time. Adding in factors necessarily means your portfolio’s performance does not resemble the market; there may be periods of underperformance.

Moreover, we would also expect factors to have negative premiums from time to time, even for extended time periods. There have been more 10 year periods where the U.S. market delivered a negative premium than there have been 10 year periods where U.S. Value delivered a negative premium.

It's also largely only been a U.S. problem. Over the last 30 years or so, Value elsewhere in the world has outperformed the market in many cases. I also don't believe tech will continue to consistently outperform the market consistently in the future, which has been the driving force behind Growth's recent boom.

While I acknowledge I could be completely wrong, I still choose to tilt Small-Cap Value because I believe the Size and Value factor premia still exist because the evidence suggests that is more likely than them simply being broken factors.

Tim Maurer Simple Money Portfolio ETF Pie for M1 Finance

M1 Finance is a great choice of broker to implement the Simple Money Portfolio because it makes regular rebalancing seamless and easy with one click, has zero transaction fees, and incorporates dynamic rebalancing for new deposits. I wrote a comprehensive review of M1 Finance here.

M1 doesn't allow for fractions of 1% for holdings, so I had to add and subtract 0.5% here and there below. Using low-cost ETF's, we can construct the Simple Portfolio pie like this:

- VOO – 8%

- VOOV – 7%

- VIOO – 8%

- VBR – 7%

- SCZ – 15%

- EFV – 15%

- VGIT – 40%

You can add the Simple Money Portfolio pie to your portfolio on M1 Finance by clicking this link and then clicking “Add to Portfolio.”

References

Fama, E., & French, K. (1992). The Cross-Section of Expected Stock Returns. The Journal of Finance,47(2), 427-465. doi:10.2307/2329112

Fama, Eugene F. and French, Kenneth R., The Value Premium (January 1, 2020). Fama-Miller Working Paper No. 20-01 . Available at SSRN: https://ssrn.com/abstract=3525096 or http://dx.doi.org/10.2139/ssrn.3525096

Disclosures: I am long VOO and VBR.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply