Is the Value premium dead? Probably not. With Value suffering a beating for a decade, let's hope it's time for its resurgence. Here we look at the best Value ETFs to buy value stocks in 2025.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it here:

Introduction – Why Value ETFs?

If you've landed on this page because you're looking for a Value ETF, you probably already know the answer for why we would be interested in Value ETFs in the first place.

Value stocks are thought to be underpriced relative to their fundamentals. These are usually relatively boring companies in the bargain bin. Unlike high-flying growth stocks like Amazon, Apple, etc., Value stocks typically don't make the headlines.

Value stocks are sometimes downtrodden, forgotten stocks that have had a rough run, and are considered riskier than Growth stocks. While there are surely some behavioral components too, the theory goes that investors are compensated on average for taking on that extra risk, hence the “Value premium,” one of the risk factor premia discovered by Eugene Fama and Kenneth French that explain the differences in returns between diversified portfolios. This “Value factor” measures the relative cheapness of any given stock or fund.

There's a neat asymmetry of expectations and consequential behavior that favors Value stocks, which David Dreman and Michael Berry documented in a 1995 paper. They showed that when the earnings of Growth stocks are greater than expected, those stocks tended to increase in price only a little, but when those earnings were below expectations, those stocks fell by a lot. Value stocks exhibited the opposite behavior. When their earnings exceeded expectations, their share price grew drastically, and when earnings were lower than expected, share price fell only slightly.

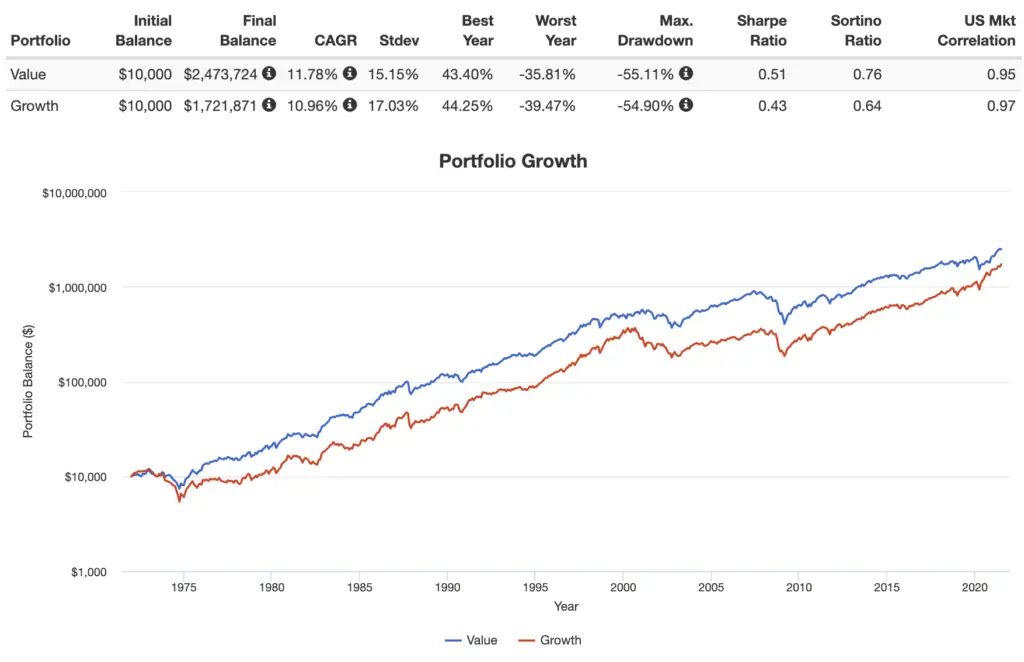

Basically, every day when we wake up, we would expect Value to outperform Growth, and indeed it has historically. Here is a look at Value's performance vs. Growth going back to 1972:

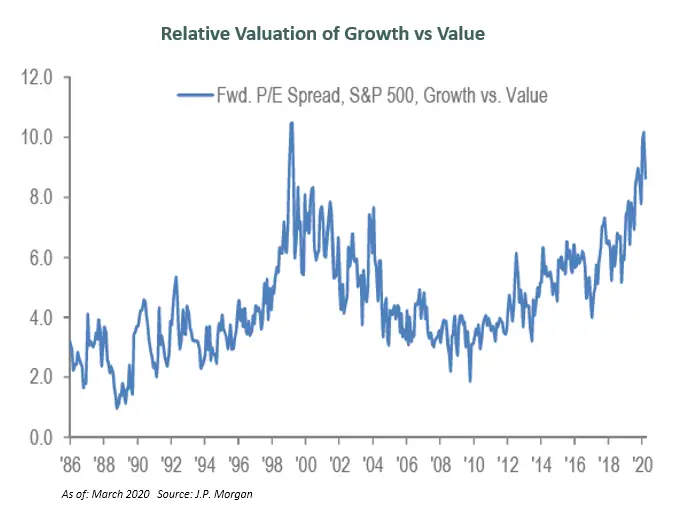

Unfortunately the Value factor has suffered in recent years, severely underperforming Growth. This has caused many to succumb to recency bias and jump on the Growth bandwagon, driving down its expected return. I don't employ or advise market timing, but AQR maintains that Value has basically been the cheapest it's ever been in the past couple years, suggesting that right now may actually be the worst time to give up on the factor. Basically, the spread between Growth and Value has recently been as large as it's ever been, meaning Value has looked extremely cheap and Growth is looking extremely expensive, meaning Growth now has lower expected returns.

We would also expect factors to have negative premiums from time to time, even for extended time periods. Value stocks have actually delivered a more reliable premium than the market historically. That is, there have been more periods Value has delivered a positive premium than the market, and there have been periods when the market premium was negative and the Value premium was positive.

AQR suggests Value is due for a comeback. This theory has been true in 2021 and 2022, with Value beating Growth. Conveniently, in March, 2021, Yara, Boonz, and Tamoni concluded that large value spreads have reliably preceded greater returns for Value and have provided statistically significant predictive power for those attempting to time Value, i.e. rotating in and out of Value stocks. Moreover, there has existed a positive relationship between the size of the spread and the future premium delivered – that is, the larger the spread, the larger the expected premium. Here's what that spread looked like going into 2021:

Value ETFs obviously allow us to diversify within value stocks and avoid having to try to pick them individually, which tends to be a fool's errand.

So now that we know why we might want to tilt Value, especially right now with its higher expected returns in the near future, let's explore the best Value ETFs that capture the expected premium most effectively.

Evaluating Value ETFs

Different Value ETFs have different exposure to the actual Value factor, written as HmL or high minus low. That just means some funds are more value-y than others. If we describe Value as cheap stocks, we would say a fund with a low loading on Value is capturing comparatively more expensive cheap stocks, while a fund with a high Value loading is capturing comparatively cheaper cheap stocks, if that makes sense. [Note that ideally, this should also show up in valuation metrics like price-to-earnings ratio (P/E ratio).]

We can measure this by performing a statistical regression on any given fund over a specific time period. In that manner, we can compare the relative exposure to Value among different funds at once – basically, do they provide the exposure they claim? And is one better than another? Usually a fund with superior exposure has a higher fee. In those cases, we want to try to estimate if we think the expected premium makes up for the fee delta and trading costs given the fund's loading on Value.

The 7 Best Value ETFs

Given all that, here are what I think are the best Value ETFs for 2025 for various cap sizes and geographies.

Most of the ETFs below are incorporated into my Vigorous Value Portfolio that I designed for those wanting to place some bets on Value.

AVUV – Avantis U.S. Small Cap Value ETF

I think AVUV from Avantis probably deserves the first mention. It has sort of been the golden child of the U.S. small cap value segment since its recent launch in late 2019, and for good reason. It provides some impressive exposure to the Size, Value, and Profitability factors, so much so that it replaced VIOV in my own portfolio.

In a nutshell, AVUV has done a great job so far of capturing small, cheap stocks in the U.S., at a relatively low fee of 0.25%, only 10 basis points higher than VIOV's fee of 0.15%. We would expect its premium to more than make up for its greater fee. I included it in my list of small cap value funds here, and I compared it to some other popular small cap value funds in more detail in a separate post here.

Other ETFs considered included: VBR, IJS, VIOV, SLYV, ISCV, VTWV, RZV, DFAT, DFSV, OSCV, PQSV, SVAL

AVDV – Avantis International Small Cap Value ETF

Similarly, AVDV from Avantis seems to be the clear choice for international small cap value exposure in Developed Markets. Previously we had to rely on some expensive dividend funds from WisdomTree as proxies to capture this corner of the global market, but Avantis is a factor-focused fund provider, so they've got a product tailored for it.

Other ETFs considered included: VSS, DLS, SCZ, FNDC

MDYV – SPDR S&P 400 Mid Cap Value ETF

If for some reason you want to target Value specifically within U.S. mid-caps, my choice would be MDYV. This fund from SPDR seeks to track the S&P 400 Mid Cap Value Index, which conveniently utilizes an earnings screen to give us some Profitability factor exposure as well. The fund has a fee of 0.15%.

Note that if you're with Vanguard or if you just prefer a Vanguard fund, their equivalent fund for the same index is IVOV and it costs the same at 0.15%, but it is less popular than MDYV.

Other ETFs considered included: VOE, IWS, IJJ, IVOV, QVAL, IMCV

RPV – Invesco S&P 500 Pure Value ETF

For Value in U.S. large caps, it's RPV from Invesco. The fund's name is appropriate. Unlike some of its competitors, it delivers “pure value,” blowing the others (VONV, IUSV, etc.) out of the water in terms of actual Value exposure. Even though some of these competitors have a much lower fee, we would still expect a greater premium after fees from RPV.

Note that while this fund is selecting from the S&P 500, it still has positive loading on the Size factor, as the stocks exhibiting the greatest relative “cheapness” within the index happen to be smaller, and Invesco's weighting scheme for this fund actually weights cheaper stocks more. That is, stocks exhibiting greater Value get a greater weight within the fund. RPV has nearly $3 billion in assets and an expense ratio of 0.35%.

Other ETFs considered included: VTV, VONV, VLUE, IUSV, JVAL, ILCV, VOOV, VYM, SCHD, AVLV, DFLV

EFV – iShares MSCI EAFE Value ETF

EFV from iShares captures large cap value stocks (and about 10% mid-caps) in developed countries in Europe, Australia and the Far East. This fund is market cap weighted and costs 0.39%. This fund is very popular, with assets of about $15 billion.

Other ETFs considered included: IVLU, IVAL, DTH, HDEF, DOL

DGS – WisdomTree Emerging Markets SmallCap Dividend Fund

With AVDV above for small cap value in Developed Markets, I mentioned having to previously use a dividend-oriented fund from WisdomTree as a proxy. Well for the very narrow segment of small cap value in Emerging Markets, we still have to do that, as there's no great ETF yet to capture this small corner of the market. The new factor funds AVEM, AVES, DFEM, and DFEV from Avantis and Dimensional are pretty good, but technically they're not even a small cap value funds (they're more market-wide, effectively mid-cap) and they still doesn't look as good as DGS in my opinion.

For now, we want to use DGS from WisdomTree. Value factor chasers have wisened up to the exposure this fund provides, as it boasts over $2 billion in assets. This narrow exposure comes at a fairly hefty price of 0.63%, but we would still expect its premium to make up for that fee, and it is indeed more expensive to trade in Emerging Markets.

Other ETFs considered included: UEVM, EEMS, AVES, AVEM, DFEM, DFEV

FNDE – Schwab Fundamental Emerging Markets Large Company Index ETF

Similarly, there's really nothing available to directly capture large-cap value in Emerging Markets either except from some relatively expensive multifactor funds.

For now though, Schwab has an Emerging Markets fund that applies some screens for revenue, cash flow, and dividends, which gets it some somewhat naive yet appreciable exposure to the Value and Investment factors in large caps. Given Avantis's huge success with AVUV, many have been gravitating toward its broad Emerging Markets fund AVEM, but so far in its short lifespan it doesn't look terribly different from plain ol' VWO from Vanguard in my opinion, while costing 23 more bps. We'll see how it evolves as time progresses.

FNDE uses RAFI's fundamental factors in selecting and weighting its constituent stocks. This fund has over $4.5 billion in assets and an expense ratio of 0.39%.

Here's another option, though. Remember when talking about DGS above for EM small cap value, I said new funds from Dimensional and Avantis for Emerging Markets basically cover all cap sizes and are thus effectively mid cap value. As such, it may make sense to simply use one of those funds in place of both DGS and FNDE.

For me, that choice would be AVES from Avantis. In other words, the average of a small cap value fund and a large cap value fund is a mid cap value fund. What I mean by that specifically is that in terms of effective exposure, with some hand waving, we could say [(DGS + FNDE) / 2] = AVES. Doing so would also save you a bit on fees, since AVES has a fee of 0.36%, lower than that of both DGS and FNDE. This move would also simplify the portfolio a bit by eliminating a fund.

Other ETFs considered included: EEM, IEMG, XSOE, DEM, AVEM, PXH, DVYE, AVES, AVEM, DFEM, DFEV, DFAE

Adding These Value ETFs To Your Portfolio

Right now may end up being the best time to get in on Value. Only time will tell. All these value ETFs above should be available at any major broker. My choice is M1 Finance. M1 has zero trade commissions and zero account fees, and offers fractional shares, dynamic rebalancing, and a sleek, user-friendly interface and mobile app. I wrote a comprehensive review of M1 Finance here. Investors outside the U.S. can use eToro.

If you have a globally diversified portfolio of broad index funds already (e.g. VTI, VXUS, etc.) and you want to tilt/overweight Value, I've assembled all these funds into what I called a little “Value Pack” pie for M1 Finance that you can find here.

Think of it like a spice packet you'd add to a soup or something. This is basically what I did with the Vigorous Value Portfolio.

Weighting it at 10% would mean you have about a 10% Value tilt, for example. I've weighted the funds roughly equal to their relative global market weights. Don't use it as your entire portfolio unless you want to quite literally go all in on Value! You'd be missing out on basically half the global stock market comprised of Growth stocks.

Also, again, most of these ETFs above are incorporated into my Vigorous Value portfolio, if that interests you.

Disclosures: I am long AVUV, DGS, and AVDV in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Hi John, curious to know if your view on DGS has changed since Avantis launched the new AVEE?

I follow your site and your youtube vids. I know you don’t provide financial advice but I like the way you think. I’m setting up a youth account for my teen kids at Fidelity to get them thinking about investing.

I was thinking about the following portfolio:

55% NTSX

15% RPV

15% AVUV

15% QQQ

I realize that there is no international specific ETFs here and maybe I should add some (say 10%) by knocking down some of the RPV, AVUV and QQQ. and add some international but (admittedly so) I have home country bias.

Thoughts?

Thanks, Jason. If you’re using NTSX and RPV, it makes little sense to me to also use QQQ. And yes, I’d prefer int’l diversification as well.

Big fan of the site and your yt channel.. One of my go-to sources (along with Ben Felix).

Was looking for a good value etf to add to NTSX. in a portfolio. VTV has been my usual large cap value favorite and was just doing a compare and contrast with RPV and SCHD. RPV is definitely deep value, but it’s cap size puts it more into mid -range. That would be great except I’m also including AVUV. Don’t care about dividends in this portfolio, and trying to keep it as simple as possible. SCHD seems to be a solid choice. Good value and quality loading.

Appreciate any thoughts/feedback. Thanks!

30% – NTSX

10% – VTV or SCHD or RPV or ?

20% – AVUV

20% – AVEM

16% – AVDE

4% – AVDV

Thanks, Dave! Looks pretty good to me. Your thought process there on the value fund seems very reasonable. At 10% it’s not going to make a huge difference whichever one you go with.

What do you think about VFVA?

Enjoy your work. Thoughts on RSP?

Thanks, Thomas! I like RSP for a single fund solution, but it’s basically just a way to get more exposure to smaller stocks. I prefer to hone in on my factor exposure a bit more granularly, if that makes sense.