SPACs are hot right now. Should you invest in them? Maybe. Are they just a fad? Only time will tell. Here we'll explore what SPACs are, talk about their characteristics and risks, and check out the best SPAC ETFs to invest in SPACs in 2024.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Introduction – What Are SPACs?

SPACs are Special Purpose Acquisition Companies. They are companies that merge with or acquire companies that want to go public. SPACs typically have a target acquisition in mind at formation, but they don't have to disclose that. This is why they're called “blank check companies.”

SPACs don't have business operations. They are ad hoc shell companies formed specifically for this “special purpose.” A SPAC is an IPO for IPOs. They take capital from investors to make those deals. And if they don't strike that deal within 2 years of their formation, that capital must be returned to those investors.

SPACs had some rough early days when they first came on the scene. Even as recently as a decade ago, about half of SPACs failed. They've become much more efficient and successful in recent years, though, and now that failure rate is near zero. This has largely happened due to specialization in specific industries by SPAC organizers.

Why SPACs?

SPAC creators can boost their own returns by taking up equity in it. Unlike retail investors, SPAC sponsors can buy units of founder shares and warrants, allowing them to avoid downside risk and simultaneously get a nice equity chunk of the future company. The sponsors also arguably get greater liquidity from the SPAC than from a traditional venture capital or private equity setup.

SPACs offer advantages to the company being acquired, too. A small company can avoid private equity deals and just sell to a SPAC. They also conveniently get a backdoor IPO (initial public offering) that's faster, thereby allowing them to avoid the traditional, arduous IPO process. They can also potentially get access to a highly-specialized sponsor team that adds strategic value. So sort of a win-win-win for most of the parties involved.

In practice, SPACs basically offer a new play toy for billionaires to take large stakes in companies and then go public with them. SPACs have even outpaced traditional IPOs in recent years.

For post-IPO retail investors, SPACs supposedly provide access to venture-capital-type deals that were previously only accessible to the wealthiest investors. You might get to experience the famous “pop” when they announce the company they're acquiring. Sounds exciting, right? Well, maybe…

Risks of SPACs

Know what you're getting into. SPACs clearly offer benefits to their creators, sponsors, and acquisitions. But as usual, things are not so attractive later down the line for the retail investor. The inherent structure makes the odds stacked against the post-IPO investor. In fact, the retail investor is basically paying for the outsized returns of and taking on the risk for the original sponsors. The retail investor is likely once again “late to the party.”

SPACs are also akin to speculative unicorn chasing. In fact, one of the few SPAC funds out there explicitly claims that “SPACs can provide investors who may not be able to access private equity transactions a means to invest in so-called ‘unicorns' at an earlier stage that might otherwise be possible.” I can't decide if the word “unicorn” in a prospectus is a good thing or a bad thing.

Investors may not even know what the SPAC plans to acquire, and the SPAC itself may not know what it wants to acquire at the time of formation! If I told you to give me a million dollars for some unknown idea I might have a year from now, would you? SPACs have received a lot of press and hype recently, but remember they're essentially just piles of investor capital. Moreover, the data has shown that both SPACs and traditional IPOs tend to lag the market in their first 12 months.

A recent marketing tactic by SPACs is to attach a celebrity or well-known influencer to fuel its hype. Recent examples include Shaquille O'Neal, Colin Kaepernick, and Alex Rodriguez. This fact alone should raise some red flags in my opinion. Or you may also just trust a big name asset manager like Bill Ackman, who started his own SPAC.

SPACs can openly pump up a stock because they don't have the “quiet period” requirement of a traditional IPO, a rule that says a company going public can't share opinions and information between the time of registration through 40 days after the stock begins trading. The positive PR spin claims that this allows companies to “tell their story” more easily by IPO-ing through a SPAC. According to SPAC creators, the most “innovative” companies are doing it this way. It's possible that future regulations will close these seeming loopholes that makes SPACs attractive in the first place.

If your “this sounds like a bubble” spidey sense is tingling, you might be right. The IPO market is already bubbling. I've seen SPACs called “a bubble within a bubble.” Call me paranoid, and I know I'm being a bit hyperbolic, but SPACs are sounding an awful lot like the new CDO's and penny stocks to me, and I think they should be approached with the same caution. Only time will tell. They raised over $80 billion in 2020.

SPAC ETFs

So let's say you want to invest in SPACs. How do we choose the right ones? Well, we can diversify across them with SPAC ETFs, which have emerged to meet the demand and the mania surrounding this trendy investment vehicle. The ETF holds a basket of SPACs, and one would hope at least a few of them “pop.”

Below are some SPAC ETFs to choose from. Pay attention to which one(s) you choose. They vary considerably in scope and type of management.

SPAK – Defiance Next Gen SPAC Derived ETF

SPAK was the first SPAC ETF to market. It's the only passively managed (meaning it tracks an index) SPAC fund. It holds U.S. SPACs and SPAC-merged companies. This fund seeks to track the Indxx SPAC & NextGen IPO Index.

Index eligibility comes after a minimum $250 million market cap, free float of 10%, and basic volume and liquidity requirements. The index is weighted 60% to SPAC-derived companies and 40% to SPACs themselves. It's rebalanced quarterly. Holdings are market cap weighted, so the largest deals get the most weight inside the fund. Single holdings are capped at 12% of the fund.

SPAK has about $50 million in assets and a fee of 0.45%.

SPCX – The SPAC and New Issue ETF

SPCX was the first actively-managed SPAC ETF on the scene, from Tuttle Tactical Management.

Unlike SPAK, SPCX doesn't hold the post-deal companies. Tuttle focus on selecting the “best” SPACs by looking at the management teams and their track records, while also considering valuation. Tuttle like to jump on new SPACs, and will avoid ones they deem too expensive even if they like the management. They explicitly seek out the “buzz” and “rumor.”

SPCX launched in late 2020 and has amassed about $100 million in assets. The fund tends to hover around 100 holdings and has an expense ratio of 0.95%.

SPXZ – Morgan Creek – Exos SPAC Originated ETF

SPXZ is another, newer actively-managed SPAC ETF that comes from Mark Yusko and Morgan Creek Capital Management. EXOS Financial is the sub-advisor. SPXZ launched in January, 2021.

SPXZ holds both pre- and post-merger SPACs, specifically targeting about 33% of the former and 67% of the latter. Because of this, there is usually zero overlap between SPXZ and SPCX. Investors seeking active management in this space may want to utilize both funds to diversify their exposure further (theoretically decreasing single SPAC risk), but only if they're also interested in holding post-merger companies.

Yusko claims that active management is important here because post-merger companies experience a wide range of possible outcomes. He also maintains that “the SPAC merger will become the preferred method of going public for high-growth, innovative companies of the future.” In fairness, he also explicitly says that this is a long-term investment in that buying post-merger companies – which comprise most of this fund – is a bet on their long-term future. Yusko himself has said he hopes to “find the Amazons of tomorrow.”

SPXZ also uses equal weighting to avoid concentration, and holds the 50 largest SPACs by market cap that it deems eligible for the fund. The fund looks for the largest SPACs on purpose, as they believe size and quality of the SPAC are correlated. The fund has about 100 holdings and an expense ratio of 1.00%. At the time of writing, it has a little over $20 million in assets.

SPAK vs. SPCX vs. SPXZ – Historical Performance

Of course, everyone probably just wants to see how these 3 SPAC ETFs have performed relative to one another. But remember these things before making any conclusions:

- Past performance does not indicate future performance.

- These funds are fundamentally different in terms of what they're buying.

- These funds have only been around for a few months, so this backtest may not mean much.

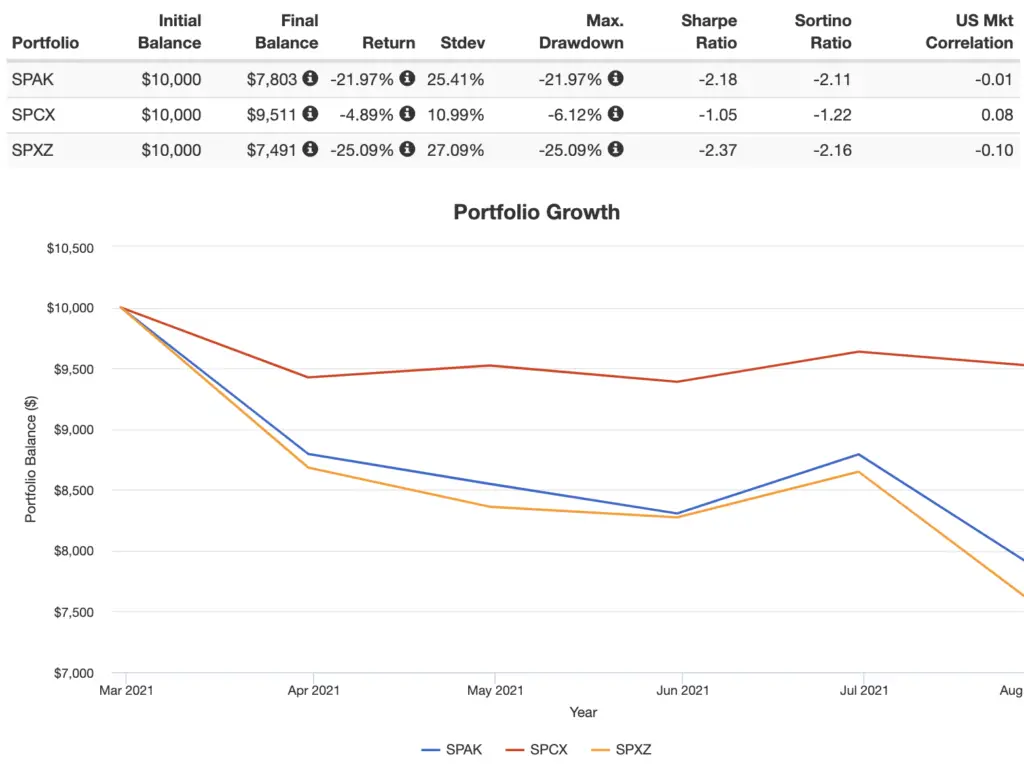

Here's March, 2021 through July, 2021:

SPXZ is the newest. If we exclude it and just compare SPAK and SPCX, we can go back a bit further to January, 2021:

So SPAK and SPXZ have tracked pretty closely. This probably makes sense. The former tracks a market cap weighted index and is 40/60 SPACS to post-merger companies. The latter specifically seeks the largest SPACs by market cap and is roughly 33/67 SPACS to post-merger companies.

SPCX is all SPACs, and Tuttle are specifically looking for that “buzz” and “pop.”

All 3 of these funds have lagged the S&P 500 so far.

Conclusion

Yusko's claim that active management is valuable in this space may indeed be valid. Only time will tell. But so far in its short lifespan, his fund's behavior looks a lot like that of the passively managed SPAK, which costs less than half the price of SPXZ.

SPCX is a different animal and altogether avoids the post-merger entities. That may prove good or bad. So far it has resulted in comparatively better performance, but simply relying on the “buzz” and “pop” may not be a sustainable long-term strategy, especially given the potential for regulatory risk.

There's also a general style problem here that no one seems to talk about. SPAC-derived companies are almost always small cap growth stocks, which on the whole have been the worst-performing segment of the market historically and do not seem to pay a risk premium. Of course, one or two of them may indeed go on to become the “Amazons of tomorrow,” but at that point these funds above might not even still be holding them.

In any case, my personal knee-jerk reaction is that SPACs in general look like a speculative bubble to me. Even some of the verbiage used to describe them is precisely the same that people used to talk about CDO's, tech stocks in 2000, and penny stocks. I would consider SPACs if they offer a demonstrable diversification benefit, but I wouldn't expect outsized returns from them, especially since the post-IPO retail investor is getting the short end of the stick. I also avoid small cap growth stocks as it is anyway.

What do you think of SPACs? Have you been considering them for your portfolio? Let me know in the comments.

Disclosures: None.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply