HNDL is a proprietary fund-of-funds income ETF from Strategy Shares with a target 7% yield. But is it a good investment? I review it here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Introduction – What Is HNDL and How Does It Work?

HNDL is fund-of-funds ETF from Strategy Shares. The sub-advisor is Rational Capital LLC. “Fund-of-funds” just means it's a single fund that holds other funds inside it. HNDL is focused on providing income, with a target annualized yield of 7%, paid monthly. Note that distributions may come as return of capital. The fund seeks to track the proprietary Nasdaq 7HANDL™ Index.

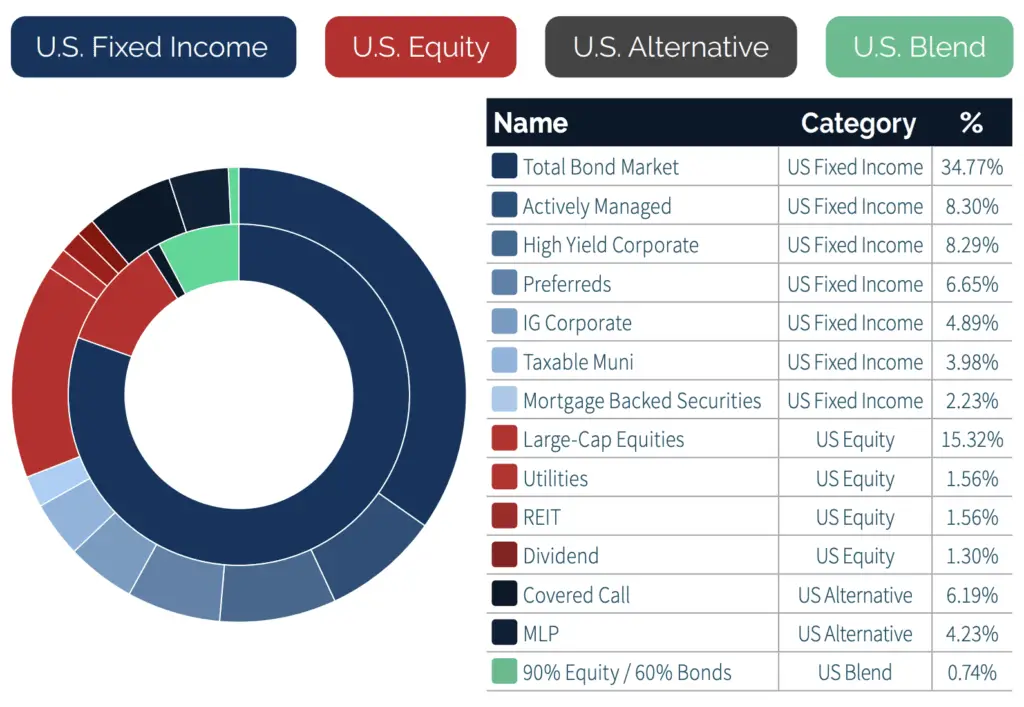

Half of this index is allocated to fixed income and equity ETFs at 30/70 stocks/bonds (called the “Core Portfolio”) and the other half is a “Dorsey Wright Explore Portfolio,” a tactical allocation with U.S. fixed-income, U.S. blend, U.S. equity and U.S. alternative assets, or categories that have historically provided high levels of income.

Here's how those two 50% components shake out. The first one, the “Core,” is 30/70 stocks bonds. As an aside, historically this asset allocation has generated the highest risk-adjusted return. That 30% piece is entirely U.S. large caps and heavily tilts tech using QQQ as roughly half of that piece, meaning 15% of the total fund. The other 15% is broad U.S. large caps like the S&P 500. So nothing too crazy going on here.

The other 50% component is a tactical allocation of income-generating funds for things like preferred stock, junk bonds, MLPs, Utilities, MBS, REITs, and more.

The fund then overlays 30% leverage via swaps for an overall leverage ratio of 1.3x.

This is admittedly hard to visualize and was just as hard to comprehend to write it all out. Here's what it all looks like straight from Strategy Shares themselves:

The fund is rebalanced monthly.

HNDL has amassed a little over $900 million in assets since its inception in 2018 and has an expense ratio of 1.17%.

Is HNDL a Good Investment? Probably Not.

First, let's talk about the fundamental construction of HNDL. This fund does precisely what I see novice investors do all the time and what I'm constantly advising against – it takes different segmented strategies with different purposes that may have merit on their own and just mashes them together somewhat haphazardly. One should almost always view the portfolio holistically and not use mental accounting to separate it into different buckets. In this case, HNDL explicitly does this with two separate halves of the fund, and then it subdivides those halves.

If funds could talk, HNDL is basically saying “well, we'll put half in a conservative 30/70 allocation of broad, safe, boring index funds in case we screw up with this other half where we're trying to time the market and ratchet up yield.” Even within that first half, it weirdly puts half of the equities in QQQ to track the NASDAQ 100 Index. But QQQ is basically a tech fund at this point, and the market is already over 1/4 tech. So for that entire equities position on the “safe” half, as I've referred to it, roughly half of it is in tech alone! To add insult to injury, HNDL is holding even more QQQ on the other side via QYLD. More on this in a second.

This is just performance chasing. Big Tech has had a stellar run in recent years, but that's not a recent to jump on the bandwagon, and we wouldn't expect that trend to continue. I've shown elsewhere that large cap growth is currently looking extremely expensive relative to history and relative to Value, meaning the segment now has lower expected returns.

Moreover, while it has suffered in recent years, we would expect Value to outperform due to the Value factor premium. Value is looking extremely cheap right now, and the valuation spread between Value and Growth is wide, which typically precedes outsized performance from Value. Of course, only time will tell what the future holds, but this seems like a silly sector bet given the fund's stated goal of income, as most of those stocks don't pay a dividend anyway. Speaking of factors, HNDL has negative loading on all the ones we care about – Size, Value, and Profitability.

In fairness, this may also just be a marketing tactic by Strategy Shares to attract assets, as funds like QQQ and QYLD – and really anything with “NASDAQ” in the name – have surged in popularity in recent years due to recency bias.

Now let's talk about the bonds side of that first half. Remember, this is 70% of the first 50% component, so it comprises 35% of the total fund. For this piece, HNDL is using total bond market funds like BND. This sounds nice, but I've explained before why exclusively using treasury bonds should be objectively preferable in diversified portfolios, especially when volatility and risk are the concern (which they clearly are, given a conservative 30/70 allocation).

While it may seem counterintuitive at first, diversifying within an asset class does not necessarily make a better diversifier for the total portfolio. In this instance, corporate bonds included in total bond market funds – usually at 25-30% – make this a suboptimal choice in my opinion. The choice of total bond market funds here makes even less sense given the fact that the fund also holds junk bonds to boost its income.

That covers that first half. The other 50% component is a “tactical allocation” smorgasbord of different assets – REITs, MLPs, muni bonds, junk bonds, utilities stocks, covered call funds, and more. This is where the fund is buying and selling things that typically provide high levels of “income” in the form of dividends, bond interest, and option premiums, thus HNDL's 7% target annualized yield. That's not a terrible idea as long as we're maintaining broad diversification, but remember this is only half of the fund.

To show you why this mishmash of ingredients is so strange and nonsensical, let's look at some of the specific holdings. The fund is simultaneously holding:

- QYLD, a covered call ETF that I hate.

- QQQ, the underlying index on which QYLD sells call options.

- VOO and VTI, Vanguard's ETFs for the S&P 500 and total U.S. stock market, respectively. The former comprises roughly 82% of the latter.

- ITOT, a total U.S. stock market ETF from iShares, which, for all intents and purposes, is the same thing as VTI.

- BND, SCHZ, and SPAB, which all capture the same thing – the total U.S. bond market.

- PFFD, a preferred stock ETF from Global X.

- VIG, Vanguard's dividend growth ETF.

- a tiny bit of NTSX, a 90/60 stocks/bonds fund from WisdomTree that I love.

Pick a lane. HNDL seems to have a lot of trees but no forest. The left hand isn't talking to the right hand. Some of these assets work against each other in terms of what they're trying to accomplish. You can't just throw a bunch of different tickers in a bucket and call it “well-diversified” (they explicitly say this in the fund's literature). But that's what's happening here.

Moreover, these funds don't really work together seamlessly in the cohesive effort of providing stable income. Again, optimize the portfolio as a whole for its intended goal(s). If income is the goal, put all your efforts into that. If mitigating volatility and risk is the goal, put all your efforts into that. This fund can't seem to decide what it wants to be, so it split itself into different strategies that are all glued together.

You might also notice that HNDL is entirely U.S. assets. It holds no international stocks or bonds. That's not ideal. The U.S. is one single country. It also makes no use of factor diversification within equities by utilizing, for example, small cap value stocks. Again, you can't tout being “well-diversified” if you don't make the effort to actually do that.

Lastly and arguably most importantly, we are asked to pay an astronomical 1.17% fee for this cauldron of different ideas, which seems insulting, considering most of HNDL's holdings are simply low-cost, highly liquid, US-centric index funds that any retail investor can go and buy themselves. I included the “US-centric” part because international assets would be more expensive and could at least offer a partial explanation for the higher fee, but alas they're absent. Here are some numbers and thoughts to illustrate just how insane this fee is:

- VOO and VTI, for example, both of which HNDL holds, cost the same tiny 0.03% fee. HNDL's fee is 39x that.

- The “safe” 50% component of 30/70 U.S. stocks and total U.S. bond market funds would cost you about 0.05%. HNDL's fee is over 23x that.

- QYLD is probably the most expensive fund in HNDL, and it costs 0.60%, roughly half of HNDL's fee. But then QYLD only makes up about 6% of the fund.

- I designed a dividend portfolio for income investors that is arguably more diversified than this and it costs 0.11%. HNDL's fee is over 10x that.

So what are we paying for?

I have to assume the creators want this fund to look more complicated than it really is to try to justify it exorbitant fee. I'm guessing this is why they use multiple funds on the “safe” component that track the exact same market segment, because they make no mention of tax loss harvesting, and you wouldn't need to do that even if it were for that purpose. In fairness, these assumptions may be incorrect.

On the other component, “tactical allocation” sounds cool but is almost certainly unnecessary and suboptimal. We know stock picking and market timing don't work on average over the long term. They mention trading on momentum, but you can just buy a momentum fund yourself.

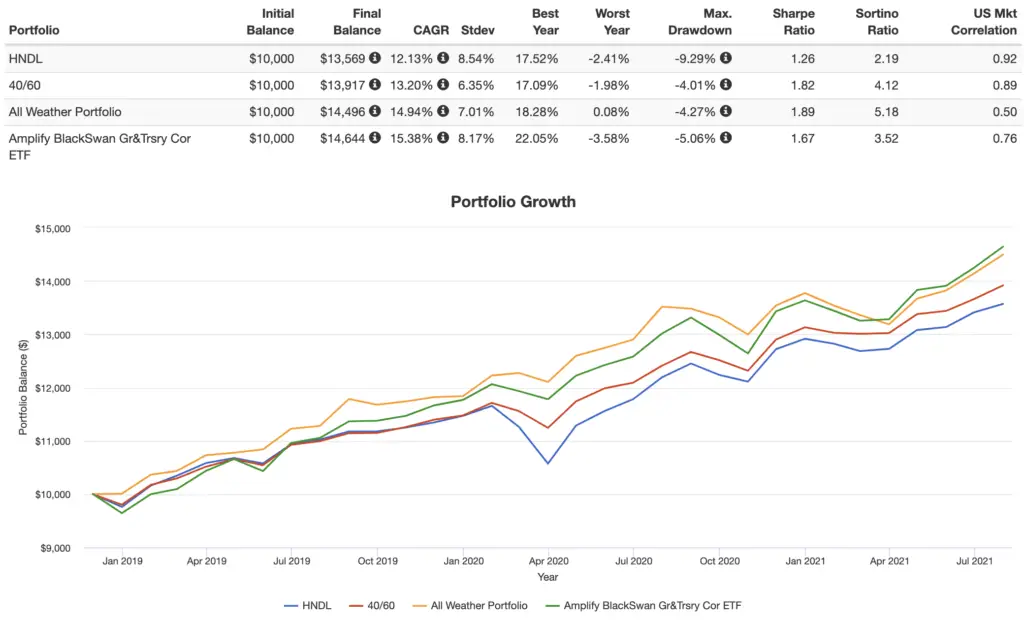

We can briefly look at some historical performance too to further illustrate just how bad HNDL is. Granted, the backtest below is only a couple years, starting in December 2018, but at least we get to see behavior through the March 2020 crash. It goes through July, 2021, comparing HNDL, a 40/60 portfolio of U.S. stocks to intermediate treasuries, the famous All Weather Portfolio, and SWAN (70/90 target exposure). I chose these because they're all designed to mitigate volatility and risk, similar to how HNDL aims to provide steady income without substantial price movement.

Notice the lower volatility, smaller drawdowns, and higher general and risk-adjusted returns of all the alternatives compared to HNDL. Conveniently, they're all also significantly cheaper. And those are just a few examples. Basically, HNDL's “safe” component still can't save it from itself.

In my review of QYLD, I noted that if you're just planning on reinvesting the fund's distributions, it doesn't make sense to buy “income” funds like these. Period. This should seem intuitive, but I've seen many say they treat these funds as a parking garage for “savings” or that they use the yield to buy other investments. Don't do that.

This is especially true in a taxable environment where HNDL's tax drag will be larger, because you're taxed on every distribution, regardless of whether or not you reinvest it. Personally, I'm a fan of simply selling shares as needed for any “income” needed, which should be mathematically preferable anyway if you don't actually need that income on a monthly basis, as it allows you to leave more money in the market longer.

Inexperienced investors seem to have this idea that the “income” and dividends from these expensive funds are free money, or that selling shares of a low-cost index fund like VTI to realize gains of an equal amount is somehow inferior to receiving a dividend. Neither of these things is true. This irrational preference of dividends as income is just a well-documented – and admittedly understandable – mental accounting fallacy. I suspect investors unfortunately aren't looking too far past the high yield carrot of these funds before buying in. Using dividends as income is fine, but not if you're paying 1.17% for the vehicle with which to do so.

But again, if income is the concern and you still want to use dividends for it, a combination of dividend stocks and high-yield bonds may appeal to you and would be cheaper and arguably more diversified than this fund. I think “income” is overrated. I'd be more likely to just buy something like SWAN and set up an automatic monthly transfer from the brokerage account that sells shares for me; there's my “income.” Again, I'm not a dividend investor anyway, so these types of yield-focused strategies don't appeal to me regardless. I'd rather create my own dividend when I want to instead of having my investments force a taxable withdrawal on me.

At this point I could list out the exact funds and percentages used by HNDL so that you could replicate it yourself – obviously excluding the swaps and tactical trading – at a fraction of the cost. But I don't want to do that, because I believe so strongly that this fund as a whole is a strategy – if you can even call it that – that doesn't make much sense. The funny thing is I actually don't know which fund I hate more out of HNDL and QYLD. HNDL might take the cake.

If you own this fund and your assets are part of HNDL's billion-dollar AUM, I am genuinely curious to hear what made you buy it, aside from the obvious 7% target yield that they boast. I'm 100% serious. I know that what may seem obvious to me as a seasoned investor is definitely not obvious to those with little to no experience who are simply looking for an income fund. Similarly, I realize that what may be a deterrent to me may seem like an attractive feature to someone else. I can't understand why this fund has $1 billion in assets.

Or if you just have thoughts on HNDL, let me know in the comments.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Disclosures: I am long VOO and NTSX in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Thank you for your review of HNDL. I owned a good chunk of HNDL because I am retiring and was looking to generate some income and I liked the 7% yield and monthly distributions.. I recently spoke with the HNDL folks and they thought that upwards of 50% of the distributions for the current fiscal year may be return of capital. We may have to wait until the annual report in April of 2022 to see how they classify the distributions. While I do not know if this will have any negative impact on their NAV, I was not comfortable with that and am looking for other options.

Thanks again for your review and for your website!

Thanks, Ron!

I own HNDL because of its investment approach. I like the diverse quantity and quality of funds instead of just stock picks. As well, as a retiree, I am enjoying the interest income I get with a stable value on my capital. I am seeking income over total appreciation because I don’t have 40 years until retirement anymore. I need preservation and income. In that regard, HNDL works for me. Therefore, I do not think HNDL mashes (funds) together somewhat haphazardly. You make HNDL management seem unprofessional in their analysis. HNDL has a proven record of returns. As a result, I am comfortable with my investment. I also own SWAN, YYY, Vanguard Wellesley Income, Vanguard Corporate High Yield and RYDL. I will most likely invest in NUSI next. Thanks for the info.

Again, creating your own “income” is the same thing as receiving it as a dividend. HNDL has a “proven record of returns” because recent years have been great for basically any investing strategy. I applaud HNDL’s management team for their successful marketing efforts in getting people to buy this strange, expensive fund.

Bought hndl as an alternative to annuity and looking as augmenting social security pension. I have resisted annuities. My pension income does not cover expenses and I’ve been drawing from retirement and Savings for 12 years now (73 ). I’m also forced to sell shares to meet rmd requirements of tax deferred accounts now and am building up more in taxable accounts. I was bit uncomfortable with fees and volatility of hndl but was attracted to pitch as “another pension”. I liked your review of hndl and qyld. I’m not smart enough to understand hndl strategy so you cleared up some of the smoke. And you helped me clarify my objectives. I do hold some blue chip stocks that pay good dividends. But am looking for a better portfolio strategy overall and Have been reading your reviews of various portfolios such as Dalios awp. Appreciate and relate to your views. Thanks. I’ll probably sell hndl. Any Comments you have to me would be appreciated.

Thanks for the comment, Dave! Glad you found the info helpful.

Just found your very informative site while Googling HNDL because I’m retired and looking for low volatility investments. In the comparison chart above, are all four rebalanced and if so, at what interval?

Annually