While these 3 ETFs from Vanguard look very similar based on their tickers, they are in fact very different. Here I explore VOO, VOOV, and VOOG.

In a hurry? Here are the highlights:

- VOO, VOOV, and VOOG are all popular index funds from Vanguard.

- VOO tracks the S&P 500 Index. VOOV tracks the S&P 500 Value Index. VOOG tracks the S&P 500 Growth Index.

- That is, VOOV is roughly half of VOO, and VOOG is the other half.

- All 3 funds have some overlap.

- VOOV and VOOG are more expensive than VOO.

- At the time of writing, the market already tilts Growth.

- VOOG has outperformed in recent years, though we would expect VOOV to win out over the long term.

- VOOV is objectively not the best fund to specifically target large cap value stocks.

Contents

Video

Prefer video? Watch it here:

VOO vs. VOOV vs. VOOG – Methodology

If you've arrived on this page, you likely already know that stocks are a significant driver of portfolio performance, that index funds are a great way to get immediate diversification, and that Vanguard has some of the best, cheapest index funds around. Three such index funds from Vanguard are VOO, VOOV, and VOOG.

First let's talk about VOO. The Vanguard S&P 500 ETF launched in 2010, and is one of the most popular stock ETFs in existence. The fund seeks to track the famous S&P 500 Index, which is composed of the 500 largest U.S. companies. This index is considered a sufficient proxy and barometer for “the market” in the U.S. because it spans all sectors and is about 82% of the total U.S. stock market by weight.

Now let's talk about VOOV. The addition of the letter “V” is for Value. The name of this fund is the Vanguard S&P 500 Value ETF. Appropriately, it seeks to track the S&P 500 Value Index. As the name suggests, this fund selects Value stocks – stocks that are thought to be underpriced based on their fundamental valuation metrics – from the S&P 500. That is, this fund holds roughly half of the S&P 500. Put another way, VOOV is about half of VOO.

So we would call VOOV a “large cap value” fund. These stocks are usually relatively boring and have an established business model with significant market penetration. Value-heavy sectors include Utilities, Financials, REITs, and Consumer Staples. Notable examples include Bank of America, Ford, Disney, Verizon, and Johnson & Johnson. Value stocks have outperformed Growth stocks historically and are considered riskier. I wrote a separate post about tracking down the best Value ETFs. It's worth noting that VOOV doesn't actually provide great exposure to the actual Value factor compared to its competitors, and it has a lot of overlap with its parent index.

The other half of VOO is, you guessed it, VOOG. The “G” is for Growth. The fund's index is the S&P 500 Growth Index. This is the other style of stocks – Growth stocks. These stocks trade based on the future potential earnings of the company. They typically reinvest their earnings into new technology, equipment, etc. We call VOOG a “large cap growth” fund. This segment crushed the market for the decade 2010-2019, thanks largely to the stellar run by Big Tech. Growth stocks make the headlines. Notable examples include Apple, Amazon, Google, Facebook, and Tesla.

I said half of VOO is VOOV and the other half is VOOG, but in the interest of full disclosure, the math isn't quite that clean for these specific funds. Because some growth stocks can exhibit value characteristics and vice versa, and because of the way S&P constructs their indexes, all 3 of these funds actually have some overlap. Here's how it shakes out:

- VOOV makes up about 60% of VOO by weight.

- VOOG makes up about 65% of VOO by weight, meaning the market already currently tilts Growth.

- VOOV and VOOG have about 27% overlap by weight.

Now let's look at the historical performance of VOO, VOOV, and VOOG.

VOO vs. VOOV vs. VOOG – Historical Performance

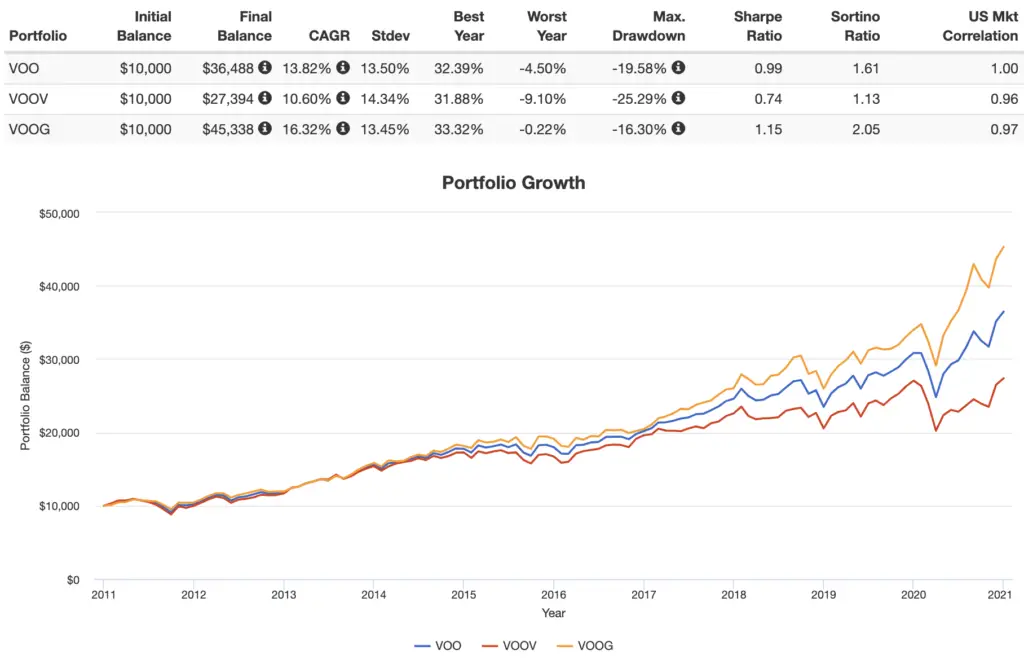

Using live fund data, here's VOO vs. VOOV vs. VOOG from their inception in 2010 through 2020:

I was hesitant even putting this backtest in here. Take it with a handful of salt. Don't succumb to recency bias by chasing performance and going all in on large cap growth stocks. Growth has had an amazing run over precisely the backtested time period. The next decade may – and likely will – look different.

Remember, Value has still outperformed Growth historically, and Value still has greater expected returns. The valuation spread between Value and Growth is huge currently. That is, Growth is looking extremely expensive relative to history, and Value is looking extremely cheap relative to Growth. Large spreads for Value have historically preceded its market outperformance. Only time will tell.

VOO vs. VOOV vs. VOOG – Sector Composition

| VOO | VOOV | VOOG | |

| Basic Materials | 2.70% | 3.10% | 1.80% |

| Consumer Staples | 5.90% | 8.90% | 2.60% |

| Consumer Discretionary | 15.00% | 11.90% | 18.10% |

| Financials | 14.30% | 25.50% | 2.90% |

| Healthcare | 12.50% | 14.20% | 11.50% |

| Industrials | 9.70% | 12.30% | 6.70% |

| Energy | 2.90% | 6.00% | 0.20% |

| Technology | 32.80% | 10.40% | 55.40% |

| Telecommmunications | 1.50% | 2.70% | 0.30% |

| Utilities | 2.50% | 4.70% | 0.50% |

Notice how the market (VOO) at this point is over 30% tech, which makes VOOG over 55% tech!

VOO vs. VOOV vs. VOOG – AUM and Fees

VOO is one of the most popular funds out there with over $240 billion in assets. It is also very affordable with a fee of 0.03%.

VOOV has about $2.3 billion in assets. Its fee is 0.10%.

VOOG has about $6.4 billion in assets and also has a fee of 0.10%.

Conclusion

VOO, VOOV, and VOOG are all highly liquid funds from Vanguard.

Remember, VOOV + VOOG basically equals VOO. VOOV is Value stocks from the S&P 500. VOOG is Growth stocks from the S&P 500. While Growth has crushed Value for the decade 2010-2019, Value has still outperformed Growth historically, and Value has greater expected returns than Growth. Growth is currently looking extremely expensive relative to history (and fundamentals do not explain this expensiveness), and Value is looking extremely cheap relative to Growth. That said, all crystal balls are cloudy.

VOO is cheaper than VOOV and VOOG in terms of fees. But I wouldn't own VOOV or VOOG anyway, because VOOV does a comparatively poor job of capturing actual Value stocks, and VOOG does a comparatively poor job of capturing actual Growth stocks. If you care about the exposure you're paying for, here's my breakdown of value funds, and here are some recommendations for large cap growth.

Moreover, Vanguard has some other, cheaper funds for these same segments, namely VTV for Value and VUG for Growth. If you just want an inexpensive Vanguard fund to hone in on Value or Growth, go with one of those. They both only cost 0.04%. These are cheaper because they don't have to pay to use the S&P name.

Value and Growth tend to switch back and forth in terms of periods of one outperforming the other. Market timing usually doesn't work, and recency bias is all too real. If you don't care about tilting (overweighting) one of these styles, just buy VOO to capture the S&P 500 and call it a day.

Conveniently, all these funds should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Do you own VOO, VOOV, or VOOG? Let me know in the comments.

Disclosure: I am long VOO in my own portfolio.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

I would think putting 50% in VOOV and 50% in VOOG would then capture all of VOO and allowing you to double up on the few growth stocks that also qualify as value and the few value stocks that also qualify as growth. but you 10 year back test did not show an advantage. Must of been gobbled up in additional fees?

Probably no real advantage and potentially more concentration risk within a handful of companies.

While very much appreciating all of the input and info, I was wondering where VYM would stand next to the 3 ? ( voo, voog, voov)?

VYM would be most similar to VOOV but more focused on dividend yield whereas VOOV seeks to identify Value stocks.

Why is the cost of VOO so much more than SPLG? Why would someone purchase VOO over SPLG when the track the same index?

Thanks,

They cost the same at 0.03%.

Sorry, what I meant was why is the share price so different? Is it the total AUM?

VOO $400 ish/share

SPLG $50 ish/share

I noticed that their returns over the years have been similar. So why would one spend $400/share vs. $50/share?

I hope that makes sense. Thank you!

Ah. SPLG probably had some splits. If your broker offers fractional shares, share price doesn’t matter.

Oh, okay. That makes sense. Unfortunately, mine does not right now. Thanks for the response!