QQQ from Invesco tracks the NASDAQ 100 Index. SPY from SPDR (and VOO from Vanguard) tracks the S&P 500. These are two very different funds that track very different indexes. I compare them here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

In a hurry? Here are the highlights:

- QQQ and SPY are two very different funds.

- QQQ from Invesco tracks the NASDAQ 100 Index. SPY from SPDR tracks the S&P 500 Index.

- QQQ is 100 stocks in a handful of sectors, largely concentrated in tech. SPY is 500 stocks spread across all sectors.

- QQQ is already inside SPY, comprising 42% by weight. SPY is already over 1/4 tech.

- QQQ is purely large cap growth stocks, which are looking extremely expensive relative to history, and fundamentals do not explain their expensiveness.

- SPY is basically the same thing as VOO from Vanguard; they track the same index.

- QQQ has a fee of 0.20%. SPY is cheaper at 0.09%. VOO is even cheaper at 0.03%.

- QQQ has beaten SPY in recent years, but that doesn't mean it will continue to do so.

- QQQ should not replace SPY as a core holding in a diversified portfolio.

Contents

Video

Prefer video? Watch it here:

QQQ vs. SPY (and VOO) – Methodology, Similarities, Differences, Stats, & More

QQQ is an extremely popular fund from Invesco that seeks to track the NASDAQ 100 Index. These are the 100 largest companies that trade on the NASDAQ exchange, excluding Financials. This index describes itself as companies “on the forefront of innovation.”

Prominent holdings include names like Apple, Microsoft, Amazon, and Google. In fact, these 4 names make up over 1/3 of QQQ. As such, it's basically a tech fund at this point due to Big Tech making up such a huge chunk of the market by weight. Specifically, QQQ is over 63% tech at the time of writing.

QQQ launched in 1999. It has over $180 billion in assets and an average daily volume of over $12 billion. It costs 0.20%. QQQ has grown even more in popularity over the past decade or so due to its market outperformance thanks to the stellar run by Big Tech. It also has a 3x leveraged cousin TQQQ, as well as a new, cheaper little brother QQQM.

Now let's talk about SPY. It's the original ETF from SPDR; it launched in 1993. It costs 0.09%. SPY is still the largest, most traded fund out there, with over $380 billion in assets. It seeks to track the famous S&P 500 Index, and it does a great job of doing so. These are the 500 largest companies in the United States. The S&P 500 is representative of U.S. large cap stocks, and is considered a barometer of the U.S. stock market as a whole.

VOO from Vanguard is basically the same thing as SPY except it's a bit cheaper (VOO costs 0.03%). It tracks the same index. Thus, a comparison of QQQ and SPY is simultaneously a comparison of QQQ and VOO.

Again, given the recent run of large cap growth stocks over the past decade, many novice investors (and sadly, experienced investors) have been flocking to QQQ, even letting it replace SPY or VOO as their core holding. Don't do that.

If you didn't already pick up on this fact, QQQ is not at all a well-diversified fund, and should not replace a broad market index like the S&P 500 as a core holding in a diversified portfolio. Again, it's mostly tech companies; sectors like Utilities, Industrials, and Consumer Staples are all but absent from this fund.

QQQ is a highly concentrated basket of 100 companies in a handful of sectors. SPY is 500 companies across all sectors. Since Big Tech companies are indeed big, the tech sector now comprises over 1/4 of the S&P 500. Because of this, investors may not realize that the companies in QQQ comprise roughly 42% of the S&P 500 by weight. That is, QQQ is already inside SPY. If you own the latter, you already own the former.

Fundamentally, buying QQQ is also an inherent bet that Financials will underperform every other sector (the Nasdaq 100 Index excludes them) and a belief that the exchange on which a stock trades is related to its performance (the index only includes stocks that trade on the NASDAQ exchange). Hopefully the absurdity of these two ideas needs no further explanation.

QQQ vs. SPY & VOO – Historical Performance

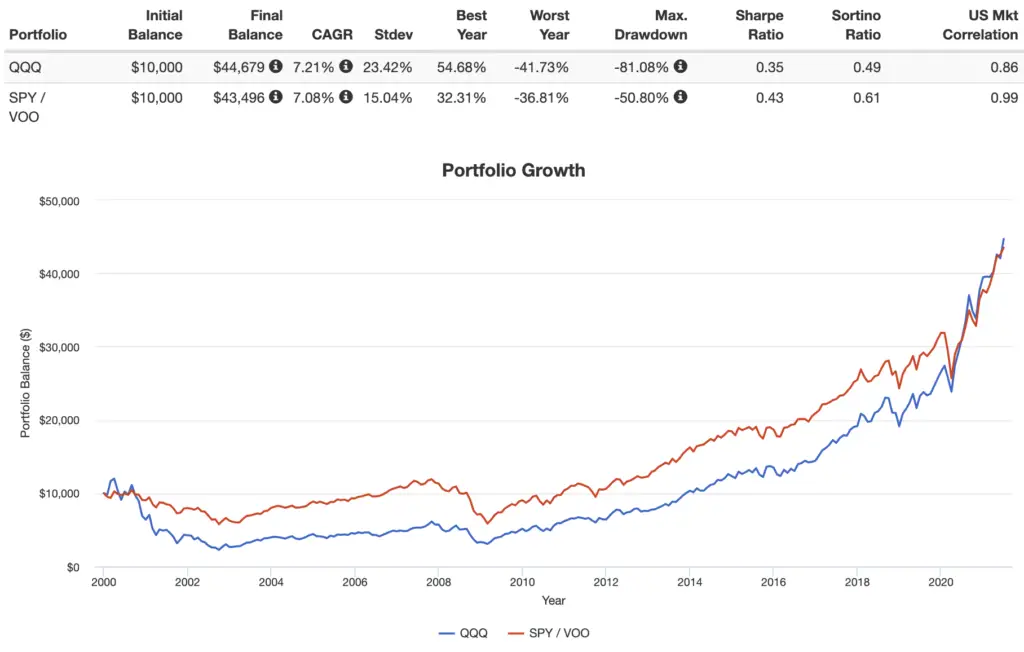

Let's talk about performance. Here's the history from 2000 through June, 2021:

QQQ and SPY have been neck and neck at the end. Granted, QQQ had a rough start with the Dotcom crash. Still, check out its much greater volatility and drawdown. SPY still delivered a much greater risk-adjusted return.

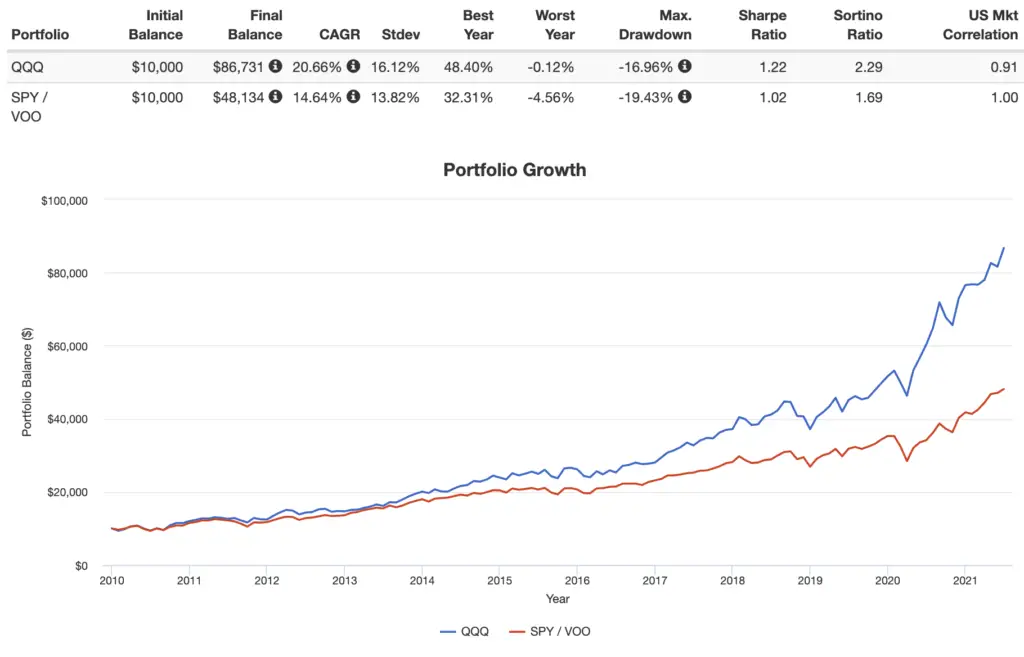

Now let's look at the past decade, showing why people have flocked to this fund:

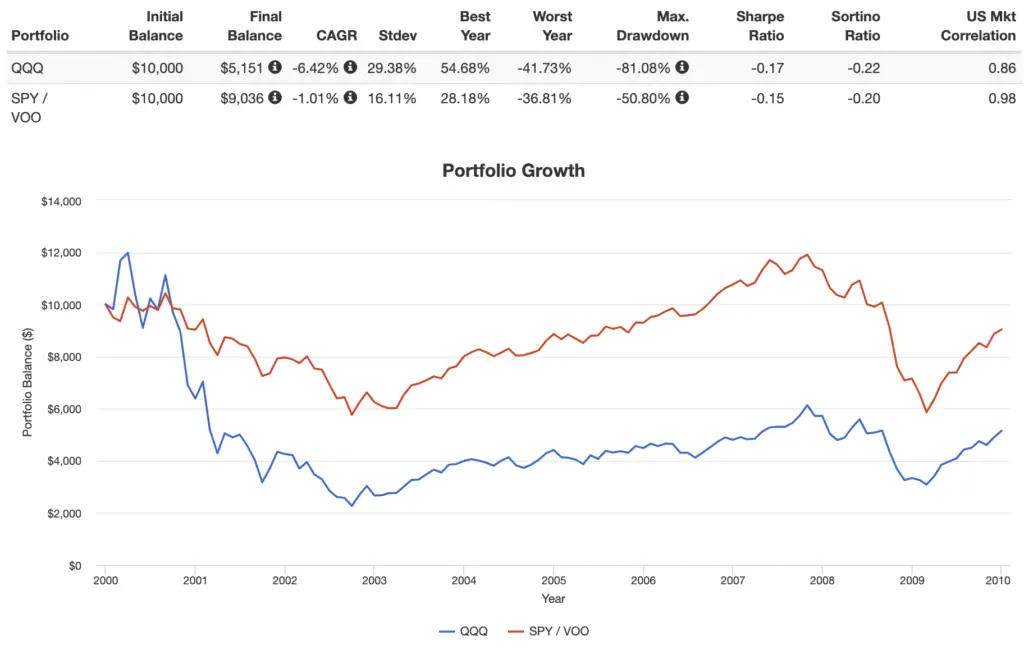

Looks great, right? Even though it still exhibited greater volatility, QQQ even had a higher risk-adjusted return than the broader SPY. But don't get too excited. Again, we wouldn't expect the next decade to look like the previous decade. Let's look at the decade 2000-2009, which was a different story:

Both funds lost money because they had to endure 2 crashes, but you still would have come out ahead with SPY.

Imagine for a second that this is January, 2010. After the previous decade, the S&P 500 is down by about 10% for that time period versus the Nasdaq 100 being down about 50%. Would you still be as enthused about QQQ? Logically, we should be more willing to buy when prices are low, but I'd be willing to bet the honest answer to this question for most folks would be “no.” A rational investor should want to avoid expensive stocks and buy cheap stocks, but this unfortunately isn't how investors' highly-emotional brains work.

QQQ has beaten SPY historically in terms of performance. But don't succumb to recency bias and performance chasing. Past performance does not indicate future performance. More importantly, large cap growth stocks are now looking extremely expensive relative to history and are at the valuations we saw in 2000 at the height of the tech bubble, meaning they now have lower future expected returns. To make things worse, fundamentals of these companies do not explain these valuations. The situation has simply been an expansion of price multiples.

Value stocks, on the other hands, are looking extremely cheap, meaning they now have greater expected returns. Of course, we expect Value to outperform every day when we wake up anyway due to what we think is a risk factor premium. If you buy QQQ, you won't own any Value stocks. QQQ is purely large cap growth stocks, the segment with lower expected returns. You also won't own any small- or mid-cap stocks, which have outperformed large stocks historically.

The valuation spread between Value and Growth was recently as large as it's ever been. Historically, wide value spreads have also reliably preceded massive outperformance by Value. At the end of the day, we're still paying for a discounted sum of all future cash flows; Growth cannot get more expensive forever.

People like to claim “tech is the future!” That may be true, but that doesn't have much to do with stock market returns, which are not correlated with GDP. The economy is not the stock market, and the stock market is not the economy. Remember that extremely high expectations for these tech firms are already priced in, and they will have to exceed those expectations in order to beat the market. Moreover, good companies tend to make bad stocks and bad companies tend to make good stocks.

While I don't employ or condone market timing, we also must acknowledge the fact that we may see rising interest rates sometime in the near future, and QQQ inherently has more interest rate risk than SPY. Moreover, QQQ by definition excludes Financials, which tend to do well when interest rates rise.

Also remember that you don't need a “tech tilt” anyway; the market is already over 30% tech at this point.

QQQ vs. SPY & VOO – Conclusion

Don't use QQQ as the core of your portfolio. Period. Doing so is purely performance chasing.

Some like to tilt (overweight) with QQQ, but remember that SPY already has a tech tilt because it's market cap weighted. QQQ is already inside SPY and VOO. If the companies in QQQ do well, they will also rise within SPY, so you already have exposure to their success.

Only time will tell which index outperforms. We can't know the future, but I would argue that's the reason for broad diversification in the first place.

Conveniently, all these funds should be available at any broker, including M1 Finance, which is the one I'm usually suggesting around here.

What do you think of QQQ and SPY? Let me know in the comments.

Disclosure: I own VOO in my own portfolio.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

AVUV, etc. are managed funds. I’m not convinced value is making a comeback fully yet. When an established value index like the Russell 1000 value index compared to the Russell 1000 growth index breaks out in a definitive fashion then I would change (value vs. growth is in a long term downtrend).

What do you think of VONG vs. QQQ? I see the two things are similar but VONG has greater diversification. VONG hasn’t performed as well as QQQ since inception of the former but I think if one wanted a growth tilt this is an unbiased way to get it. That said I’ve been a big fan of the NDX Composite for a long time. QQQ and FNCMX track 1:1 almost even though one is the top 100 and the other is ostensibly all 3000.

I only try to invest in index funds, so sorry about that emphasis since I don’t care about any specialty or managed funds. The statistics about managed funds turn me off them.

AVUV is rules-based active. For all intents and purposes, it is no more “managed” or “active” than a so-called “index” created by S&P that uses earnings screens like VIOV. “Passive” is a myth anyway. One could make the argument that QQQ resembles an active fund in its de facto exclusion of entire sectors.

It also strikes me as odd that you’re willing to engage in market timing but not a rules-based-active fund. Waiting for a “break out” of Value would likely be the worst time to buy, and is how many buy high and sell low after chasing performance.

To answer your question, I’d rather take VONG over QQQ if those are my 2 choices.

I’m using QQQ as a tilt, but I also consider it my 10% play money for investing. I may change this, but the rest of my portfolio will stay the same:

VTI = 65%

QQQ = 10%

VCLT = 10%

BIV = 10%

SCHP = 5%

Despite this, people will continue to use QQQ as their core. For people that wish to do this, what are some suggested funds that they should hold to help stay diversified?

Of course if you were to diversify based on QQQ, you’d be better off just holding VOO. 😅

VT…

To specifically hold the opposite of what QQQ is (and thus diversify against it), I’d say Utilities (e.g. FUTY) and small cap value (e.g. AVUV, AVDV, DGS).