Mid-cap stocks have exhibited higher returns than large-caps historically. Below we'll review the 5 best mid-cap ETFs to access the middle segment of the market in 2025.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

In a hurry? Here's the list:

- VO – Vanguard Mid-Cap ETF

- IWR – iShares Russell Mid-Cap ETF

- SCHM – Schwab US Mid-Cap ETF

- IJH – iShares Core S&P Mid-Cap ETF

- SPMD – SPDR Portfolio S&P 400 Mid Cap ETF

Contents

Introduction – Why Mid Caps?

Mid-cap stocks are often referred to as the “forgotten size segment” or the “orphaned index,” due to the fact that large-caps and small-caps get all the press. Many investors tilt large-cap or small-cap, altogether ignoring or forgetting about mid-caps, or simply relegating them to their limited exposure in a total market index fund.

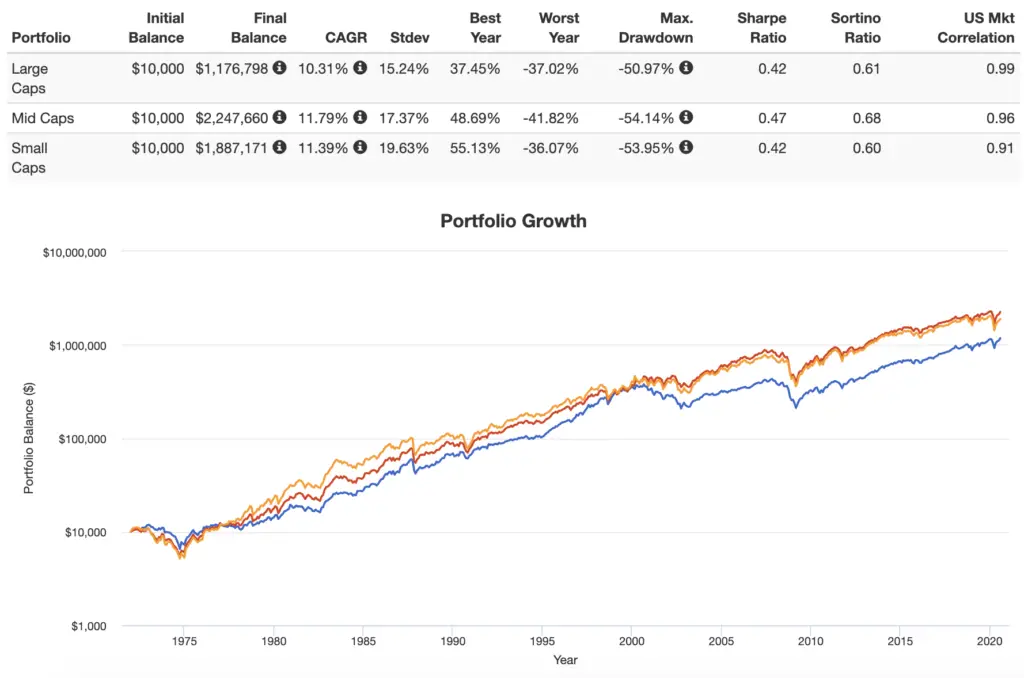

Small-cap stocks are usually companies in their early stages of growth. Large-caps are well-established, “stable” companies. Mid-caps, of course, are somewhere in the middle. Investors assume that mid-cap stocks carry more risk and return than small-caps, and less risk and return than large-caps, and understandably so, as this is how the Size factor premium should play out on paper. Returns going back to 1972 tell a slightly different story:

At least for the period 1972 through July 2020, mid-caps as a whole have achieved higher general and risk-adjusted returns than small-caps, with lower volatility.

So now that we know mid-caps are probably a solid investment, let's explore the 5 best mid cap ETFs.

Video

Prefer video? Watch it below. If not, keep scrolling to keep reading.

The 5 Best Mid Cap ETFs

Below are the 5 best mid cap ETFs from various providers:

VO – Vanguard Mid-Cap ETF

The Vanguard Mid-Cap ETF (VO) is one of the most popular ETFs for the mid cap market segment. The fund has over $60 billion in assets and a low expense ratio of 0.04%. This ETF gets you broad exposure to the mid-cap range of stocks with over 350 holdings, and seeks to track the CRSP US Mid Cap Index.

It's worth noting that VO has a much higher weighted average market cap than the other funds on this list, so it arguably skews large cap. This may or may not be desirable. Those seeking true mid caps should probably prefer a different fund.

IWR – iShares Russell Mid-Cap ETF

Those seeking broader exposure to US mid caps will enjoy the fact that IWR from iShares has over 800 holdings via the Russell MidCap Index, which is composed of the 800 smallest stocks in the Russell 1000 Index. As a result, just like VO, IWR ventures a bit into large cap territory with a weighted average market cap of about $25 billion.

IWR has about $35 billion in assets but is more expensive than other funds on this list with a fee of 0.19%.

SCHM – Schwab US Mid-Cap ETF

The Schwab US Mid-Cap ETF (SCHM) is another great low-fee option for investing in mid-cap stocks. This ETF tracks the Dow Jones U.S. Mid-Cap Total Stock Market Index, putting it squarely between small caps and large caps. SCHM has about 500 holdings and has an expense ratio of just 0.04%.

IJH – iShares Core S&P Mid-Cap ETF

The iShares Core S&P Mid-Cap ETF (IJH), as the name suggests, seeks to track the S&P MidCap 400 Index. IJH is the most popular fund out there for the US mid cap segment, and for good reason. Its S&P index conveniently screens for earnings, providing positive loading on the Profitability factor.

The fund has over $88 billion in assets, 400 holdings, and an expense ratio of 0.05%.

SPMD – SPDR Portfolio S&P 400 Mid Cap ETF

SPMD from SPDR seeks to track the same index as IJH but now at a slightly lower fee of 0.03%, which conveniently makes it the cheapest on this list. In my opinion, it also happens to provide the best exposure to US mid caps, so it would be my choice. SPMD has over $10 billion in assets.

International Mid Caps?

It's worth noting that U.S. investors wanting exposure international mid caps have basically zero options aside from a pretty pricey dividend fund from WisdomTree, which is DIM with a fee of 0.58% and a pretty low AUM of only a little over $100 million. For that reason, I would either move down to international small caps, for which more options exist, or simply target both small caps and large caps (or the total stock market) internationally.

Where to Buy These Mid Cap ETFs

M1 Finance offers all these mid cap ETFs. The broker has zero trade commissions, zero account fees, and offers fractional shares, dynamic rebalancing, and a sleek, user-friendly interface and mobile app. I wrote a comprehensive review of M1 Finance here.

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Disclosures: None.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

What made you go long VOE as opposed to say VO or VOT.? Value or growth / blend?

Sorry, just didn’t update this. I no longer own VOE. But I do tilt Value based on what I laid out here on factors.

Hi John,

You made a really compelling argument at the top of this article for owning mid-cap stocks. I’ve been playing around with some back-testing of mid-caps and surprisingly owning a single mid-cap fund would provide greater returns than a 50/50 split fund of Large-cap and small-cap value and they would do so at similar volatility. They seem to weather any economic conditions fairly well. I also prefer to tilt towards value stocks but when I saw how well a simple mid-cap blend fund could do and with such resiliency I couldn’t believe my eyes! Did you exclude them from your portfolio for any particular reason? As always, thank you for sharing,

— David

Your backtest probably didn’t go back far enough, and we’d probably want to avoid small cap growth stocks. I explained that and my incidental exclusion of mid-caps here.

True, I only back tested to 1981. When I run it again to include the 70’s small-cap value does so well it doesn’t take much of it to totally smokes all other cap sizes.

I went with IJH. No overlap with VOO. VOE has a lot of overlap with VOO.