DFSV is a new targeted factor ETF from Dimensional (DFA) for U.S. small cap value stocks. I review it here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Introduction – Factors and Dimensional Fund Advisors (DFA)

To set the stage for why we might be interested in DFSV in the first place, let's take a sec to briefly review equity risk factors, Dimensional as a provider, and the small cap value universe. If you've landed here, you're probably at least somewhat familiar with all those things.

Basically, we expect risk factors like Size and Value (i.e. small and underpriced stocks) to pay a premium over the long term, Dimensional Fund Advisors (DFA for short) have long been the gold standard for providing funds to capture exposure to those factors most effectively, and there are a multitude of small cap value funds to choose from at this point.

I went into factors in great detail in a separate post here, and I covered Dimensional and some of their funds in a separate post here. As you might imagine, for any given fund, we're interested in how much factor bang we're getting for our buck. In other words, how effective and efficient is the fund at delivering that exposure?

Specific to small cap value funds, for example, we're able see the actual values, called loadings, for these individual risk factors like Size, Value, and Profitability. A higher number means a greater loading or more targeted exposure.

Dimensional Fund Advisors was actually founded in 1981 on this specific idea, with the goal of spearheading and utilizing some of the best academic research to exclusively offer funds that capture these independent risk factors to varying degrees, for the expectation of greater returns. Founder David Booth says DFA is all about the implementation of great ideas. In fact, the researchers who discovered factors, Eugene Fama and Ken French, as well as other big names in financial academia such as Merton Miller and Myron Scholes, were on the board of DFA to help guide this scientific investing philosophy.

The Case for DFSV

DFSV, which launched in early 2022, is the new ETF counterpart for Dimensional's DFSVX mutual fund that has been around since 1993.

I'll make the case for DFSV by first discussing an older, more popular small cap value ETF which is VBR from Vanguard. If you're familiar with my blog posts and videos, you might know I tend to compare to VBR a lot when discussing small cap value funds. For those in the know, this may seem like an unfair comparison.

But the intention is not simply to pick on VBR, but rather to use it as the basis for the small cap value discussion in terms of live funds simply because it is one of the most popular and most affordable small cap value ETFs out there, so it's arguably the quintessential entry-level fund for that market segment.

In other words, it's not unreasonable to expect a novice investor who wants to tilt small cap value to buy VBR. I'd venture to guess even most savvy factor investors have owned VBR at one time or another, even if that ownership was short-lived. It used to be one of the only games in town for retail investors, as it has been around since 2004, and its mutual fund equivalent VISVX launched in 1998.

The point is that using VBR as a basis for comparison allows investors who may be dipping their toes into factor investing to clearly see the explicit distinction between what we can might a “shallow” factor fund (in this case, VBR for small cap value stocks) and a very targeted one, both in terms of actual loadings and performance, which we'll go over shortly.

Using VBR as the control group for the experiment, if you will, also illustrates a point I'm always harping on about how fees are relative to the exposure you're paying for, and how in some cases a more purposefully targeted fund like DFSV, for example, can more than make up for its greater fee in its greater performance, an idea which tends to upset the apple cart for Boglehead purists who speak about fees in absolute terms.

Basically, while it's called a small cap value ETF, VBR is neither very small nor very value-y compared to something like DFSV, which I'll prove to you in the next section. I compared a handful of the most popular small cap value funds, including VBR, VIOV, and more in a separate post here.

DFSV Factor Loadings

So now we'll look at the factor loadings I mentioned earlier to show how DFSV provides more targeted exposure than something like VBR. Basically we're looking for higher numbers for each factor, which essentially show the factor exposure above that of the total stock market, which you'd get with something like VTI.

| DFSV | VBR | |

|---|---|---|

| Beta | 1.04 | 1.01 |

| Size | 0.87 | 0.59 |

| Value | 0.43 | 0.34 |

| Profitability | 0.13 | 0.10 |

| Investment | 0.08 | -0.01 |

| Alpha | -0.08% | -0.04% |

| R2 | 98.5% | 97.7% |

Notice the higher values for DFSV for Size and Value, which I've bolded.

These differences also show up in metrics like average market cap and the price-to-earnings ratio (P/E ratio for short). VBR has an average market cap roughly twice that of DFSV and a P/E ratio that is about 35% higher.

Theoretically, this should give DFSV a performance edge over the long term, and indeed this has been the case historically, which we'll look at next.

DFSV Performance

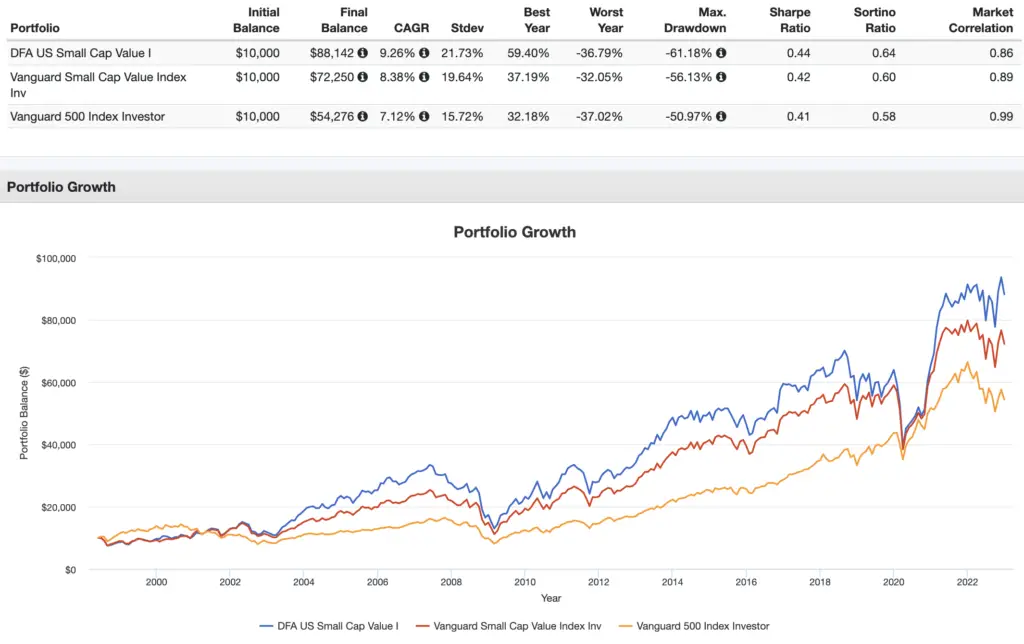

Using their mutual fund equivalents to extend the backtest, below I've compared DFSV to VBR and the S&P 500 for the period 1998 through 2022:

As you can see, DFSV has beaten both over the backtested period on both a general and risk-adjusted basis despite its greater volatility.

Conclusion – Is DFSV a Good Investment?

So should you invest in DFSV? Maybe.

As you can see, DFSV is a fine choice for the dedicated factor investor who wants more targeted exposure in their portfolio. Of course, as I hinted at earlier, this comes at a cost. DFSV carries a fee of 0.31%, about 5x that of popular indexed competitors from the likes of Vanguard and iShares.

Also remember this fund is technically actively managed, though managers are acting within pretty strict parameters in their stock selection methodology.

Still, these characteristics may create some cognitive dissonance for the staunch Boglehead index investor. Investors should always aim to understand and be comfortable with their investments. If an index fund like VBR or VIOV helps you stay the course more easily, then one of those may very well be the right choice for you. Only you can assess whether or not DFSV is suitable for your portfolio.

Conveniently, DFSV should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

What do you think of DFSV? Do you own it? Let me know in the comments.

Disclosure: None.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply