Covered calls are pitched as a “free lunch” and a way to “collect rent” on your stocks for buy-and-hold investors. Let's explore why that's not the case.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

What Are Covered Call Options?

Options contracts are derivatives that allow traders to speculate on the value of the underlying security. Call options allow the holder to buy an asset at a set price within a given time period. Put options allow the holder to sell an asset at a set price within a given time period.

A call option is considered “covered” if the seller already owns the shares of the underlying security as a long position. This means if the buyer chooses to exercise the call option, the seller can deliver those shares.

Why Covered Calls Are Not a “Free Lunch”

The idea is usually proposed as risk-free “rental income” for long-term buy-and-hold investors while owning a stock or a fund. The story goes that you can simply write (sell) call options on the shares you own to collect some monthly income in the form of the option premium.

In short, while they're relatively low-risk, covered calls cap the potential upside and don't protect the downside for the seller. Let's look at an example.

Suppose you own VTI, the Vanguard ETF for the total U.S. stock market, with a current price of $100/share. You sell a call option on VTI with a strike price of $105 and an expiration of 3 months. Let's also assume the premium collected is $0.50 ($50 for the single contract of 100 shares).

If VTI doesn't move above $105, you've collected a premium of $50 over the 3-month period for writing the option and you still own all your shares.

If VTI does move above $105, the buyer would exercise the option, in which case your upside is capped at $105/share. If VTI moves above $105.50 (strike price plus premium), you would have been better off simply holding the fund and not writing the option, as you've now missed out on the market's gains.

Markets are efficient enough to where there's really no free lunch in investing. Diversification is probably the closest thing to one.

Covered Calls vs. Buy and Hold Investing

As such, in my opinion there's really no reason for the long-term buy-and-hold investor to write covered calls, because we can't predict the future. Again, simply put, that investor expects the market to go up, and just a handful of days each year are responsible for the market's annual performance.

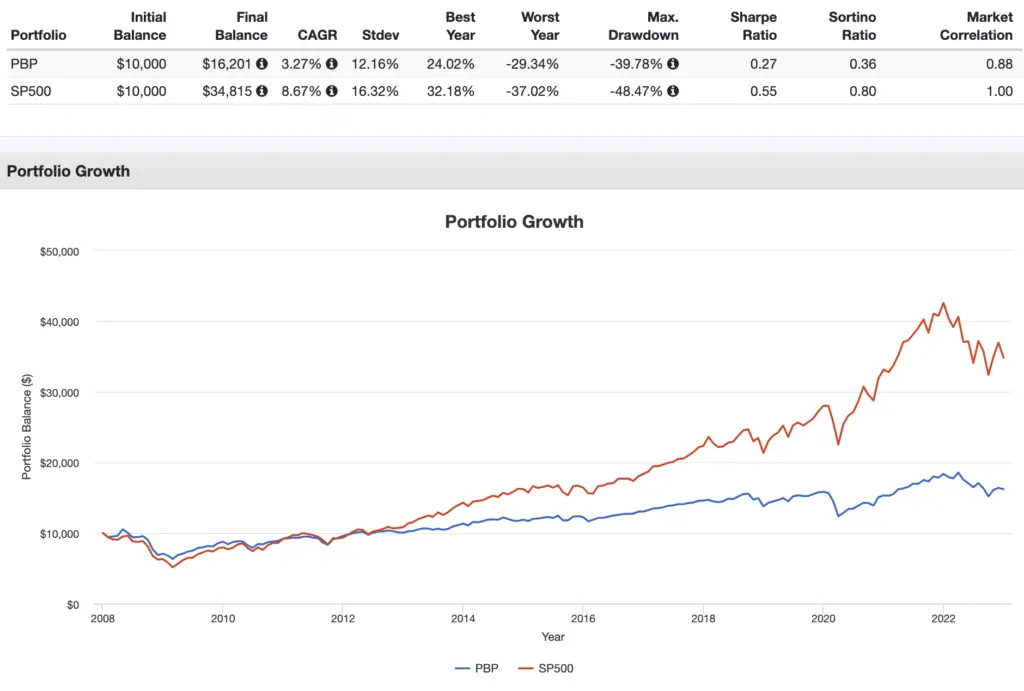

Here's that concept illustrated with live fund data using PBP, a covered call ETF for the S&P 500, versus VOO, an index fund from Vanguard for the S&P 500 Index per se, for the period 2008-2022:

Do you use covered calls? Let me know in the comments.

Disclosures: I am long VOO in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply