Covered calls are options sold on owned investments to generate current income. Here we'll review the best covered call ETFs for 2024.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video – The Best Covered Call ETFs

Prefer video? Watch it here:

Introduction – What Are Covered Call ETFs and How Do They Work?

Covered call ETFs own stocks, typically from some underlying index, and sell call options on them to generate income. As such, they're usually somewhat in between a true index fund and an actively managed fund that selects stocks.

Covered call writers own the underlying security and collect a premium on the option sold, providing current income. The call option written is considered “covered” because the underlying security is already owned.

The buyer of the call option has the right to buy the underlying at the strike price at or before expiration. For example, if I own a fund like QQQ for the NASDAQ 100 and I think it's going to be relatively flat for the next 30 days or so, I might sell a call option on it, for which I receive cash immediately (called the premium). The buyer of that call option is hoping QQQ goes up. As the seller, I'm hoping it stays flat. Call options are usually sold to generate income in a flat or mild bear market.

Covered calls are also referred to as a “buy-write” strategy, i.e. buying something and writing an option on that thing. This strategy allows covered call ETFs to have huge distribution yields upwards of 10% that typically pay monthly, making them attractive to income investors and retirees. That yield may be classified and taxed as return of capital (ROC) or ordinary income, depending on the year. That is, those dividends (which are technically really not dividends but rather distributions from option premiums) are not considered qualified dividends.

A covered call ETF may be suitable for your portfolio if you desire a yield-focused strategy for current income, with the trade-offs being greater fees (the average covered call ETF expense ratio is 0.71%), muted long term total returns, less diversification, lower portfolio efficiency, and possibly greater tax costs. Because of these things, recognize that it inarguably makes little sense for the young accumulator with a long time horizon to own a covered call ETF.

Now let's cover the list of the best covered call ETFs.

7 Best Covered Call ETFs

Here are the 7 best covered call ETFs that are the most popular, in no particular order.

QYLD – Global X NASDAQ 100 Covered Call ETF

QYLD is the most popular covered call ETF with nearly $7 billion in assets, which is more than half of the total assets under management of all covered call ETFs combined (about $12 billion).

QYLD launched in late 2013. Its popularity has soared in recent years with choppy, faltering markets, high inflation, and low interest rates during which investors scrambled for yield. There's even an entire community on Reddit dedicated to this single fund.

QYLD is the Global X NASDAQ 100 Covered Call ETF. It is one of three covered call ETFs from Global X; each use a different subset of the U.S. stock market. We'll go over the other two shortly. Technically these funds also have indexes for a hypothetical buy-write strategy. For QYLD, it's the CBOE NASDAQ-100 BuyWrite V2 Index.

As the name suggests, QYLD from Global X owns stocks from the NASDAQ 100 Index and writes covered calls on them. QYLD was the first covered call ETF to use this index. The NASDAQ 100 is a tech-heavy index of non-financial large cap growth stocks in the U.S. that trade on the Nasdaq exchange.

While the NASDAQ 100 is obviously much less diversified than something like the S&P 500, its greater volatility may be desirable in this context because it means greater option premiums, which of course is the focus of the fund.

QYLD has a distribution yield of 13.27% and an expense ratio of 0.60%. I wrote a separate comprehensive post on QYLD here.

XYLD – Global X S&P 500 Covered Call ETF

While QYLD uses the NASDAQ 100, Global X also offers XYLD, which uses the famous S&P 500, comprised of the 500 largest publicly traded companies in the United States.

This makes XYLD more diversified than QYLD. The retiree withdrawing regularly and using covered calls as income may want that greater diversification because it means lower volatility.

XYLD is next in popularity with a little over $2 billion in assets. The fund launched in 2013. Its index is the CBOE S&P 500 BuyWrite Index.

XYLD has a distribution yield of 13.13% and a fee of 0.60%.

RYLD – Global X Russell 2000 Covered Call ETF

RYLD finishes the Global X covered call ETF trifecta and uses the Russell 2000, which is roughly 2000 small- and mid-cap stocks from the investable U.S. stock market.

That is, whereas XYLD is using large caps via the S&P 500, RYLD covers the rest of the U.S. market with smaller stocks. As such, investors may want to combine XYLD and RYLD for greater diversification to capture the entire U.S. stock market.

RYLD launched later than its peers in 2019 and has about $1.4 billion in assets. Its index is the CBOE Russell 2000 BuyWrite Index.

RYLD has a distribution yield of 13.20% and an expense ratio of 0.60%.

DIVO – Amplify CWP Enhanced Dividend Income ETF

DIVO is an income-focused covered call ETF from Amplify that launched in late 2016 and has roughly $2.6 billion in assets.

DIVO aims to provide income from both dividends themselves and option premiums. To do so, the fund's managers actively select a handful of dividend stocks from the S&P 500 – selection criteria are basically dividend growth and strong earnings – and tactically writes short-term covered calls on some of them. In doing so, DIVO leaves more upside potential but has a lower distribution yield than other funds on this list.

This has worked out well historically with a greater total return than its broader counterpart XYLD since inception, but DIVO is also much less diversified with only 25 holdings. We also know active management tends to perform passive indexing over 10+ year periods.

DIVO has a distribution yield of 4.80% and a fee of 0.55%.

JEPI – JPMorgan Equity Premium Income ETF

JEPI is a comparatively newer ETF from J.P. Morgan that launched in mid-2020 and has quickly amassed nearly $19 billion in assets.

Earlier I said QYLD is the most popular covered call ETF. This is because technically JEPI is not really a true covered call ETF. It uses equity linked notes, or ELN's, that basically have covered call mechanics baked in. These ELN's introduce a layer of credit risk for investors.

JEPI is somewhat similar to DIVO in that it is actively selecting stocks from the S&P 500, this time based on value (e.g. price-to-earnings ratio), low volatility, and ESG, resulting in a basked of a little over 100 holdings.

JEPI has a distribution yield of 11.66% and a fee of 0.35%, making it the most affordable fund on this list.

KNG – First Trust Cboe Vest S&P 500 Dividend Aristocrats Target Income ETF

KNG is a covered call ETF from First Trust that launched in early 2018 and has a little over $500 million in assets.

KNG holds a famous group of stocks called the Dividend Aristocrats – U.S. stocks that have increased their dividend over the past 25 consecutive years – and equally weights them and then overlays a limited covered call strategy on them to generate income. I say limited because the fund simply aims for a yield about 3% above that of the S&P 500.

KNG has 67 holdings, a distribution yield of 4.07%, and a fee of 0.75%, making it the most expensive fund on this list.

PBP – Invesco S&P 500 BuyWrite ETF

Lastly, PBP is an older covered call ETF from Invesco that launched in 2007 and has about $100 million in assets.

If you don't care about yield per se but like the characteristics of a covered call strategy, PBP may be the fund for you because it simply reinvests all the dividends and option premiums from its holdings, giving it a relatively low yield of only 1.30%. Those holdings are just the straight S&P 500, via the same index as XYLD – the

CBOE S&P 500 BuyWrite Index.

As such, with a fee of 0.49%, you could think of PBP as basically a cheaper version of XYLD that reinvests dividends and option premiums instead of distributing them. Their total return performance has been nearly identical historically.

I think the PBP never attracted assets is because it launched right before the Global Financial Crisis of 2008 and then looked terrible during the market's recovery, as covered calls cap upside potential.

Covered Call ETFs Performance Compared

Since some of these covered call ETFs have substantially different methodologies, you're probably most interested in a performance comparison among them. Since JEPI launched in mid-2020, we can't go back too far if we include it, so first we'll look at a short backtest that includes it and then another one without it to look back a bit further.

Here are the risk and total return metrics for QYLD, XYLD, RYLD, DIVO, JEPI, KNG, the S&P 500, and a traditional 60/40 portfolio for the period June 2020 through 2022. Because we're looking at total return, we can exclude PBP because its total return is virtually identical to XYLD. Also note this is the precise time period of an environment in which we'd expect covered call funds to beat the market – a gradual bear market.

| Ticker | CAGR | St. Dev. | Max Drawdown | Sharpe |

|---|---|---|---|---|

| QYLD | 2.19% | 14.53% | -22.74% | 0.17 |

| XYLD | 8.21% | 12.19% | -18.25% | 0.64 |

| RYLD | 11.36% | 13.72% | -18.18% | 0.79 |

| DIVO | 15.07% | 15.37% | -13.10% | 0.94 |

| JEPI | 12.51% | 12.86% | -12.99% | 0.92 |

| KNG | 13.55% | 17.28% | -17.88% | 0.78 |

| SP500 | 10.97% | 18.86% | -23.95% | 0.60 |

| 60/40 | 3.76% | 13.05% | -20.62% | 0.29 |

Also note that large cap growth stocks suffered greatly over precisely this time period, illustrated by QYLD's abysmal performance. Small stocks also beat large stocks over this time period, which explains RYLD's outperformance of both XYLD and QYLD.

DIVO's tactical strategy seems to have paid off over the backtested period, even with just a handful of stocks. When we stop to think, this makes perfect sense, as Value crushed Growth in 2021 and 2022, and DIVO is specifically selecting Value stocks.

Now let's remove JEPI and RYLD to go back a bit further to April 2018, which is when KNG launched:

| Ticker | CAGR | St. Dev. | Max Drawdown | Sharpe |

|---|---|---|---|---|

| QYLD | 2.86% | 14.45% | -22.74% | 0.18 |

| XYLD | 4.41% | 14.98% | -23.43% | 0.28 |

| DIVO | 11.51% | 15.69% | -18.86% | 0.69 |

| KNG | 9.42% | 17.66% | -23.52% | 0.53 |

| SP500 | 9.97% | 18.87% | -23.95% | 0.53 |

| 60/40 | 6.30% | 11.64% | -20.62% | 0.48 |

DIVO also performed comparatively best over this time period on both a general and risk adjusted basis. Does that make it the best covered call ETF? Impossible to say. 25 holdings makes me nervous, regardless of what these numbers say.

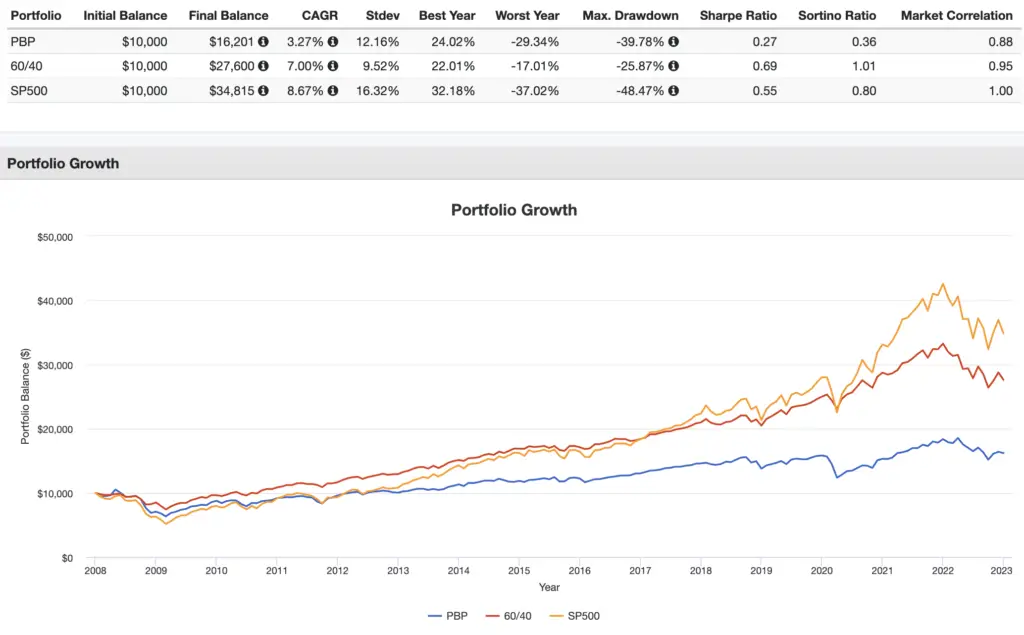

In the interest of full disclosure, it's also worth noting that these short backtests paint a somewhat unrealistically rosy picture for these covered call funds. If we go back to PBP's inception in 2007 and look through 2022, we can see a visualization of the shortcomings I mentioned at the top, mainly that covered calls are not an efficient way to de-risk a portfolio and they tend to hamper long term returns:

Conclusion – Are Covered Call ETFs a Good Investment?

So are covered call ETFs a good investment? Maybe, but probably not.

Remember what I said earlier. Covered call funds are only suitable for the short-term investor who consciously wants an option writing strategy to generate current income that they're using every month. Otherwise, they make little sense.

Prefer video? Watch it below. If not, keep scrolling to continue reading.

Even then, as I've noted elsewhere and as the backtests above show, there are more efficient, more effective ways to de-risk a portfolio, like bonds. This inefficiency also comes at a much greater cost, as covered call funds are typically pretty pricey.

Novice investors seem to have this idea that the “income” from these expensive buy-write funds are free money and that selling shares of a low-cost index fund like VTI to realize gains of an equal amount is somehow inferior to receiving a monthly distribution. Neither of these things is true.

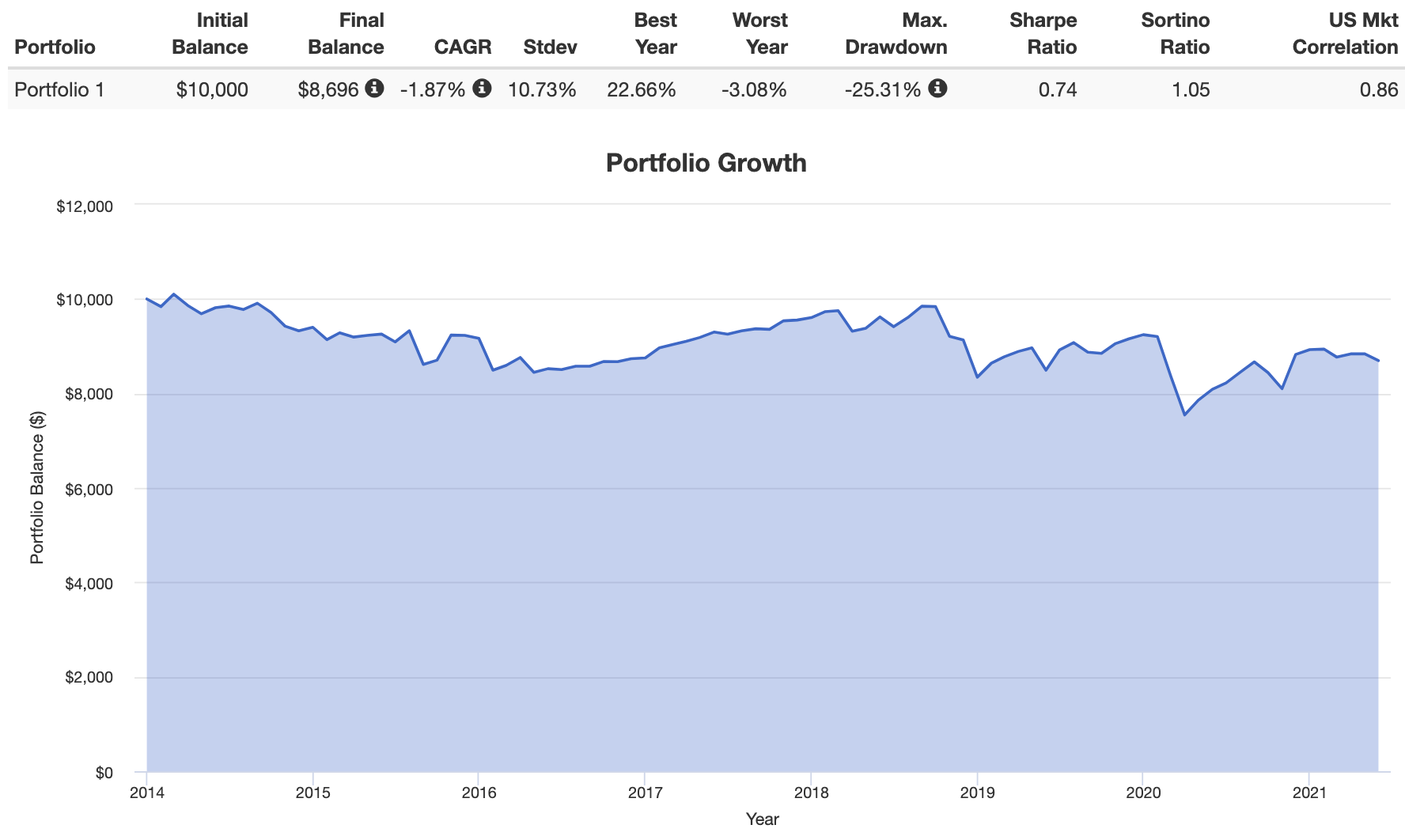

This irrational preference of dividends as income is just a well-documented – and admittedly understandable – mental accounting fallacy. Removing that high yield, the capital appreciation component of some of these funds has actually been negative since inception, as is the case for QYLD:

Proponents seem to erroneously believe that covered call ETFs are somehow made “safe” by their selling options. This is provably false, as we easily showed earlier.

The promises and benefits touted by these funds and their supporters – such as greater Sharpe ratios – often don't hold water under the smallest amount of scrutiny, such as their objective inability to outperform the underlying index of their holdings even on a risk-adjusted basis, much less a better diversified portfolio across asset classes like a 60/40. Basically, in market downturns, a covered call fund will fall with the market by an amount precisely equal to the market's drawdown minus the income received from the option premium.

This doesn't even consider potential tax costs. You're taxed on any taxable distributions, regardless of whether or not you reinvest them. Thankfully, some of the distributions of covered call ETFs may be classified as a return of capital or ROC, meaning no taxes (until your cost basis is zero), and most of them have indeed been ROC in many years, but this hasn't always been the case, so that preferable tax treatment is by no means guaranteed. This was a big wake-up call for many QYLD investors in early 2022, when Global X announced that 100% of QYLD's distributions for 2021 would be classified as – and thus taxed as – ordinary income, not as ROC. Ouch.

In fairness, novice investors likely see the extremely attractive, high distribution yields of these funds and don't look much further, and they probably don't understand how covered calls work. The problem I hinted at earlier is that most new, young investors are investing for retirement, have a very long time horizon, and don't need current income, so any advisor worth their salt would conclude that covered call funds are unsuitable for them.

Don't succumb to mental accounting bias; the premium received doesn't mean much if the market crashes. At the end of the day, total return is what matters. Period. I suspect income investors who own these funds perhaps simply aren't being honest with themselves by selectively ignoring their long term total returns compared to a benchmark like the S&P 500 or 60/40 and instead are just focusing on that juicy monthly yield. Discussing and celebrating that yield, such as in dividend-focused communities on Reddit, usually just seem to be a clique of confirmation bias.

In my opinion, complex funds like these are usually just a great way for asset managers to extract more fees at the detriment of retail investors.

I'm a fan of simply selling shares as needed for any “income” needed, which should be mathematically preferable anyway if you don't actually need that income on a monthly basis, as it allows you to leave more money in the market longer. On this point, proponents of covered call funds may concede that they're not great for young investors, but they still like to claim that these products are a crucial component for retirees.

The story goes something like this: For the retiree, current income is used monthly for expenses and thus should be an important focus, so the high distribution yield from a covered call fund makes for a higher safe withdrawal rate because it allows you to avoid dipping into the principal as much, which is particularly useful during crashes and bear markets. This sounds nice and arguably even sensible, but upon empirical investigation, this argument doesn't hold much water either, at least over the past 15 years.

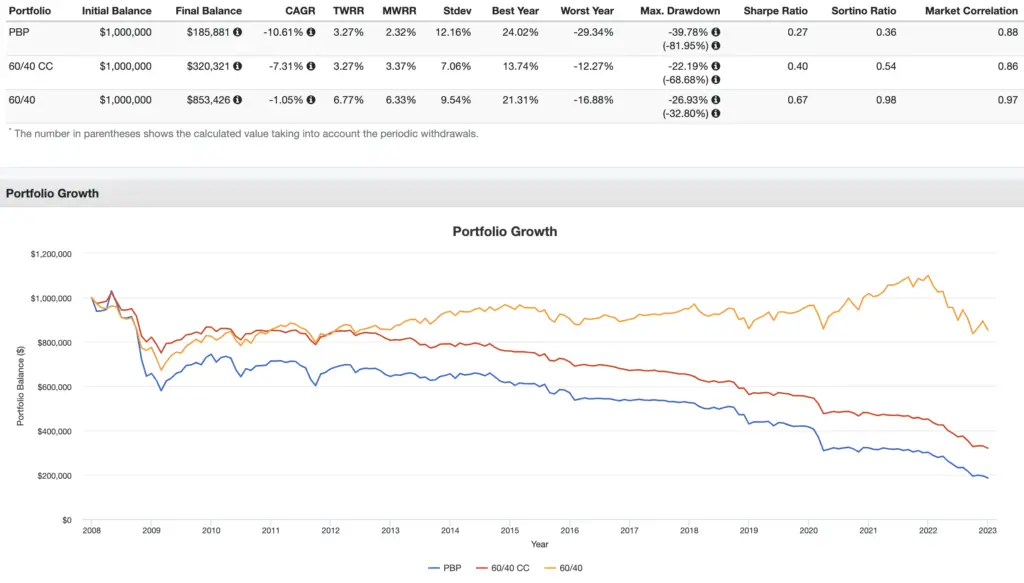

Using live fund data, here's a backtest for the period 2008-2022 for PBP, the covered call ETF from Invesco for the S&P 500 that we covered earlier, a 60/40 portfolio using PBP for the equities side, and a classic 60/40 portfolio using a starting balance of $1 million and monthly withdrawals of $5,000, adjusted for inflation:

After 15 years, final balances would be $186k, $320k, and $853k respectively. The safe withdrawal rates (SWR) of these portfolios for that period were 6.89%, 7.59%, and 9.09% respectively. Conveniently, this backtest includes the major drawdowns of 2008, 2018, and 2022, giving us a pretty good stress test.

Once again, thinking of yield as income separate from “principal,” while it may make you feel better, is just mental accounting with no magical benefits. Total return is what matters.

If one is set on using yield as income, you've also got other, cheaper, more efficient options like REITs, dividend stocks, junk bonds, etc. I designed a dividend portfolio for income investors here that may appeal to you.

Even if you hate bonds, we can construct a demonstrably superior strategy to QYLD, for example, with even the simplest, naive mix of 50% NASDAQ-100 and 50% T-bills, which are the risk-free asset. I've created that pie for M1 Finance here if you're interested. I wrote a comprehensive review of M1 and why it's great for income investors here.

To be fair, covered call funds certainly aren't the worst way I've seen to try to generate income. We'd expect buy-write strategies to outperform over brief periods of flat or mild bear markets when other assets like stocks and bonds are all declining, such as we saw for some months in the past few years. So some small allocation to a covered call fund may be warranted for the income investor or retiree.

You should be able to find these covered call funds at any major broker, including M1 Finance, which is the one I'm usually recommending around here.

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Do you own any of them? Let me know in the comments.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Covered Call ETF FAQ's

Lastly, here are some frequently asked questions about covered call ETFs.

What is a covered call ETF?

A covered call ETF is a fund that holds assets like stocks or bonds and writes call options on them, usually to generate income and a high distribution yield.

How do covered call ETFs work?

A covered call ETF holds assets like stocks or bonds, even from an index like the S&P 500, and then sells call options on them, for which the fund receives income immediately in the form of an option premium. This allows these funds to distribute those premiums to investors in the form of a high monthly yield.

Are covered call ETFs safe?

“Safe” is subjective, but covered call ETFs are not necessarily safer than the underlying index on which they're writing the call options. This is because covered call ETFs for stocks will fall with the broader stock market. The option premium received does not really provide downside protection.

Are covered call ETF dividends qualified?

No, dividends from covered call ETFs are not qualified. They may be classified as return of capital (ROC) or ordinary income, depending on the year.

How are covered call ETF dividends taxed?

Dividends from covered call ETFs may be classified – and thus taxed – as return of capital (ROC) or ordinary income, depending on the year.

Are covered call ETFs worth it?

Only you can decide whether or not a covered call ETF is “worth it,” as that will depend on your personal goals. Covered call ETFs do usually have much higher fees than, say, a plain index fund for the S&P 500 Index like VOO from Vanguard.

Are covered call ETFs good for retirement?

If the retiree is withdrawing regularly for current income, some allocation to a covered call ETF may arguably be good for retirement, but this of course depends on the investor's personal goal(s), time horizon, risk tolerance, and other investments in the portfolio. Investors should consult a financial professional to assess suitability.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Super interesting! Thanks John.

It would be valuable to add SVOL to the mix,

I’ve been playing around with backtest comparison of the Ginger Ale Porfolio ( on of my favorite performance benchmarks ) vs. 80/20 SCHD/CCETFs e.g.: JEPI, DIVO, SVOL…. so far looks promising but curbed by PortfolioVisualizer data availability.

Do you think its a sustainable strategy?