The Larry Swedroe Portfolio – or simply the Larry Portfolio – was created by the legendary evidence-based investing author and advisor Larry Swedroe. Here we’ll take a look at its components, performance, and the best ETFs to use in its implementation.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Larry Swedroe Portfolio Video

Prefer video? Watch it here:

What Is the Larry Swedroe Portfolio?

The Larry Swedroe Portfolio, also simply called the Larry Portfolio, comes from (you guessed it) legendary author and financial advisor Larry Swedroe.

The Larry Portfolio was designed to capture more risk-free return (alpha) by enhancing factor exposure to the known equity factors that explain stock market returns outside of market beta (from Fama and French), in this case particularly the Size and Value factors. Specifically, small stocks tend to have higher returns than large stocks, and Value stocks, usually somewhat-boring stocks that are believed to be underpriced, tend to have higher returns than their Growth counterparts.

The Larry Portfolio attempts to capture the return of the stock market at a lower volatility and risk by going all in on Small Cap Value globally. Many seasoned investors seem to be tilting toward small cap value stocks nowadays, but Swedroe clearly has a stomach of steel in using small cap value stocks for the entire equities position.

He argues that due to their greater volatility and higher expected returns, this heavy tilt allows for a lower allocation to stocks and a higher allocation to intermediate treasury bonds which are considered “safer” and less volatile than stocks. I'm a fan of global diversification, and this portfolio hits small cap value stocks in every geography. Basically, the Larry Portfolio takes factor investing in equities to the extreme.

Interestingly, this 30/70 asset allocation happens to be the risk parity weighting for stocks and intermediate bonds.

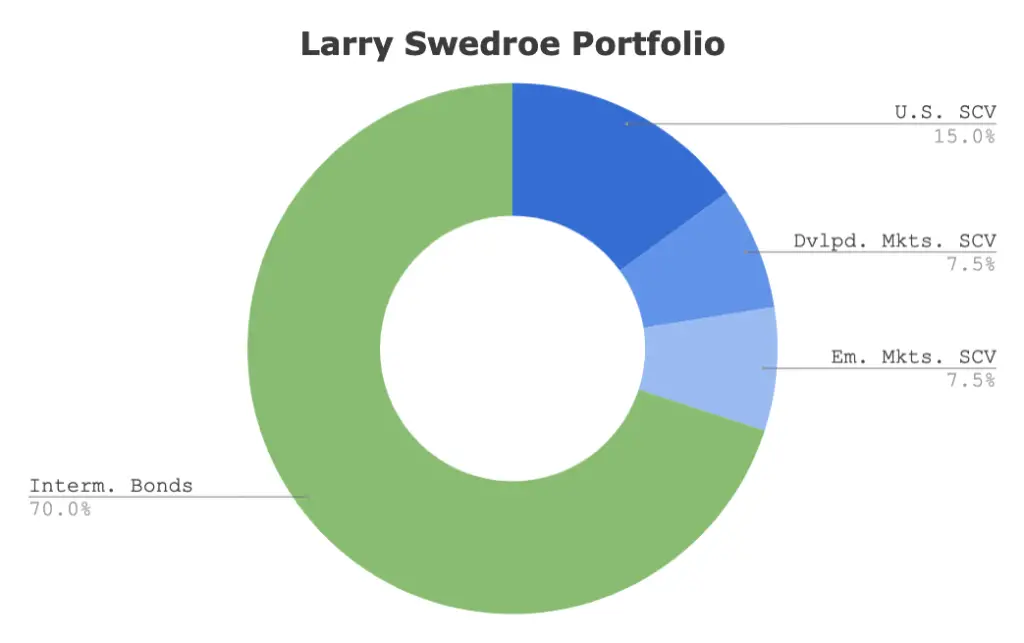

The Larry Swedroe Portfolio looks like this:

- 15% U.S. Small Cap Value

- 7.5% ex-US Developed Markets Small Cap Value

- 7.5% Emerging Markets Small Cap Value

- 70% Intermediate Treasury Bonds

Who Is Larry Swedroe?

Larry Swedroe is the director of research for Buckingham and the BAM Alliance. Swedroe is a prolific writer and contributor in the investing world. You'll see him making forum posts on the Bogleheads Forum as well as writing syndicated articles around the web for sites like ETF.com, Yahoo Finance, and Forbes. If you've read my take on dividends, you'll know I'm a big fan. He takes a scientific, evidence-based, data-driven approach to investing, not unlike Paul Merriman; I usually try to do the same.

Swedroe originally presented the Larry Portfolio in a book with Kevin Grogan in 2014 titled Reducing the Risk of Black Swans. They released a new, updated edition of the book in 2018 that you can get on Amazon here. I would also highly recommend his book The Only Guide to a Winning Investment Strategy You'll Ever Need. If you're interested specifically in learning about factor investing, he also has a book titled Your Complete Guide to Factor-Based Investing.

Larry Swedroe Portfolio Performance Backtest

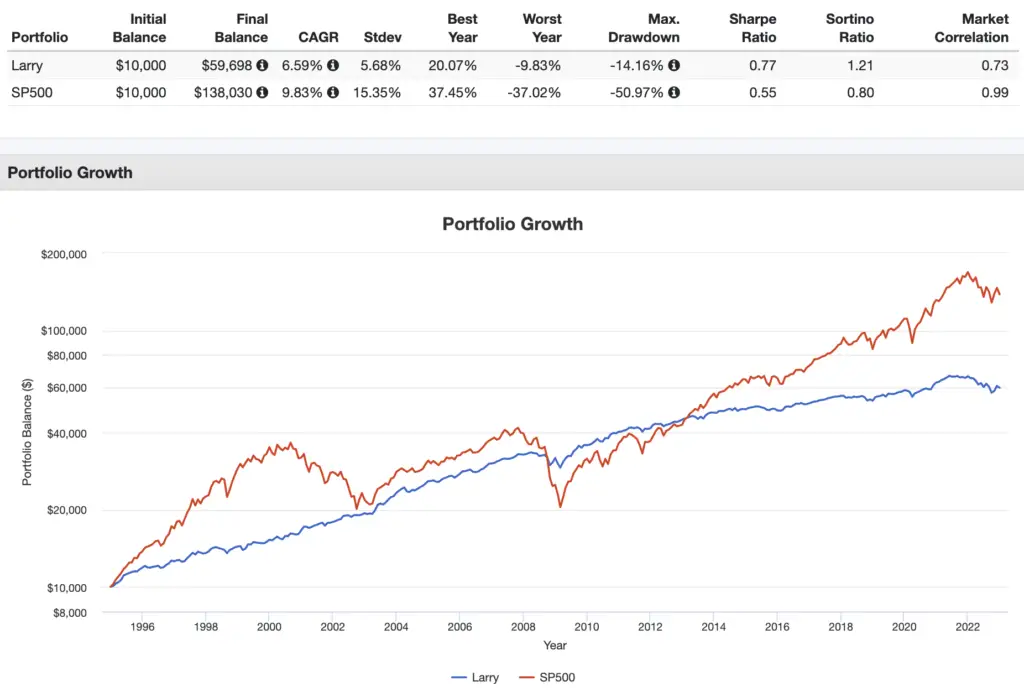

Using comparable mutual funds from Dimensional to extend this backtest, here's a rough approximation of the Larry Portfolio's performance vs. an S&P 500 index fund for the period 1995 through 2022:

It doesn't look too exciting, but note that these are two very different portfolios for different risk tolerances. Notice how the Larry Portfolio had about 1/3 the volatility of the S&P 500, and a max drawdown of about 1/4 the size. As a result, the Larry Portfolio delivered a much higher risk-adjusted return (Sharpe).

The Larry Portfolio should also reliably beat the stock market in years of bear markets and market crashes. Appropriately, the Larry Portfolio beat the S&P 500 in years like 2000, 2001, 2002, 2008, 2018, and 2022.

A more appropriate comparison would be to that of a traditional asset mix with a similar level of risk. Remember what Markowitz told us in the 1960's. For any given level of risk, a rational investor should want the greatest expected return. Hopefully that's intuitive. Put another way, for a required return, we should prefer the portfolio with the lowest risk.

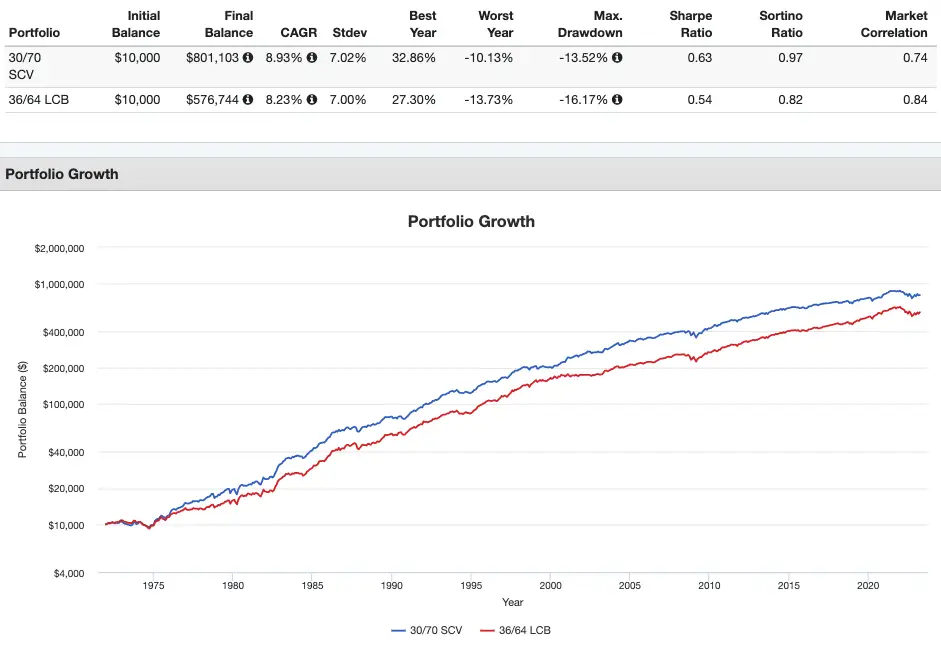

Below is an ad hoc backtest using U.S. small cap value just to illustrate this concept and what Swedroe set out to do. Notice how if we use volatility as a proxy for risk and compare to a more “traditional” asset mix with an equal volatility (which turned out to be 36/64 using U.S. large cap stocks), we got a much higher return, not to mention superior best year, worst year, and max drawdown stats due to being able to hold more bonds and get risk factor diversification:

The Larry Swedroe Portfolio is for the risk-averse investor who still wants to take advantage of factor tilts in equities, namely Size and Value with small-cap value stocks. This portfolio requires high conviction in these factors, as it contains no large- or mid-caps.

The decade 2010-2019 wasn't great for the Size and Value factors. I would argue this shouldn't deter you from believing in them long-term. Small-caps have still crushed large-caps historically, and Value has beaten Growth historically. Moreover, we would expect negative factor premiums from time to time, even for extended time periods like the last decade. But interestingly, there have been more 10 year periods where the U.S. market delivered a negative premium than there have been 10 year periods where U.S. Value delivered a negative premium.

As a rule, I don't employ market timing, but AQR submits that Value is basically the cheapest it's ever been right now, suggesting that now may be the worst time to give up on the factor, and that it's due for a comeback. Giving up on a portfolio simply because it underperforms its benchmark is known as tracking error regret; don't succumb to it. Value stocks beat Growth stocks in 2021 and 2022, so that comeback may indeed be happening.

Factors are simply unique or independent sources of risk. A typical 60/40 portfolio has more risk than one might realize at first glance. Due to the comparatively greater volatility of stocks compared to bonds, over 90% of the portfolio's risk is market beta.

Conveniently, diversifying across factors actually leads to a “stronger” portfolio in terms of reducing the risk of black swan events, but you must be able to live with tracking error regret, a term for giving up on a strategy after its underperforming its benchmark for some period of time. Adding in factors necessarily means your portfolio’s performance does not resemble the market; there may be periods of underperformance.

I personally still very much believe in the Size and Value factors; like the Larry Portfolio, my portfolio tilts Small Cap Value.

Larry Swedroe Portfolio ETF Pie for M1 Finance

M1 Finance is a great choice of broker to implement the Larry Portfolio because it makes regular rebalancing seamless and easy, has zero transaction fees, and incorporates dynamic rebalancing for new deposits. I wrote a comprehensive review of M1 Finance here.

Utilizing some pretty new funds from Avantis with great factor loading so far, we can construct the Larry Portfolio pie like this:

- AVUV – 15%

- AVDV – 8%

- AVES – 7%

- VGIT – 70%

Since M1 Finance doesn't allow fractions of 1%, I made AVDV 8% and AVES 7%.

You can add the Larry Portfolio pie to your portfolio on M1 Finance by clicking this link and then clicking “Save to my account.”

Canadians can find the above ETFs on Questrade or Interactive Brokers. Investors outside North America can use Interactive Brokers.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Disclosures: I am long AVUV and AVDV in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

What would the Larry Swedroe portfolio be using only Vanguard ETF funds?

Excellent evaluation!

How would one go about making this a little more aggressive? Swapping out some of the fixed income for say, NTSX?

AVUV – 15%

AVDV – 8%

AVEM – 7%

NTSX – 30%

VGIT – 40%

Sure. In general, bonds > stocks makes it more aggressive. And/or adding leverage as with NTSX.

I’d say DGS vs AVEM for SCV.

This would be fun with a modified version with less bonds and more stock but swap the bonds to long term

Agreed on the DGS.

I’m sure Larry Swedroe would not agree with you with your selection of small cap value and emerging market value funds. Their fund construction and degree of tilt to size and value is much inferior to the Avantis funds (AVUV, AVDV and AVEM) or the comparable Dimensional Funds.

Just haven’t gotten around to updating these ETFs. The Avantis funds are very new.

Updated.

Swedroe has mentioned that he uses the Bridgeway small cap value fund. There’s a recent ETF conversion of the tax managed SCV. BSVO.

If anyone is curious to see a much longer performance backtest, you can plug in the funds DFSVX, DISVX, DFEVX, VFITX into portfolio visualizer to get data starting from April 1998 (time period – month to month).

Those funds are extremely similar in methodology to the Avantis funds (AVUV, AVDV, AVEM). There are still not great emerging value ETF funds out there especially with more reasonable expense ratios, and AVEM is a somewhat light value tilt. For an alternative ETF that goes deep into emerging value, FNDE is an option.

From April 1998 – May 2021

Vanguard 500: 7.86% CAGR / 0.45 Sharpe Ratio

LP w/ treasury: 7.12% CAGR / 0.93 Sharpe Ratio

LP w/o treasury: 10.18% CAGR / 0.50 Sharpe Ratio