A good credit score is arguably the most important factor in getting favorable interest rates to save big on interest charges over the long run. Here we'll look at how to raise your credit score quickly and easily before you apply for that credit card, mortgage, or car loan.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

What Is a Credit Score?

First, what is a credit score? Simply put, your credit score is quite literally the score of your credit history in relation to loans, credit cards, etc. It's a single metric that summarizes your credit risk, which creditors can quickly use to assess the creditworthiness of an individual. Generally speaking, a higher credit score means the borrower is more likely to pay back the loan. Think of the credit score as a snapshot of your credit at any point in time. The score can rise or fall fairly quickly, within a matter of a couple months.

Credit scores can easily be compared among borrowers. All things being equal, a borrower with a higher credit score will have access to higher-quality loan products at more favorable interest rates.

What Is a FICO Score?

Credit scores are standardized by a company called FICO, an acronym for Fair Isaac Corporation, which is a data analytics that developed the famous standardized FICO score that is used by most creditors.

The terms credit score and FICO score are largely interchangeable, though note that while all FICO scores are credit scores, not all credit scores are FICO scores. Your FICO score only considers credit information reported by the credit bureaus Equifax, Transunion, and Experian.

Why Is Having a Good Credit Score Important?

If you've landed on this page, you likely already know why having a good credit score is important.

Simply put, compared to a poor credit score, a higher credit score saves you a significant amount of money in interest over the life of your mortgage, auto loans, and more by allowing you to qualify for lower interest rates and more favorable loan terms. Generally, a better credit score allows you to achieve your financial objectives more easily and more quickly.

Your credit score can also affect things outside of lending, like whether or not a landlord will rent to you, your next cell phone lease, hiring decisions, and insurance premiums.

What Is a Good Credit Score Range?

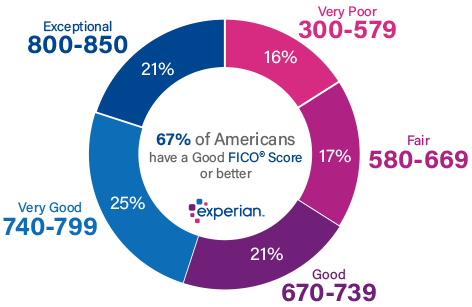

The range for credit scores is 300 to 850, wherein a higher number is better. A good credit score range is considered to be anything above about 670. Technically, the different credit score ranges are classified by FICO as follows:

Very Poor: 300-579

Poor: 580-669

Good: 670-739

Very Good: 740-799

Excellent: 800-850

The average credit score in the U.S. is about 710. 67% of Americans have a FICO score that is considered to be “Good” or better.

Average Credit Score by Age

Generally, as we'd expect, credit scores increase with age. Here's the average credit score by age for 2020 from Experian:

| Age | Average FICO Score (2020) |

|---|---|

| 18-23 (Gen Z) | 674 |

| 24-39 (Millenials) | 680 |

| 40-55 (Gen X) | 699 |

| 56-74 (Baby Boomers) | 736 |

| 75+ (Silent Generation) | 758 |

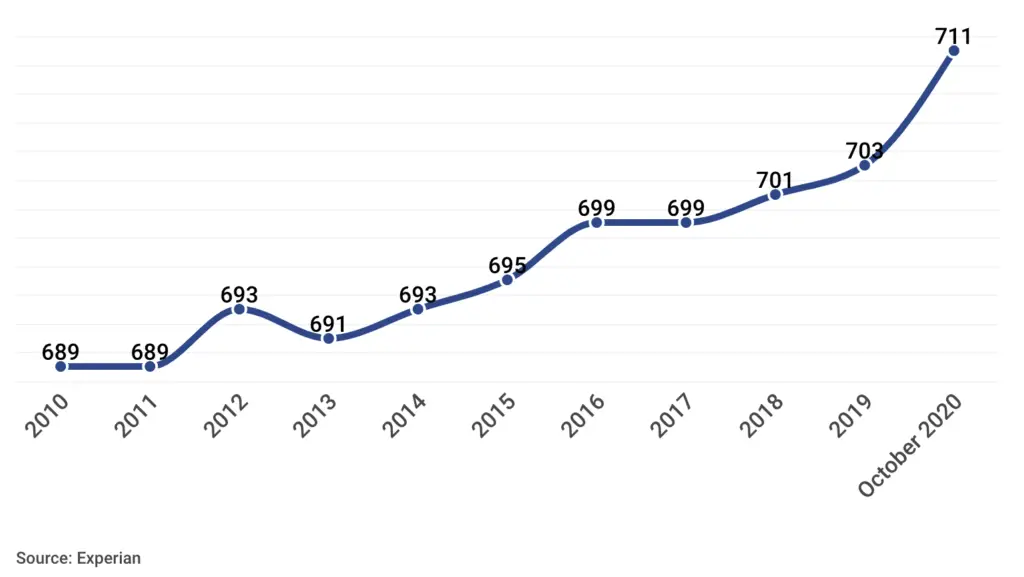

Credit Score Charts

Here are some informative credit score charts and graphs:

Average FICO Score

What Affects Your Credit Score?

There are several different factors that affect your credit score, with some being more impactful than others:

- Payment history is the most important factor that affects your credit score. Have you made all your minimum payments on time or have you missed some? Lenders want to see a strong payment history that indicates that you'll be able to pay back a loan on time. Unlike investing in the stock market, past performance here (past payments) does indicate future performance. Even one missed payment can have a significant negative impact on your credit score, and it remains on your credit report for 7 years. It's estimated that payment history accounts for about 35% of your FICO score.

- Your credit utilization is the next most important credit factor. Specifically, we're talking about what's called your credit utilization ratio – how much debt you've accrued relative to your total credit limit. In short, how much credit are you using? Try to keep this metric under 30% to keep your credit score in good shape; keeping it under 10% will yield the best score. For example, if you're using $3,000 of revolving credit and your total credit limit is $10,000, your credit utilization is 30%. Having a high credit utilization ratio suggests to lenders that you are too reliant on credit. Credit utilization accounts for 30% of your FICO score.

- Credit history length is next on the list. How long have you been using credit? Just like lenders like seeing a history of on-time payments, it helps even more when you've been doing that for a long time. A longer history means a higher score. This factor accounts for 15% of your FICO score.

- The fourth and oft-overlooked factor is your credit mix. Lenders like to see multiple types of debt, e.g. a credit card, car loan, personal loan, mortgage, etc. because this shows that the borrower is able to manage a range of credit accounts. Individuals with higher credit scores typically have a broader range of credit types. This factor contributes 10% to your FICO score.

- New credit accounts for the final 10% of your FICO score. This refers to recently opened accounts and applications. Too many new accounts and hard inquiries (when a lender pulls your credit report) – especially in a short amount of time – can be a red flag to lenders and can lower your credit score. Hard inquiries typically stay on your credit report for 2 years before falling off.

Your FICO score does not consider any of the following in calculating your credit score:

- age

- race

- religion

- sex

- marital status

- salary

- occupation

- employment history

- soft inquiries

Utility bills (phone, water, electricity, etc.) and your on-time payment thereof typically do not affect your credit score, but Experian specifically recently introduced a feature called Experian Boost where you can upload utility bill payment history that may, as the name suggests, boost your score with that specific bureau.

How To Raise Your Credit Score Fast

To improve your credit score quickly, the next logical step is to identify which of the aforementioned factors may be hurting your score the most. Then assess which of those factors you can remedy or improve immediately. Let's look at how to raise your credit score fast:

Clean Up Your Credit Report

An important first step in boosting your credit score quickly is to make sure all the information on your credit report is yours. Any inaccurate information or fraudulent accounts could be having a significant negative impact on your credit score without you realizing it. Here's how to assess and dispute any inaccuracies:

- Use Credit Karma to review your credit score and report. Look for any fraudulent information. Credit Karma usually can’t correct these entries for you, but it lets you view what the report from each credit bureau says.

- If you have any incorrect or fraudulent entries, you’ll have to edit them or file disputes directly with each specific credit bureau, as different lenders pull reports and scores from different credit bureaus. In some instances this may require signing up for a premium paid account, even if only for a month.

- Equifax

- Experian

- Transunion

- If you found a significant number of fraudulent entries or if you’re concerned that your sensitive information is out there for fraudsters to use, consider temporarily placing a freeze on your credit with each of the above bureaus and using a protective monitoring service like Norton Lifelock, which delivers cyber security, device protection, online privacy, and identity theft protection. Trust me; it’s much easier to preemptively prevent these types of invasions than to try to remove and correct them after the fact.

Lower Your Credit Utilization Ratio

If you have some cash and your credit utilization is hovering right at the line around 30% or 10%, it will likely be beneficial to go ahead and make an extra payment to get it below those thresholds as soon as possible. Depending on when you get paid, try to make extra payments as soon as possible, even if that means making multiple payments throughout the month. It's a common myth that you should carry a credit card balance every month; this is not true. Lowering credit utilization is probably the easiest, quickest, most impactful way to improve your credit score quickly.

Creditors only report balances to the credit bureaus once a month, so making any extra payments helps ensure they report a lower balance every month. Let's say your credit card has a limit of $1,000 and you put all your expenses on it to get the cash back, amounting to $500 every month. If your expenses rack up during the first half of the month and the creditor reports the balance on the 15th but you pay off the entire balance later on the 20th, it's going to look like you're constantly carrying a $500 balance every month, which is a utilization of 50%.

FICO looks not only at your overall credit utilization but also the utilization for each account. Let's say one of your credit cards has a utilization of 35% and another has a utilization of 5%. You may be tempted to go ahead and pay off the second card with the lower utilization, but you'll improve your score faster by paying down the first card with the higher utilization first.

There's another way you can instantly lower your credit utilization ratio and improve your score: increasing your credit limit. Call each creditor and ask if they'll increase your credit limit without a hard inquiry. I would suggest only doing this online if the page specifically says it is not a hard inquiry. Any increase in your credit limit immediately lowers your utilization ratio.

Don't go applying for new credit cards just to decrease your credit utilization.

Diversify Your Credit Mix

Another factor you can target is credit mix. Applying for a new type of debt like a personal loan, while obviously also resulting in a hard inquiry, diversifies your debt portfolio. Conveniently and arguably more importantly, this also immediately increases your total credit limit and thus lowers your aforementioned credit utilization ratio. Though it may seem ironic, this new type of debt will usually increase your score, but keep in mind this trick only works if you don't currently have that specific type of debt, e.g. a personal loan as an installment loan type, and if you don't already have several hard inquiries still sitting on your credit report.

Use Experian Boost

Consider looking into Experian Boost where you can upload utility bill payment history that may slightly boost your score with that specific bureau. The tool connects to your bank account to pull your payment history. Obviously only do this if you have made your utility payments on time and in full. Don't expect anything drastic; Experian reports that the average boost is 13 points.

Things NOT To Do

- Obviously don't miss any future payments, as that delivers a huge derogatory blow. Consider enabling automatic monthly payments and/or calendar reminders, which can be particularly useful if you have credit accounts across multiple creditors to keep track of. If you've missed payments in the past, especially recently, call the creditor immediately and ask if they'll stop reporting the missed payment on your credit report.

- Don't close old, unused accounts, as this will increase your credit utilization ratio and decrease your average credit account age, both of which will lower your credit score.

- A debt settlement program may also look attractive, but settling your debts for less than the original agreed-upon amount lowers your credit score and is a red flag to lenders.

- Similarly, don't pay a credit repair agency. Credit repair agencies may make promises to magically boost your credit score quickly and want to charge you for it, but they don't have any magic bullets or secret tricks not already on this page.

- Don't apply for new credit cards just to lower your credit utilization.

- Don't carry a balance on credit cards.

Authorized User

If you have thin credit (short credit history and low number of accounts), you can also ask a friend or relative with a strong credit history to add you as an authorized user on their account. This can immediately improve your credit score by allowing you to piggyback on their credit history, even if you don't use their credit cards.

The opposite is also true, though. If this friend or relative misses payments and has a high credit utilization, this will reflect poorly on you and could lower your score. If you were previously an authorized user and your credit is still suffering from derogatory marks that weren't your fault, you can dispute those with the credit bureaus.

Secured Credit Card

A secured credit card from a bank – a credit card for which you put up a cash deposit as collateral – is also a useful tool for those with little to no credit history. This is only useful for those who have never had a credit card; it won't really do anything for those with an established credit history.

Summary

So to recap, correct any inaccurate or fraudulent information on your credit report, pay down existing debt as much as possible, ask creditors for higher credit limits, don't miss any future payments, don't close old accounts, and consider applying for a new type of debt to diversify your credit portfolio. There's no overnight fix, but a reasonable timeline to expect to see changes is 30-90 days.

Credit repair agencies may make promises to magically boost your credit score quickly and want to charge you for it, but they don't have any magic bullets or secret tricks not already on this page.

Lower credit scores have more room to move. If you have a very poor to fair credit score (based on the categories above), it's not unreasonable to expect an increase of 50-100 points by doing a few of the things discussed above.

How To Check Your Credit Score

The fastest and easiest way to check your credit score is with a tool like Credit Karma. It's free and won't hurt your credit score (it's a soft inquiry). Credit Karma only shows scores and reports from Transunion and Equifax, so you may want to create an account with Experian as well, as some lenders may pull from that bureau specifically.

Remember that to correct any incorrect or fraudulent information, you'll want to create accounts specifically with the credit bureaus anyway. Always check your credit score and report entries before applying for a new credit account, as you may unknowingly have entries that will negatively affect the lending decision or loan terms.

Note that your credit scores can – and likely will – differ among the different credit bureaus. This can be due to several reasons. One bureau may keep a very old credit account in consideration, while another may drop it. One bureau may have more (or fewer) entries than another. Payments also get reported to the different bureaus at different times each month. As usual, try to keep an eye on all 3 major reporting bureaus when you can. The bureaus themselves typically offer free credit monitoring, alerting you to any changes to your credit report.

Conclusion

Having a good credit score is more important than you may realize, allowing you to more quickly and more easily achieve your financial objectives, potentially saving you thousands of dollars in interest in the process. Know the factors that impact your score, and keep an eye on your credit reports from the 3 major reporting bureaus. Tools like Credit Karma make this easy. To improve your score quickly, pay down as much debt as possible, don't miss any future payments, consider applying for a new type of debt, and correct any inaccuracies or fraudulent entries on your credit reports.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply