Hands-off “robo-advisor” investing platforms like Wealthfront are surging in popularity recently with low fees, savings accounts, convenience, and modern apps and interfaces. Here we'll compare Wealthfront and M1 Finance. I wrote a separate comprehensive review of M1 Finance here if you're interested in that.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

M1 Finance vs. Wealthfront – Summary Comparison

Contents

M1 Finance vs. Wealthfront – Commissions and Fees

M1 Finance offers fee-free investing; no account fees and zero commissions, plain and simple. There are obviously miscellaneous one-time fees for things like paper statements, outbound account transfers, inactivity, etc.

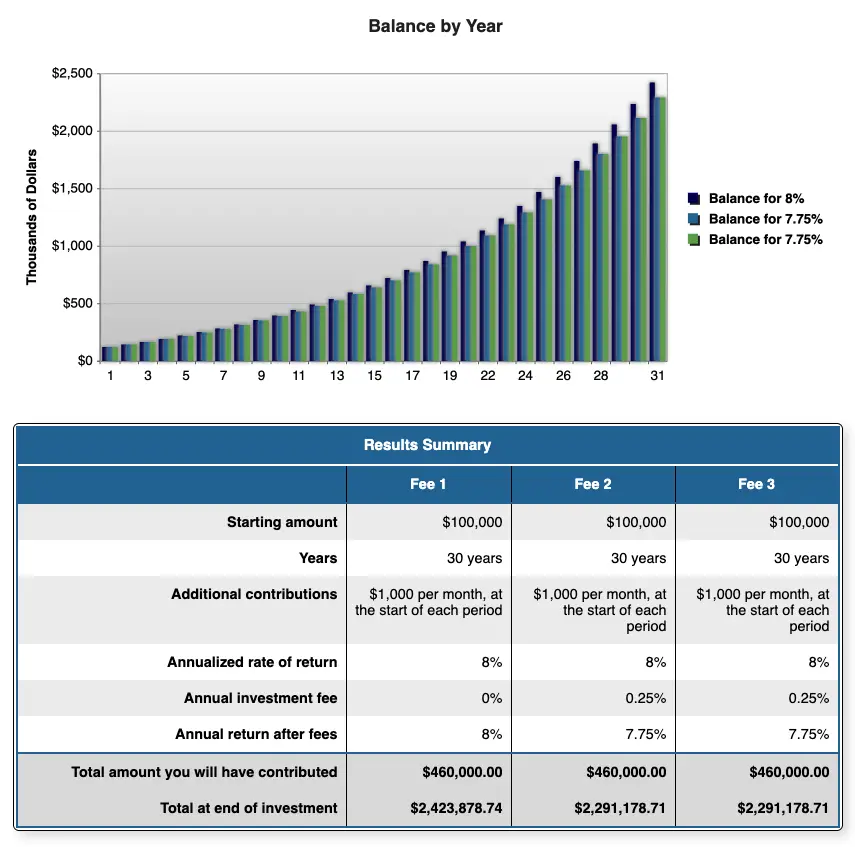

Wealthfront has a 0.25% annual fee based on your invested balance. This fee may look extremely low at first glance, but let's examine how it affects a portfolio's value over time:

Using a starting balance of $100,000, $1,000 contributed monthly over 30 years, and an annualized rate of return of 8%, Wealthfront's 0.25% fee costs you $132,700 in fees.

Notice how the value differences become more pronounced near the end of the investing horizon when the account value is larger. Such is the power of compound interest, in this case unfortunately working against you.

So obviously M1 wins out on fees. But what if you still want to pay for expert investing? Luckily, you can still access M1's “Model Portfolios” for free. More on that later.

M1 Finance vs. Wealthfront – Account Types

M1 Finance offers the following account types:

- Individual

- Joint

- Traditional IRA

- Roth IRA

- Rollover IRA

- SEP IRA

- Trust

- Custodial

Wealthfront offers all those same accounts except Custodial, plus a 529 college savings account.

Neither platform offers:

- SIMPLE IRA

- Solo 401(k)

- HSA

- Non-Profit

M1 Finance also offers an optional FDIC-insured checking account with a debit card. Wealthfront offers an FDIC-insured savings account; they do note on their website that a debit card option may be coming soon.

M1 Finance vs. Wealthfront – Investment Products

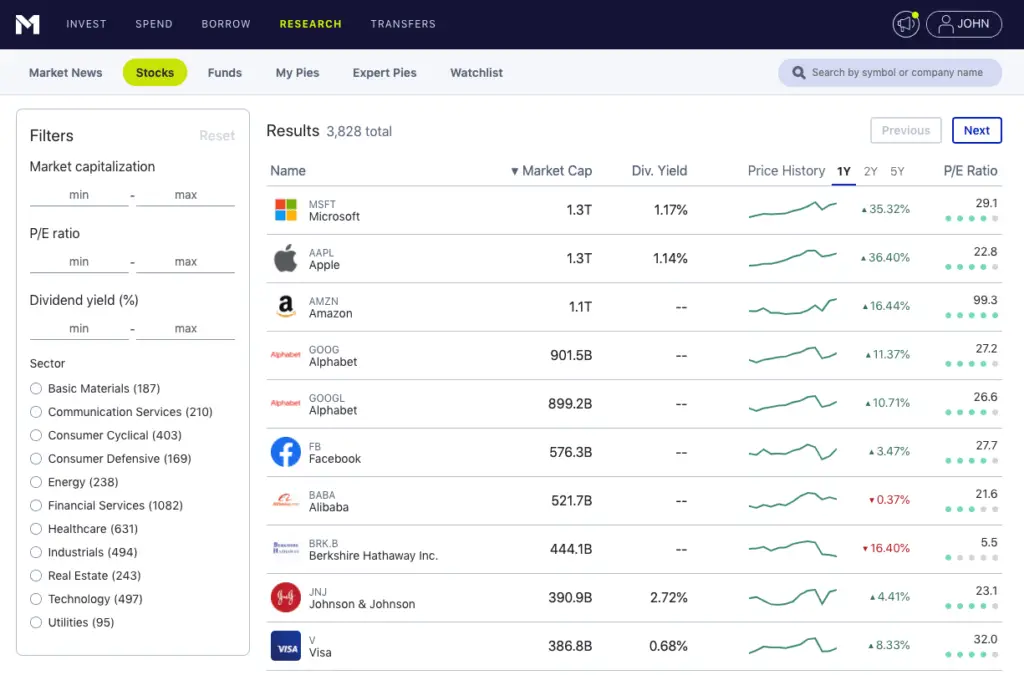

M1 Finance offers most ETF's and individual stocks traded on major exchanges.

Wealthfront only offers a small handful of low-cost broad index ETF's through their pre-built portfolios based on the investor's risk tolerance, much like Betterment and Acorns. As with most robo-advisors, these pre-built portfolios seem to be based on modern portfolio theory. Note that Wealthfront is a true robo-advisor; there's no human intervention or advising and you cannot select your own investments.

You can easily access all these on your own with M1 Finance using low-cost Vanguard funds. You can also use M1's “Model Portfolios” for free. M1's Model Portfolios include target date funds with different risk tolerances, sustainable investing (ESG) portfolios, dividend-focused pies, and more. Wealthfront does not offer themed portfolios.

With Wealthfront, as your account balance gets larger, you get access to more advanced investing features in what Wealthfront calls their PassivePlus® suite:

- $100k – Stock-level tax-loss harvesting sells individual stocks within your portfolio at a loss to lower your tax bill.

- $100k – Risk parity allocates assets within a portfolio based on their contribution to the portfolio's overall risk.

- $500k – “Smart beta” investing strategically holds stocks in an attempt to target specific exposure to the known risk factors that explain stock returns.

At this time, neither platform offers mutual funds, options, futures, forex, or cryptocurrency. They are not built for day trading.

M1 Finance vs. Wealthfront – Margin

Wealthfront and M1 Finance both have great rates on margin loans. Margin is simply a collateralized loan on your invested securities to provide enhanced exposure for investing. M1 is usually a bit lower.

M1 wins on margin rates, but Wealthfront still has a significantly better margin rate than traditional brokers like Schwab, Fidelity, etc.

M1 Finance vs. Wealthfront – Mobile App

Both M1 Finance and Wealthfront have modern, intuitive, robust mobile apps for both Apple iOS and Android.

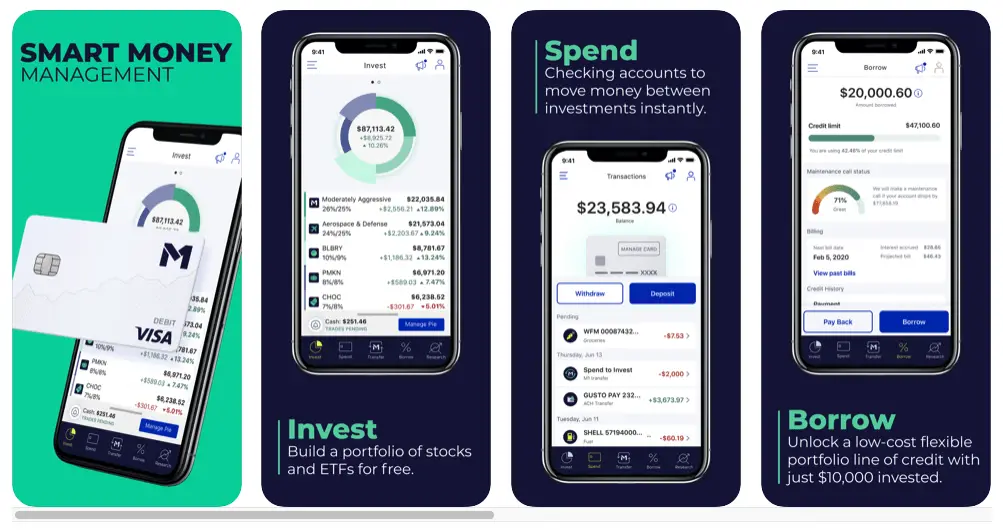

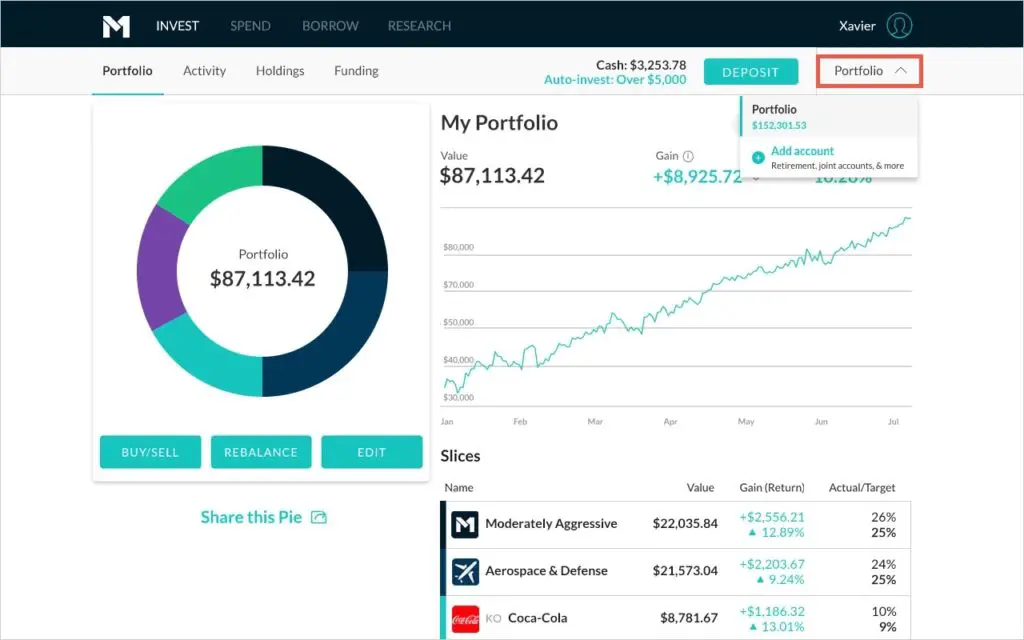

Here are some screenshots of the M1 app:

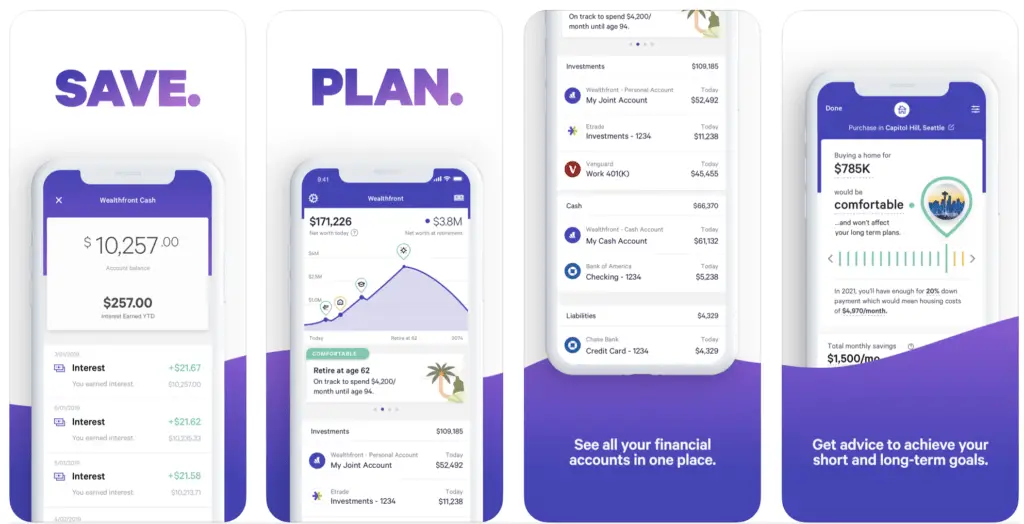

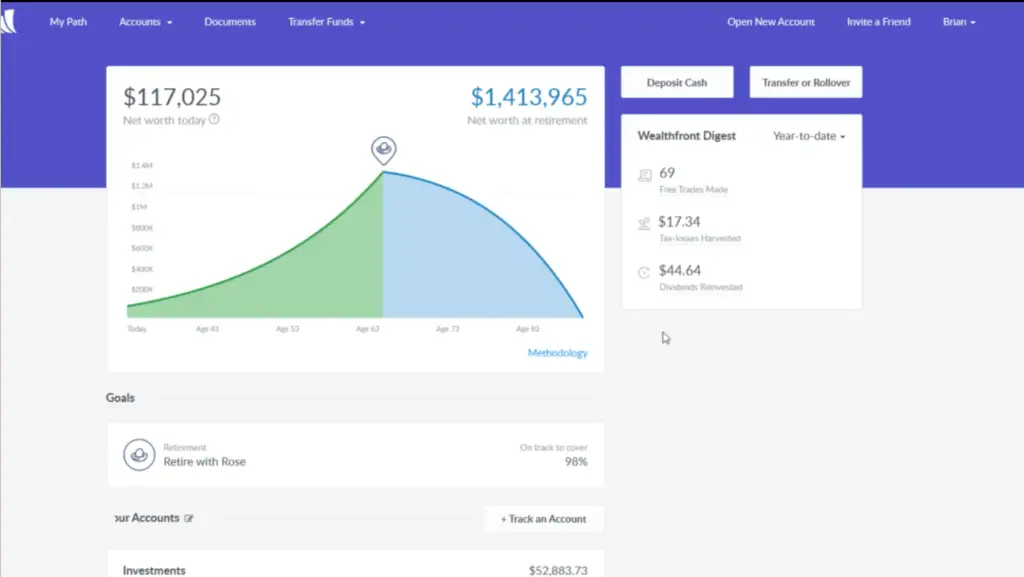

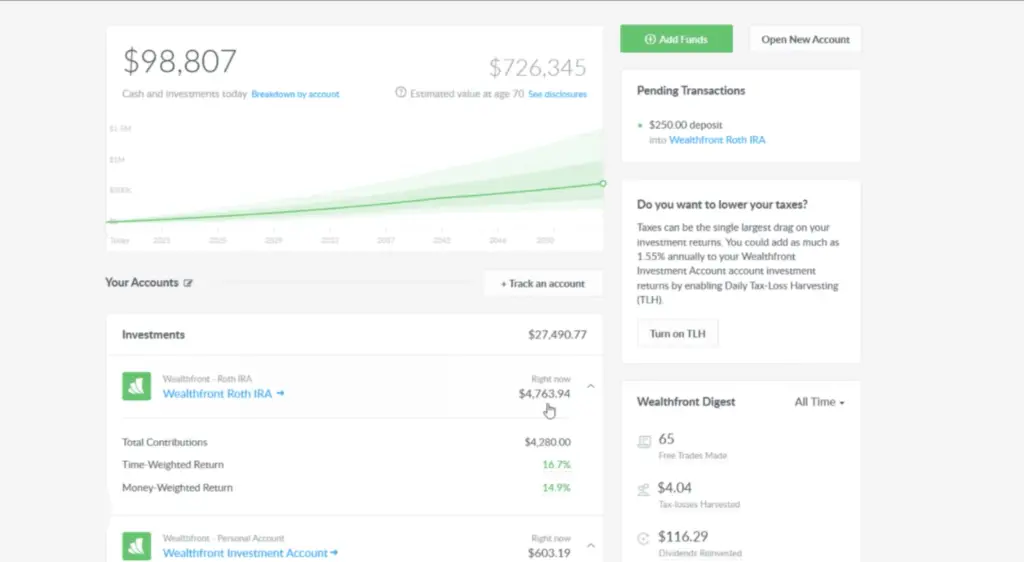

Here are some screenshots of the Wealthfront app:

M1 Finance vs. Wealthfront – Interface/Usability

Similarly, both M1 Finance and Wealthfront have intuitive, easy-to-use desktop interfaces.

Here's M1 with its pie-based visualization:

And here's Wealthfront:

M1 Finance vs. Wealthfront – Extra Features

Neither M1 Finance nor Wealthfront offers robust charting and analysis tools but both do have educational articles and regular tips via their blogs. M1's research tools are pretty basic – stock and ETF screeners, technical indicators, etc. Wealthfront doesn't allow you to choose your own investments, so they have no research tools.

Both M1 Finance and Wealthfront offer automatic rebalancing that uses new deposits to keep your portfolio at its target asset allocation.

As mentioned, Wealthfront incorporates stock-level tax-loss harvesting and risk parity if your invested balance is above $100k, and “smart beta” investing if your invested balance is over $500k.

M1 Finance offers fractional shares, a feature that allows every penny to work for you. This means you can buy a fraction of a single share of a stock or ETF, allowing your money to compound faster with dividend reinvestment. This is especially important for young investors with a small amount of capital. Wealthfront does not support fractional shares, which I think is surprising considering their advanced tech and other offerings.

M1 Finance vs. Wealthfront – Summary and Conclusion

- M1 Finance and Wealthfront are both built for passive, long-term, buy-and-hold investing.

- M1 Finance offers free investing; plain and simple. Wealthfront carries a 0.25% fee. While that may not sound like much, these fees shave off a massive amount of money from your portfolio over the long-term.

- M1 and Wealthfront offer all the same account types, and Wealthfront adds a 529 account option.

- M1 Finance offers most ETF's and individual stocks. Wealthfront only offers a small collection of broad index funds inside their pre-built portfolios. Wealthfront do not offer individual stocks, and do not allow self-directed investing.

- Wealthfront and M1 Finance both have great margin rates, but M1's are slightly better.

- M1 Finance and Wealthfront both have sleek, modern, intuitive, robust mobile apps and desktop web interfaces.

- M1 Finance has an optional FDIC-insured checking account with debit card. Wealthfront offers an FDIC-insured savings account and plans to add a debit card in the future.

- Both M1 and Wealthfront employ automatic rebalancing.

- M1 Finance supports fractional shares. Wealthfront does not.

- M1 Finance has Model Portfolios that you can invest in for free. Wealthfront's pre-built portfolios carry the 0.25% fee. Neither platform offers human advising.

- M1 Finance has an account minimum of $100. Wealthfront's account minimum is $500.

M1 Finance offers the aforementioned quantitatively-analyzed and optimized “Model Portfolios” that you can invest in for free and be completely hands-off. Wealthfront obviously has the pre-built portfolios ready to go, but M1 allows you to buy the exact same ETF's commission- and fee-free, thereby avoiding those fees that drag down your portfolio's returns. You can also simply use M1 to invest in a “lazy portfolio” and have it rebalance automatically.

Moreover, Wealthfront makes it sound like they're actively managing your portfolio. They're not. Recall that the system is simply investing your money in a small handful widely-available low-cost index ETF's and shifting the allocations based on risk tolerance, which I would argue you can easily do yourself anyway with M1 Finance. For the most part, Wealthfront appears to invest your money upon initial deposit and then doesn't do much after that aside from gradually adjusting your asset allocation, so I don't understand the need for the hefty ongoing annual fees.

I do think out of the true robo-advisors like Betterment, Wealthsimple, and Wealthfront, Wealthfront is probably the best with its comparatively low fee, more advanced tech, savings account, and margin offering. But it's still surprising that Wealthfront does not offer fractional shares.

Consequently, I don't see a compelling reason to choose Wealthfront over M1 Finance, unless for some reason you absolutely believe you can't complete the steps of setting up and investing in a portfolio on M1. If you're purely looking for an investing platform, I would suggest that the marginally greater effort of investing with M1 Finance is more than worth the savings on fees over the long-term.

I wrote a separate comprehensive review of M1 Finance here if you're interested in seeing the nuances of the platform.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Hi John,

Thanks for all the great content!

What do you think of tax lost harvesting? Wouldn’t that alone make Wealthfront compelling over M1 for a taxable account?

TLH is usually just delaying tax costs, not avoiding them. I don’t get too excited about it.