Micro cap stocks are smaller than small cap stocks, and thus would be expected to pay more of a risk premium. Here we'll check out the best micro cap ETFs and explore the problems with the cap size.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Introduction – Why Micro Cap Stocks?

Micro cap stocks are smaller than small cap stocks. It's somewhat of a forgotten segment of the market, as these stocks are the most volatile, and there aren't many products available to capture them.

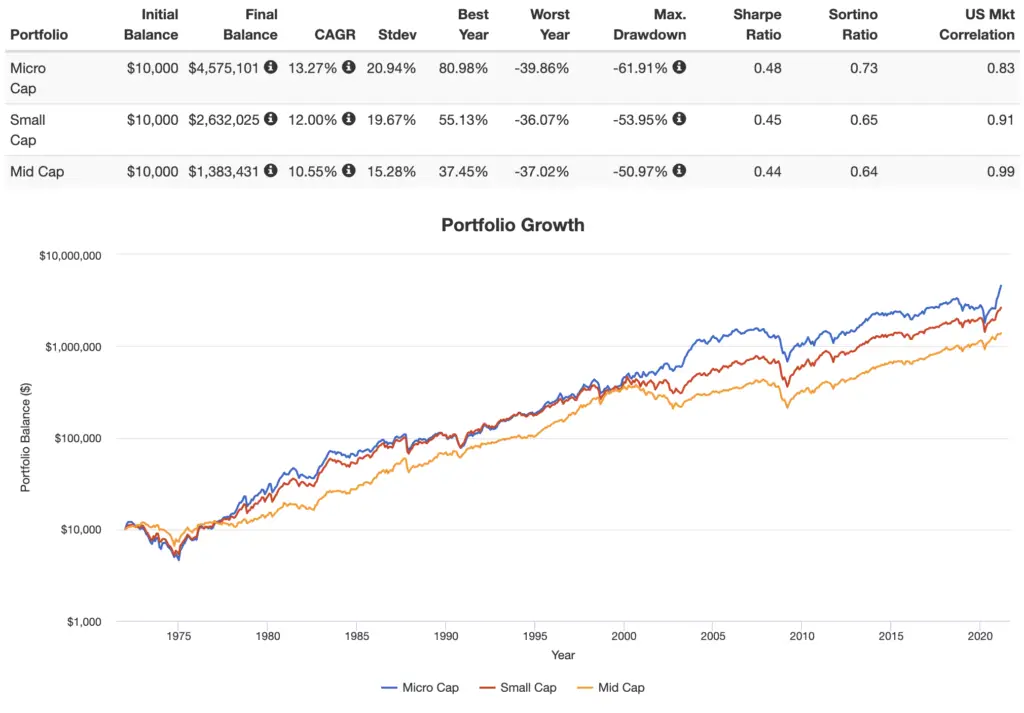

First, remember the Size factor premium – small stocks tend to outperform large stocks because small stocks are riskier, so investors are compensated for that risk. Micro caps have indeed outperformed other cap sizes historically:

Secondly, remember that factor premia get stronger as we go smaller. That is, factors like Value and Profitability pay higher premiums and are more statistically significant in smaller stocks. This is why small cap value is usually the golden child of the market.

Lastly, micro caps per se may even provide a diversification benefit inside U.S. equities, with a correlation to the U.S. stock market of about 0.8.

So ideally, we'd buy a micro cap value fund that captures cheap stocks with strong financials to tilt Value and Profitability within micro caps, right? Unfortunately, no such product exists unless Dimensional launches an ETF equivalent of their US Micro Cap Portfolio mutual fund (DFSCX) for the public.

Since we can't readily access micro cap value, we're essentially placing a larger bet on beta by buying a micro cap fund.

Some even consider micro caps a proxy for private equity, with comparatively greater transparency and liquidity.

The Problem with Micro Cap Funds

The problem with most micro cap funds is that they're usually not really micro cap funds. This is because micro cap stocks by nature aren't very investable due to their relative illiquidity and extreme volatility. Ironically, the theory goes that micro caps pay a significant premium precisely because of that illiquidity and volatility. Moreover, the policies of asset management companies typically prevent fund managers from buying these illiquid, low-price-per-share stocks.

Active funds that have emerged over the years to buy true micro cap stocks are either closed to new investors, are unavailable to retail investors, have high minimum investments, and/or command extremely high fees. Examples include:

- WMICX – Wasatch Micro Cap Fund

- RYOTX – Royce Micro-Cap Fund Investment Class

- DFSCX – Dimensional US Micro Cap Portfolio Fund

- BRSIX – Bridgeway Ultra Small Company Market Fund

WMICX has far outperformed the others on this list historically, but it comes at an astronomical cost of 1.66%.

Feel free to research these options. For ones like BRSIX that are open to new investors, minimum initial investments may differ among different brokers.

Let's check out options for micro cap ETFs.

The Best Micro Cap ETFs

There are currently only 3 micro cap ETFs available, all of which are suboptimal and bittersweet in their own way. Here they are:

IWC – iShares Micro-Cap ETF

The iShares Micro-Cap ETF (IWC) is by far the most popular of these 3 micro cap ETFs, with nearly $1 billion in assets.

IWC seeks to track the Russell Microcap Index, which sounds nice, but this is simply the smallest 1,000 stocks in the Russell 2,000 Index. Thus, by definition, these are not true micro caps, so the fund skews more toward small caps. Ideally we're looking for a weighted average market cap below about $300 million for true micro caps. The weighted average market cap of IWC is $750 million.

Moreover, this pseudo-micro-cap exposure comes at a relatively high cost of 0.60%, so we're paying much more for exposure that's not really what we're aiming for. In short, I'd rather just hold a cheaper, more liquid, “normal” small cap value fund.

FDM – First Trust Dow Jones Select MicroCap Index Fund

Popularity and liquidity drop off steeply after IWC. The First Trust Dow Jones Select MicroCap Index Fund (FDM) has an AUM of about $150M.

FDM seeks to track the Dow Jones Select Microcap Index. While IWC has over 1,000 holdings, FDM only has about 150, so it's arguably less diversified and differs in sector weightings. FDM also still has a higher weighted average market cap than IWC at about $820 million.

But, FDM at least screens for liquidity and strong financials, while IWC does not. As a result, FDM has comparatively greater loading on Value and Profitability with a similar loading on Size, which means greater expected returns over the long term for FDM. The Value factor has suffered over the past decade so IWC has slightly won out over that time, but going back to 2006 through 2020FDM has had higher rolling returns, slightly lower volatility, and a smaller max drawdown.

FDM has the same fee as IWC at 0.60%. I'd take FDM out of the two.

DWMC – AdvisorShares Dorsey Wright Micro-Cap ETF

DWMC is the last micro cap ETF. First, note that DWMC has low volume and AUM. The fund was created in late 2018 but hasn't taken off at all; its AUM is only a little under $5 million (that's million with an M). As such, the fund may be at risk of closure any day.

DWMC is an actively managed ETF, but it employs rule-based selection based on price momentum, so it's not truly active. Unlike IWC and FDM, DWMC doesn't really care about liquidity, profitability, etc.; it's seeking out volatile micro caps. This increases management costs, which shows up in the fund's high fee of 1.32%.

DWMC has outperformed the other two funds over its short lifespan on both a general and risk-adjusted basis. Like FDM, DWMC only holds about 150 stocks. Its weighted average market cap is about $950 million.

I'd be worried about the fund closing, but even if I were open to paying 1.32% for DWMC, I'd probably rather save up the minimum initial investment for one of the mutual funds mentioned earlier: either BRSIX (cheaper at 0.75%) or WMICX (pricier at 1.66%).

Honorable Mention: AVSC – Avantis U.S. Small Cap Equity ETF

Since I first wrote this blog post, Avantis launched AVSC, the Avantis U.S. Small Cap Equity ETF. While it's not explicitly a micro cap fund, it's holding smaller stocks than most small cap funds, with a weighted average market cap of about $1.7 billion. That's higher than the other funds on this list, but lower than its competitors in the small cap space.

AVSC aims to hold U.S. small caps with robust profitability. This is noteworthy, because a fund like IWC above has negative loading on the Profitability factor and is probably holding stocks we'd ideally like to screen out.

AVSC has 1,344 holdings and is also much more affordable than the other funds where with an expense ratio of 0.25%.

Conclusion

On paper, the micro cap equities segment looks like an extremely attractive investment. Unfortunately, at this time, the attempts at implementation fall extremely short, with no great options readily available to retail investors. Most micro cap funds are not truly micro caps, and nothing exists to specifically target micro cap value.

If I wanted to place an expensive, highly volatile bet on micro caps, I'd aim for the mutual funds BRSIX or WMICX. But I'd be more tempted to wait around with the hope that Dimensional launches an ETF equivalent of their micro cap fund DFSCX for the public.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply