Large cap growth stocks have smoked the market in recent years thanks to Big Tech. Here we'll list some of the best large growth ETFs.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

In a hurry? Here's the list:

- VUG – Vanguard Growth ETF

- IWF – iShares Russell 1000 Growth ETF

- IVW – iShares S&P 500 Growth ETF

- VONG – Vanguard Russell 1000 Growth ETF

- SCHG – Schwab U.S. Large-Cap Growth ETF

- IUSG – iShares Core S&P U.S. Growth ETF

Contents

Introduction – Why Large Cap Growth?

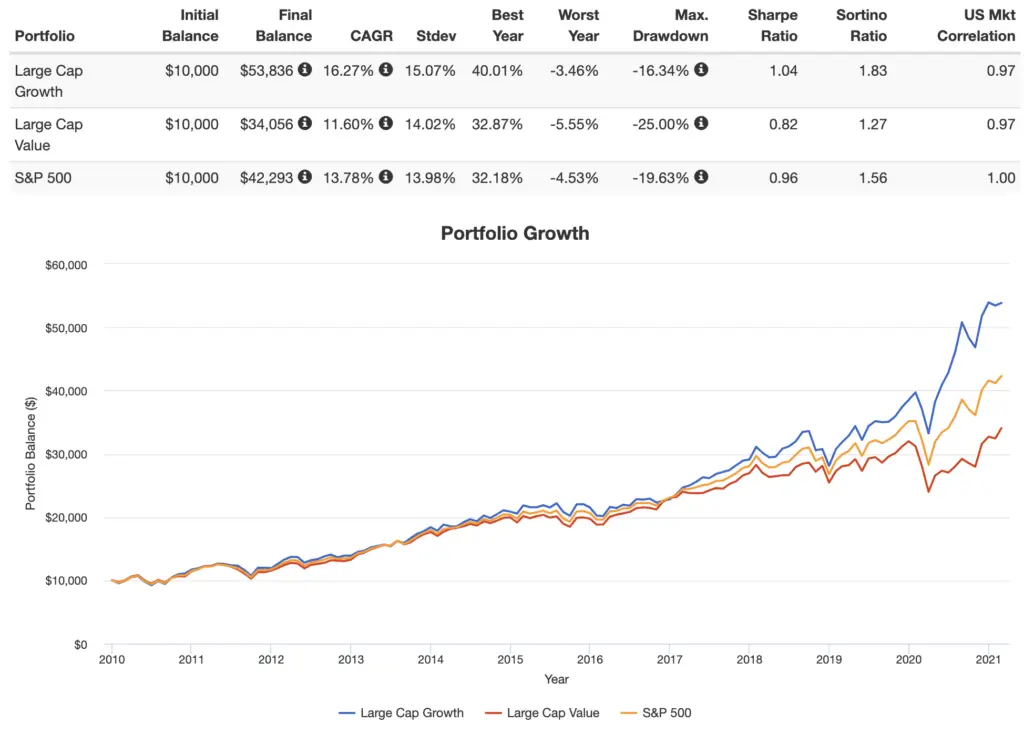

Large cap growth has crushed Value and the broader market in recent years, largely thanks to the stellar run by Big Tech, causing some to even posit that the Value premium is dead. I happen to disagree with that last part, but the insane performance of large cap growth can't be disputed; many are now choosing to overweight large cap growth relative to its market weight in an attempt to chase that performance. Here's large cap growth vs. large cap value and the S&P 500 over the past decade:

Let's explore the best large cap growth ETFs.

The 6 Best Large Cap Growth ETFs

Below are the 5 best large cap growth ETFs. We'll also discuss the exposure of each fund to companies with strong profitability metrics and hopefully the Momentum factor as well.

VUG – Vanguard Growth ETF

The Vanguard Growth ETF (VUG) is the most popular large cap growth ETF with nearly $70 billion in assets. The fund seeks to track the MSCI US Prime Market Growth Index and is very affordable with a fee of only 4 basis points.

There's no real tradeoff for that low fee. VUG can still be considered an aggressive large cap growth fund – it has the largest exposure to market beta as well as some positive loading on Profitability. VUG would probably be my choice of the funds on this list.

IWF – iShares Russell 1000 Growth ETF

The iShares Russell 1000 Growth ETF (IWF) is comparable to VUG above but tracks the Russell 1000 Growth Index. IWF commands a much higher fee of 0.19%. It has also outperformed the other funds on this list over the past decade.

IVW – iShares S&P 500 Growth ETF

IVW is pretty straightforward, taking the famous S&P 500 Index and identifying stocks that exhibit Growth characteristics within it, comprising the S&P 500 Growth Index. Using the S&P name means this fund has a fee of 0.18%, but IWV has significantly underperformed IWF over the last 10 years, even though it had the highest comparative exposure to the Momentum factor.

VONG – Vanguard Russell 1000 Growth ETF

VONG tracks the same index as IWF above – the Russell 1000 Growth index – but at less than half the cost. It has a fee of 0.08%.

SCHG – Schwab U.S. Large-Cap Growth ETF

Schwab has fairly recently launched some very affordable index ETFs. SCHG seeks to track the Dow Jones U.S. Large-Cap Growth Index. Its fee is equal to that of VUG at only 0.04%.

IUSG – iShares Core S&P U.S. Growth ETF

IUSV is another affordable large cap growth ETF with a fee of 0.04%. This fund seeks to track the Russell 3000 Growth Index.

Where to Buy These Large Cap Growth ETFs

All these large cap growth ETFs should be available at any major broker. My choice is M1 Finance. M1 has zero trade commissions and zero account fees, and offers fractional shares, dynamic rebalancing, and a sleek, user-friendly interface and mobile app. I wrote a comprehensive review of M1 Finance here.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply