Two popular dividend-focused ETFs are SPHD, the Invesco S&P 500 High Dividend Low Volatility ETF, and SCHD, the Schwab U.S. Dividend Equity ETF. Let's compare them.

First, note that I don't chase dividends. But I recognize that many investors use dividends to supplement their current income, particularly in retirement. Others just irrationally prefer dividend-paying stocks. I even designed a dividend-focused portfolio for income investors. In any case, these two funds are very popular and take a pretty different approach. Here we'll review these dividend ETFs and explore the differences between them.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

In a hurry? Here are the highlights:

- SPHD and SCHD are two popular dividend-oriented ETFs from Invesco and Schwab, respectively.

- SPHD launched in 2012 and SCHD launched in 2011.

- SPHD costs much more at 30 bps, while SCHD costs 6 bps.

- Both are very popular and have significant AUM, but SPHD is more popular than SCHD.

- SPHD looks for high-yield, low volatility stocks in the S&P 500.

- SCHD looks for high-quality companies with a sustainable dividend via profitability screens.

- SPHD overweights REITs, and SCHD excludes them.

- Since SPHD's inception in 2012, SCHD has massively outperformed it on both a general and risk-adjusted basis, all while ironically exhibiting lower volatility.

- SPHD delivers slightly greater exposure to equity risk factors like Value, Profitability, and Investment.

Contents

Video

Prefer video? Watch it here:

SPHD vs. SCHD – Methodology, Factors, and Fees

SPHD launched in 2012. It is the Invesco S&P 500 High Dividend Low Volatility ETF. As the name suggests, SPHD is comprised of a basket of high yield stocks from the S&P 500 that exhibit lower than average volatility. Appropriately, SPHD tracks the S&P 500 Low Volatility High Dividend Index. This index takes the 75 highest-yielding stocks from the S&P 500 Index and then picks the 50 lowest volatility stocks from that basket, and weights them from greatest to least dividend yield, with sectors capped at 25%.

SCHD is the Schwab U.S. Dividend Equity ETF. It launched in 2011. The fund seeks to track the Dow Jones U.S. Dividend 100™ Index, which is comprised of 100 stocks with at least 10 consecutive years of dividend payments and a minimum market cap of $500 million. Stocks are then selected for the index by screening for yield, profitability and cash flow metrics, and projected dividend growth. This fund excludes REITs. Individual companies are capped at 4% and sectors at 25%.

Unlike SPHD, SCHD does not care about the volatility of its holdings. As we'd also expect, SPHD's yield is a bit higher than SCHD's by about half a percent.

In terms of factor exposure, SPHD tilts small (positive on Size) and also has slightly higher loading across Value, Profitability, and Investment compared to SCHD.

The more stringent selection of SPHD also comes at a much greater cost. Its fee is 0.30%, compared to 0.06% for SCHD.

SPHD vs. SCHD – Sector Composition

| SPHD | SCHD | |

| Basic Materials | 7.8% | 2.8% |

| Consumer Staples | 19.3% | 14.7% |

| Consumer Discretionary | 5.9% | 7.5% |

| Financials | 6.2% | 19.6% |

| Healthcare | 11.7% | 13.1% |

| Industrials | 3.2% | 15.8% |

| Energy | 10.1% | 5.9% |

| Technology | 2.6% | 14.9% |

| Telecommmunications | 6.5% | 5.4% |

| Utilities | 21.6% | 0.4% |

| Real Estate | 11.3% | 0.0% |

Notice how SPHD massively overweights traditionally “defensive” sectors like Consumer Staples and Utilities, while severely underweighting Technology compared to the broader market. This makes sense, as these defensive sectors are notorious for high dividend yields and low volatility, while we can say the opposite about the Technology sector.

SPHD also drastically overweights REITs at about 11%, while REITs only comprise about 4% of the broader market by weight. SCHD, on the other hand, has basically zero exposure to Utilities and REITs.

SPHD vs. SCHD – Performance Backtest

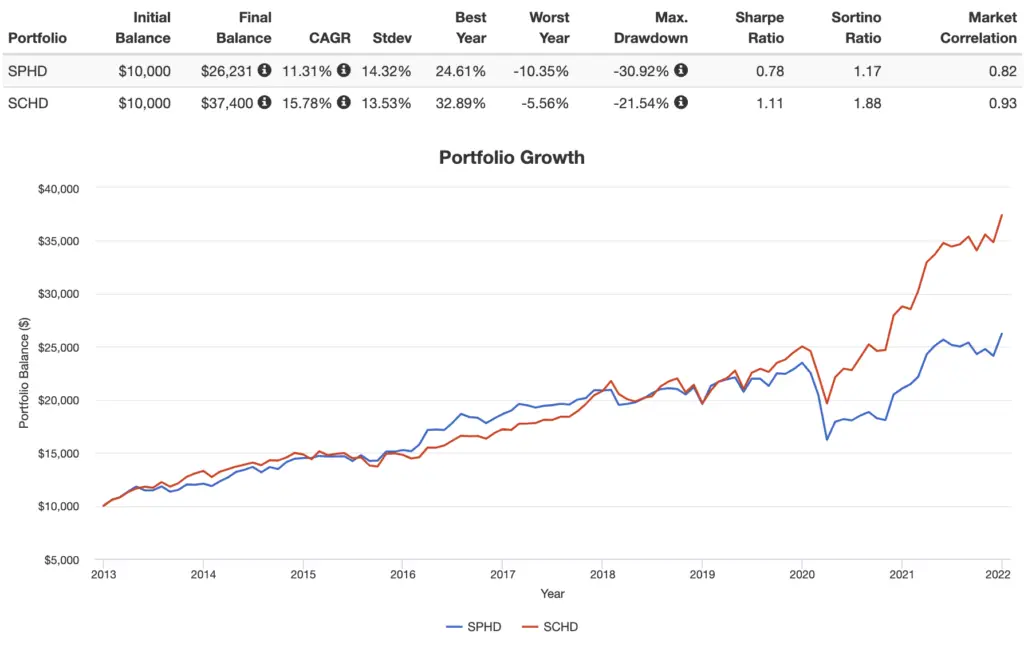

Here's a performance backtest of SPHD and SCHD going back to SPHD's inception in 2012 through 2021:

SCHD has massively outperformed SPHD over the backtested time period on both a general and risk-adjusted basis, due mainly to its much smaller drawdown and much quicker recovery from the March 2020 crash.

A glaring irony here is that despite SPHD selecting lower volatility stocks, its volatility has been greater than SCHD, even though SCHD doesn't really care about the volatility of its holdings. This is because, as I've noted elsewhere in regards to SPLV, while it may seem counterintuitive, a basket of low volatility stocks does not necessarily result in a low volatility basket.

SPHD vs. SCHD – Conclusion

If you're solely focused on yield and/or prefer to massively overweight Consumer Staples, REITs, and Utilities relative to the broader market, SPHD may be of use. Otherwise, I'd probably take SCHD out of these two. Remember too that SPHD is 5x the price of SCHD.

In any case, in my opinion, neither of these funds is perfectly suitable as a core holding in a well-diversified portfolio.

Conveniently, both SCHD and SPHD should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

Do you own either of these dividend funds in your portfolio? Let me know in the comments.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply