Nuclear power plants use uranium to produce electricity. Here we'll check out the 3 best uranium ETFs for 2024 to invest in nuclear energy.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Introduction – Why Uranium ETFs for Nuclear Energy?

Fundamentally speaking, nuclear power plants produce electricity by using low-enriched uranium fuel through a process called nuclear fission, which is the splitting of uranium atoms in a nuclear reactor. Uranium is the primary commodity that drives the nuclear energy industry.

Nuclear energy is reliable and relatively clean. As the world aims to move away from oil and reduce carbon emissions, nuclear power may become an attractive energy source.

A report from the World Nuclear Association in September 2021 puts nuclear energy at just 10% of the world’s electricity production, but that percentage is likely to increase in the future due to the benefits associated with nuclear power. These benefits often get overlooked because when people think of nuclear energy, they think of examples like Chernobyl and Three Mile Island.

Nuclear energy tends to be extremely reliable, as nuclear power plants operate continuously. This is particularly important during natural disasters when other power sources may be unavailable. Nuclear power is also very energy-dense, making it a cost-efficient method of generating electricity.

Nuclear power also produces no greenhouse gas emissions. As countries move toward sustainable energy sources, nuclear is looking increasingly attractive. Whereas fossil fuels release carbon dioxide and other pollutants into the atmosphere, nuclear power plants only produce small amounts of manageable, storable waste. Investing in nuclear energy can help to reduce a country's carbon footprint and meet its emissions reduction targets.

The utilization of nuclear power also allows for domestic job creation and a reduction in a country's reliance on foreign fuel sources.

Potential risks of investing in nuclear energy include the risk of accidents and the potential for nuclear weapons proliferation. Moreover, building and maintaining nuclear power plants can be expensive, which may render it economically unviable in some cases.

Nuclear energy ETFs allow investors to get exposure to companies involved in uranium mining, nuclear power facilities construction, the generation of electricity from nuclear sources, and service providers of the nuclear power industry. This is important because uranium is currently inaccessible via futures contracts.

The nuclear energy activities of publicly traded utilities typically only accounts for a tiny percentage of their revenues. Thus, the funds we're discussing have considerable direct exposure to uranium and in some cases are simply uranium funds. In other words, we can use the terms nuclear and uranium interchangeably in this context of investing.

In fact, uranium mining funds have been one of the best performing segments of the market since the beginning of Russia’s invasion of Ukraine. Russia accounted for 6% of uranium exports in 2020. 45% of all uranium mining also comes from Kazakhstan, which was formerly part of the Soviet Union and is a close ally of Russia.

Specific to the United States, the Inflation Reduction Act (IRA) of 2022 also cements the US's dedication to nuclear energy, particularly as governments seek to reduce their significant reliance on Russian oil and gas. The IRA offers significant tax credits for existing nuclear reactors, tax incentives for advanced reactors and other new clean energy efforts, and funding for the development of a domestic supply chain for high-assay low-enriched uranium, commonly referred to as HALEU.

Below we'll check out a few of the best uranium ETFs to invest in nuclear power.

The 3 Best Uranium ETFs To Invest in Nuclear Energy

The 3 uranium ETFs below differ somewhat in size, scope, and direct exposure in relation to nuclear power production.

URA – Global X Uranium ETF

URA from Global X is by far the most popular ETF in this space with nearly $1.7 billion in assets. The fund launched in late 2010.

URA offers straightforward exposure to companies involved the extraction, refining, exploration, or manufacturing of equipment for the uranium and nuclear industries. It does so via the Solactive Global Uranium & Nuclear Components Index, which is cap weighted.

URA has 47 holdings and an expense ratio of 0.69%.

URNM – Sprott Uranium Miners ETF

URNM from Sprott launched in 2019 and has since amassed about $900 million in assets, making it younger and less popular than URA.

Like URA, URNM also holds a cap weighted basked of uranium mining and production companies. Its index is the North Shore Global Uranium Mining Index.

URNM has 38 holdings that are basically a subset of those in URA. As such, we would say URNM is also less diversified than URA.

URNM also costs more at 0.85%.

NLR – VanEck Uranium+Nuclear Energy ETF

NLR from VanEck launched in 2007 and has roughly $55 million in assets.

NLR holds companies involved in the nuclear energy industry that derive at least 50% of their revenue from this segment. The fund holds more utilities with nuclear power plants and less pure uranium mining and energy plays. That is, this ETF focuses more on the operation and less on the production. In fact, NLR is about 70% utilities.

As such, NLR has been much less volatile than our other two funds here but has also severely underperformed them. We'll cover this performance in a sec.

This also shows up in NLR's country exposure with it being heavily US-centric at nearly 50%. It all but ignores the usual big players in the uranium space like Canada and Kazakhstan, to which URA and URNM are well-exposed.

NLR seeks to track the MVIS Global Uranium & Nuclear Energy Index, has 26 holdings, and happens to be the most affordable on the list with a fee of 0.60%.

Uranium ETFs Performance Compared

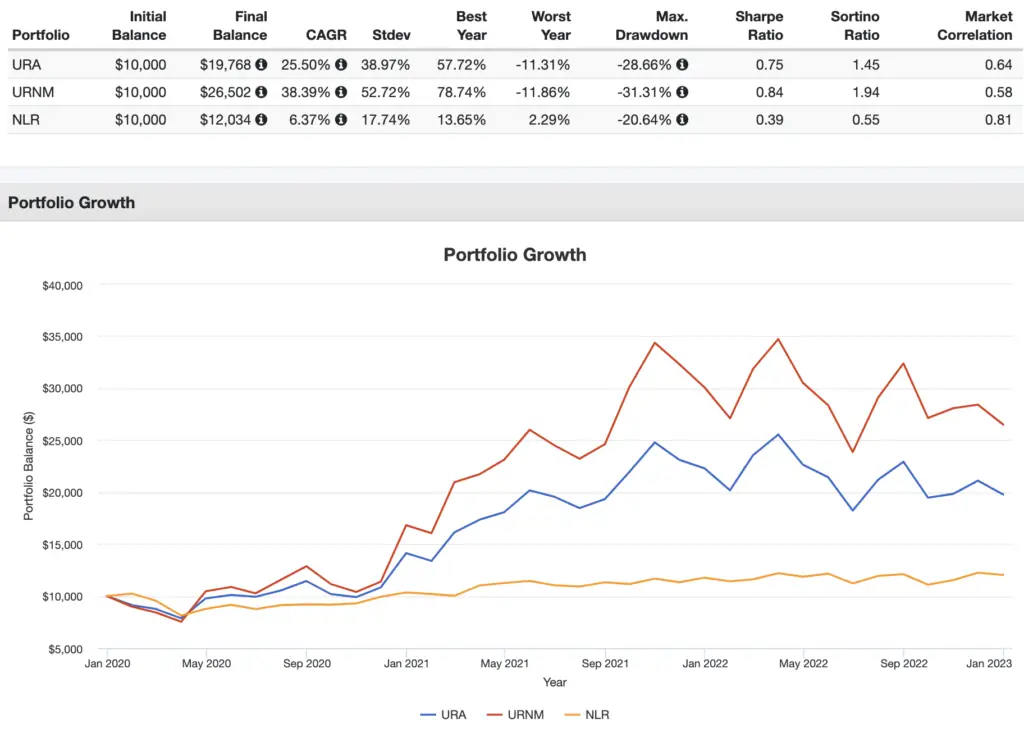

Going back to URNM's inception in 2019, it has far outperformed URA and NLR, though URA and URNM are much more volatile than NLR:

Notice their meteoric rise in 2021, which was arguably also fueled by Reddit taking notice of uranium mining stocks and adding fuel to their fire, similar to how they did with GameStop.

Which Uranium ETF Is Best?

So which uranium ETF is best? There's no simple answer.

Glancing at the backtest above, one might be tempted to simply go with the greatest historical performer which would be URNM. But keep in mind this backtest only covers a couple years, which is a very short time period. It's entirely possible that one of its competitors beat it going forward.

Also remember that URA and URNM are more pure uranium plays than the broader NLR, and the former are thus much more volatile. The low-risk investor would probably want NLR.

Considering that URNM is more expensive, less liquid, and less diversified than URA, I'd probably go with URA from Global X.

Where To Buy These Uranium and Nuclear Energy ETFs

All these uranium ETFs should be available at any major broker. My choice is M1 Finance. The broker has zero trade commissions and zero account fees, and offers fractional shares, dynamic rebalancing, and a modern, user-friendly interface and mobile app. I wrote a comprehensive review of M1 Finance here.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply