VTI is the ETF from Vanguard for the total U.S. stock market. VTSAX is its mutual fund equivalent. Which one should you choose? I compare them here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it here:

VTI vs. VTSAX – Structure, Methodology, Fees, and Tax Cost

VTI is the Vanguard Total Stock Market ETF that launched in 2001. As you might guess, this ETF captures the total investable U.S. stock market in the form of over 4,000 holdings across large, medium, and small stocks. It does so by tracking the CRSP U.S. Total Market Index, which is market cap weighted.

VTSAX is simply the mutual fund equivalent of VTI. VTSAX is called the Vanguard Total Stock Market Index Fund. VTI and VTSAX track the same index and thus provide the same exposure.

So fundamentally, we're comparing an ETF and a mutual fund. I wrote a separate post here on ETFs vs. mutual funds. The primary differences are as follows:

- ETFs allow for intraday trading whereas mutual funds trade at their true NAV once per day at the close of trading, so ETFs have greater liquidity.

- ETFs typically have lower fees. This is true in this case; VTI costs 0.03% while VTSAX costs 0.04%.

- Mutual funds typically have minimum investment requirements and transaction fees, and ETFs don't. In this context, VTSAX has a minimum initial investment requirement of $3,000. VTI has no minimum and you can even own fractional shares at some brokers. Pay attention to any potential transaction fees for buying VTSAX at your broker.

- ETFs tend to be more tax-efficient than mutual funds due to their being able to avoid capital gains distributions. Conveniently here, though, Vanguard's unique share class structure means these two funds essentially have the same tax cost.

As we'd also expect, funds have the same dividend yield of 1.63%. Both are also extremely popular with hundreds of billions of dollars in assets.

VTI vs. VTSAX – Historical Performance

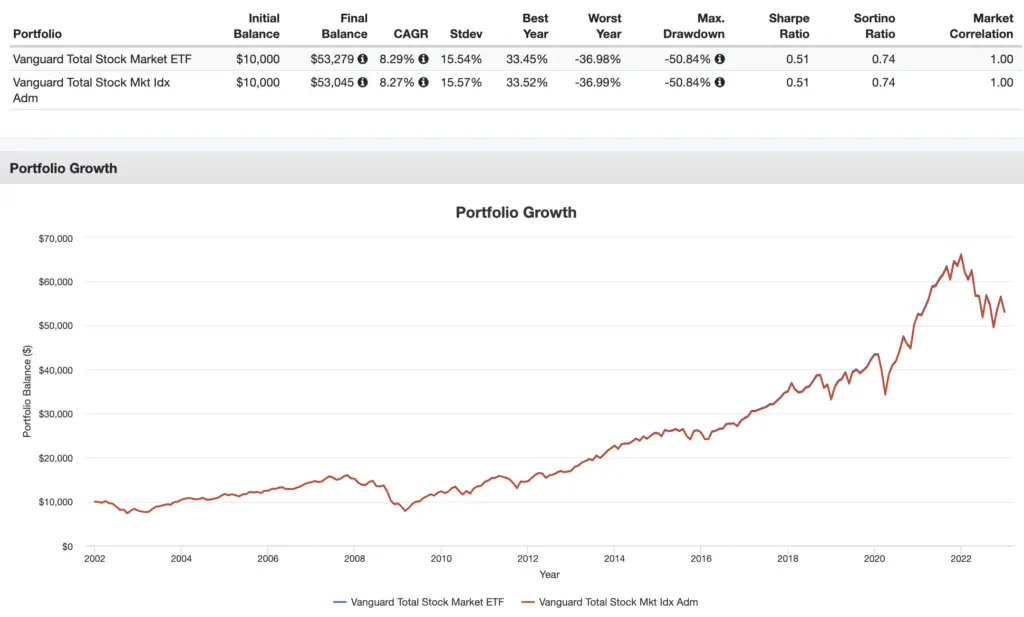

As we'd expect, performance between VTI and VTSAX has been virtually identical historically:

Conclusion on VTI vs. VTSAX

So which one should you buy?

The important takeaway is that VTI and VTSAX are virtually identical other than the required minimum investment and intraday trading ability. Both are a fine choice to invest in the U.S. stock market, as Vanguard is the go-to for reliable and highly liquid index funds with the lowest fees, and passive indexing is a great way to diversify your investment portfolio and avoid stock picking and sector bets, which tend to be fool's errands.

Perhaps the most important thing to note is if you've got a 401k plan from your employer, you'll likely see VTSAX as an option and not VTI, as employer-sponsored plans typically only offer mutual funds.

Another thing to keep in mind is that it's likely wise to diversify globally in stocks instead of solely focusing on the U.S. To do that, a popular funds from Vanguard for international stocks are the VXUS ETF and the VTIAX mutual fund, which capture all stocks outside the United States.

VTI and VTSAX should be available at any major broker that offers both ETFs and mutual funds. Remember VTSAX has a minimum initial investment requirement and may carry a transaction fee from your broker, whereas VTI has neither of these.

What do you think of VTI and VTSAX? Do you own either in your portfolio? Let me know in the comments.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply