AOM is an ETF from iShares that is part of their line of Core Allocation ETFs, which provide a well-diversified portfolio in one single fund. But is AOM a good investment? I review it here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

AOM ETF – What, How, and Why

The AOM ETF from iShares is part of their line of asset allocation ETFs called Core Allocation Funds that launched in late 2008. AOM is called the Core Moderate Allocation ETF. It has about $1.5 billion in assets.

We call these “asset allocation ETFs” because they hold a diversified basket of different assets in one single fund based on a specified asset allocation, which is quite literally the allocation to different assets, expressed as a ratio. In the case of AOM, that ratio is 40/60, meaning 40% stocks and 60% bonds, which iShares calls a “moderate” allocation. As such, AOM is likely more appropriate for retirees and investors with a low risk tolerance.

Whereas a target date fund shifts that asset allocation based on an increasingly conservative glidepath, these funds keep the allocation static over time.

ETFs are typically a single-asset product, but each fund in this line of Core Allocation ETFs from iShares uses 7 of their own vanilla index funds to construct a globally diversified mix of stocks and bonds:

IVV – iShares Core S&P 500 ETF

IDEV – iShares Core MSCI International Developed Markets ETF

IUSB – iShares Core Total USD Bond Market ETF

IEMG – iShares Core MSCI Emerging Markets ETF

IJH – iShares Core S&P Mid-Cap ETF

IAGG – iShares Core International Aggregate Bond ETF

IJR – iShares Core S&P Small-Cap ETF

The relative weights of these assets align with their global market cap weights at any given point in time.

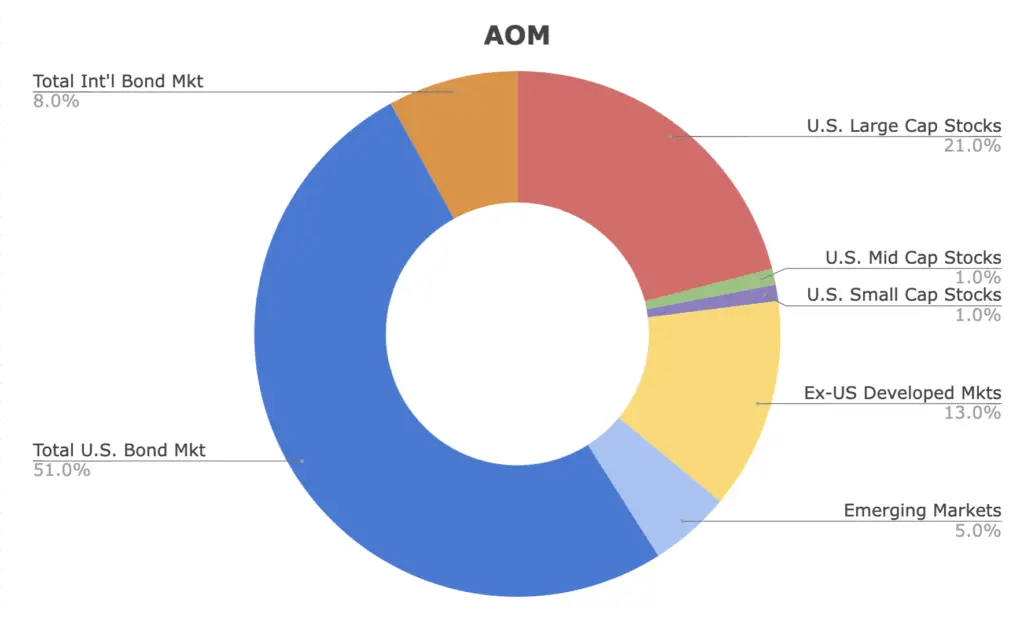

AOM's current exposure looks like this:

21% U.S. Large Cap Stocks

1% U.S. Mid Cap Stocks

1% U.S. Small Cap Stocks

13% ex-US Developed Markets

5% Emerging Markets

51% Total U.S. Bond Market

8% Total International Bond Market

Historically, exposure like this with one ticker was only available with a mutual fund. These Core Allocation Funds provide a well-diversified index portfolio in a single ETF wrapper, all at a relatively low fee of 0.15%. I discussed here that, compared to mutual funds, ETFs offer greater flexibility, accessibility, control, and tax efficiency. As far as I know, these are the only broad, low-cost asset allocation ETFs available.

This simplicity of a one-fund portfolio can be extremely valuable for the index investor who wants to be completely hands off. You don't have to worry about choosing investments and you don't even need to do any rebalancing because the fund does it for you.

These products massively decrease the mental and logistical effort required in portfolio management, and more importantly, mitigate the investor's own behavioral biases like recency bias, performance chasing, and loss aversion. As a result, it is well documented that investors who hold balanced allocation funds tend to outperform investors who try to manage everything themselves

These funds even have their own proprietary indexes, each for a different target level of risk. For AOM, that's the S&P Target Risk Moderate Index. The index is rebalanced semiannually in April and October.

AOM ETF Performance

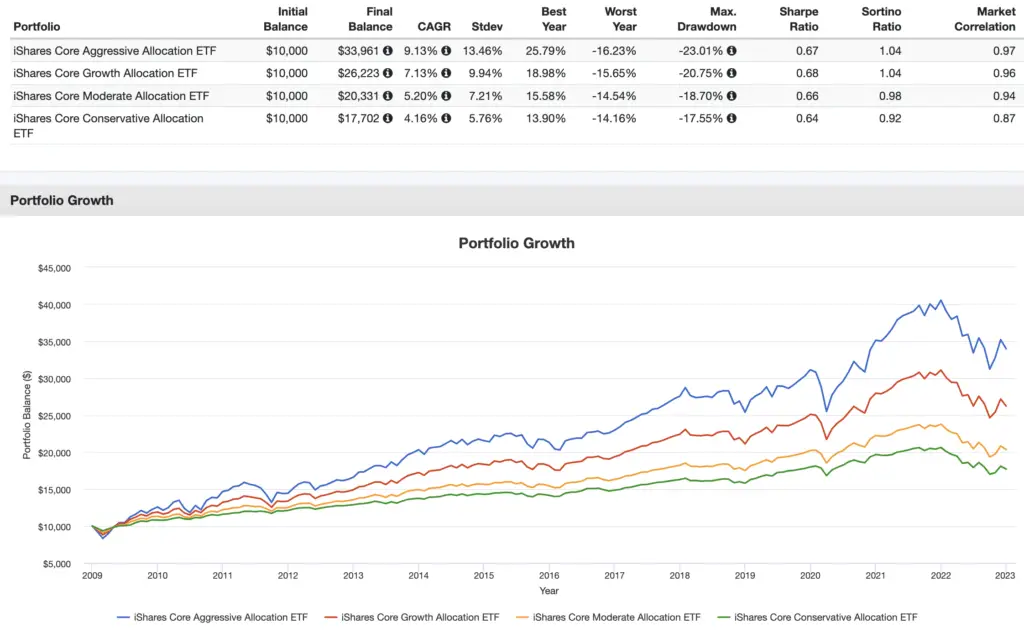

Going back to their inception in 2008, here is a performance backtest of AOM compared to its sister funds through 2022:

Is AOM a Good Investment?

So is AOM a good investment? Maybe.

As usual, that depends on your personal goal(s), time horizon, and risk tolerance, and specifically whether or not those things align with an 80/20 portfolio of global stocks and bonds. And just because it has outperformed its peers thus far does not mean it will do so in the future.

In general, as mentioned earlier, AOM and rest of the iShares Core Allocation Funds provide a great single-fund solution for the hands-off global index investor at a relatively low fee. For those reasons, they even get the stamp of approval from staunch Bogleheads even though they aren't Vanguard products.

These ETFs are also portable across brokers if you decide to switch, whereas a target date mutual fund might not be. They don't offer any magical tax efficiency different from their constituent components, but of course we would consider them to be more tax-efficient than a mutual fund, making them potentially attractive for taxable space.

AOM could of course be used as one's entire portfolio, or could be used as a core of stocks and bonds alongside other assets like gold.

Conveniently, AOM should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

Disclosure: None.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

John, what are your thoughts on using this ETF in a taxable account? Thanks!

Not the most tax efficient but not bad at all, aside from bonds obviously being comparatively less tax efficient than stocks. US investors would also get pass-through foreign tax credits on the international holdings.