Humans are inherently susceptible to irrational preferences called biases. Since investors are human, there are a number of investing biases to be aware of and try to avoid.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it below. If not, keep scrolling to keep reading.

Introduction – What Are Investing Biases?

Classical economics assumes humans make perfectly rational choices. Psychologists in the 1960's started a field of study now known as behavioral economics after observing that people are very susceptible to irrational decision making based on emotions.

Investing biases are these irrational preferences that affect investing decisions and subsequent outcomes. They are errors in logical thinking. Not all investing biases are necessarily negative, but those are usually the ones we want to focus on. Biases distort our ability to make rational financial decisions based on objective facts and evidence.

Psychologists have identified many different types of biases. These can be cognitive (making decisions based on rules of thumb) or emotional (usually reactionary based on one's feelings and personal experience). The former are universal and are easier to identify and correct via adapting behavior and modifying processes. The latter can be highly personal and are more challenging to address, as emotional biases are typically deeply rooted in one's feelings and beliefs.

The degree to which one succumbs to biases can also depend on one's personality. Understanding these things is critical to preserving investment returns and achieving one's financial objectives.

Below we'll briefly look at the biases that impact investors most, with examples and strategies to overcome them.

1. Herding

Herding is said to be perhaps the most pervasive bias investors fall victim to. It describes an investor following the trend of their peers piling into a particular stock or fund. This could be from seeing more headlines about a stock, and/or just word of mouth. We often hear herding described as “jumping on the bandwagon.”

Humans naturally want to be part of a community. Following the crowd – or at least being influenced by what the crowd is doing – is human nature. Evolutionarily speaking, conformity typically serves us well in social settings. In regards to stock picking, the investor (or trader, in this case) may be able to turn a quick profit if they can get in on the “trend” early enough to ride the wave upward. On the flip side, it may come crashing down later.

In any case, herding is irrational in that it refers to investors taking action simply because others are taking the same action. As you might imagine, this can result in bubbles and panic selling. The Dotcom bubble and subsequent crash is a perfect example of this, when stock market valuations in no way reflected the firms' fundamentals.

Herd investors typically don't have any sort of investing plan, much less an investment policy statement that would prevent them from taking such action in the first place. They typically listen to the noise and trade often based on the shiny object of the week. They also don't know how severely they underperform the market. Herding appears to be the behavioral finance explanation of the momentum factor, and may be responsible for the insane valuations we've seen in recent years for Big Tech.

As usual, one can avoid herding by ignoring the short-term noise and avoiding trading on emotion. Don't pay attention to the pundits and the sensationalized headlines. Do your own research, remain objective, and stay the course. It's easier said than done, but don't be afraid to go against the herd if the fundamentals warrant doing so. As Buffett said, be greedy when others are fearful and be fearful when others are greedy.

2. Confirmation Bias

Confirmation bias describes seeking out and giving more weight to information that supports and confirms the belief(s) you already hold. If you are long on a certain stock, you will likely pay more attention to articles with a positive sentiment about that stock.

Speaking more broadly, you will likely seek out and emphasize information that supports your particular investing strategy. Simultaneously, one will likely ignore or give less weight to information that contradicts their hypothesis. This avoidance of contrarian information is specifically known as the Semmelweis reflex. Those who succumb more to confirmation bias are more likely to engage in the herding behavior described above. Combined with herding, this means you will give less consideration to information that goes against the herd mentality.

For example, investors may find and give credence to biased research that confirms their existing opinion, they may irrationally interpret unbiased research in a way that confirms their existing opinion, or they may selectively remember only the bits and pieces from a piece of unbiased research that confirm their existing opinion. This may cause investors to get stuck in their own echo chamber of thoughts and strategy and irrationally disregard diversification or new ideas that don't fit their narrow scope.

Confirmation bias is a cognitive bias, meaning it arises from faulty reasoning. Specifically, we call it a belief perseverance error in that the person is irrationally or illogically holding on to their beliefs.

Avoid confirmation bias by giving all information fair consideration and try not to go in with a preconceived conclusion. It can also be a good practice to purposefully seek out contrary viewpoints to attempt to challenge and disprove your own.

3. Overconfidence Effect

One of the most common biases in behavioral finance is overconfidence. This one is pretty self-explanatory and is severely damaging to portfolios. Investors tend to overestimate their own abilities. This can result in engaging in stock picking that underperforms the market for far longer than they should, taking on unnecessary risk, underestimating legitimate risks, erroneously thinking that one can consistently time the market, and illusively believing you can predict or control an inherently random situation or outcome.

Over 70% of Americans believe they are above average, despite that being statistically impossible. Confidence is useful evolutionarily and socially because it gives us courage to act and pursue goals, but unfortunately that usually works against us in investing, as short-term market movements are essentially random and unpredictable. Because of that fact, greater intelligence or skill gives you no advantage.

Men seem to be more susceptible to overconfidence bias than women because they feel a greater need to take action and solve problems, which explains why women tend to earn higher investment returns than men, as women trade less and take on less unsystematic risk. In the context of investing, taking action typically just makes things worse. Warren Buffett famously said once that “inactivity strikes us as intelligent behavior.” Jack Bogle admonished investors to “stand there and do nothing.”

Larry Swedroe maintains that overconfidence is the biggest risk facing most investors. Most fund managers, for example, think they are able to consistently beat the market, when in reality, very few do. Even in the face of that fact, most fund managers consciously believe they are part of that small percentage that is able to do so. Ray Dalio, founder of Bridgewater, the world's largest hedge fund, has explicitly stated that he takes an “all weather” approach precisely because he recognizes how damaging overconfidence in one's bets can be.

In a sense, overconfidence can be the result of other biases, such as confirmation bias. The information you seek out and give credence to may and likely will cause you to be overconfident in whatever your hypothesis is. Overconfidence can also increase trading costs in that the investor will likely be jumping around to different investments they feel confident about.

Be rational and see what the data has to say about the probabilities of your proposed strategy or action, and consider the consequences of being completely wrong. Seriously, ask yourself “what if I'm wrong?” and assess how bad the outcome of that bet can possibly be. Read viewpoints contrary to your own. Walk through past investing decisions objectively and assess how they worked out. Remember that all crystal balls are cloudy, and realize that you are probably not as skilled as you think you are in choosing the correct investments. Index funds are probably the way to go for investors who are able to recognize that they succumb to overconfidence bias.

4. Loss Aversion

Loss aversion, as the name suggests, describes the fact that humans tend to be more sensitive to losses than to gains. That is, we tend to feel the pain of losses much more than the joy of gains. Consequently, we tend to do more to avoid losses than to acquire gains. As you might suspect, loss aversion is very much an emotional bias.

Psychologists Kahneman and Tversky found in a 1979 study that a loss has about 2.5 times the emotional impact of a gain of the same magnitude. That is, on average, humans are willing to participate in a 50/50 bet with a potential loss of $10 only if the potential gain is at least $25.

Loss aversion can cause investors to take on less risk than they ideally should to achieve a particular financial objective. Ironically, it can simultaneously cause the investor to make riskier moves for the sole purpose of mitigating expected pain. It can also cause investors to delay or altogether avoid selling losing investments because then the loss becomes “real.”

For example, a young investor with a high tolerance for risk and a long time horizon should likely be invested in 100% stocks for a while. If instead they construct something like the Permanent Portfolio with heavy allocations to diversifiers with lower expected returns like gold and short term bonds, they have an opportunity cost by taking up valuable space in the portfolio, likely dragging down their long term total return.

Note that this tradeoff may be perfectly desirable for risk-averse investors who have a weak stomach, but it will likely make it take longer to reach their financial goal. Even a difference of half a percent in annualized return makes a huge difference over 30+ years. Learn to manage risk, not avoid it.

The principle of loss aversion may also cause investors to put more weight on bad news and less weight on good news, which may contribute to herding and panic selling. Declining markets tend to be more volatile than rising markets.

Similarly and arguably more importantly, many investors spend way too much time thinking about and preparing for crashes and “corrections” that may not arrive for years. This could be in the form of sitting on cash to try to time the market, dollar cost averaging, increasing bonds and lowering stocks, etc.

This is closely related to the famous Gambler's Fallacy, the irrational idea that past outcomes of independent events affect the probability of future outcomes – that if you've landed on black 5 times in a row, you're now “overdue” for a red. Traders may believe that the market is going to drop simply because it has been going up. The opposite could just as easily happen, which is momentum. Traders betting on seeing the same outcome are falling victim to the hot hand fallacy, a term from basketball describing the belief that the same outcome will continue to occur. Price movement is typically random.

Similarly, many investors refuse to sell losing investments because they believe they can wait for them to “get back to even,” even though that outcome may not even be likely, much less guaranteed. Sometimes, inaction can be just as harmful as action.

Again, pick an asset allocation that fits your risk tolerance and time horizon, stay the course, rebalance regularly on a calendar, and ignore the short-term noise. One of my famous investing quotes comes from legendary investor Peter Lynch:

Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.

5. Endowment Effect

The endowment effect is closely related to loss aversion and is another emotional bias. It refers to the fact that investors tend to irrationally value things they own more than their market value. That is, they value the same investment more if they own it than if they didn't own it. Loss aversion can contribute to the endowment effect.

The endowment effect causes investors to irrationally hold on to losing or suboptimal investments longer than they should. An example would be an investor who inherits and holds on to shares of stock from a relative, which may have a sentimental value, when there's no rational reason to not sell the stock. If the stock is declining, the investor may irrationally believe it is due for a rebound, when in reality the investor should treat it as a sunk cost and cut their losses.

Another common example is to accumulate, become emotionally attached to, and refuse to sell stock of one's own employer, causing the investor to be dangerously overexposed to the economic risks of one single company. Ask former Enron employees how that worked out for them…

6. Status Quo Bias

Status quo bias is another emotional bias. Humans are resistant to change. We generally like things to stay the same. In investing, this means investors may be resistant to new ideas, new research, etc., particularly when it conflicts with our existing beliefs.

An investor who has only ever invested in stocks may be resistant to bonds when entering retirement, when we know they should probably diversify their assets more at that point to reduce portfolio volatility and risk. On the other side, a conservative investor who prefers fixed income investments may be averse to stocks, when in reality they may require the higher expected returns of stocks in order to meet their financial objective. These are the cases we typically see, where investors either take too much or too little risk by having allocations that are do not match their true risk profile and investing objectives.

The decision process itself can seem daunting, so humans prefer indecision. When presented with options, we tend to favor the one that most closely maintains the status quo. We tend to view change as a cost, even when it's not. When change does cost something, we tend to exaggerate that cost, even if we realize that particular change is the rational thing to do. Status quo bias can work together with loss aversion and the endowment effect to cause investors to hold on to losing investments. Status quo bias may also cause investors to avoid changing brokerages or fund providers even when it is objectively optimal to do so.

On a broader scale, investors may believe the bull market they're in will continue forever, or that interest rates will stay the same, or that Growth stocks will continue to beat Value stocks. All of these are examples of fallacious thinking as a result of status quo bias.

Investors with status quo bias tend to distort facts and interpret them as favoring inaction. While emotions typically cause people to trade more and change strategies, in these cases it is emotions that are causing the fear of change. Objectively interpreting facts is crucial to avoiding this bias.

7. Familiarity Bias and Home Country Bias

In the context of investing, familiarity bias describes a tendency to invest in things we're familiar with and avoid uncertainty. As you can imagine, this works directly against the idea of diversification and can pose a concentration risk. Here are some examples:

- An investor may irrationally choose to only invest in companies whose products they use on a daily basis, which would likely have them missing out on exposure to some sectors altogether.

- An investor may only prefer mega cap stocks that are household names and altogether disregard small cap stocks, even though we would expect the latter to outperform the former.

- More broadly, investors tend to have home country bias, overweighting or solely investing in companies in their home country, while the research illustrates a range of benefits from global diversification in equities.

Familiarity bias works together with status quo bias in that the investor wants to keep doing what is familiar, thereby avoiding change. Don't be hesitant to step outside your comfort zone with your investments.

8. Survivorship Bias

Survivorship bias describes the tendency for humans to only pay attention to the outcomes that “survived.” In investing, this means we remember the stocks and funds that “survive” and thrive but forget the ones that go under or are otherwise excluded from the data.

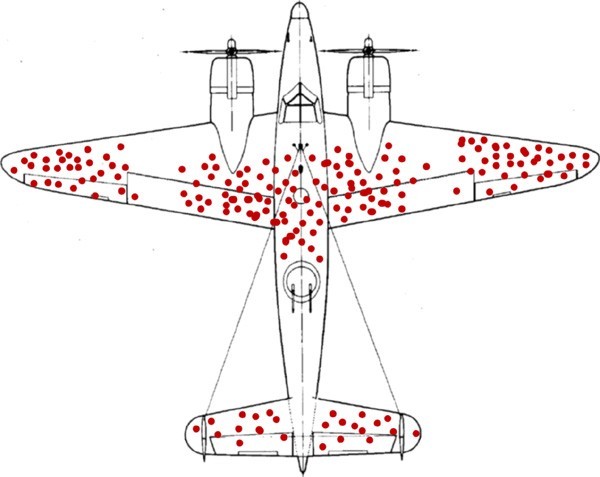

Perhaps the best example of survivorship bias is outside the world of finance, but the illustration is worth it. In World War II, the British were losing planes that were being shot down over Germany. They wanted to add armor to specific areas of the planes to make them more resilient, so they looked at the planes that returned to see where they were being shot the most. Overlaying the diagrams produced this result:

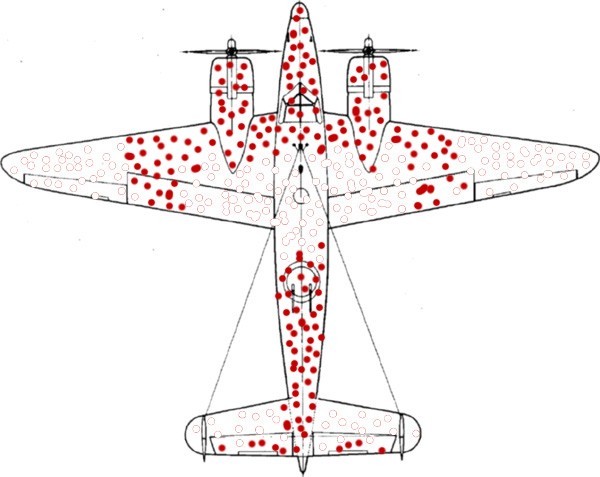

Thankfully, before adding extra armor to those sections of the plane, they got a second opinion from a Hungarian mathematician named Abraham Wald, who immediately pointed out that these were only the planes that survived, and that they were forgetting about all the planes that were shot down. He proposed reinforcing precisely the opposite areas of the plane, as planes were crashing because they were being shot in these areas:

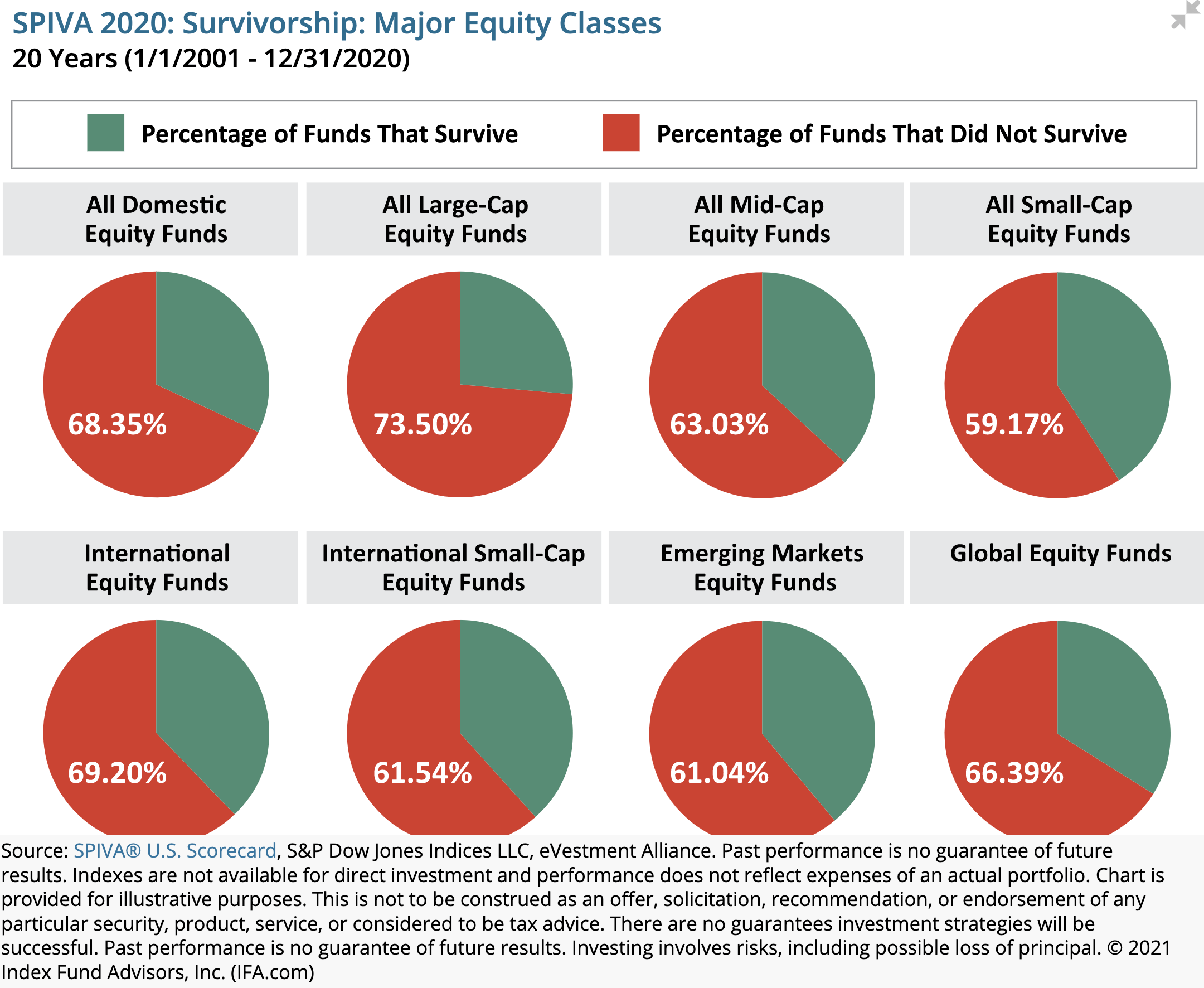

I harp on survivorship bias all the time. Novice investors point to Lynch and Buffett as evidence that markets aren't efficient and can be beaten. They forget the 98 other managers who underperformed the market and didn't make the headlines, or worse yet, closed up shop because of their poor performance:

The tiny percentage of active investors who beat the market are the exception that proves the rule. As an aside, we also now know that the alpha generated by active managers who beat the market almost always come from their excess exposure to independent sources of risk that tend to pay a premium, not from their supposed “skill.”

Speaking of manager performance, studies investigating it usually overstate it because of their inherent survivorship bias by excluding funds that didn't survive. Dimensional found that “for actively managed US equity mutual funds over the period from 1991 to 2020, survivorship bias overstates the median fund alpha by 0.60% per year: The median fund alpha is –0.84% per year among surviving funds compared to –1.44% per year among both surviving and non-surviving funds.”

In regards to retail investors, survivorship bias simply means we are typically looking at an incomplete dataset. Stock pickers, for example, may not realize that on the 50th birthday of the S&P 500, only 86 of the original 500 companies remained. In evaluating an investment, prospective investors may only look at its best years. We only see the high flying stocks, funds, and managers that make the headlines, usually after a very short, unrepresentative run of extreme success.

9. Recency Bias

Recency bias is another one that rears its ugly head often. It describes the tendency to pay attention to and give more weight to outcomes that occurred in the recent past, when in many cases they shouldn't be considered any more important than those that happened in the distant past. This usually happens naturally because we tend to remember what happened most recently. In doing so, investors that succumb to recency bias tend to believe that recent trends will continue.

People who began investing anytime from about 2010 to 2020 have had a great run without a major crash aside from a couple minor corrections. This is particularly true for the stellar returns from large cap growth stocks like Big Tech (FAANG). These novice investors aren't accustomed to the fact that they will likely see several crashes in their long term investing horizon, and that equity styles and cap sizes show up at different times. On average, major stock market crashes occur every 9 years.

On the individual stock level, a stock that did well the previous year will not necessarily do well this year. This applies to sectors as well; past returns do not indicate future returns. For another example of recency bias, researchers found that the Global Financial Crisis of 2008 fueled increased trading, and that trading resulted in worse performance outcomes for those traders.

These investors who have seen crashes and bear markets sold their investments in a panic because they believed the market would continue dropping, completely missing out on the rebound due to this irrational fear. On the flip side, investors in a raging bull market may succumb to overconfidence believing that the trend will continue and take on more risk than is appropriate for them.

At the time of writing, investors have flocked to large cap growth stocks recently due to their decade of outperforming Value stocks from 2010 to 2020, evidenced by huge inflows into tech-focused funds like VGT and QQQ (and the 3x TQQQ). We call this performance chasing – buying what has done well recently with the expectation that it will continue to do so. It's a perfect example of recency bias. While a decade may not sound “recent” and is a longer cycle than we usually see, it's still a drop in the bucket in the history of the stock market, and is likely only about 15% of one's total investing horizon. Falling victim to recency bias is usually a great way to buy high and sell low.

Value has greater expected returns than Growth, Value has beaten Growth historically, and the valuation spread between Value and Growth is now as large as it's ever been (Dotcom bubble levels), meaning Growth is looking extremely expensive and now has lower future expected returns, and Value is looking extremely cheap and is [hopefully] due for a comeback. Value has been putting up impressive numbers and has beaten growth in the first half of 2021; my fingers are crossed that it continues, as I tilt Value.

Regardless of whether or not you believe the Value premium is dead, the point is that recent trends may not – and likely will not – continue into the future, and one should consider a complete dataset in making investing choices instead of weighing the recent past more heavily. Also keep in mind that if your investing horizon is 30+ years, what happens in the next year or two should be of little concern. Again, take a broader view, own the total market, focus on the long term, and ignore the short term fluctuations and trends.

10. Tracking Error Regret

Tracking error regret refers to the regret that investors may feel if their particular strategy underperforms a benchmark over some time period. This regret can be dangerous because it can lead to financially harmful things like market timing, emotional trading, or switching to a different investing strategy altogether at precisely the wrong time.

For example, a U.S. investor who is globally diversified may feel dissonance over the fact that international stocks have outperformed the U.S. in only 2 of the 10 years between 2010 and 2020, though there are plenty of rational reasons to diversify internationally in stocks. The decade prior was basically the opposite; a U.S. investor would have regretted not being globally diversified. Notice how this is closely tied to recency bias.

Since stocks have the greatest expected returns of all investable securities, tracking error regret has the potential to be more prevalent in bull markets as one diversifies into other assets with lower expected returns over the long term (bonds, gold, etc.) when compared to a popular benchmark that is 100% stocks. Remember that your asset allocation should match your personal time horizon, risk tolerance, and financial objectives. What is right for you may not be – and probably isn't – right for someone else. For example, a retiree with a low tolerance for risk who is invested in a 30/70 portfolio of stocks/bonds should not be comparing their portfolio's performance to the S&P 500. Sadly, investors derive too much satisfaction (or dismay) from an apples-to-oranges comparison of their portfolio's performance to that of a popular benchmark.

Perhaps no one is more familiar with tracking error regret than small cap value investors after the decade ending in 2020, over which time small stocks underperformed large stocks and Value stocks underperformed Growth stocks. Any well-versed factor investor knows we should expect negative premiums from time to time, even for extended periods, but sticking with a small value tilt has required a high level of conviction and a true belief in the Size and Value factor premia to not abandon ship over a 10-year period.

I always think of Larry Swedroe when discussing tracking error regret; his entire equities position is in small cap value stocks. Remember that your strategy's recent performance does not at all change the fundamental reasons you went with that strategy in the first place. For example, Swedroe himself reminds us that Value's recent underperformance does not change the fact that we should still expect it to beat Growth on average. Investors who abandon their strategy due to tracking error regret typically do so at precisely the worst time, as their underperforming investments have greater expected future returns at that point.

Take your time, do your research, be patient with and have conviction in your strategy (hopefully it's broad index funds!), and stay the course.

11. Anchoring Bias

Anchoring bias refers to relying too heavily on an arbitrary reference point or single piece of information when making an investing decision. This “anchor” becomes irrationally significant in the investor's mind, usually as somewhat of a starting point for a decision. Anchoring bias is a cognitive bias that we would classify as an information processing error, meaning information is used illogically or irrationally to inform decisions.

Perhaps the best example of a commonly used anchor in investing is simply the share price of a stock. If a stock is trading at $100 per share, for example, you might decide that number sounds expensive so you're not buying until it drops by 10% to $90, even though there's no logical reason to expect the stock to ever drop to that price. Instead, the share price rises by 10% to $110 per share and you missed out on those gains thanks to anchoring bias. Suppose you then bought in at $110. This would likely be a new psychological anchor. If the stock then dropped back down to $100, anchoring bias would make you irrationally feel like the stock is due to revert back up to $110, while this may never happen.

Anchoring bias also works in tandem with loss aversion and the endowment effect to further explain why investors hold on to losing investments. They may be anchored to the price at which they originally acquired the investment rather than objectively seeing the investment's fundamental value. An investor's feelings about their anchors may be completely detached from rational asset pricing, causing them to buy high and sell low, as stocks do not necessarily revert to their mean.

Similarly, investors may apply an arbitrary valuation metric to multiple stocks, when in reality each stock has a different earnings potential and different fundamentals. Attempt to identify any anchors you might have and always try to view the situation objectively and quantitatively.

12. Mental Accounting Bias

Mental accounting refers to applying different subjective values to the same amount of money. Humans tend to organize and classify finances in different groups based on their origin or intended purpose. Like anchoring bias, mental accounting bias is another information processing error.

For example, people tend to place a higher value on money they earn and a lower value on money won or gifted to them (“extra” or “found money”), sometimes spending the latter frivolously, when in reality, money is fungible and these different types should be treated exactly the same. Some people spend their tax refund like it's a gift, for example. Sadly, corporations take advantage of this tendency by advertising ways for you to spend that refund around tax time each year.

The house money effect is the term that specifically describes a particular case of mental accounting wherein investors take on greater risk when reinvesting profits from existing investments than they otherwise would from their savings, viewing their “winnings” as extra money. Similarly, we like to attach mental labels to money, such as “vacation” or “saving for college.” We then view their values differently, which is irrational. For example, it is illogical to both maintain a savings account and simultaneously have high-interest credit card debt. Logically speaking, the former should be used to pay off the latter.

Combined with loss aversion, investors needing capital tend to prefer to sell a winner over a loser, when they should ideally harvest the losses of the loser for a tax break. They do this because they view the absolute value the loss as being greater than the gain, feeling that they need to wait for the loser to rebound.

I see mental accounting bias often when talking to dividend investors. The irrational preference for dividend stocks for the sake of the dividend per se is a mental accounting fallacy. Dividend investors, even if they realize dividends aren't free money, tend to view the dividend payment as separate “income.” We know that the share price compensates for the dividend payment and that selling shares of an equivalent value is the same and should actually be mathematically preferable over the long term. I delved into this concept in detail in a separate post here. I suspect mental accounting is also responsible for dividend investors' fascination with the covered call income fund QYLD.

For another example specific to investing, I see mental accounting all the time with investors creating multiple portfolios – a “safe” one and a “risky” one for growth – and viewing them separately. This doesn't make much sense. Money is fungible, meaning it's all the same. Treat it the same across your various accounts, view your portfolio holistically, and make plans ahead of time for unexpected income so that you don't treat it as “extra” money.

13. Hindsight Bias

Hindsight bias is a cognitive bias that describes the tendency of people to convince themselves that they correctly predicted a past event, or that their prediction was more accurate than it really was. This causes investors to think they can accurately predict future events (overconfidence!).

As you can imagine, this bias comes into play with market crashes and stock rallies. Investors anticipating a crash that they think is imminent will almost always look back in hindsight and think that they accurately predicted when the crash happened, when in reality the exact time of a crash is largely unpredictable. This is especially true if the investor experiences losses and subsequent regret from the crash. Just because one fears a crash doesn't mean they know when it will happen. Expecting a crash doesn't really do anything for us as investors. These statements come to mind:

- “I called it!”

- “I knew it all along!”

- “I said this would happen.”

Following crashes, you'll always hear pundits saying things like this and pointing to indicators that they didn't mention before the crash. On the flip side, they will cite indicators of rallies in hindsight as well, such as strong earnings, low interest rates, low unemployment, lower taxes, etc.

The same can be said for missing out on individual stocks that turned out to be 10- or 20-baggers like Apple or Amazon. It's easy to look back in hindsight and say they saw it all along and that they should have invested more in these winners. The reality is that it is nearly impossible to identify the next Amazon before it becomes Amazon. I like to remind people that there's no way to know the perfect portfolio or investment ahead of time, and that optimal portfolios can only be known in hindsight.

Hindsight bias may hinder out ability to learn from our mistakes, as we likely won't view them as mistakes, or we may view those mistakes as less significant than they really were. This leads to overconfidence in one's abilities. Oftentimes, the information we have available to us now in hindsight was not available at the time of the decision. Consider keeping an investing journal of thoughts and actions so that you can look back and objectively evaluate those decisions and subsequent outcomes, and learn to admit that you were wrong in the past.

14. Narrative Bias

Narrative bias describes the tendency to irrationally give greater weight to a story versus objective facts.

Humans love a good story because we're emotional creatures. Unfortunately this usually clouds our judgment and impairs our ability to make rational choices. High flying stocks you see in the headlines may have a great story, but their fundamentals may not – and perhaps never did – reflect their success, in which case buying that stock at any point would have been demonstrably irrational.

The emotional components of stories are easier for us to remember than the logical facts. This can cause investors to overvalue or undervalue investments based on irrelevant criteria. Investors may abandon logic to instead pursue the story. Narrative bias actually may partially explain the undervaluation of Value stocks, as they usually have boring stories, as opposed to Growth stocks like innovative tech companies, which are often overvalued. Historically, stock brokers who were paid on trade commissions used narrative bias to sell stocks to clients.

Our brains even like to create stories where none exist, connecting events by establishing causal relationships that aren't actually there. A common one I hear a lot is that one should buy Apple stock solely because everyone has an iPhone. This completely disregards the company's earnings, valuation, competitive landscape, etc.

Realize that stories are just that. Look for the objective facts and data.

15. Irrational Escalation of Commitment and Sunk Cost Fallacy

Irrational escalation describes the behavior of irrationally continuing a behavior in the face of negative consequences, even after being presented with new information.

This specifically explains the act of the example we've used several times so far of the investor holding on to losing positions for longer than they should because they don't want to actualize the loss (avoiding cognitive dissonance) or because they hope the investment will rebound. This can happen even if the investor is exposed to information contrary to their original decision.

Basically, loss aversion, the endowment effect, and status quo bias drive this irrational escalation of commitment to the losing investment. Investors may even double down and buy more, colloquially described as “throwing good money after bad.” This is called the sunk cost fallacy, where people make irrational decisions to attempt to justify earlier decisions, instead of accepting that the bad decision is now a sunk cost that is likely unrecoverable.

Don't stay emotionally attached to bad outcomes and dig yourself further in the hole. Assess the situation rationally, cut your losses, and move on.

16. Optimism Bias

Optimism is useful in our everyday lives in terms of happiness and having healthy relationships, but it can lead us astray in investing. Victims of optimism bias are said to be “wearing rose-tinted glasses.”

On average, investors tend to be overly optimistic about financial markets in that they overestimate the probabilities of favorable events and underestimate the probabilities of detrimental events. They may even erroneously believe that bad outcomes simply can't happen to them. These investors will irrationally take on more risk than they should and may throw all precaution to the wind.

A rational investor should always remain skeptical and approach financial markets objectively. Optimism bias inhibits this process. One must remove the rose-tinted glasses. Evidence suggests that optimists may even simply ignore information to the contrary of their optimistic viewpoint. Optimists may ignore the very real likelihood of seeing several market crashes during their investing horizon. They will also usually believe they are beating the market even when this is demonstrably false.

As you can see, optimism bias can lead to reckless behavior, unnecessary assumption of risk, and irrational conclusions that are not based in reality. It is closely related to overconfidence bias in that optimism bias can fuel overconfidence and the illusion of control. One's degree of optimism bias can be heavily influenced by their environment and previous life decisions. It is imperative that investors know the range of possible outcomes with realistic probabilities and forecasting. Advisors can and should help in this process.

17. Outcome Bias

Outcome bias describes the tendency to irrationally evaluate a decision based on its subsequent outcome rather than on its merits at the time the decision was made. Doing so overemphasizes the outcome and perhaps forgets the events leading up to the outcome.

Investors may fall victim to anecdotal evidence from friends as a reason to buy a certain investment after only looking at the successful outcomes of others and ignoring the actual fundamental merits of the investment. Similarly, an investor may look at the lucky success of their own investments as a reason to make those same trades again, even if the fundamentals don't warrant doing so.

As you can imagine, outcome bias can lead to the irrational assumption of unnecessary risk that may not match the investor's risk profile and goals. In reality, good decisions can result in bad outcomes (“bad break”), and bad decisions can result in good outcomes (“dumb luck”). The evaluation of those decisions should depend on the information at hand and the expected probabilities of the possible outcomes, not on the eventual outcomes per se.

It is human nature to succumb to outcome bias. It is far simpler to observe and assess the outcome than to analyze the quality of the original decision that resulted in the outcome. Consider an example of two fund managers picking a basket of stocks and comparing the performance after 12 months between the two baskets. It is likely a toss up for which fund manager wins over such a short time period, over which the movement of these stocks was likely unpredictable, even in aggregate. We cannot reliably conclude that the fund manager with the greater performance after 1 year is the better manager.

Similarly, we can look at a Growth investor and a Value investor for the period 2010 to 2020. The Growth investor outperformed, but that does not necessarily make him the better investor. Perhaps the investing horizon is to last for another 20 years until 2040. Based on all available information at the time of the original decision, I would argue the Value investor is still the “better” investor, as we expect Value to beat Growth over the long term due to the Value factor premium. We expect periods of factor underperformance, and these two equity styles tend to trade off being on top, so concluding in 2020 that Growth was the “right” choice is shortsighted and involves outcome bias and recency bias. The occurrence of the unexpected outcome does not make the rational expectation of the expected outcome any less valid.

Unfortunately but understandably, short-term outcomes have become a heuristic for retail investors to evaluate fund managers, as they can easily see their performance and are probably not going to dig too deep into their fundamental investing thesis and strategy. Try not to anchor yourself to the outcome and instead look at the fundamentals.

18. Law of Small Numbers

Drawing conclusions from a dataset requires a sufficiently large sample of observations. The law of small numbers is the term used to describe the mistake of drawing erroneous conclusions from a small sample size.

A fair coin has a 50% probability of landing heads and a 50% probability of landing tails. If you flip the coin 4 times and observe 4 heads, you might believe the coin is rigged. This is the law of small numbers. The probability of heads should eventually converge to 50%, but this may require 1,000 coin flips. You need a larger sample size to see the expected outcome.

This shows up in investing when investors wrongly arrive at conclusions based on a small number of observations, sometimes a single one. This can often be in terms of lengths of time. For example, an investor starting out may put $1,000 into the stock market and experience a crash the following week, which causes the investor to conclude that stocks as a whole are too risky and that they should invest solely in short-term treasury bonds for the next 30 years instead.

Granted, this decision may very well match the investor's risk tolerance if they are extremely risk-averse, but they are only seeing a sample size of a terribly short time period of 7 days, when we have historically seen that market crashes have occurred about every 9 years on average when looking at the entire history of the stock market. This investor just had terrible luck and experienced a low-probability event.

Other examples of the law of small numbers include:

- Evaluating one's trading algorithm on an insufficient number of trades.

- Concluding the superiority of a particular market segment after only a year of its outperformance.

- Evaluating manager success after a short time period of only a few years.

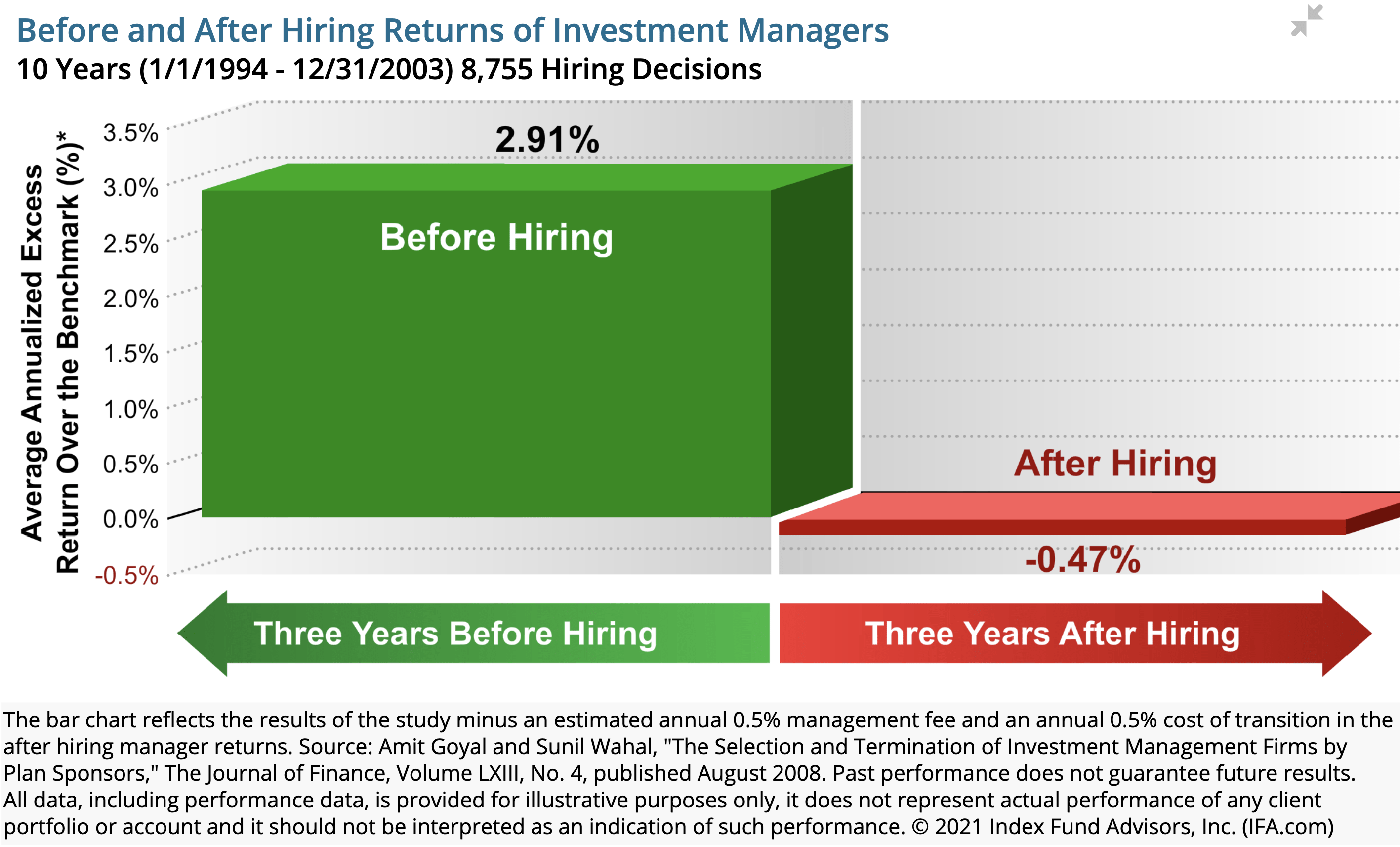

Regarding that last one, managers actually tend to underperform after being hired due to their recent success:

Meaningful conclusions cannot be drawn from small sample sizes and short time periods. Always try to get the most observations possible and look at the longest possible time period.

19. Self-Attribution Bias

Self-attribution bias or self-serving bias describe how humans tend to attribute past successes to their own skill and attribute past failures to external factors.

Self-attribution bias is very closely related to overconfidence and hindsight bias. We may tend to focus on successful stock picks and either ignore the losers or conclude that the losers had some external influence that caused their loss. Investors who succumb to self-attribution bias may be unable or unwilling to take accountability for their bad decisions and mistakes. They also typically disregard the role of luck in their investing outcomes, which is related to outcome bias in that their original decisions that led to may not have been rational.

For example, an investor may claim their successful years were due to their skill in choosing particular investments but then blame their failing years on unavoidable market forces. In reality, the successes could have been dumb luck, and the failures could have been due to bad decisions. The same investor may also selectively remember more of the successes and attribute them to accurate predictions, which is hindsight bias. This will likely lead to overconfidence and greater risk taking going forward.

Be objective in evaluating your own performance. Note the successes and failures and the likely reasons thereof. Again, a journal can help keep track of thoughts and actions that lead to the observed outcomes. You'll likely find that you were right far less than you thought, and that your favorable outcomes were either due to luck or market-wide forces.

20. Availability Bias

Availability bias refers to the tendency to extrapolate perceptions of trends and attributes to financial markets based on those in one's own personal life. Availability bias is a cognitive bias and is specifically an information processing error.

Outcomes you are familiar with may seem more likely than unfamiliar outcomes. That is, investors use the information that is most available to them. This poses somewhat of a concentration risk (think law of small numbers) where investors may use insufficient information to arrive at conclusions, ignoring important information that is not immediately available.

As an extreme, unrealistic example, suppose a novice investor has no access to the internet, financial literature, or professional advice. He talks to his friends who say they are invested in gold and real estate and claim to be having success. This investor may then irrationally choose to solely invest in these same assets simply because of the availability of this information from his friends. Similarly, the investor's friends may tell him how they all got burned by the recent market crash and are solely investing in T Bills for the next 30 years. This may cause the investor to do the same, which would likely mean he comes up short of his financial objective.

While these examples are obviously farfetched, they illustrate the idea of availability bias that information that is closest to the investor will likely influence their choices. This could be in the form of advertising, comments from friends and family, advice from a professional, a blog or YouTube channel they frequent, etc. Investors falling victim to availability bias may altogether ignore actual objective research on their own and may just use this information that they've absorbed to make their investing decisions. Some investors who experienced the 2008 crash were scared of the market for years after because it was highly personal. Different investors may even view the same event very differently based on their personal perspective.

As you can imagine, this incomplete picture can lead to suboptimal financial choices. A single investor's perceptions likely do not reflect those of the broader market. But at a broader scale, availability bias can lead to herding, if many investors are exposed to the same information with the same sentiment about particular investments. It is easier to be exposed to the sensationalized headlines about the high flying stocks that are syndicated around more, which is why many succumb to stock picking in the first place.

Remember recency bias too, which says investors tend to overweight recent information. As the investor's sources of information change, so too will their investment choices. Investors with availability bias often overreact to news, mitigate low-probability risks unnecessarily, and buy stocks that they hear about more often.

As usual, try to be as objective as possible and retain a broad perspective to consider all points of view, particularly those contrary to your own beliefs. Seek out a professional advisor who can assess your personal needs and risk profile.

21. Authority Bias

Authority bias describes the tendency to irrationally give more weight to the opinions of an individual regarded as an authority, regardless of the merits of those opinions. We may even abandon our own beliefs if the authority holds a contrary viewpoint.

Retail investors put way too much trust in the opinions of experts and even pseudo-experts who make headlines. Past results in financial markets do not indicate future results. I've shown you several times already how most experts can't predict market crashes, pick winning stocks, or beat the market consistently.

Michael Burry got famous from being correct on one single huge bet. Should we now regard him as an oracle? Probably not.

Ray Dalio is one of the smartest investment managers of our time, and he has said plenty of things over the years that have been patently false.

JL Collins is popular among novice index investors, and he has a great overall Boglehead-based message, but I vehemently disagree with his blanket dismissal of bonds and international stocks.

One should never simply take the recommendations and opinions of experts at face value. Always evaluate them completely and objectively as you would any other piece of information that didn't come from an expert.

22. Restraint Bias

Restraint bias refers to the tendency to overestimate the amount of self-control we have in the face of temptation.

Humans act more impulsively than we like to think we do. It's hard to quit smoking or avoid junk food. In investing, this means you may succumb to things like herding and performance chasing more easily than you think. You may be tempted to sell to “lock in” gains. You may be tempted to follow the crowd into whatever market segment has been doing well. You may be tempted to buy a stock after reading headlines that praise it. Restraint bias means we are realistically more likely to give in to those temptations than we think we are.

Set strict parameters for yourself with an Investment Policy Statement and a Withdrawal Policy Statement to help prevent impulsive actions that will likely be detrimental to your financial goals.

23. Information Bias

Information bias refers to the false belief that more information will always improve decision making.

We tend to seek out more information, believing that it will better equip us to make smarter choices. Investors will typically consume extra useless information that doesn't actually aid in the decision on a particular investment. One needs to be able to separate information that is relevant and useful from information that is unhelpful and ignore the latter. This irrational behavior of seeking out more information can cause analysis paralysis, or, conversely, can cause impulsive, reactionary decisions that don't align with your long-term goals.

The finance world can definitely be a case of information overload. Daily headlines evaluate price movement. Ignore them. Pundits switch off being bullish and bearish on particular investments. Ignore all that too. Superior investing decisions are made by focusing on the long term, sticking to the fundamentals, and disregarding the short-term noise. Stay the course, as Bogle said.

Conclusion

There are plenty of investing biases that can damage portfolios and derail excellent financial plans. Notice how the solutions for nearly all of them are to check emotions at the door, make a plan and write it down, invest broadly, don't try to time the market, stay rational and objective whenever possible, stick to the fundamentals, evaluate holistically, stay open-minded, take a broader perspective, focus on the long term, and ignore the headlines.

If you feel stuck, I wrote up somewhat of a reference guide for beginners here.

Have you found yourself falling victim to any of the above investing biases? Let me know in the comments.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

This article is a big reality check. Very interesting. Love this article.

Thanks! Glad you enjoyed it!

‘Set strict parameters for yourself with an Investment Policy Statement and a Withdrawal Policy Statement to help prevent impulsive actions that will likely be detrimental to your financial goals.’

Writing about these specifically would make a good article, I’ve seen these mentioned before, but never in any detail that might help in terms of how they are created and used.

Good suggestion!

From 10:

‘For example, a U.S. investor who is globally diversified may feel dissonance over the fact that the U.S. has outperformed international stocks in only 2 of the 10 years between 2010 and 2020, though there are plenty of rational reasons to diversify internationally in stocks.

Seems like a typo here?

maybe should be written as:

‘For example, a U.S. investor who is globally diversified may feel dissonance over the fact that the U.S. has outperformed international stocks in 8 of the 10 years between 2010 and 2020, thinking they should not invest in international, though there are plenty of rational reasons to diversify internationally in stocks.

Oops. Yep. Thanks for catching. Corrected.