Portfolio rebalancing refers to adjusting the allocations of different assets to maintain a desired risk profile. Here we'll look at what rebalancing is and when, why, and how to do it.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it below. If not, keep scrolling to keep reading.

What Is Portfolio Rebalancing?

Portfolio rebalancing refers to bringing the assets in one's portfolio back to the target asset allocation, which refers to the specific ratio among assets for a desired risk profile. Specifically this means selling overweight assets and buying underweight assets.

For example, suppose you have a desired allocation of 50% stocks and 50% bonds, written as 50/50. If your stocks position grows by 10% and your bonds position falls by 10% during the year, the portfolio has now drifted to 55% stocks and 45% bonds, or 55/45. By rebalancing, you bring the portfolio back to 50/50 by selling 10% of the stocks position and buying 10% more bonds.

It's worth noting that one asset does not have to lose value for the portfolio to stray from its target allocations. The only requirement is a relative difference in returns (which will almost certainly happen in a year), and those returns can all be positive.

Why Is Rebalancing Important?

So why should we care about rebalancing the portfolio? Why not let the winners rise and the losers fall?

First, your target asset allocation has [hopefully] been set based on your personal goal(s), time horizon, and risk tolerance. If the portfolio strays from that target allocation, it no longer aligns with those things.

A misaligned portfolio is now either too aggressive or too conservative; either case is potentially problematic, especially for retirees. A disciplined investing approach is crucial for long-term success. By not rebalancing your portfolio, you are letting the markets determine its level of risk. Rebalancing is also a good time to double check your risk tolerance.

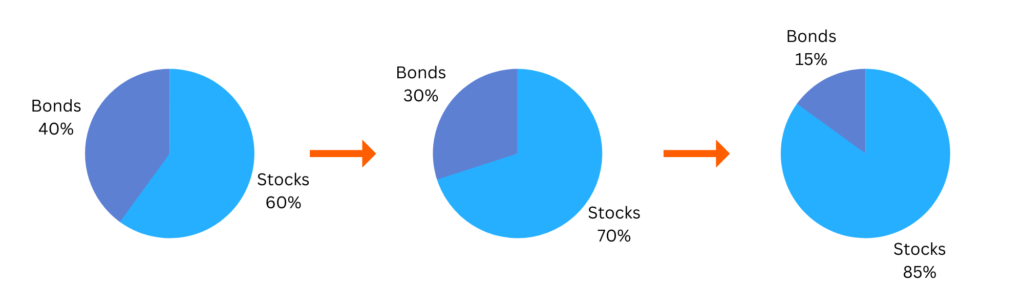

For some more concrete examples to drive this point home, a classic 60/40 portfolio in 2003 would have drifted to a more aggressive 70/30 going into the Global Financial Crisis of 2008 without being rebalanced, meaning a much rougher ride and a deeper drawdown. If left to run unchecked, that same portfolio would be at 85/15 today.

For the famous Lost Decade of 2000-2009, a 60/40 portfolio that was not rebalanced would have returned 34%, while rebalancing annually would have boosted that return to 41%. These real-world examples illustrate how rebalancing can significantly impact risk and returns.

Secondly, while it may seem counterintuitive at first glance, rebalancing is quite literally buying low and selling high, as you are selling the asset that has risen and buying the asset that has fallen. Moreover, all else equal, assets that have risen in price now have lower expected returns, and assets that have fallen in price now have greater expected returns.

In that sense, rebalancing at regular intervals forces the investor to avoid their own behavioral biases. Investors tend to want to buy more of the asset that has performed well recently, called herding or performance chasing, and buy less of the underperforming asset. This is the precise opposite of rebalancing. Past performance is not an indication of future performance.

Lastly, rebalancing maintains the portfolio's diversification over time. As allocations stray, the portfolio becomes more concentrated in one asset, which decreases diversification and increases risk. This is particularly important for risk-averse investors and those approaching or in retirement.

Hopefully now you see why rebalancing is a crucial component of portfolio management.

How Often Should I Rebalance My Portfolio?

Markets are always moving. So how often should we rebalance?

To put it simply, annually is fine, and the evidence says that anything more frequent is probably unnecessary and seems to have no objective benefit. That is, you can login to your account once a year to rebalance. Think of rebalancing like an oil change for your car. For retirees with something like a Traditional IRA which has required distributions, you could make your annual withdrawal and rebalance at the same time.

Some may choose to use thresholds or bands to trigger a rebalance for a more “as needed” approach instead of using a calendar. This is a more active choice and requires a little more effort in checking the portfolio more often.

For example, the investor may choose to rebalance only if an asset changes in value by at least 10%. With this method, assets are given a target weight and a tolerance range. This is how many actively managed funds are rebalanced to decrease transaction costs.

If you happen to use a broker that still charges transaction fees, you'd probably want to limit your rebalancing frequency to no more than once per year. Also pay attention to any fees for mutual funds like load fees.

For a more volatile strategy involving leverage, you'd probably want to do quarterly or semiannually, as those assets will be moving more quickly.

You can include your rebalancing protocol in your investment policy statement.

Rebalancing in a Taxable Account – Tax Consequences

Note that in a taxable account, you should try to avoid selling positions with capital gains, as that will be a taxable event at the time of sale. Instead, ideally simply buy enough of the underweight asset to rebalance the portfolio. A broker like M1 Finance does this automatically by directing new deposits to the underweight asset.

You can also use that opportunity in a taxable account to harvest losses by selling a losing position before the end of the year and buying a substitute fund. Tax loss harvesting can offset any capital gains or reduce one's income tax liability.

How To Rebalance Your Portfolio

So how exactly do we rebalance? Here are the steps.

- Login to your account once a year.

- View the values of your assets and calculate how much you need to buy and sell of each. If your broker doesn't show the actual percentages, you can calculate this with dollar amounts by dividing the amount of one asset by the total of all assets. For example, for a stocks position worth $300 and a bonds position worth $700, the stocks position is ($300 / ($300 + $700)) = $300 / $1,000 = 30%.

- If a tax-advantaged account like a Roth IRA, sell the overweight assets and buy the underweight assets as needed. If a taxable account, buy enough of the underweight asset to bring the portfolio back into balance.

Some brokers may have a one-click “Rebalance” button, which is extremely convenient. M1 Finance has this for example, in addition to the dynamic rebalance mentioned earlier wherein new deposits are directed to underweight assets.

Don't forget you may need to do this in multiple accounts, such as a 401k with your employer and your own Roth IRA.

If you're using a target date fund, it will do the rebalancing for you.

When and how do you rebalance your portfolio? Let me know in the comments.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply