VXUS and IXUS are two popular index funds for the total international stock market outside the U.S from Vanguard and iShares, respectively. Here we'll review their differences, similarities, performance, and why you might want one over the other.

In a hurry? Here are the highlights:

- VXUS is from Vanguard and IXUS is from iShares

- Both VXUS and IXUS capture the same segment of the global market: stocks outside the U.S.

- For all intents and purposes, these funds are basically the same except for some very subtle differences.

- VXUS seeks to track the FTSE Global All Cap ex US Index.

- IXUS seeks to track the MSCI ACWI ex USA IMI Index.

- VXUS can be considered more diversified with about 8,200 holdings, versus about 4,200 for IXUS.

- Historical performance has been nearly identical, and we would expect that.

- VXUS tilts slightly larger than IXUS with a weighted average market cap about $500 million higher.

- IXUS tends to pay more qualified dividends and thus appears to be slightly more tax efficient.

- If you use tax loss harvesting, these funds are a great pair.

- These funds cost the same fee at 7 bps.

Contents

Video

Prefer video? Watch it here:

VXUS vs. IXUS – Methodology, Composition, Fees, AUM, and Reasoning

VXUS and IXUS are two low-cost, market cap weighted funds that capture the same segment of the global market – stocks outside the U.S. VXUS is from Vanguard and IXUS is from iShares. For U.S. investors not already using a total world fund like VT, these two provide a quick way to get broad exposure to markets outside one's home country.

Let's talk about international stocks in general for a second. Why would you want to buy either of these funds in the first place? If you've landed here, you probably already know that index funds are a great way to get immediate, broad diversification across all sectors of the stock market, and that it's likely wise to diversify beyond the borders of one's home country. You also probably already know that both Vanguard and iShares have solid track records of providing highly liquid, low cost index funds.

So first, VXUS, the Vanguard Total International Stock ETF. The fund launched in early 2011 and seeks to track the FTSE Global All Cap ex US Net US RIC Index. Its mutual fund equivalent is VTIAX.

IXUS is the iShares Core MSCI Total International Stock ETF. It launched in late 2012 and seeks to track the MSCI ACWI ex USA IMI Index.

So what's the difference? Note that for all intents and purposes, these funds can be considered basically identical. The tiny variations that do exist are very subtle.

- First, VXUS is about twice as popular as IXUS with nearly $50 billion in assets. This makes sense, as Vanguard is typically the go-to for broad index funds like these, and VXUS also launched first by about 18 months.

- Secondly, VXUS tilts slightly larger than IXUS, with a weighted average market cap higher by about $500 million. That is, IXUS has a tiny bit more exposure to small caps.

- Thirdly, IXUS has historically paid a slightly higher percentage of qualified dividends and could thus be considered ever so slightly more tax efficient. If using this pair for tax loss harvesting, I would put IXUS in the taxable space.

- Lastly, VXUS could technically be considered more diversified with about 8,200 holdings, compared to about 4,200 for IXUS.

We could have a bit more discussion if one of these were cheaper than the other, but these two funds have the same fee of 0.07%.

VXUS vs. IXUS – Historical Performance

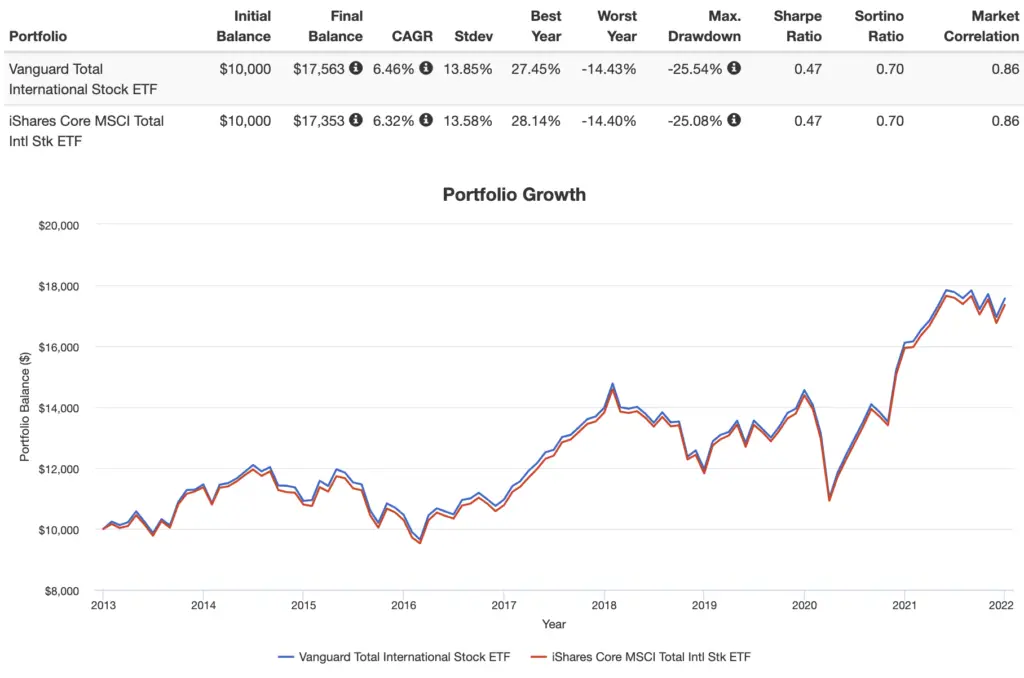

These funds have traded off years of outperformance. From IXUS's inception in 2012 through 2021, VXUS has slightly beaten it on return but with slightly greater volatility and a larger max drawdown. Thus, their risk-adjusted return has been identical:

Conclusion

Since VXUS and IXUS have the same fee, this is not a decision to lose sleep over and you can't really go wrong with either. They make a great pair for tax loss harvesting, and I would probably use IXUS in taxable. A choice between these two probably simply comes down to your personal preference of provider.

Conveniently, both of these funds should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

What do you think of VXUS and IXUS? Let me know in the comments.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply