State-owned enterprises typically have inherently lower operating efficiency due to compromised business interests. It may be prudent to avoid them in your international portfolio. Here we'll see what the data has to say.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

What Are State-Owned Enterprises?

State-owned enterprises, or SOEs, refer to companies with at least partial government ownership. The relevant financial products typically define an SOE as having greater than 20% government ownership, but an SOE could really have 1% government ownership or 100% government ownership. Often, the state has a controlling share of an SOE, though this isn't always the case.

SOEs aren't really prevalent in free economies like the United States, where publicly traded companies are largely free to operate as they wish without government intervention, though we do still have government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac.

SOEs are much more common in Emerging Markets like China. Most SOEs are remnants of communist regimes that have now embraced capitalism. Naturally, SOEs are typically involved with energy, materials, financials, etc. as these comprise a country's banking system, infrastructures, and natural resources. Examples include mining companies, public transportation providers, postal services, and utilities. SOEs like these are sometimes created solely to boost the economy of a developing country, e.g. oil in Brazil.

According to the International Monetary Fund (IMF), the assets of state-owned enterprises worldwide is $45 trillion.

Advantages of SOEs

While SOEs may sound bad so far, there can be economic advantages.

Some SOEs gain the status of being a legal, government-backed monopoly, effectively eliminating any competition.

The stock returns of SOEs also tend to be more stable (less volatile), which may be desirable for some risk-averse investors.

Disadvantages and Risks of SOEs

State-owned enterprises can be propped up by government funding to prevent them from failing, particularly when they're deemed necessary to a country's infrastructure, such as the U.S. Postal Service, which has been allowed to operate at a loss for extended periods. This is particularly prevalent in China, where a free market would otherwise cause the business to fail. Even worse, individual heads of government may use the state's controlling share in a company to pursue personal goals.

This government ownership naturally leads to decreased operating efficiency, as managers are serving two opposing interests: government and shareholders. Bureaucracy and political interests are usually at odds with shareholder value maximization. Unfortunately, it is more likely that the governments' interests win out. which means lower profits.

The prevailing view is thus that these opposing interests invariably lead to lower stock returns on average, and that investors should invest in companies with their interests in mind, i.e. companies that are not SOEs.

Let's see what the empirical evidence has to say.

State-Owned Enterprises – Fundamentals and Performance Data

If the theoretical basis for lower expected returns of state-owned enterprises is sound, we would expect it to show up both in fundamental valuation metrics and in the empirical historical stock performance.

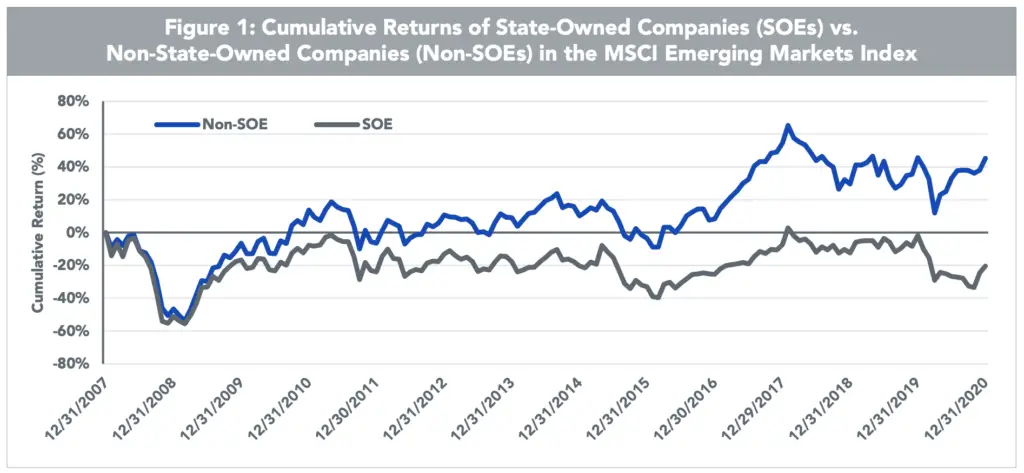

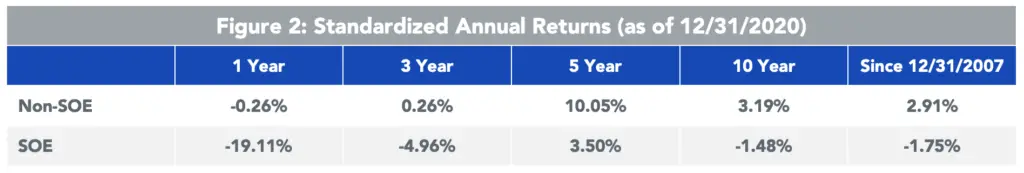

The first obvious place to look is historical returns between SOE and non-SOE firms. To show this, WisdomTree took the Emerging Markets universe and looked at cumulative returns for broad market-cap-weighted portfolios of SOEs and non-SOEs, with an SOE being firms with greater than 20% state ownership:

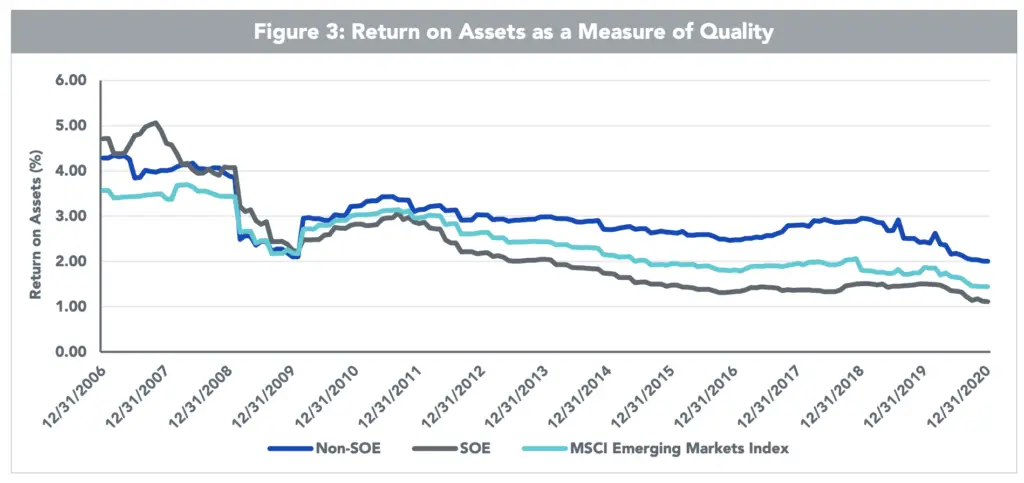

As. you can see, the data greatly favor non-SOEs. We would expect this performance to show up in some difference in fundamental metrics for quality and/or efficiency. And indeed it has, showing up in the difference of Return on Assets:

Interestingly, the gap seems to be widening in recent years too.

Avoiding SOEs in Your Portfolio

So we can see why we might want to avoid SOEs, but how can we do that and remain globally diversified in stocks?

WisdomTree themselves created a first-of-its-kind fund to capture Emerging Markets while excluding SOEs, defined as firms with greater than 20% government ownership. The ticker is $XSOE. Here's how the fund has performed vs. the broader Emerging Markets index since the fund's inception in 2015:

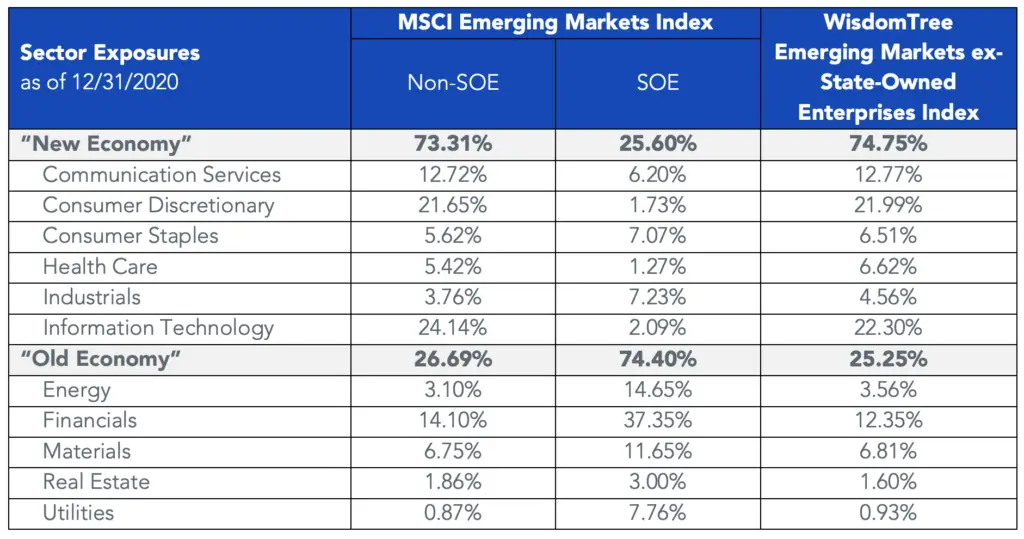

Note though that the sector exposure varies significantly between SOEs and non-SOEs in Emerging Markets:

WisdomTree notes that “it is prudent to consider the exposure of SOEs compared to non-SOEs in the broad MSCI Emerging Markets Index. Since the end of 2007, the benchmark has seen an evolution of exposures. SOEs continue to occupy a large share of the market’s overall exposure. Worth noting is the growth of the Information Technology and Consumer sectors over this period, particularly among non-SOEs. It is no coincidence that these “new economy” sectors have been among the key drivers of broad EM returns and overall growth of the market, as some of the more traditional, “old economy” sectors, such as Energy and Financials, have lost market share and continue to be the largest sectors of SOEs.”

Investors still wanting some exposure to SOEs and the “old economy” sectors in Emerging Markets can hedge their bets by utilizing both $XSOE and a broad Emerging Markets index fund like $VWO.

Also keep in mind that with the sector weightings above, XSOE naturally tilts toward growth stocks, and Growth has performed particularly well over the backtested period. This may be desirable if the rest of your portfolio heavily tilts Value, but again it may be a good idea to still maintain some reasonable exposure to SOEs in Emerging Markets to keep those Value-oriented sectors like Utilities.

It's entirely possible that this recent outperformance was due to these different sector weightings and Growth tilt, but I still like the idea of avoiding SOEs on a fundamental basis.

Conclusion

Given the intuitive logic of decreased operational efficiency and the data, it may be prudent to avoid or at least underweight state-owned enterprises (SOEs) in one's international investment portfolio. XSOE from WisdomTree is a fund that captures Emerging Markets while selectively excluding SOEs, defined as having greater than 20% state ownership. The sector exposure of XSOE will likely differ from “traditional” Emerging Markets funds that do include SOEs, so it may be wise to keep minimal exposure to maintain sector diversification.

How do you feel about SOEs vs. non-SOEs? Let me know in the comments.

Disclosures: I am long XSOE and VWO.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Me again. Would you consider sharing your thoughts on FRDM?

Haven’t looked into it.

Why do you think that SOEs wouldn’t have their political risks and unfriendliness to shareholders priced in? Also how would this relate to other groups that tend to not reward shareholders, for example Korean companies, where even non-SOEs tend to have low valuations due to their tendency to sit on cash rather than return value to shareholders?

I have a few possible theories, but I don’t have much conviction about them:

1. high state ownership skews pricing; this applies more to companies with very high state ownership, 50%+

2. there is some correlation between countries which have SOEs and countries which restrict investment in some way, in this case likely restricting citizens to investing within their country due to tax laws, bidding up the price

I don’t specifically avoid SOEs, but it is more a matter of practicality; I use Dimensional or Avantis tilts for all of my international investments, and they don’t offer ex-SOE. This likely does actually overweight me because of their value tilts, but that’s life.

I have been interested in this fund for a while now. I have a few questions:

1. Could the over performance be attributed to the difference in dividends? VWO has nearly 3% whereas XSOE has around half that (according to M1 Finance app). Would this also make this fund more tax efficient than other emerging market ETFs?

2. Your recommendation to hold some SOEs alongside this fund has me wondering if I paired this up with DGS, would that be sufficient? I’m not sure how to check the percentage of SOEs in an ETF.

3. Would it be unwise to tax loss harvest from VWO to XSOE? I feel like because they aren’t very similar, there are more risks to doing this.

Thanks!

1. No. Dividends don’t do anything. XSOE has beaten VWO since its inception. Not sure about tax cost; XSOE may do more trading. View the prospectuses.

2. Not sure. You could look into each of the top holdings of DGS manually, I suppose.

3. Depends on the goal, I guess. Definitely 2 different funds so no risk of wash sale, but still a correlation of 0.94. You’d only need to dip out of it for 30 days.

Hope this helps, Jon.