Low volatility ETFs provide a way for investors to stay in stocks while still limiting portfolio volatility and risk. Here we'll look at the best low volatility ETFs to access stocks with less movement.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Introduction – Why Low Volatility Stocks?

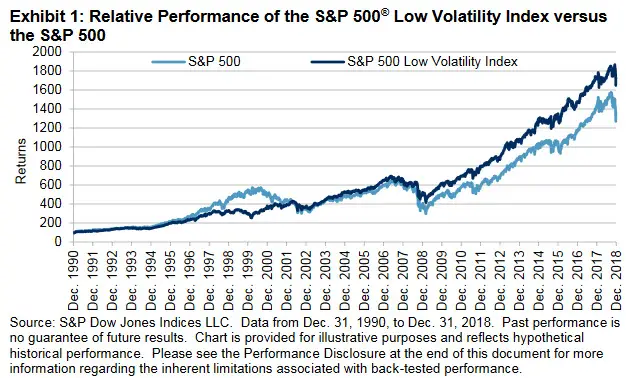

Low volatility stocks refer to stocks with lower-than-average price movement. Theoretically, low volatility stocks should fall less than the broader market when the market drops and rise less than the broader market when the market rises, thereby muting peaks and valleys. Interestingly though, history has told a slightly different story that has favored the upside.

Traditional wisdom – and specifically, the capital asset pricing model (CAPM) – maintains that there should be a positive relationship between stock risk and return. That is, over sufficiently long investing horizons, more risk should provide the potential for more reward. It should follow that higher-volatility stocks should provide higher returns, but empirical evidence has shown that relationship to be largely flat and sometimes even negative. This is known as the “low volatility anomaly.”

In short, defensive, low-volatility stocks have historically delivered higher returns than the most volatile stocks. Consequently, “low volatility” is an empirical equity factor that explains the differences in returns between diversified portfolios. The low volatility factor has been pervasive across geographies and asset types for the past 90+ years.

Several explanations have been proposed for the low volatility anomaly:

- Constraints for or aversion to the use of leverage and/or shorting, thereby driving investors to high-volatility stocks.

- Irrational preference (“taste”) for high-volatility stocks as attention-grabbing, “lottery-like” investments (chasing unicorns).

- The interests and incentives of professional fund managers do not align with those of their clients.

Arguably just as important as the conclusions above is the fact that low volatility stocks allow risk-averse investors to remain in stocks while limiting volatility and risk on the equities side, as drawdowns of low volatility stocks should be inherently smaller than the broader market, boosting risk-adjusted returns as measured by Sharpe. If history continues with the low volatility anomaly, these low-risk investors may not even have to give up any returns to reduce portfolio volatility.

ETFs have emerged based on the low volatility factor to provide investors with a vehicle to capture the factor and limit downside movement without picking individual stocks. Investors should note, however, that the sector weightings of these low volatility ETFs may not match that of the broader market, as exposure to higher-volatility stocks and sectors is eliminated or reduced.

Below we'll check out the best low volatility ETFs.

The 3 Best Low Volatility ETFs

Below are the 3 best low volatility ETFs for conservative investors to participate in stock returns while limiting downside risk.

USMV – iShares MSCI USA Min Vol Factor ETF

The iShares MSCI USA Min Vol Factor ETF (USMV) is the most popular fund in this space with over $34 billion in assets. This ETF is unique in that it uses a special algorithmic optimization to hold a basket of low-volatility stocks in aggregate while also attempting to keep factor and sector exposure diversified. The fund seeks to track the MSCI USA Minimum Volatility Index. It has over 194 holdings and an expense ratio of 0.15%.

SPLV – Invesco S&P 500 Low Volatility ETF

The Invesco S&P 500 Low Volatility ETF (SPLV) holds the 100 least volatile stocks of the S&P 500 that comprise the S&P 500 Low Volatility Index. Compared to USMV above, SPLV provides a basket of individual low-volatility stocks as opposed to a low-volatility portfolio in aggregate. SPLV does not run any sort of optimization like USMV does. As such, SPLV's holdings and sector exposure are considerably different than those of USMV. Historically, USMV has delivered greater returns and lower volatility than SPLV. SPLV has over $8 billion in assets and an expense ratio of 0.25%.

EFAV – iShares Edge MSCI Min Vol EAFE ETF

Those seeking international exposure can use the iShares Edge MSCI Min Vol EAFE ETF (EFAV) to capture low volatility stocks in developed markets outside of North America. The fund seeks to track the MSCI EAFE Minimum Volatility Index. It has over $10 billion in assets and an expense ratio of 0.20%.

Where To Buy These Low Volatility ETFs

All the above low volatility ETFs should be available at any major broker. My choice is M1 Finance. The broker has zero trade commissions and zero account fees, and offers fractional shares, dynamic rebalancing, intuitive pie visualization, and a sleek, user-friendly interface and mobile app. I wrote a comprehensive review of M1 Finance here.

References

- https://www.sciencedirect.com/science/article/abs/pii/S0304405X14002323

- https://www.tandfonline.com/doi/abs/10.2469/faj.v67.n1.4

- https://link.springer.com/article/10.1057/s41260-016-0036-1

- https://thebamalliance.com/blog/low-volatility-advantage-not-what-youd-expect/

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3442749

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=980865

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2055431

- https://jpm.pm-research.com/content/40/3/61

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Crazy idea, but what if you replaced bonds for one of these in a taxable account?

Stocks – even min vol – are very different from bonds. Could maybe argue replacing something like 90/10 with one of these.