AVUV is a relatively new targeted factor ETF from Avantis for U.S. small cap value stocks. I review it here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it here:

Introduction – Factors

Give me a minute to set the stage for AVUV by briefly covering factors, Avantis as a provider, and the small cap value status quo.

If you've landed on this page, I'm going to guess you've probably heard that overweighting small cap value stocks in one's portfolio may be a good idea, or you're already doing it with a different fund and you want to attempt to optimize your exposure.

Why do we think small cap value stocks are the golden market segment? Well, there are these things we call factors which just describe particular characteristics about stocks in aggregate, such as a stock's price relative to its profitability, which we call Value. These risk factors are the unique sources of risk that explain the differences in returns between diversified portfolios.

In overweighting these factors in the portfolio, we expect greater returns over the long-term as well as a convenient diversification benefit. This has been true historically, as small cap value stocks have been the best performing segment of the stock market.

I went into factors in detail in a separate post here so I won't bore you with the details here, but in this context essentially for any given fund, we're interested in how much factor bang we're getting for our buck. Specific to small cap value funds, for example, we're looking at the values, called loadings, for these individual factors like Size, Value, and Profitability. In a nutshell, we're talking about overweighting or tilting with certain risk factors in equities that have greater expected returns

The Case for AVUV and Avantis

By sheer assets, VBR from Vanguard seems to be the most popular choice for U.S. small cap value stocks. If you're reading this post, there's a pretty good chance you already own it.

Unfortunately, VBR is neither very small nor very value-y. That is, it basically tilts mid-cap and has smaller factor loadings compared to other options in the space, of which there are many now. I'll go ahead and give away the punchline. I compared a handful of the most popular small cap value funds in a separate post here and crowned AVUV the winner.

Dimensional Fund Advisors (DFA for short) have long been the gold standard for factor funds. A few years back, some folks from Dimensional left to create Avantis, so it shares DFA pedigree. Avantis have quickly boasted their competency as a fund providers in creating some of the best factor funds around.

Enter AVUV, their offering for ultra-targeted factor exposure in U.S. small cap value stocks.

AVUV Performance

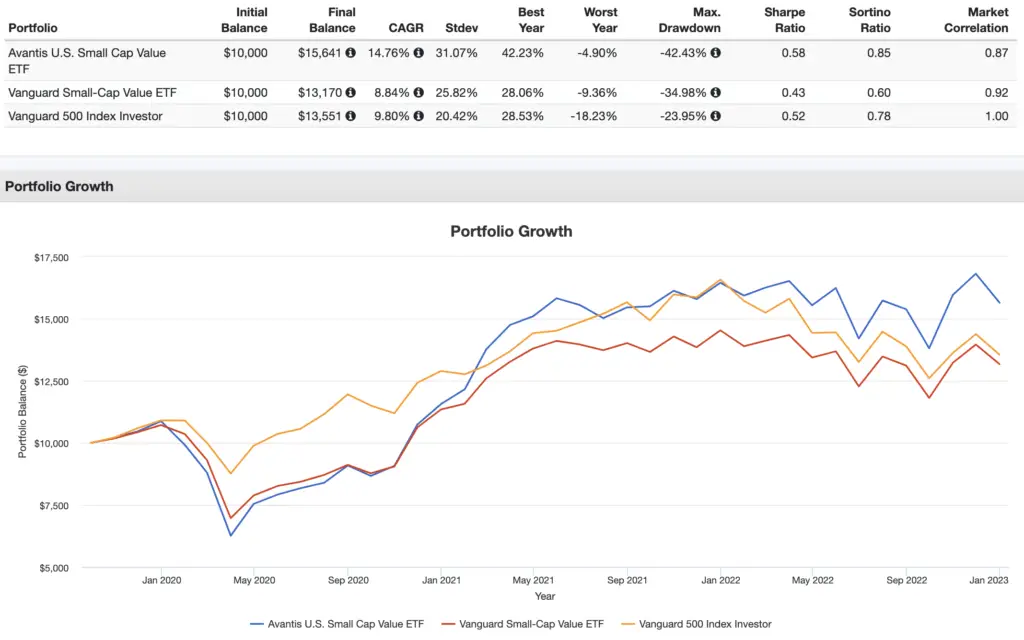

This targeted exposure has paid off for AVUV so far. While this short backtest shouldn't mean much, below I've compared AVUV to the aforementioned VBR from Vanguard and the S&P 500 over its short lifespan thus far from October 2019 through December 2022.

As you can see, AVUV has handily beaten both. And while it was also much more volatile, it was still able to deliver a much greater risk-adjusted return than those two as well for both Sharpe and Sortino.

AVUV Factor Loadings

Specifically, here's a comparison of the factor loadings of AVUV and VBR for the period October 2019 through December 2022:

| AVUV | VBR | |

|---|---|---|

| Beta | 1.09 | 1.00 |

| Size | 0.82 | 0.50 |

| Value | 0.59 | 0.45 |

| Profitability | 0.15 | 0.04 |

| Investment | -0.07 | -0.13 |

| Alpha | 0.17% | -0.14% |

| R2 | 98.4% | 98.4% |

Notice how these loadings illustrate what I said earlier – AVUV is basically holding smaller, more value-y, more profitable stocks than VBR. Theoretically, this should give AVUV a performance edge over the long term.

Conclusion – Is AVUV a Good Investment?

So should you invest in AVUV? Maybe.

First let's dispel a myth that's used as the most common criticism of AVUV (or really any Avantis fund) among staunch Bogleheads. Their knee-jerk reaction is to reject this fund immediately because it's technically actively managed, which is supposed to be a cardinal sin for Boglehead purists.

What they fail to realize, however, is that these funds are rules-based active, meaning managers can only act within strict, pre-established parameters, not the true “active” that we usually think of. In fact, AVUV is no more “active” than the S&P index that VIOV from Vanguard uses, and actually has lower turnover. Moreover, “passive” is a myth anyway and is more of a sliding scale than a binary on/off switch.

Another common criticism is AVUV's fee of 0.25%, which is admittedly high compared to something like VBR which costs less than 1/3 of the price at 0.07%. However, many don't seem to understand or like to ignore the fact that fees are relative and should not be compared in absolute terms.

Basically, does the premium we're expecting to receive outweigh the greater expense ratio? Specifically, will the differential of AVUV's greater loadings compared to VBR's pay us more than the fee difference of 0.18%?

In this case, to answer those questions, I'd say it does and they will, respectively. Others apparently feel the same, because AVUV is Avantis's most popular fund.

Glance at the performance backtest above again to see this concept in action. Whether or not this will stay true in the future over the long term remains to be seen, and of course those answers are my opinion and are not objective facts, as the future is unknowable and factor premia are not guaranteed.

So if you can get over both of those things, I think AVUV is a fine choice for those wanting superior factor tilts with U.S. small cap value stocks, even for Bogleheads. To offer some social proof, savvy investors much smarter than myself within the Rational Reminder community (the forum for the eponymous podcast from Ben Felix and Cameron Passmore of PWL Capital) like this fund a lot, and it's even part of their model portfolio.

That said, I'm of the mind that one should always understand and be comfortable with what they're buying to hold for the long term. AVUV is arguably for the more advanced, die-hard factor investor who can stay the course without feeling unease or tracking error regret, not only from comparing AVUV to its indexed competitors, but also from potentially seeing the small cap value segment as a whole underperform for extended periods.

Assess whether or not you want to factor tilt at all, and if so, whether or not you want to use a young, pricier, ultra-targeted fund to do so. I can't answer that for you.

Conveniently, AVUV should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

In the interest of full disclosure, I own AVUV in my own portfolio after concluding, after much research, that it was indeed a suitable investment for me, but I am in no way affiliated with Avantis.

What do you think of AVUV? Do you own it? Let me know in the comments.

Disclosure: I am long AVUV in my own portfolio.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply