Investors looking for small cap value ETFs have a multitude of low-cost choices, but the differences among some of them are not immediately obvious. We'll investigate them here. Stay tuned; there's a pretty clear winner.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Introduction – Small Cap Value

I've delved into small cap value in detail previously here in terms of the premiums themselves and here in terms of ETFs to capture those premiums, as well as mentioning it in my brief reviews of several lazy portfolios that tilt small cap value. Because of that, I won't bore you with the details yet again here.

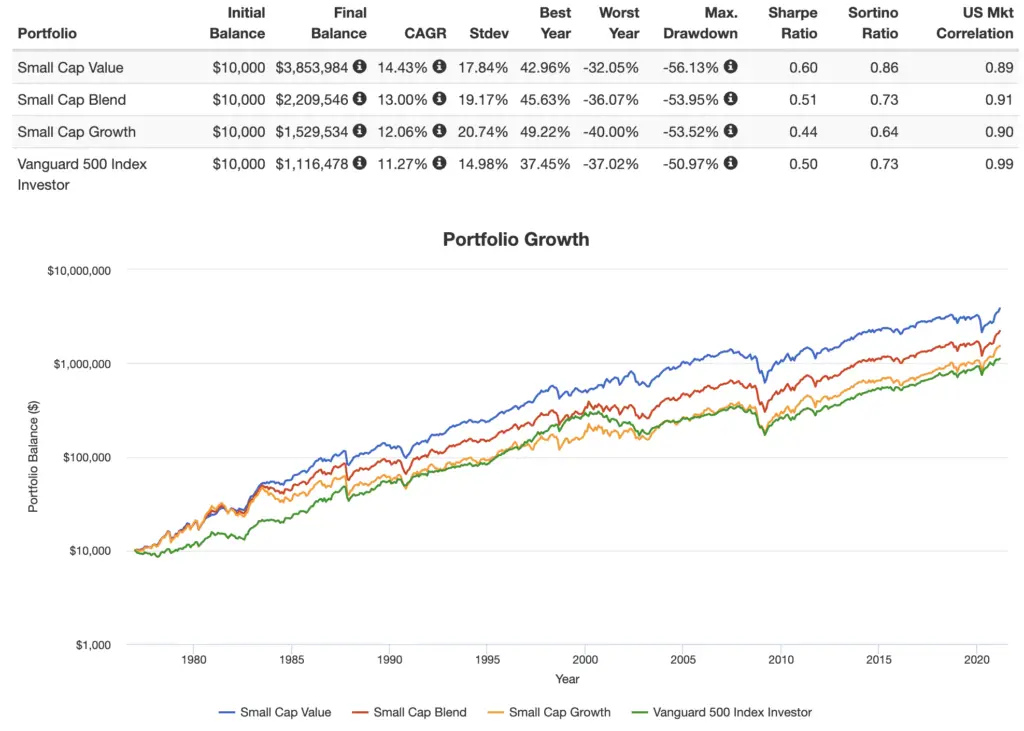

The quick summary is that small cap value stocks have outperformed other cap size and style combinations historically due to the Size and Value risk factor premia. Conveniently, the other factor premia are most prominent in the small-cap universe, and small value offers a diversification benefit separate from its greater expected returns that can improve portfolio outcomes in relation to risk metrics (e.g. max drawdown) and sequence risk.

The good news is that investors – at least U.S. investors – have a number of great options for small cap value in the form of highly-liquid, low-cost ETFs. Unfortunately, the differences among these ETFs are not always immediately obvious, and their factor loading varies greatly. Let's dive right into the specific differences among the most popular small cap value ETFs – VIOV, VBR, AVUV, IJS, SLYV, DFAT, and ISCV.

Update – January 18, 2023: I also added a brief mention on Dimensional's new DFSV at the bottom of this post.

Small Cap Value ETF Showdown – VIOV, VBR, AVUV, IJS, SLYV, DFAT, & ISCV

Let's start with analyzing VBR from Vanguard as a basis for the discussion.

VBR is far and away the most popular small cap value ETF, probably because it's one of the oldest and one of the cheapest, with a fee of only 0.07%. VBR casts a wide net that holds nearly 1,000 stocks. Because of this, it's not actually a pure small cap value play; it has some decent mid cap value exposure as well.

This might sound like a good thing, but in targeting the Size and Value premia, we're looking for the smallest and cheapest stocks simultaneously. Put another way, we're looking to capture the cheapest stocks (in terms of their relative book value) from a basket of the smallest stocks (recall that the Value premium is most prominent within the smallest stocks). Moreover, the Size premium specifically is the return of small stocks minus the return of large stocks, written as small minus big or SmB. Consequently, VBR's wider net and subsequent mid-cap exposure sort of work against our goal.

More importantly, the CRSP US Small Cap Value Index that this ETF tracks does a comparatively worse job of capturing the Value premium. That is, VBR's exposure to Value (and Size) has been lower than the other ETFs on this list. Basically, other funds deliver objectively superior factor exposure at only a slightly higher cost. In summary, VBR is neither very small nor very value-y.

Update – March 30, 2021: iShares recently slashed fees on some of its ETFs, one being ISCV (formerly JKL), the iShares Morningstar Small-Cap Value ETF. In short, ISCV provides superior factor loading to VBR and is conveniently cheaper by 1 basis point. It's a clear win for ISCV over VBR. Props to iShares. If you're just looking for the budget option, ISCV is it. I see no reason not to choose it over VBR.

This brings us to VIOV, SLYV, and IJS. VIOV is another small cap value fund from Vanguard that is slightly more expensive and tracks a different index. SLYV comes from SPDR, and IJS from iShares. All three of these funds seek to track the same index: the S&P SmallCap 600 Value Index. Conveniently, they are all great options to track that index and are pretty comparable. Their historical performance and factor loading have been nearly identical, so I'd say the choice is basically down to fees. VIOV and SLYV both cost 15 basis points. IJS costs slightly more at 18.

Again, the important takeaway is that these three ETFs deliver better exposure to Size and Value than VBR and ISCV that more than makes up for the slight increase in cost. They cost a bit more because they use the S&P name. But that's okay in this case. Conveniently, that S&P index employs an earnings screen to weed out companies with bad financials, so these three funds provide some decent exposure to the Profitability and Investment risk factors as well, again much more so than VBR. Basically, for every relevant risk factor, VIOV, SLYV, and IJS provide much better exposure than VBR. We're getting more bang for our buck, even though we're paying a slightly larger fee.

Unless you just prefer iShares products, we're down to VIOV and SLYV after taking fees into consideration. Again, they should be comparable and interchangeable. I used VIOV in my own portfolio.

But now there's a new kid in town…

The go-to fund provider for factor tilts is Dimensional Fund Advisors (DFA), but most of their funds – particularly their small cap value funds, in this case – aren't available to retail investors like you and me. A few employees recently left DFA and started their own shop called Avantis, and Avantis launched its U.S. small cap value product AVUV in late 2019. DFA funds are typically pretty expensive. Surprisingly, AVUV from Avantis has a relatively low expense ratio of 0.25%. This may sound high at first glance, but hear me out.

In its short lifespan, compared to VIOV, AVUV has delivered slightly better exposure to the Value and Investment factors and comparatively much better exposure to the Size and Profitability factors. Remember, size matters; we're aiming for the smallest stocks, inside which the other factors are more powerful. AVUV's P/E (price to earnings) ratio is also roughly 1/4 that of VIOV.

In targeting U.S. small value, AVUV is exactly what we're looking for, with decent Profitability and Investment exposure as an added bonus. This superior exposure is worth the step up in cost of 10 basis points over VIOV and SLYV in my opinion. Put another way, for a given target factor exposure, it would require a greater amount (more allocation) of VIOV than it would with AVUV, so the lower fee for VIOV doesn't really save you as much as it appears at first glance. Again, we're getting more bang for our buck. Avantis also conveniently considers Momentum at the time of their trades.

For those reasons, AVUV has now replaced VIOV in my own portfolio as of February, 2021. Factor investors have been paying attention; the fund has also surged to nearly $1 billion in assets, so liquidity shouldn't be a problem.

We should probably expect these results, as Avantis, like DFA, lives and breathes factors, and their products are designed to deliver the best exposure possible, whereas the other ETFs on this list just happen to provide decent factor exposure from a good index. The difference is subtle but important.

I'll be keeping an eye on AVUV's future factor loading, but it looks like a solid bet so far, and the switch to it from VIOV has caused me no dissonance.

Update – July 14, 2021: Dimensional has converted their Tax-Managed US Targeted Value Portfolio fund DTMVX to the ETF DFAT. It's a tax-managed fund that, as the name suggests, targets Value across small- and mid-caps. Don't get too excited. Basically, it's neither as small nor as value-y as AVUV yet costs more at 0.34%. Its historical loadings on Profitability and Investment were even lower than VIOV. Still sticking with AVUV.

Update – January 28, 2023: Dimensional has also launched a small cap value ETF with heavier tilts than DFAT, which is DFSV, the ETF equivalent of their mutual fund DFSVX. In a nutshell, it looks extremely similar to AVUV, but I still prefer AVUV. I have a post dedicated to DFSV here and I specifically compared it to AVUV here.

Targeting small cap value outside the U.S. is not as cut and dry. I explored international small cap value ETFs separately here.

What fund(s) are you using for your small cap value tilt? Does the recent emergence of AVUV from Avantis have you rethinking your small cap value fund choice? Let me know in the comments.

Disclosures: I am long AVUV in my own portfolio. Note that I am not affiliated with Avantis and I get no sort of kickback or compensation if you decide to buy AVUV (or any of the other funds listed here). I've also received no form of compensation from Avantis for the words I've written on this page. My discussing AVUV and crowning it the superior U.S. small cap value ETF are simply the result of my own independent research and analysis.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

I am trying to decide whether AVUV or VIOV is the best choice for me. I don’t want to have to check on an actively managed ETF to see if they are still making good decisions. At least with the passive approach, I don’t have to worry about a mistake on the part of the management.

Sure in the long run AVUV might outperform VIOV if they keep succeeding in having better size and value factor loading. But am I wrong in saying there’s an added risk that they might not be able to do that for 30+ years?

AVUV is no more “active” than VIOV’s S&P index, and actually has lower turnover.

Do you think we can trust AVUV will continue offering this level of factor exposure? As more investors get onboard, will it not be more difficult to find SCV with such low P/B and market cap?

Only time will tell. On the second question, no. Larger and less value-y companies will fall out of a SCV fund and new, smaller ones will enter.

XSVM looks very interesting. Based on avg market cap and other metrics taken from ETF.com so does RSZ.

Both look like they are more value oriented and have a better size factor tilt.

They do come with elevated expense ratios at .39 and .35.

They also aren’t as diversified.

I looked into this some and may have found some helpful info based on average market cap, p/e and p/b.

Data only taken from 1 site so far and my not be the most accurate.

AVUV sits around 3.3B, 14x and 1.5 x book. 630ish holdings

XSLV is 1.7B, 9x and 1.2 x book.. 120ish holdings

so it appears to be heavily skewed towards smaller value and as a secondary, I believe they also look for momentum factor amongst those smallest of smalls.

Last that I never heard of until comparing tonight is

RZV. 1.2B, 12x and .99x book..170ish holdings

It appears they may offer a better factor tilt as the cost of reduced holdings and increased expense ratios if .39 and .35. when compared to AVUV.

I’d definitely love any thoughts or feedback.

Where is vtwv or iwn or fisvx? No love for the Russell ?

FISVX 0.5 er.

Avuv has over $7 billion in AUM. At what point will it become more difficult to target smaller cap stocks or maintain its factor exposures?

Now that DFSV is out are you going to update this?

After I evaluate it, sure. It just launched 3 weeks ago.

What about the new dimensional small cap value etf DFSV?

Haven’t evaluated it yet.

Jeffrey, I finally got around to publishing a post on DFSV here and then compared it to AVUV here.

Thanks for this wonderful site generally and this post particularly.

I’m wondering if you’d recommend reducing the percentage allocated to SCV if using a super “value-y” ETF like AVUV vs. VBR? I’m using a slightly modified Golden Butterfly that as you know calls for equal amounts of TSM and SCV.

Probably not. Just depends on the degree of tilt you’re looking for.

For a broad market ETF with some-moderate value/size/profitability tilt — the fairly new launch of DFA US Core Equity 2 ETF (DFAC) – actually a mutual fund conversion – is very close to Avantis’ AVUS.

DFAC also appears to be highly liquid too. These 2 will be real close competitors.

Those core funds have very light tilts.

Being this is a small value showdown, what’s preventing me from giving AVUV the edge is it’s market cap breakdown. If you go to etfdb’s site and compare AVUV with VIOV, IJS, or SLYV, AVUV’s market cap breakdown shows the following:

Mid = 57.36%

Small = 36.78%

Micro = 5.04%

Large = 0.82%

AVUV is weighted more in mid-cap, while SLYV, VIOV, and IJS has the most weight in small-cap.

Cap sizes vary among publishers and are somewhat arbitrary. Regardless, AVUV has still delivered superior factor loading, including greater Size loading, which is what we care about. SLYV, VIOV, and IJS are still great choices, though.

I just heard of an interesting one today. XSVM. I came back here because I thought you might like it.

It screens the s&p600 for the top 240 based on p/e, p/s and p/b.

Then out of the 240 best “value” names, it somehow calculates the top half of those based on momentum. So you sorta get 2 factors in this. Size and momentum.

Reasonable expense ratio and a backtest shows it, so far, has done well against AVUV

What about ISVL (counterpart of SVAL) vs AVDV

SVAL seems even more “small” and “Value” than AVUV according to Morningstar. Do you consider this as a possible alternative of AVUV?

Lau, thanks for the suggestion. SVAL still has less than half the loading on Value compared to AVUV in its short lifespan so far and is heavily concentrated in Financials at nearly half the fund’s weight, but I might be inclined to buy this just for its seeming ability to capture really small stocks with decent financials, i.e. betting on Size. It’s nearly a micro cap fund that looks better than funds that call themselves micro cap funds. I’ll definitely keep an eye on it.

Carolyn, seems like most small caps are down lately and I don’t want to invest in more just want to switch from VIOV to AVUV.

What about the new DFAT ETF from Dimensional? Worth discussing as an addendum to your post?

Yea I’ll probably get around to including DFAT in here. It seems to deliver a bit more on Value, but AVUV still gets much smaller (SMB) and captures more Profitability (RMW).

Pat, finally got around to checking out DFAT. Nothing to get excited over IMHO.

VBK is performing better than VIOV so would it be a better short-term buy?

VBK is currently performing better than AVUV so would it be a good buy short-term instead of AVUV?

Past/current performance is not indicative of future performance. I’m in it for the long term. Don’t try to time the market. Also depends on what you mean by “currently.” Since January of this year, no, VBK is not “currently performing better than AVUV.”

I know you’re right about not trying to time the market, but it sure is tempting when my small cap fund is doing poorly. I’m planning on switching to my VIOV when it goes back up to the $188 I bought at to AVUV. Another blogger suggested diversifying with AVUV, RWJ, and XSVM to capture different types of small caps.

What’s your small cap fund?

Don’t buy funds just because a blogger (myself included) said so. Do your own due diligence and know exactly what you’re buying and why you’re buying it. First decide what segment of the market or what risk factor you want exposure to, and then try to find a fund to capture that exposure.

I meant to say I’m going to switch my small cap fund VIOV to AVUV when the former goes back up to $188 where I bought at.

AVUV seems to have dipped so maybe a good time to for Jeanne to buy? I bought it for the same reasons you did but am thinking maybe I should have looked into the companies a little more. I am wondering what the recent down turn/sideways price action lately is reflecting. Profit taking perhaps?

Impossible to say. I don’t try to time the market. Others probably shouldn’t either. Ignore the short-term noise, focus on the long term, and stay the course.

Really like your blog. It aligns deeply with my own investing philosophy. I will be delving into your site more deeply.

Quick question on AVUV vs VIOV. On MStar, AVUV seems to have slightly less loading to “Value” and “Size”, and a higher avg market cap. This seems contradictory to what you find above. What leads you to believe that AVUV has a better Size and Value factor loading than VIOV?

Thanks for the kind words!

Can you link me? Just looked again. Neck and neck on Value but AVUV smokes VIOV on Size and Profitability.

With the recent changes in iShares Morningstar U.S. Equity Style Box ETFs (https://www.businesswire.com/news/home/20210322005482/en/PRODUCT-UPDATE-iShares-Morningstar-U.S.-Equity-Style-Box-ETFs) it appears they now have the lowest fees (0.06%). Might ISCV (formerly JKL) be better than VIOV/SLYV? Or between VIOV and VBR?

Been meaning to add ISCV to this discussion since iShares dropped fees recently. Its factor loading is superior to VBR (and it’s cheaper!) but not as good as VIOV/SLYV.