VIOV is an index ETF from Vanguard for U.S. small cap value stocks. I review it here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

The Case for VIOV and Small Cap Value Stocks

Give me a sec to set the stage for VIOV by briefly covering why we like small cap value stocks in general.

If you've landed here, you probably already know that small cap value stocks have beaten every other segment of the stock market historically due to what we believe are risk premiums for things like Size and Value, which we colloquially call factors. That is, we expect smaller stocks that are also thought to be underpriced based on their fundamentals to have greater returns over the long term.

Of course there are small cap value stocks in a total stock market index fund like VTI, but because it's market cap weighted, meaning companies are weighted within the fund by their relative size, small cap value stocks actually only make up a measly 3% of VTI. Thus, we have to purposely overweight them to get those greater expected returns, and of course we can do so with a dedicated small cap value ETF.

Enter VIOV, an index fund from Vanguard created in 2010 that seeks to track the S&P Small-Cap 600 Value Index. Conveniently, this index also employs some earnings screens to make sure constituent stocks are profitable, so we get some naive exposure to the Profitability factor as well.

As such, VIOV offers up some appreciable factor exposure while still being a relatively plain index fund by most standards, which is nice for Bogleheads, who usually only stick to Vanguard index funds. In fact, while it's a little bit pricier, we would consider VIOV to have more attractive factor loadings – meaning comparatively “better” small cap value exposure – than its older brother VBR, another Vanguard small cap value fund which tracks a different index. We would expect this, as VBR is actually more of a mid-cap fund with a weighted average market cap roughly 3x that of VIOV.

VIOV Performance

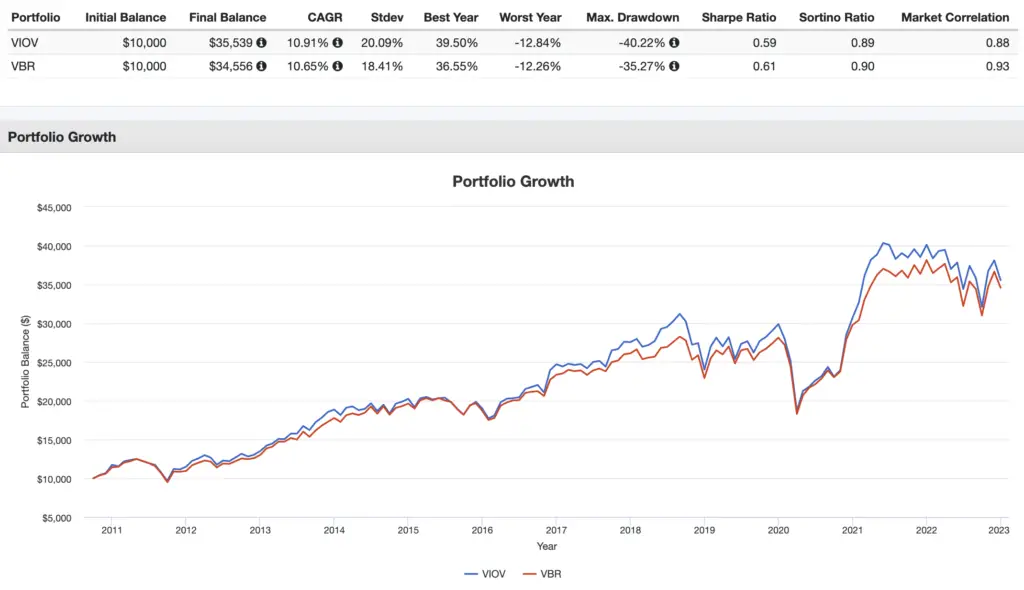

This exposure has paid off for VIOV so far in that it has narrowly beaten VBR historically for the period October 2010 through 2022:

Conclusion – Is VIOV a Good Investment?

So should you invest in VIOV? Maybe.

First, assess whether or not overweighting U.S. small cap value stocks in your portfolio is right for you. Recognize that there can be extended periods of the segment's underperformance compared to the broader market. The premiums we expect are also not guaranteed.

In overweighting small cap value stocks, your portfolio's behavior will not look like that of the market, for better or for worse. You may feel uneasy when seeing that happen, which is known as tracking error regret.

Also of course realize small cap value stocks should probably not make up your entire portfolio, for the same reasons. If you buy VIOV, hopefully it's alongside broader index funds such as VT, VTI, or VOO.

Also note that because this fund is more narrowly focused, its fee, at 0.15%, is a bit higher than those broader index funds I just mentioned. Of course we would expect the future small cap value premium to outweigh that small difference in fees, but again this by no means guaranteed.

In conclusion, VIOV is a fine choice for a U.S. small cap value fund, particularly for those who like to stick with Vanguard index funds, and I would argue it is demonstrably superior to its older brother VBR. You could also use that pair as substitutes for tax loss harvesting if we're talking about a taxable account.

Conveniently, VIOV should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

What do you think of VIOV? Do you own it? Let me know in the comments.

Disclosure: None.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply