VB, VIOO, and VTWO are three popular small cap ETFs from Vanguard. Is there one that reigns supreme? I compare them here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it here:

What We're Looking For in a Vanguard Small Cap ETF

So let's talk about what exactly we're looking for in a Vanguard small cap ETF. First, we want sufficient AUM and liquidity to avoid the risk of fund closure and large bid-ask spreads.

Secondly, we probably want our underlying index to have some form of earnings screen. Small cap growth stocks with weak profitability have been the worst performing segment of the market historically, so it may be best to try to weed those out.

Thirdly, all else equal, we should obviously prefer a lower average market cap, meaning the fund is holding smaller stocks. Loading on the Size factor comes into play here too. In other words, how effectively has the fund been able to capture the actual Size premium?

Lastly, we obviously want to consider fees, though not necessarily in an absolute sense. Basically, how much small cap bang are we getting for our buck?

VB vs. VIOO vs. VTWO

So now let's look at our specific funds – VB, VIOO, and VTWO – and run them through the aforementioned criteria.

Regarding AUM and liquidity, conveniently all three of our funds here are very popular, so liquidity is not a concern. In fact, the least popular fund of these three still has nearly $2 billion in assets.

First let's break down VB. It's called the Vanguard Small-Cap ETF. The fund seeks to track the CRSP US Small Cap Index. This index is pretty simple; it's just the bottom 2-15% of the investable U.S. stock universe by market cap. This means VB actually ends up skewing mid-cap, with a weighted average market cap of $6.7B, over 2x that of the other 2 funds here. VB's comparative factor loading corroborates this fact, with much lower exposure to the Size factor compared to both VIOO and VTWO.

Now let's talk about VTWO. It's called the Vanguard Russell 2000 ETF. As the name suggests, this ETF seeks to track the famous Russell 2000 Index, holding the 2000 smallest stocks by market cap from the broader Russell 3000. Like the CRSP index that VB uses, the Russell 2000 index does not have a dedicated earnings screen. However, it's inarguably holding smaller stocks than VB. Its weighted average market cap is about $3.2B.

Lastly, we've got VIOO. This is the Vanguard S&P Small-Cap 600 ETF. It seeks to track the S&P SmallCap 600 Index. This index captures roughly 600 stocks within the small cap universe selected by an S&P committee. Unlike the other two funds, VIOO does employ some earnings screens to ensure financial viability. This gives the fund small positive loading across Profitability and Investment, while VB and VTWO both have negative loadings for these.

VIOO also conveniently has the lowest average market cap at about $2.5B and the greatest loading on the Size factor, meaning it is capturing the smallest stocks with robust profitability. VIOO also actually slightly tilts Value.

So we should inarguably prefer the more effective exposure of VTWO and VIOO, but of course they happen to come with a higher price tag. That said, “higher” in this context is still comparatively very low. Specifically, VB has a fee of 0.05%, while both VTWO and VIOO have a fee of 0.10%.

In short, in considering which Vanguard small cap ETF to buy, VTWO and VIOO provide much more bang for our buck compared to VB and are very much worth the slightly higher fee in my opinion. Since VTWO and VIOO have the same fee, I see no reason not to prefer VIOO.

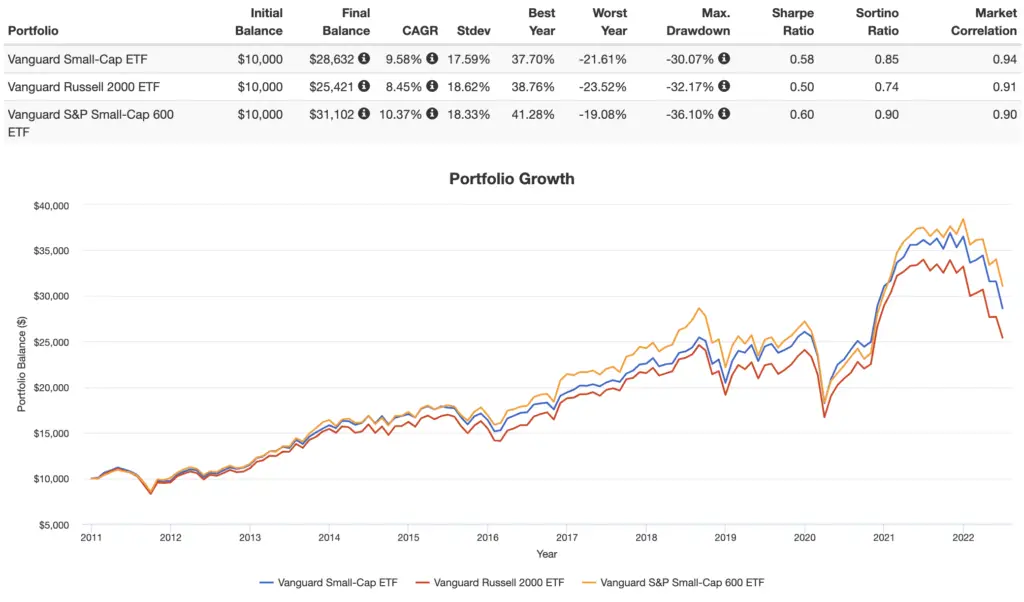

I always say backtests shouldn't mean much, but it may also comfort you to know that VIOO has outperformed VB and VTWO historically as well on both a general and risk-adjusted basis:

Conveniently, all three of these funds should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

Do you own any of these Vanguard small cap ETFs? Let me know in the comments.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply