Gold can be used as a store of value and a significant alternative asset in a diversified investment portfolio. Here we'll explore how to invest in gold quickly and easily online.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Why Invest in Gold?

Gold has long been a common currency of the world. The shiny metal is now traded on exchanges via futures and ETFs. Gold is considered a commodity. Commodities as a whole are usually used as a diversifier to lower portfolio volatility and risk.

Gold acts as a steady store and transfer of wealth because, while it is transformed into different shapes and applications, it is not consumed like oil, coffee, water, and other commodities. Ancient civilizations used gold as currency, and the U.S. monetary system was based on the gold standard, with the amount of credit directly tied to the physical supply of gold, thereby providing a cap for lending, until 1971.

Gold is perhaps most famously used as a hedge against inflation and for providing protection for a declining currency. Whether or not it has delivered on that effectively in the past is debatable, but gold inarguably does at least provide a short-term diversification benefit – with its uncorrelation to both stocks and bonds – that can reduce portfolio volatility and boost risk-adjusted returns, making it particularly attractive for investors with a short time horizon and/or low risk tolerance.

A more reliable fact is that gold is typically a popular flight-to-safety asset during periods of market turmoil, irrespective of monetary policy and interest rate environment. Worsening economic conditions have historically been correlated with a rising price of gold. This is interesting when you consider that gold is not a value-producing asset. The metal is also held in many parts of the world as a “safe haven” for times of political unrest and instability; it is referred to as the “crisis commodity.” Gold is a significant component of many popular lazy portfolios like the All Weather Portfolio, the Golden Butterfly Portfolio, and the Permanent Portfolio.

Now that you know why you might want to invest in gold, let's look at gold's historical performance.

Gold Performance vs. Stocks Historically

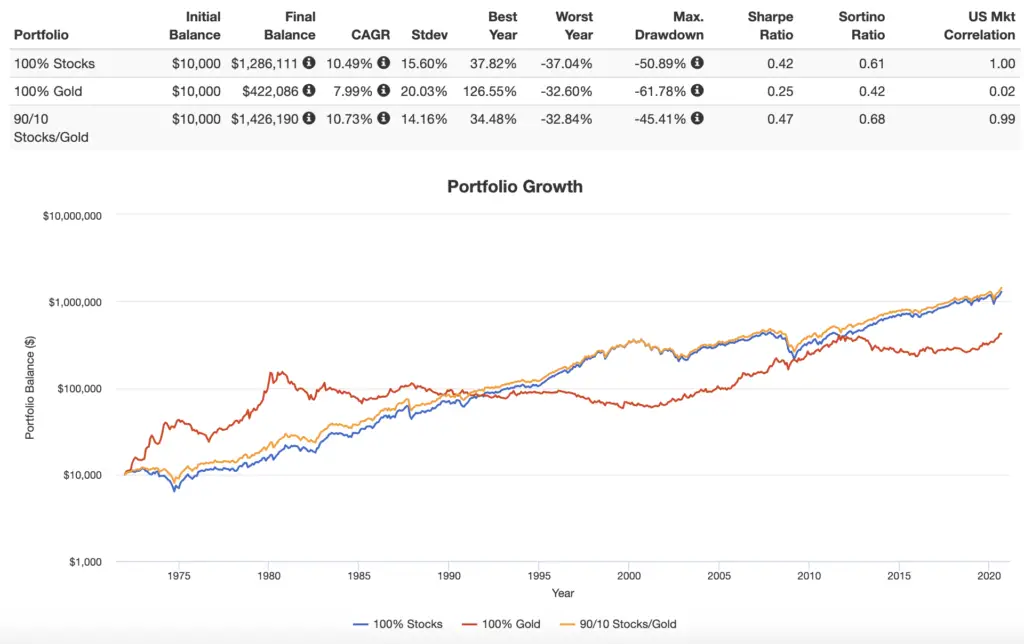

Below we can look at the historical performance of gold vs. the U.S. stock market for the period 1972 through 2019. The backtest below has 3 portfolios: 100% stocks, 100% gold, and 90/10 stocks/gold.

Notice how gold and stocks have little to no correlation. We can see that gold has been much more volatile than the stock market and that stocks have outperformed gold historically, but of course investors likely aren't going to be holding a portfolio of 100% gold. The yellow line above (Portfolio 3) shows a portfolio of 90% stocks and 10% gold. Notice how the inclusion of gold reduced volatility and drawdowns compared to 100% stocks, resulting in higher general and risk-adjusted returns historically.

Now that you've seen how gold has behaved in relation to stocks in the past, let's look at how to invest in gold.

How To Invest in Gold

There are several ways to invest in gold.

The most direct way is obviously to buy physical gold bullion. Think coins or bars that go in a bank vault. Unfortunately, this physicality, weight, and size make this form of gold quite illiquid.

The easiest, quickest, and most popular way to invest in gold is with gold ETFs. ETFs are exchange-traded funds. They are funds that trade like stocks on an exchange and track an index, in this case the price of gold. Each share of an ETF is the equivalent of 1/10 of an ounce of gold bullion.

Gold mining stocks (companies that mine the metal) are another option, but they tend to be much more volatile and unpredictable than ETFs that track the price of gold. Gold mining stocks are also more correlated with the stock market than the price of gold bullion per se.

Three of the most popular low-cost gold ETFs that track the spot price of gold bullion include:

- GLD – SPRD Gold Trust

- IAU – iShares Gold Trust

- BAR – GraniteShares Gold Trust

Conclusion

Gold is both a store of value and an alternative investment. It has proven to be a significant diversifier with a reliable uncorrelation to both stocks and bonds. Gold has been a solid hedge against market downturns historically. Gold is particularly attractive for investors with a short time horizon and/or a low risk tolerance. There are several popular, highly liquid, low-cost ETFs to track the spot price of gold bullion. All the above gold ETFs are available on M1 Finance. The online broker has zero transaction fees and zero account fees, and offers fractional shares, dynamic rebalancing, and a modern, user-friendly interface and mobile app. I wrote a comprehensive review of M1 Finance here.

Disclosures: None.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Hi,

I really like this site, and plan on following it closely. I read your piece on AVUV and small value investing and I think it was very well done. I am looking forward to passing your information on to my children, and to reading more of your material. my brain is a bit tired from reading about the small caps right now and skimming some of the other info, but as soon as I read your intro in investing in “gold” I decided I need to ask you this question NOW. I am 59 years old & have about 150K extra that I received in life insurance upon the passing of my dear spouse, that I may possibly use in the next couple years. I’d like to keep between 30K and 50K as emergency funds for my young adult children and myself, but I’m not sure I need to keep it all in cash since I have about 240K (@50%) of short term treasuries in my taxable retirement fund. Besides the retirement fund, my main asset is the family home which I don’t feel I can sell now being that it is too soon. I’m considering putting the 100K into the home over the course of a year or two, which “might” be a good investment of the money because my house is appraised for about half a million, and I literally live adjacent to 2 million dollar homes, and have experience in building and subcontracting.

So now that you mention gold as a short term asset, I am thinking I should consider buying it. The other alternative for now are I bonds which as you probably know, are linked to the CPI, but I don’t know if I can buy more than 10K worth. Would you mind sharing your thoughts and how I would go about purchasing the gold, as a lump sum or in increments? Thanks,

Thanks for the kind words! Gold is a decent short-term diversifier if you have a fixed liability or simply want to try to minimize volatility and risk. TIPS are linked to inflation and you can buy as much of them as you want. I like the idea of retirees using TIPS as a significant part of their bond allocation. But short treasuries are great too. Anyway, to answer your question, depending on the total purchase amount, I’d either buy all at once or average in over a short period like 2 months. I showed in a separate post why dollar cost averaging is suboptimal on average, but it has its psychological benefits.

Also keep in mind gold is extremely volatile so it only takes a pinch to add some buffer for the total portfolio. I’d probably never put more than 10% of the total portfolio in gold.

Hope this helps!