I bonds are low-risk, inflation-linked savings bonds from the U.S. government. Here we'll review why, when, where, and how to buy them.

Update – January 2023: I bonds are now paying a composite rate of 6.89% for savings bonds issued between November 1, 2022 and April 30, 2023.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

I Bonds Video

Prefer video? Watch it here:

Introduction – Inflation and the Case for I Bonds

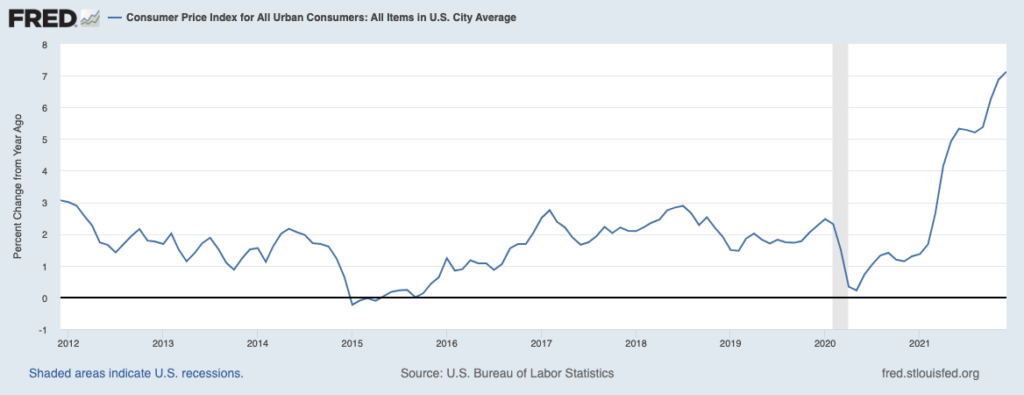

Unless you've been living under a rock, you know inflation has been heating up. Maybe you didn't know. Have you seen prices around you for things like food, gas, homes, and used cars going up? That's inflation. Inflation just means a rise in prices. Specifically relevant to the discussion here is the CPI or Consumer Price Index, a measure of inflation for consumer goods and services. I won't bore you with the details here (those are in a separate post here), but the important thing to note is that things are getting more expensive at an accelerated rate.

In October, 2021, we saw a 30-year record high for inflation.

At the same time, people are always looking for the best safe havens for short-term cash. With interest rates at record lows and inflation at record highs, now your savings account or CD earning 0.50% interest is losing money. A lot of money. Even 10-year bonds for both nominal treasury bonds and TIPS have negative real yields currently.

Some people shy away from bonds because they say they're “for old people.” Some bond investors shy away from savings bonds because they think they're complex or boring or that they don't pay much or that they're difficult to buy. None of these things are true. We want to protect the purchasing power of our cash reserves however we can.

Enter a seemingly unglamorous, somewhat esoteric product called Series I savings bonds, or I bonds, which most people didn't even know existed until recent headlines. And no, “iBonds” are not the newest product from Apple.

In November, 2021, these bonds from the U.S. Treasury began paying a guaranteed 7.12%. Let me say that again. There is a virtually risk-free asset from the United States government with a guaranteed 7.12% return. Show me another risk-free, guaranteed asset or investment vehicle paying anything close to that right now and I'll eat my hat. Did I mention they're federal tax-deferred and exempt from state and local taxes?

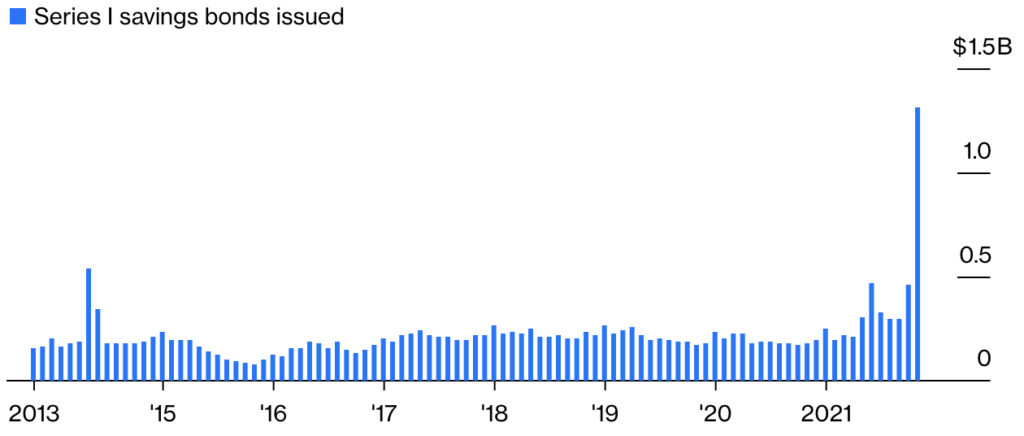

This extremely high interest rate has attracted unprecedented attention. According to their data, the U.S. Treasury issued a record-high $1.3 billion in Series I Bonds in November 2021, followed by a whopping $2.78 billion in December 2021, and $3.3 billion in January 2022. Here's what that looked like through November relative to previous months and years:

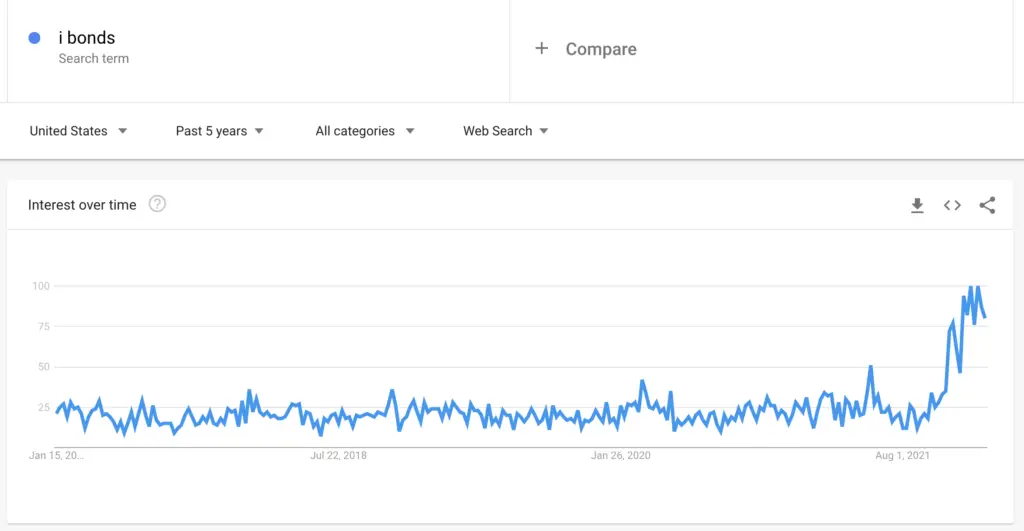

Here's Google search interest data from Google Trends for the past 5 years, with the same spike for November, 2021:

What Are I Bonds?

I bonds are low-risk savings bonds issued by the U.S. Treasury that adjust for inflation. The “I” actually stands for “inflation.” They were created in 1998. Like other types of treasury bonds, I bonds are “backed by the full faith and credit of the U.S. government.” As such, and because they cannot lose money, I bonds are considered to be basically riskless. In fact, because they are debt obligations of the Treasury, they are actually more secure than Social Security benefits.

Series I savings bonds can be used to park savings, to supplement income, to pay for educational expenses, or to give as a gift. You must have a Social Security Number and be a U.S. citizen, a U.S. resident, or a civilian employee of the United States to be eligible to buy them.

I bonds earn interest for 30 years or until you cash them out, which you can do after holding for 1 year. Like other treasury bonds, they are tax-free at state and local levels. They are also federally tax-free if used for qualified education expenses. I bonds are available in both electronic and paper form, the latter of which can only be purchased when filing your federal income tax return.

There is no secondary market for savings bonds, so they do not have price volatility.

How Do I Bonds Work?

The interest rate on I bonds is a combination of two components – a fixed rate that remains unchanged for the life of the bond and a variable inflation rate that adjusts every 6 months based on the CPI-U (Consumer Price Index for Urban Consumers). Interest is earned for 30 years or until you cash out the bond.

I bonds have a minimum holding period of 1 year. Another important stipulation is that if you hold for less than 5 years, you sacrifice the most recent 3 months' interest. For example, if you sell after 24 months, you only get 21 months of interest. Interest is earned monthly and compounded semiannually. In this sense, it is like a 15-month CD with an interest rate far more attractive than any available CD.

I bonds adjust for inflation twice a year, on May 1 and November 1. Again, their interest rate is a composite rate with two components. The inflation rate component is based on the CPI-U – as a measure of inflation of consumer prices – for the previous 6 months.

That is, if the CPI-U for the previous 6 months is determined to be 5%, for example, then the inflation rate component of the I bonds is 5%. Further suppose, for example, that the fixed rate component is 3%. That I bond will thus pay about an annualized 8% interest rate for at least the next 6 months, at which point the inflation rate will adjust again. Similarly, if you own an I bond that you bought 20 years ago with a fixed rate of 5% and the current inflation rate is 5%, the total composite rate for that bond will be about 10%.

The exact calculation is as follows:

Composite rate = [fixed rate + (2 x semiannual inflation rate) + (fixed rate x semiannual inflation rate)]A cool feature of I bonds is that you get 6 months of the current rate at the time you buy them regardless of when exactly you buy them. For example, suppose you buy I bonds in April at a rate of 5% but then that rate drops to 4% on May 1. You will still get 5% on your bonds until October 1, even though the rate changed in May. Similarly, monthly interest shows up on the first day of each month, so you'll earn the interest rate for the full month in which you buy even if you buy on the last day of that month.

Interestingly, at the time of writing, I bonds happen to have a 0% fixed rate and a 3.56% variable semiannual inflation rate, for a nominal annualized return of 7.12% and a real return (return adjusted for inflation) of zero. Understand though that this may still generate a positive real return for you if your own personal inflation is not as high as the broad CPI-U metric. For example, if you don't need to buy a car anytime soon (or if you don't drive at all) and you generate your own electricity via solar panels, your personal inflation rate should be reliably lower than the CPI-U measurement, of which energy services, fuel/oil, and vehicles are currently the primary contributors.

This 7.12% is the highest variable rate ever paid since I bonds were first introduced in 1998. Not even risky junk bonds are paying this much!

If the fixed rate component rises, you can easily redeem your old I bonds and buy new ones at the higher rate, without having to worry about selling at a discount like with a traditional bond fund on the secondary market.

I Bonds Rates

Update – April 2022: The CPI was 8.5% in March 2022, so I bonds will likely adjust upward again on May 1, 2022. This doesn't necessarily mean you should wait; 7.12% is already extremely high.

Update – January 2023: I bonds are now paying a composite rate of 6.89% for savings bonds issued between November 1, 2022 and April 30, 2023, based on a fixed rate of 0.40% and a semiannual inflation rate of 3.24%.

I Bonds Purchase Limits

Unfortunately, there are some purchase limits for I bonds. Those are $10,000 electronic per person per year, and $5,000 paper per person per year. These limits are imposed per TIN (tax identification number), so I bonds can be bought by individuals, trusts, and businesses.

For example, if you use a separate TIN for your business, you as an individual could buy $10,000 electronically per year and your business could also buy $10,000. Similarly, couples filing jointly have a purchase limit of $20,000 electronic annually, and a married couple with 2 living trusts could buy $40,000 electronic annually.

Corporations, partnerships, and other entities cannot buy paper I bonds.

I bonds you receive as gifts count toward these limits unless the transfer is due to the death of the original owner.

How To Buy I Bonds

Unlike other treasury bonds or a bond fund, I bonds cannot be bought from a regular broker like Vanguard or Fidelity. They must be purchased directly from the U.S. Treasury, whose website is appropriately named TreasuryDirect.

The specific steps look like this:

- Open a TreasuryDirect account.

- Link your bank account.

- Buy I bonds.

I'll go ahead and warn you that the TreasuryDirect website is pretty antiquated and the account creation and purchase process is a bit cumbersome, but remember you'll only be logging in at most twice a year, so it's not a huge concern. You don't need to constantly check your account like you would with a portfolio of stocks, because you already know exactly what your return will be.

With your TreasuryDirect account, you can designate a co-owner or a beneficiary.

Buy paper I bonds by submitting IRS Form 8888 with your federal tax return.

Electronic I bonds can be redeemed through the TreasuryDirect website. Paper I bonds can be cashed by mail or at some financial institutions.

Buying I Bonds as Gifts

I bonds may be a unique, attractive gift for occasions like birthdays, weddings, graduations, etc.

To buy I bonds as a gift, you and the recipient both must have TreasuryDirect accounts and you must know their account number. You must also know their full name and Social Security Number or TIN.

Savings bonds gifts can be given to both adults and children. Children under 18 can only have a TreasuryDirect account if a parent or guardian sets up a special minor account for them. Giving I bonds as a gift to children can be especially useful considering the tax benefits when using the earned interest to pay for qualified higher education expenses.

When giving savings bonds as a gift, you are required to buy and hold the bonds in your account for at least 5 business days before delivering them to the recipient so that the bank transfer for purchase has enough time to complete.

Upon delivery, recipients receive an email announcement notifying them of the gift.

You can give paper I bonds as a gift when filing your tax return (if you are owed a refund) by having the bonds be issued in the recipient's name.

Tax Benefits and Considerations of I Bonds

Again, interest from I bonds is tax-free at state and local levels and is taxable federally if not used for qualified education expenses.

I bond owners can report interest every year or simply wait until you cash the bond and report all the interest at once when you file your tax return for that year. The latter is obviously usually going to be the better choice, as it allows you to defer taxes so the interest compounds faster. The former may be useful if the I bonds are in a child's name, as the child would almost certainly be paying a lower tax rate than they'll incur in the future. You can also selectively choose to redeem I bonds in years when you have a low tax rate, offering valuable flexibility.

I bonds will be automatically cashed when they mature at 30 years if you don't do it prior.

You will receive form 1099-INT showing the interest amount for your bonds you've cashed.

I Bonds vs. EE Bonds

Electronic purchase limits, tax considerations, compounding period, and redemption and penalty periods are all the same for I bonds and EE bonds. The only real difference between I bonds and EE bonds is their interest rate and inflation protection, which are likely the most important pieces of consideration when buying savings bonds.

Whereas I bonds pay a composite rate of a fixed rate plus a variable inflation rate, EE bonds only pay a fixed rate but are guaranteed to double in value if held for 20 years. If held that long, the Treasury literally makes a one-time adjustment to double the initial face value. This creates an effective annualized return of about 3.6%.

As such, in a nutshell, I like to view I bonds as more of a short-term tool with the potential for long-term use, while EE bonds are long-term only, waiting for that doubling at the 20-year mark. You should want to hold them that long, as the fixed interest rate on EE bonds is usually negligible; at the time of writing it is 0.10%.

If you know you'll be holding long term, it's sort of a bet on whether or not the variable inflation rate of I bonds will be high enough to double in 20 years. That is, it's a bet on how high or low inflation will be. With sustained high inflation, I bonds could very well double in 10 years, making them the obvious choice. Put another way, given high enough inflation, your EE bond doubling in nominal terms may still result in a negative real return over the 20-year period.

Or with relatively low inflation like we've seen on average historically, the I bonds may take 30 years to double and the EE bond would have been the better choice. It's impossible to know the future.

Given these characteristics, I would submit that it almost never makes sense for a young accumulator to buy EE bonds, and that they can utilize other types of bonds more effectively in their portfolio diversification efforts. An EE bond is invariably a 20-year bond with no built-in inflation protection. An I bond is linked to inflation and can be anything from a 1-year to a 30-year bond; it's up to you. Consequently, I much prefer I bonds to EE bonds, even if only for their greater flexibility.

EE bonds become more attractive for older investors close to retirement who want a safe parking garage for cash, who are maximizing tax-advantaged contributions already, and who will have a low tax rate upon redemption after 20 years. Remember though that the EE bond still relies on low average inflation over the 20-year period to be able to generate a positive real return.

Note that paper EE bonds are no longer available.

I Bonds vs. TIPS

I bonds may sound like TIPS to you. TIPS are Treasury Inflation Protected Securities, or simply inflation-linked bonds. TIPS and I bonds are similar in structure and function, but have a few key practical differences:

- Remember that I bonds cannot be traded on secondary markets; TIPS can. You can buy individual TIPS directly at auction through the Treasury, or you can buy TIPS funds via ETFs through your regular broker.

- Whereas I bonds have an inflation rate component that adjusts with inflation semiannually, TIPS adjust the principal for inflation semiannually, upon which the fixed interest rate is based.

- TIPS can also decrease in value with deflation, whereas I bonds cannot lose value.

- Similarly, periods of negative real interest rates mean TIPS have negative real interest rates. I bonds have a floor of zero and cannot go negative.

- Because TIPS can be traded on the secondary market, they can be sold before maturity. Whereas I bonds must be held for at least 1 year, TIPS may be sold before then.

- Interest payments and upward inflation adjustments to the principal of TIPS are federally taxable in the year in which they occur, whereas federal tax reporting of interest on I bonds can be deferred until redemption. Both TIPS and I bonds are exempt from state and local income taxes.

- There is no purchase limit for TIPS. There is a $10,000 purchase limit for electronic I bonds.

- TIPS can be bought in an IRA. I bonds cannot be bought in an IRA.

So if we're talking about an IRA, TIPS are the only option. TIPS are also the next inflation-linked option if you've maxed out your I bond purchases ($10k electronic and $5k paper annually).

If we're dealing with taxable investments, I bonds are probably the better choice if holding for at least 1 year, as the interest and adjustments on TIPS are taxable in the year in which they occur.

At the time of writing, for a short investing horizon, I bonds are the clear winner compared to short TIPS because TIPS have negative real interest rates.

I Bonds FAQ's

Why are I bonds a good investment?

I bonds may be a good investment if you want to invest up to $15,000 annually in a virtually riskless, inflation-linked asset to hold for at least one year.

Why are I bonds a bad investment?

I wouldn't say I bonds are ever a “bad” investment, but remember your investment is locked up for a year and I bonds cannot be bought in an IRA, so they may not be suitable for your particular situation.

Can I buy I bonds at Vanguard?

No, you cannot buy I bonds at a brokerage like Vanguard, Schwab, or Fidelity. They must be bought directly from the U.S. Treasury.

Is there an I bond fund or ETF?

No, there is no such thing as a fund or ETF for Series I Savings Bonds. They must be bought directly from the U.S. Treasury.

Can I buy I bonds in an IRA?

No, I bonds cannot be bought in an IRA.

Can I bonds be purchased at a bank?

No, I bonds cannot be purchased at a bank. They must be purchased directly from the U.S. Treasury. However, you can redeem paper I bonds at some financial institutions.

Are I bonds safe?

Yes, as short-term U.S. Treasury debt obligations, I bonds are one of the safest investments in existence.

Are I bonds worth it?

Only you can decide if up to $15k annually of a virtually riskless, inflation-linked asset is worth it for you.

Can I bonds lose value?

No, I bonds have a floor of zero and cannot lose value.

Will I bonds go up or down?

It's impossible to know the future. The inflation rate for Series I Savings Bonds fluctuates with the CPI, or Consumer Price Index, every 6 months. As we've seen, that rate can go up and down. Remember that I bonds have a floor of zero and cannot lose money.

Who sells I bonds?

I bonds must be bought directly from the U.S. Treasury at TreasuryDirect.gov.

Where can I bonds be purchased?

You can buy I bonds at TreasuryDirect.gov or by electing on your tax return to buy them with your tax refund.

When do I bonds pay interest?

I bonds pay interest monthly, which is compounded semiannually.

When do I bonds mature?

I bonds mature after 30 years.

Are I bonds taxable?

In most cases, yes. Interest from I bonds is federally taxed as income but is exempt from state taxes. I bond interest can be federally tax-free if used for qualified education expenses.

How are I bonds taxed?

Interest from I bonds is federally taxed as income and is exempt from state taxes. I bond interest can be federally tax-free if used for qualified education expenses.

When are I bonds taxed?

You can choose to pay taxes on interest from I bonds in the year in which you accrue that interest or at a later date when you redeem your I bonds.

Can I bonds have a beneficiary?

Yes, you can designate a beneficiary for your I bonds.

Can I bonds have negative yield?

No, I bonds have a floor of zero and thus cannot have a negative yield.

When did I bonds start?

Series I Savings Bonds were first issued in 1998.

Conclusion – Are I Bonds A Good Investment?

Plain and simple, I bonds protect cash from inflation, thereby preserving your purchasing power. They can make a great addition for anyone with spare cash that they won't need for at least a year.

Both young investors and retirees get what is essentially an inflation-adjusted emergency fund that is highly liquid and virtually risk-free. Parents can use them as a college savings vehicle for kids. For investors who are seeking an asset for direct inflation protection, here's an option.

I bond rates today handily beat those of savings accounts, money market accounts, T bills, certificates of deposit (CDs), TIPS, and even high yield corporate bonds. They are made even more attractive considering stock market valuations are at all-time highs as well, presenting a headwind for equities going forward. Granted, these things may change in the future. But right now I bonds sound like a no-brainer to me.

If your financial advisor is truly looking out for your best interest (and worth their salt), they might mention I bonds to you. But most probably won't, because they can't buy them for you and they don't make a commission on them. They'd rather take your $10,000/year and invest it in something on which they can make a commission. Bring up the topic – and all the aforementioned benefits – of I bonds and see how your advisor reacts, and then let me know in the comments.

This is perhaps a more important point than it seems at first glance. Recall that I bonds are not a marketable security. They cannot be packaged into an I bonds ETF. So no one can make money off them. Thus there's not much of an incentive to write about or explain them. They have no price volatility or interest rate risk or credit risk for the talking heads on TV and YouTube to speculate about. This is probably why you've never heard of them until now.

Just remember there are a few important stipulations to keep in mind:

- First, you can only buy $10,000 electronically and $5,000 paper annually. This might be a drop in the bucket for some. Some see that limit and say it's not even worth their time. Nonsense. IRA contribution limits are half that of I bonds and no one complains about those not being worth their time…

- Secondly, you must hold for at least a year. You might need your emergency fund in the next year, so don't go all in at once with all your cash. If using I bonds as an emergency fund, it makes more sense to average in throughout the year to get around the challenge presented by the one-year hold requirement.

- Lastly, remember that if you cash out in less than 5 years, you sacrifice the last 3 months of interest.

Do you own I bonds? Does the recent rampant inflation have you thinking about buying some? Let me know in the comments.

Update – April 2022: The CPI was 8.5% in March 2022, so I bonds will likely adjust upward again on May 1, 2022. This doesn't necessarily mean you should wait; 7.12% is already extremely high.

Update – January 2023: I bonds are now paying a composite rate of 6.89% for savings bonds issued between November 1, 2022 and April 30, 2023.

Disclosures: I bought $10k of I bonds in November 2021, another $10k in January 2022, and another $10k in January 2023. I am in no way affiliated with TreasuryDirect.gov.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Can a US church that is not a registered 5013c but has a tax identification purchase an ibond (for an endowment). Can they purchase it if they do register as a 5013c? From the drop down selection, ‘corporation’ is the closest entity.

Actually not sure about this one. Best to consult a tax professional.

What’s the minimum amount you can buy?

$25

Do you receive any cash dividends from I bonds while holding them, or do you only get your dividends when you cash them out??

Interest is earned monthly and compounded semiannually.

What would happen if several thousand people would cash in their I bond at the same time. Would the Treas have the money available. I imagine the Treas must invest the funds, so could they handle a big payout?

My wife and I are co-trustees of a trust. Our plan is to individually purchase purchase I Bonds (we may also purchase a bond under the trust). Can the trust be named as a beneficiary on the individual bonds?

Thank you for a well written and very informative article.

Great Article!

I have bought my 10,000.00 worth of I bonds for 2022. Do I get the bonds in the mail? Am I suppose to register the bonds?

Thanks, Natasha! No and no.

Can HOA nonprofit corporation purchase electronic I Bond. Sounds like a good place for reserve funds.

Should be able to, yes. NPO’s can buy securities.

if my wife and i buy 20000 in i bonds, and we hold it for a year what will our return be

I already walked through this in the post. It will be 6 months at the current rate and then 6 months of whatever the future rate is. Current composite rate as of today is 9.62%.

My husband and I are both self-employed, separate businesses. Can we each purchase $10K for our businesses (separate EINs) and then an add’l $10K for our personal SSNs?

Also, if purchased on a Saturday (e.g. April 30th), is it an April purchase date, which I read is ideal, or is it not effective until Monday, 5/2?

Thanks so much!

Follow up question: if yes, and if one of us owns 2 businesses, can that person purchase $10K per business?

Yes, if different TINs.

Yes. Should be effective for day of purchase.