PFIX is an ETF from Simplify to hedge against upward interest rate changes and volatility. It returned a whopping 92% in 2022. But is it a good investment for 2024? I review it here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

PFIX ETF Review Video

Prefer video? Watch it here:

PFIX ETF – What It Is and How It Works

PFIX from Simplify launched in mid-2021 and has quickly amassed over $330 million in assets.

PFIX uses over-the-counter (OTC) interest rate options to provide direct, convex exposure to upward movements in long-term interest rates and interest rate volatility. Convexity in this context basically means a larger movement means a larger payoff.

For those curious, that OTC derivative is specifically a 7-year OTC payer swaption (an option on a swap). This allows PFIX's managers to hold the option position for extended periods or extreme rate movements. Maturity, term, and strike price are chosen to minimize ownership costs and maximize convexity.

This exposure is functionally similar to a short position on long-term treasury bonds with long-dated put options. The OTC derivatives used are typically only available to institutional investors. PFIX also holds some straight T-bills and TIPS to help pay for the derivatives and to offer some potential income to investors.

This sort of means that, while it may sound confusing, PFIX is long the short end of the yield curve and short the long end. Say that 5 times fast.

Traditionally, hedging large upward interest rate movements was also challenging and expensive because it required the use of futures. PFIX is the first of its kind in providing a way for retail investors to use exotic strategies that are usually reserved for the big guys in one single ETF wrapper with favorable liquidity and tax treatment characteristics, all at a pretty modest fee of 0.50%.

PFIX also pays an appreciable distribution yield of 2.98% at the time of writing.

“Interest Rates,” Fed Rate Hikes, and the PFIX ETF

When we say “interest rates,” we mean the Federal Funds Rate (FFR), also called the overnight rate. This is the interest rate set by the Federal Reserve (the Fed for short) for overnight lending between banks.

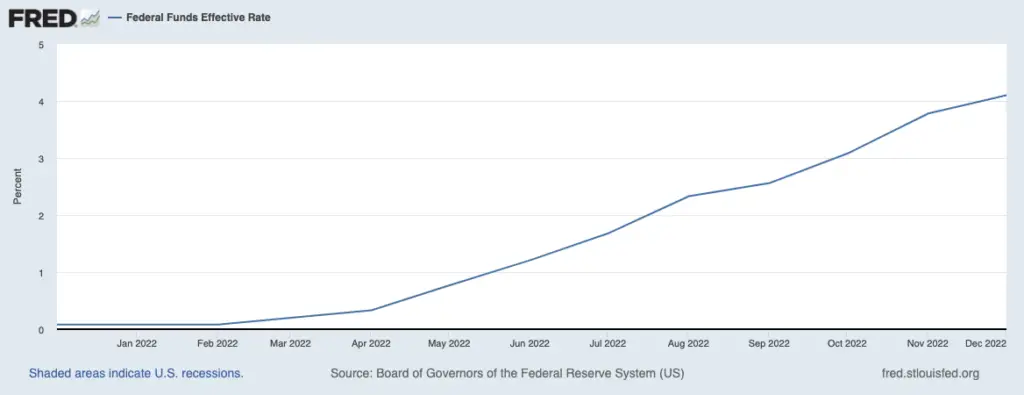

Recall that PFIX benefits from “upward movements in interest rates.” Hopefully your spidey sense is tingling, because interest rates have indeed been going up rapidly and drastically in recent months with the Fed aggressively trying to combat inflation. These upward changes in interest rates by the Fed are referred to as “Fed rate hikes.”

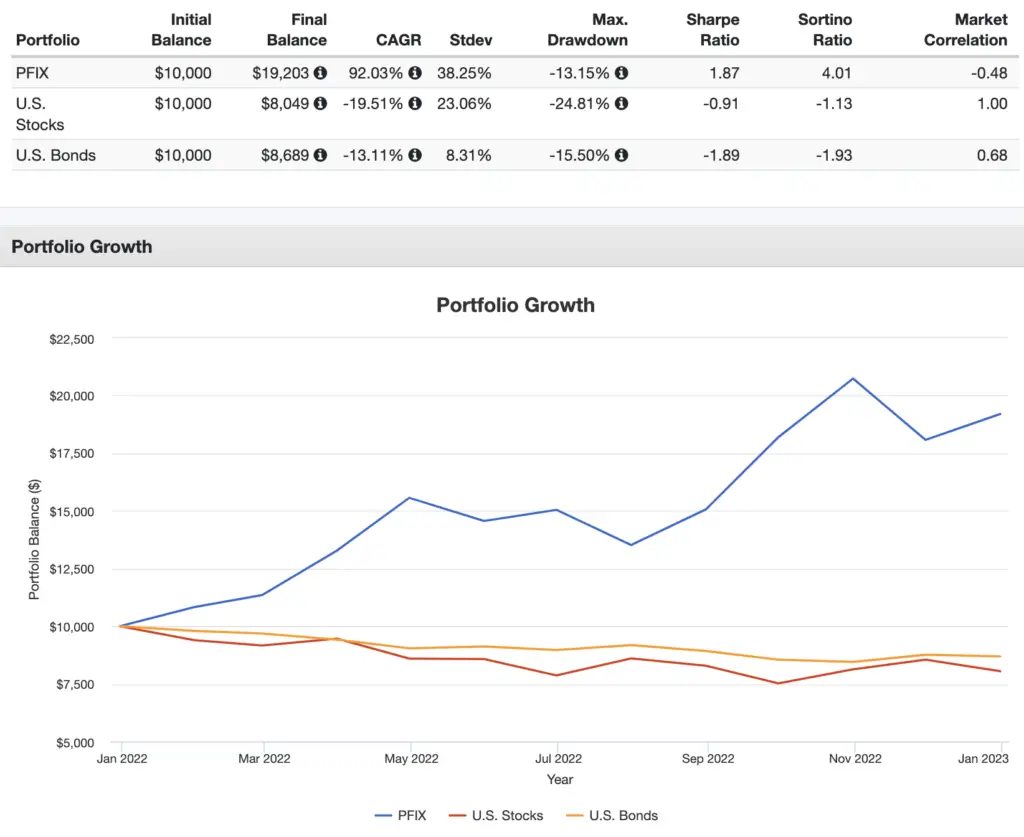

To put it simply and straightforwardly, PFIX benefits from Fed rate hikes, arguably more so than any other ETF out there. This is what allowed PFIX to be one of the best performing funds of 2022 – a year that saw several Fed rate hikes – with a massive return of 92%, while the U.S. stock market and U.S. bond market were down 20% and 13% respectively:

This illustrates how PFIX can address an environment that hurts other assets. This has also made PFIX the most popular of Simplify's funds.

In other words, PFIX seems to have launched at the perfect time to take advantage of its strategy.

What will 2024 look like for PFIX? No one knows.

Is PFIX a Good Investment?

So is PFIX a good investment? Maybe.

2022 was clearly a great proof of concept for PFIX's considerably clever and incredibly effective strategy.

Rapidly rising interest rates are usually bad for growth stocks, bonds, and real estate, so PFIX can help investors address that risk and hedge those assets in their portfolios. Of course the start of 2022 would have been the best time to buy PFIX, but with the Fed explicitly indicating that they intend to continue with rate hikes at least until inflation gets under control, PFIX may have more upside yet to be seen.

In early 2023, the bond market is indeed behaving like the Fed will continue aggressively raising rates, meaning investors believe there's no end in sight. That would be great for PFIX.

Also obviously keep in mind that the opposite can occur just as easily. If interest rates drop, we would expect PFIX to go down. It is not without its risks.

In that sense, PFIX is likely best used tactically. If the music stops for Fed rate hikes, it may be wise to abandon the fund. The problem is no one knows when exactly that will be. I personally don't think that will be until at least late 2023, but my crystal ball is broken. The point is it would make little sense to hold PFIX over the long term.

Conveniently, PFIX should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

At the very least, I think PFIX is considerably clever. What do you think of PFIX? Do you own it? Let me know in the comments.

Disclosure: None.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply