VYM is Vanguard's dividend-yield-oriented ETF. VOO and VTI are their broad market index funds for the S&P 500 and total U.S. stock market. Let's compare them.

In a hurry? Here are the highlights:

- VYM, VOO, and VTI are all very popular U.S. stock funds from Vanguard.

- VYM tracks the FTSE High Dividend Yield Index. VOO tracks the S&P 500 Index. VTI tracks the CRSP US Total Market Index.

- As such, VYM is solely U.S. large cap dividend stocks (all Value, no Growth), VOO is U.S. large-cap stocks across both Growth and Value, and VTI is essentially VOO plus small- and mid-cap stocks.

- VOO and VTI include REITs; VYM does not.

- VOO and VTI are much more diversified than VYM.

- VOO and VTI have significantly outperformed VYM going back to VYM's inception in 2006. In fairness, the Value premium has suffered greatly over that time period. Historical performance of VTI and VOO has been nearly identical.

- VOO and VTI are more popular and slightly cheaper than VYM.

- VYM is likely unsuitable as a core holding in a well-diversified investment portfolio.

Contents

Video

Prefer video? Watch it here:

VYM vs. VOO and VTI – Methodology and Composition

We can compare VYM to both VOO and VTI at the same time, as both VOO and VTI capture “the market” in the U.S. and perform nearly identically; VOO is the S&P 500 and VTI is the total U.S. stock market. I delved into comparing VOO and VTI here.

VYM, established in 2006, is a narrower segment of the market. It is the Vanguard High Dividend Yield ETF. It has about 400 holdings. As the name suggests, the fund holds large-cap U.S. stocks with a high dividend yield. Specifically, the fund seeks to track the FTSE High Dividend Yield Index.

The index is market cap weighted, and attempts to forecast dividend yield. REITs are excluded. Stocks forecasted to have no dividend yield or that haven't paid a dividend in the past 12 months are also excluded. As such, VYM is entirely exposed to large cap value; it has no exposure to large cap growth stocks, as they tend to not pay a dividend.

Sector weightings are naturally very different for VYM than for VOO or VTI. Thus, VYM alone would not be sufficient as a core holding for a diversified investment portfolio, and should probably only be used to tilt, or overweight, high dividend stocks in one's portfolio. This may be attractive for dividend investors; I'm not a dividend investor, but I did design a dividend-focused portfolio that incorporates VYM.

VOO is the Vanguard S&P 500 ETF. Established in 2010, it is one of the most popular ETFs out there. The fund seeks to track the S&P 500 Index, holding over 500 U.S. large-cap stocks, weighted by market capitalization. This index is considered a barometer for the U.S. stock market. VOO is roughly half large cap value and half large cap growth. As such, it is more diversified than VYM.

VTI is the Vanguard Total Stock Market ETF. It was established in 2001. VTI provides similar broad exposure to the U.S. stock market, but also includes small- and mid-cap stocks. Specifically, VTI is about 82% large cap stocks, 12% mid cap stocks, and 6% small cap stocks.

The fund seeks to track the CRSP US Total Market Index. This ETF has over 3,500 holdings. Consequently, VTI can be considered more diversified than VOO.

All three of these funds only hold stocks in the United States. Both VOO and VTI include REITs, while VYM does not.

VYM vs. VOO and VTI – Historical Performance

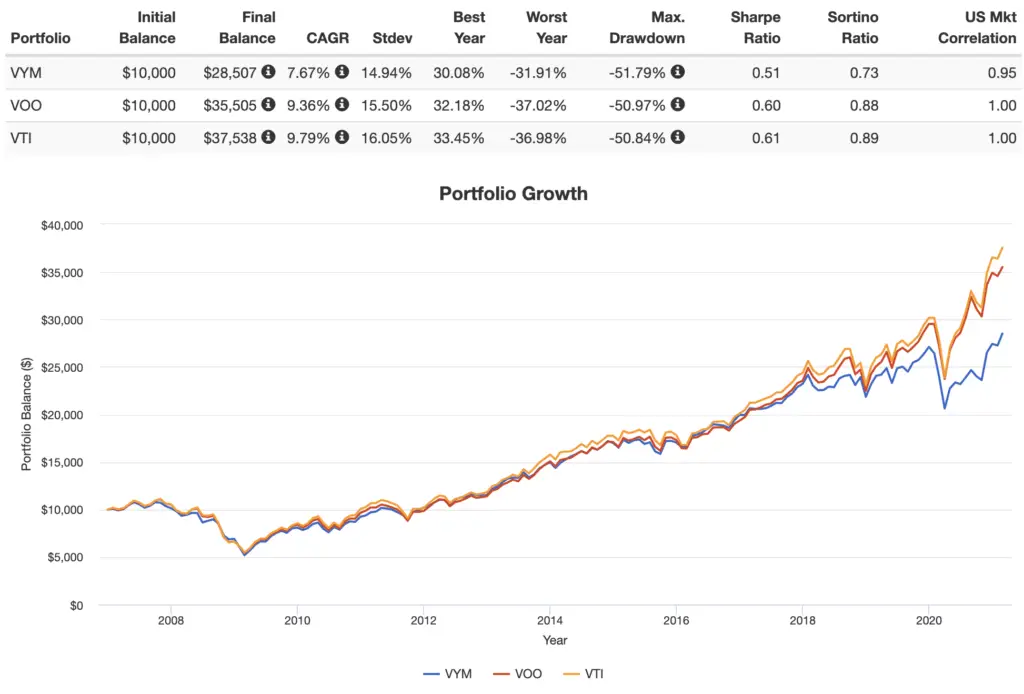

Going back to 2006 when VYM was incepted, VOO and VTI have beaten it handily:

In fairness, we should expect this result, as VYM inherently has much more exposure to the Value factor, and the Value premium has suffered over the past decade.

VYM vs. VOO and VTI – AUM and Fees

Though all three of these funds are highly liquid and very popular, Vanguard's VOO and VTI are much more popular than VYM with over $550 billion and $900 billion in assets, respectively, compared to about $33 billion for VYM.

VYM has an expense ratio of 0.06%, while both VOO and VTI are cheaper with an expense ratio of 0.03%.

Conclusion

Investors seeking broad, diversified exposure to the U.S. stock market should use VOO or VTI as a core holding. VYM only looks at large-cap, high-dividend-yield stocks in the U.S. and is thus likely better suited as a dividend tilt for those looking to use dividend yield as income or those who want a suboptimal Value factor tilt.

VOO and VTI have outperformed VYM going back to VYM's inception in 2006, as VYM has no exposure to Growth, which has beaten Value over that time period, highlighting the importance of diversification across equity styles.

VOO and VTI are also more popular and slightly cheaper than VYM.

Conveniently, all these funds should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

Disclosure: I am long VOO.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

I have $100k saving. I like to invest in dividend ETFs to earn some monthly income in stead of investing it in CD. I am looking at these ETFS VYM, SCHD, VOO, QQQ. Some of them are very high so I have this question.

Should I buy SCHD @$76/share and earn $0.67 / share in dividend?

or

Should I buy VOO @$398/share and earn $1.33/share in dividend?

I think the cheaper ETF prices is the better dividend income.

However, I am sure if my thought is right.

Can anyone please clear my thought on this?

Thanks very much.

Have a nice day!

Hi Jenny. These would be very different investments. Don’t focus on the share price. Also remember dividends are not free money, so unless you’re specifically using them as income, there’s no reason to chase the yield.

What does mean :“ dividends are not free money”?

Share price compensates for the dividend payment. See this post.

Hi Jenny , I’m on. the same stage, too. What did you do?