Webull and M1 Finance have grown in popularity recently as no-fee investing platforms. Here we'll compare them.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

M1 Finance vs. Webull – Summary Comparison

Contents

M1 Finance vs. Webull – Commissions and Fees

Both M1 Finance and Webull offer fee-free investing if above the $10k account value threshold. No trade commissions. There are obviously miscellaneous one-time fees for things like paper statements, outbound account transfers, etc.

M1 and Webull use the same clearing firm – Apex Clearing.

M1 Finance vs. Webull – Account Types

M1 Finance offers the following account types:

- Taxable

- Joint

- Traditional IRA

- Roth IRA

- Rollover IRA

- SEP IRA

- Trust

- Custodial

Webull only offers a few of these:

- Taxable

Joint- Traditional IRA

- Roth IRA

- Rollover IRA

SEP IRATrust

Neither platform offers the following:

- SIMPLE IRA

- Solo 401(k)

- 529

- HSA

- Non-Profit

M1 Finance vs. Webull – Investment Products

M1 Finance offers most ETF's and individual stocks traded on major exchanges.

Webull offers the same, plus options and crypto trading.

M1 Finance vs. Webull – Customer Service

I've seen both positives and negatives for both M1 Finance and Webull in relation to their customer service. M1 Finance is available by phone or email 5 days a week. Webull's representatives are available 24/7.

M1 Finance vs. Webull – Margin

M1 typically wins out on margin rates. Margin is simply a collateralized loan on your invested securities to provide enhanced exposure for investing or trading.

The margin loan from M1 Finance can be used for whatever you want – refinancing higher-interest debt, major purchases, unexpected expenses, etc.; it's just a low-interest collateralized loan.

Remember that margin is an additional risk, including the risk of losing more than you invest. Margin is not available for retirement or custodial accounts. Rates may vary.

M1 Finance vs. Webull – Mobile App

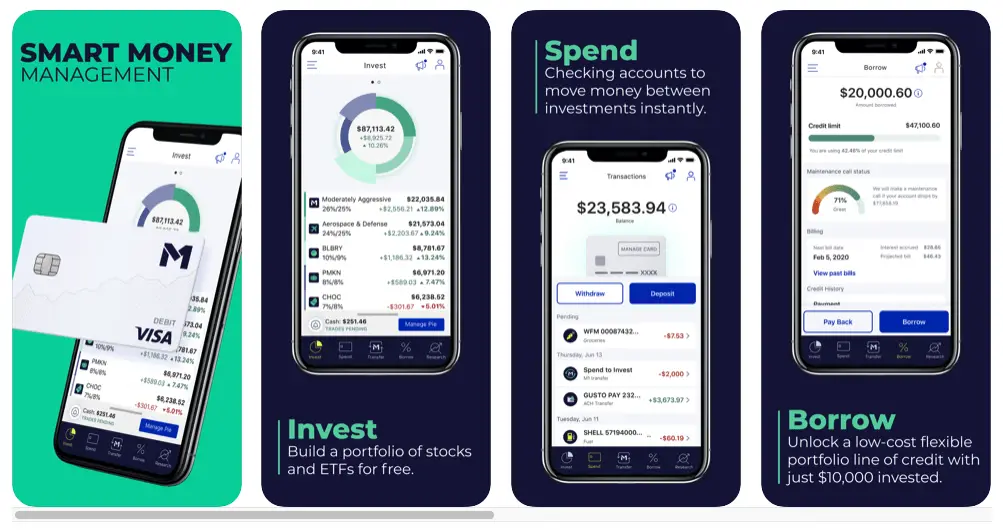

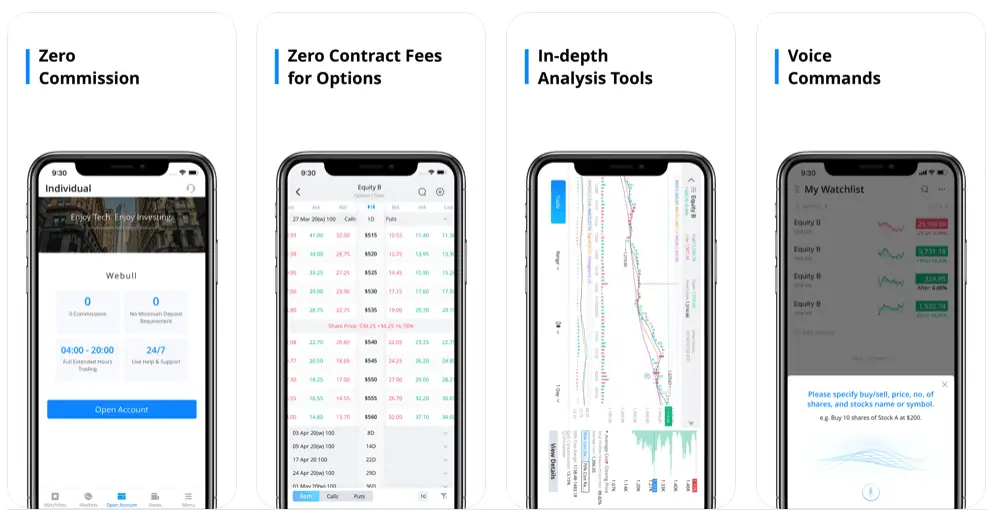

M1 Finance and Webull both have sleek, modern, intuitive, robust mobile apps for both Apple iOS and Android.

Here are some screenshots of the M1 app:

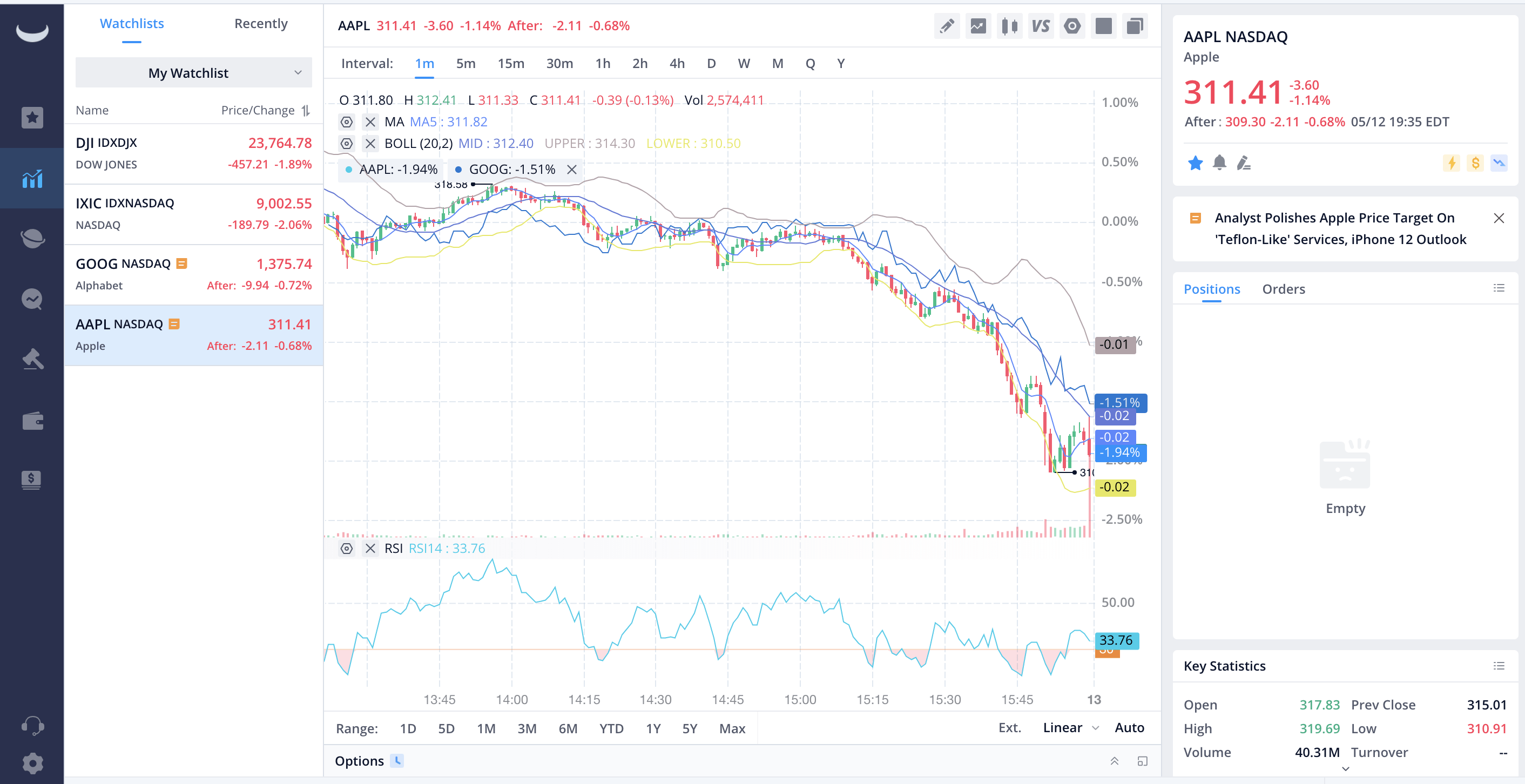

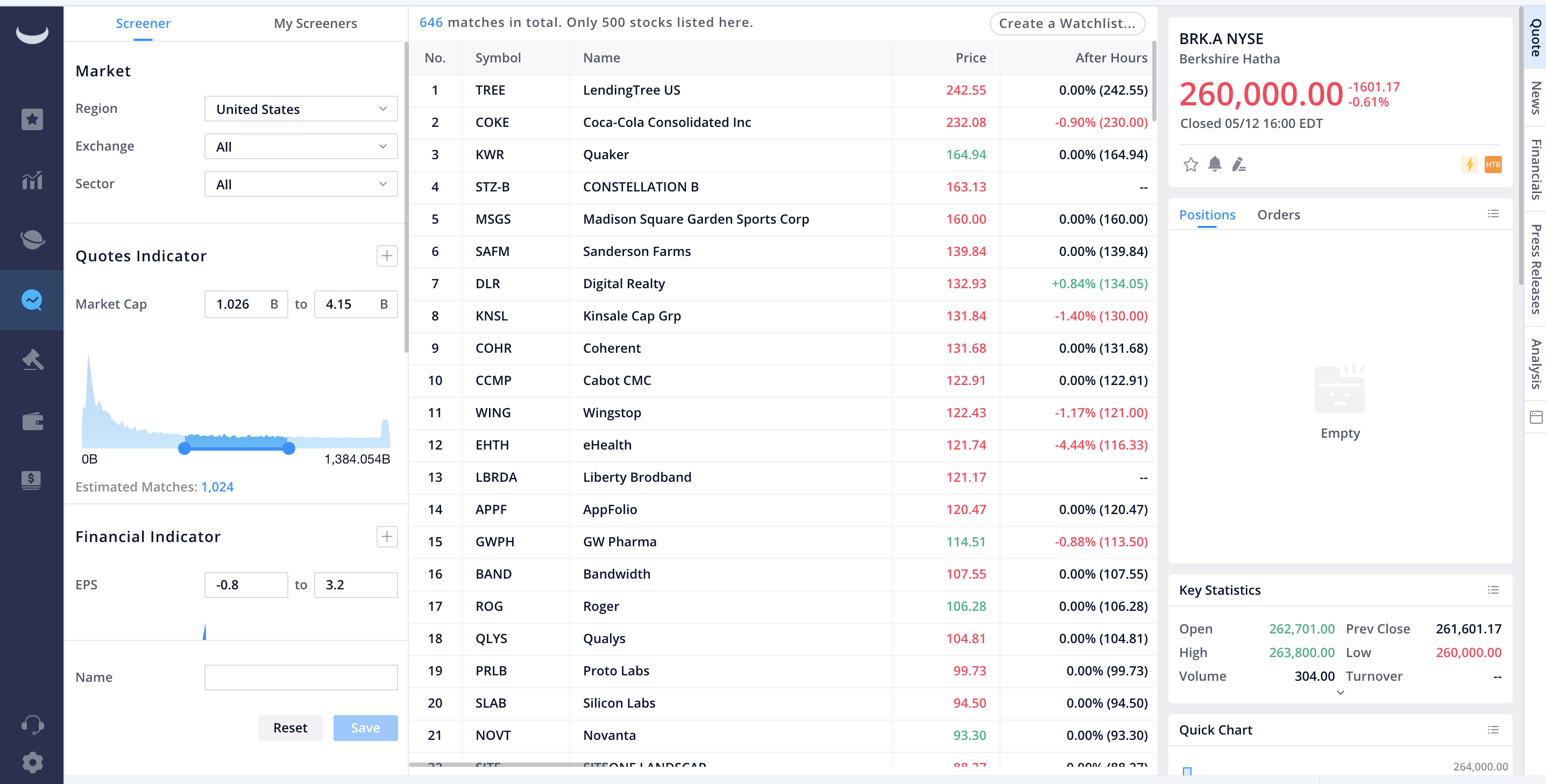

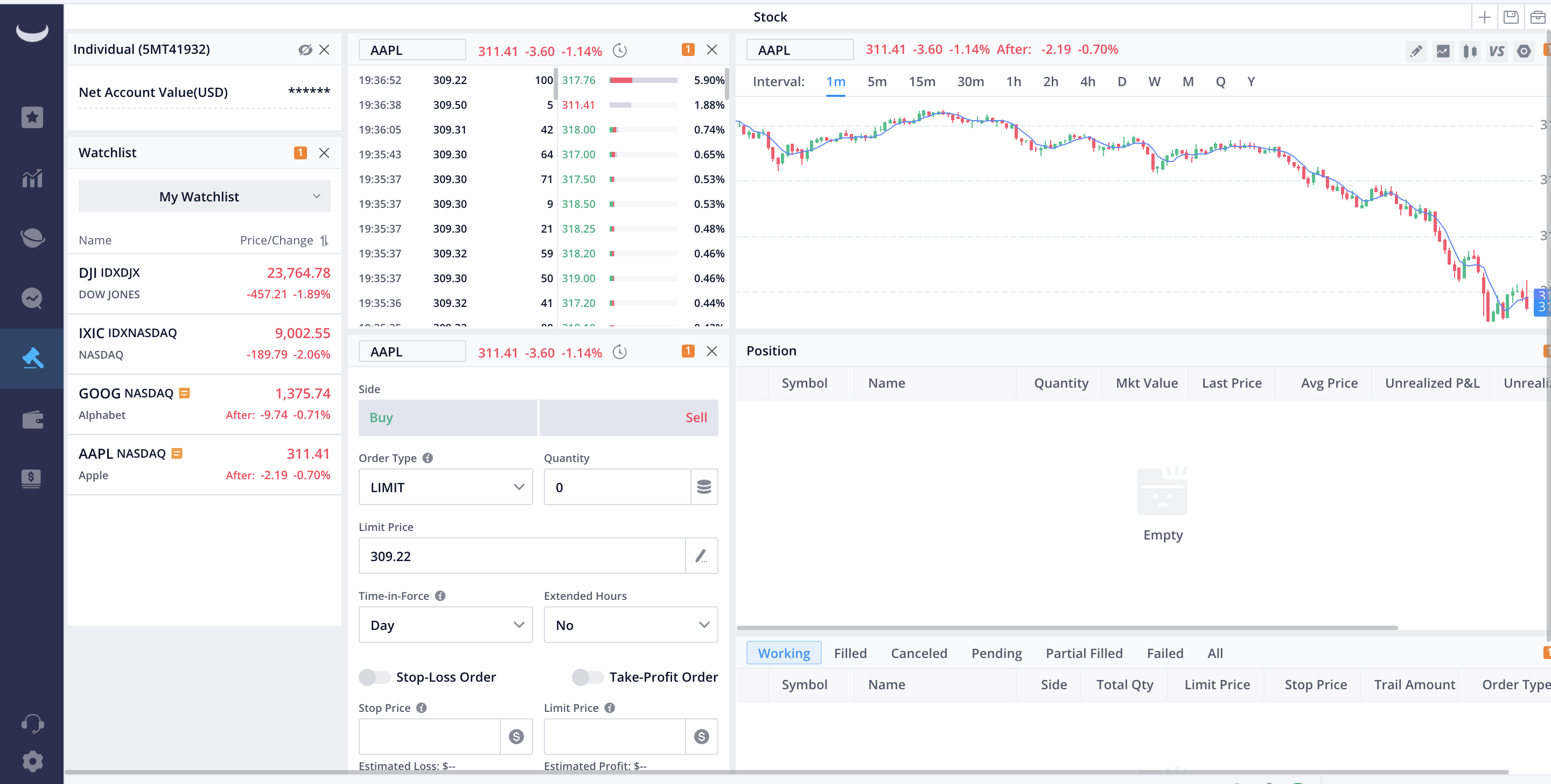

Here are some screenshots of the Webull mobile app:

M1 Finance vs. Webull – Interface/Usability

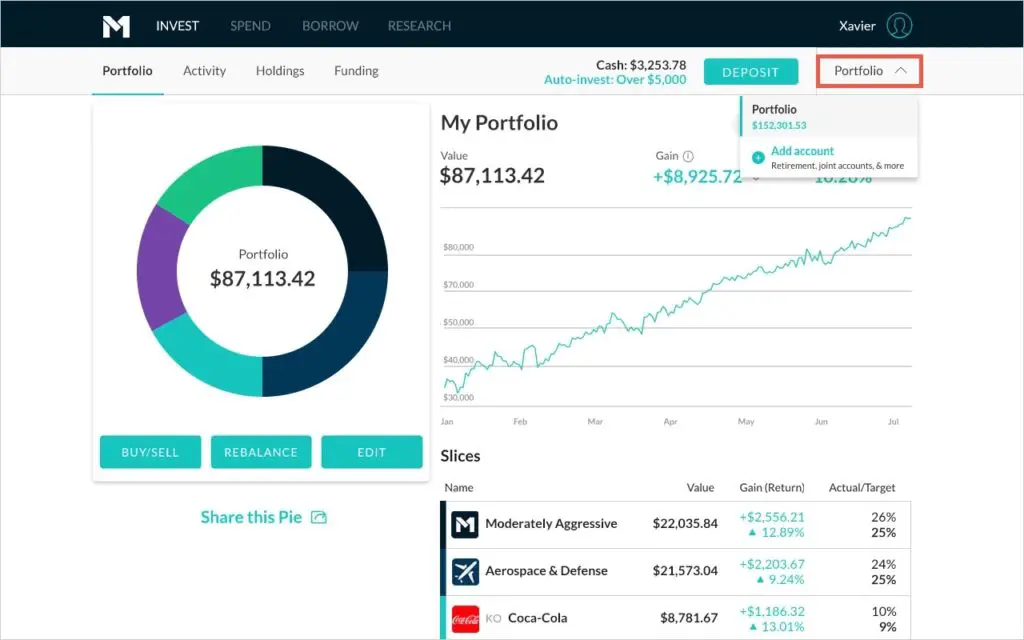

M1 Finance has a very intuitive, simple interface that will be easy to navigate for beginner and seasoned investors.

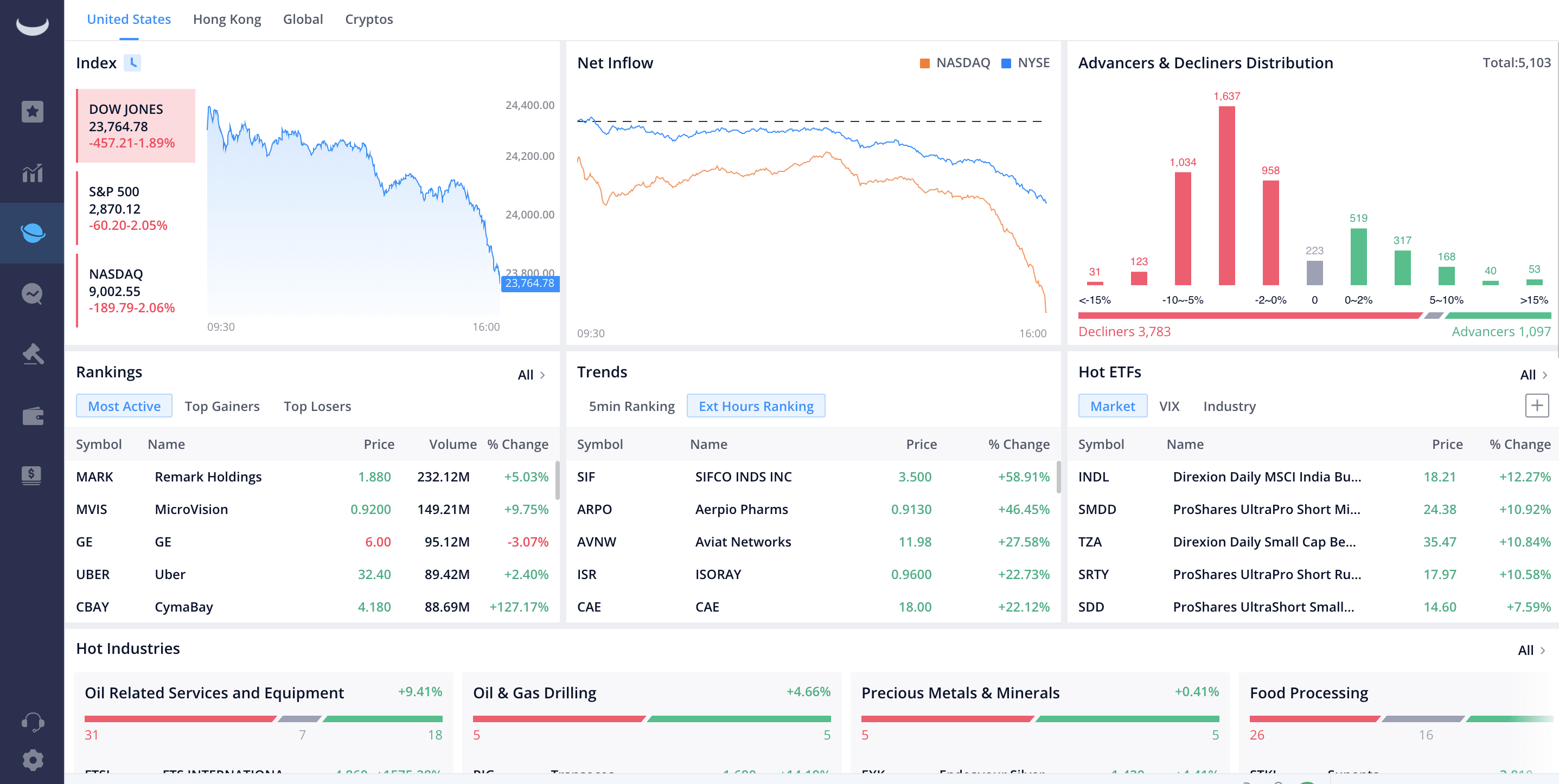

Webull, being built for trading and having more technical charting and research tools, has a more complicated interface that will be more familiar to experienced traders. As a full-fledged trading platform, Webull also offers free access to their desktop application. M1 is strictly web-based.

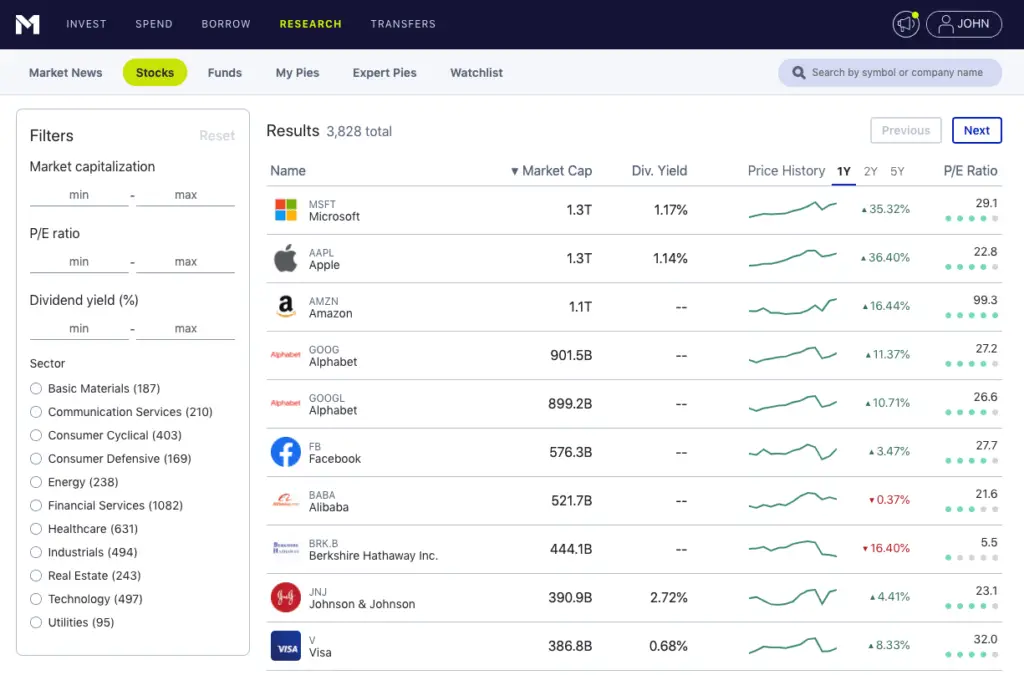

Here's M1 with its pie-based visualization:

And here's Webull:

M1 Finance vs. Webull – Extra Features

M1 Finance offers an optional FDIC-insured high yield cash account, making it a collection of financial tools instead of just an investing platform.

Webull offers much more robust technical analysis and research tools, which makes sense since it's a trading platform. M1 has a pretty basic stock and ETF screener that will be fine for most investors.

M1 Finance features “dynamic rebalancing,” using new deposits to automatically rebalance your portfolio to its target asset allocation, and fractional shares, a feature that allows every penny to work for you. Webull has neither of these things.

As a trading platform, Webull obviously offers an all-day trading window and order control. M1 Finance, on the other hand, being built for long-term buy-and-hold investing, has two daily trading windows in the morning and afternoon, and no advanced order control.

In terms of user education, Webull's articles will be a little more technical in nature. Both platforms have a blog where they post useful tips and guides. Webull also offers extended hours trading.

M1 Finance vs. Webull – Summary and Conclusion

- If you couldn't already tell, M1 Finance and Webull are largely two different things for two different audiences. M1 was designed for long-term buy-and-hold investing. As such, it is a poor choice for day trading. Webull was built for traders, and includes options contracts. These facts shine through in the aspects of each platform.

- Both M1 Finance and Webull offer commission-free investing.

- M1 Finance offers a few more account types than Webull, namely Joint, SEP IRA, and Trust accounts.

- M1 Finance offers most ETF's and individual stocks. Webull offers the same, plus options contracts and crypto trading (Bitcoin, Litecoin, etc.).

- Customer service should be comparable between the two platforms.

- M1's margin rates are much lower than those of Webull.

- M1 Finance and Webull both have solid mobile apps for both Apple iOS and Android.

- The web user interface will be slightly more confusing on Webull, as it's built for experienced traders. M1's desktop web interface is easy to navigate. Webull also adds a desktop application that M1 doesn't have.

- M1 Finance offers an optional FDIC-insured checking account, which Webull doesn't have.

- M1 employs automatic rebalancing and fractional shares. Webull has neither of these.

- M1 is also probably better if you want to implement a “lazy portfolio” and have it rebalance automatically.

M1 Finance is great for both beginner and seasoned long-term investors who want full portfolio control, zero fees, and access to cheap margin. Unlike Webull, M1 is not designed for day traders. M1 has a more intuitive interface and is better suited for beginner investors. It offers more account types, an optional checking account, fractional shares, and automatic rebalancing, and is thus better for long-term buy-and-hold investing.

Webull seems to be better suited for short-term traders than for long-term investors. As such, it naturally has better technical analysis and research tools and order control. This comes at the cost of a slightly less intuitive interface, though, so Webull is more appropriate for seasoned traders rather than for beginner investors. Webull lacks a checking account, fractional shares, and auto-rebalancing, but it does offer options trading and all-day trading that M1 doesn't have. Webull also has fewer account types and more expensive margin rates. Sign up for Webull here (get 2 free stocks – valued from $12 to $1400 – after depositing $100).

I wrote a separate comprehensive review of M1 Finance here if you're interested in seeing the nuances of the platform.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply