DIVO is an income ETF from Amplify. It uses active management to select blue chip stocks and then write covered calls on them. I review it below.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Video

Prefer video? Watch it here:

Introduction – What Is DIVO and How Does It Work?

DIVO is an ETF from Amplify, the folks who brought you SWAN. Its name is the Amplify CWP Enhanced Dividend Income ETF. As the name suggests, this fund aims to provide income from both dividends and call option premiums. The fund is managed by the sub-advisor Capital Wealth Planning (CWP). CWP refers to this as an Enhanced Dividend Income Portfolio (EDIP). DIVO launched in late 2016. It has a little over $600 million in assets and an expense ratio of 0.55%.

DIVO actively selects 20-25 stocks across all sectors in the S&P 500 based on dividend growth (think VIG) and strong earnings. It is pretty similar to JEPI in this regard. These are mega cap blue chip stocks like Microsoft, Apple, Johnson & Johnson, McDonald's, and Visa, to name a few. Incidentally, this selection methodology actually translates into appreciable loading on the Profitability and Investment factors.

The fund then overlays a tactical covered call writing strategy on some of the holdings to generate additional income. As a brief refresher, covered call writers own the underlying and collect a premium on the option, and the buyer of the call option has the right, but not the obligation, to buy the underlying at the strike price at or before expiration.

For example, if I own a fund like VOO for the S&P 500 Index and I think it's going to be relatively flat for the next 30 days or so, I might sell a call option on it, for which I receive cash immediately (called the premium). The buyer of that call option is hoping VOO goes up. As the seller, I'm hoping it stays flat. Call options are usually sold to generate income in a flat or mild bear market.

DIVO's selection methodology funnel is outlined as follows from Amplify themselves:

DIVO aims to deliver annual income of about 2-3% from dividends and an additional 2-4% from option premiums. The fund makes monthly distributions.

DIVO vs. QYLD

DIVO is the same fundamental idea as QYLD from Global X, just with a different management style and on a different index. I reviewed QYLD here.

Whereas DIVO is actively selecting a handful of mega caps from the S&P 500, QYLD is passively holding the NASDAQ 100 Index. Both funds write covered call options to generate income.

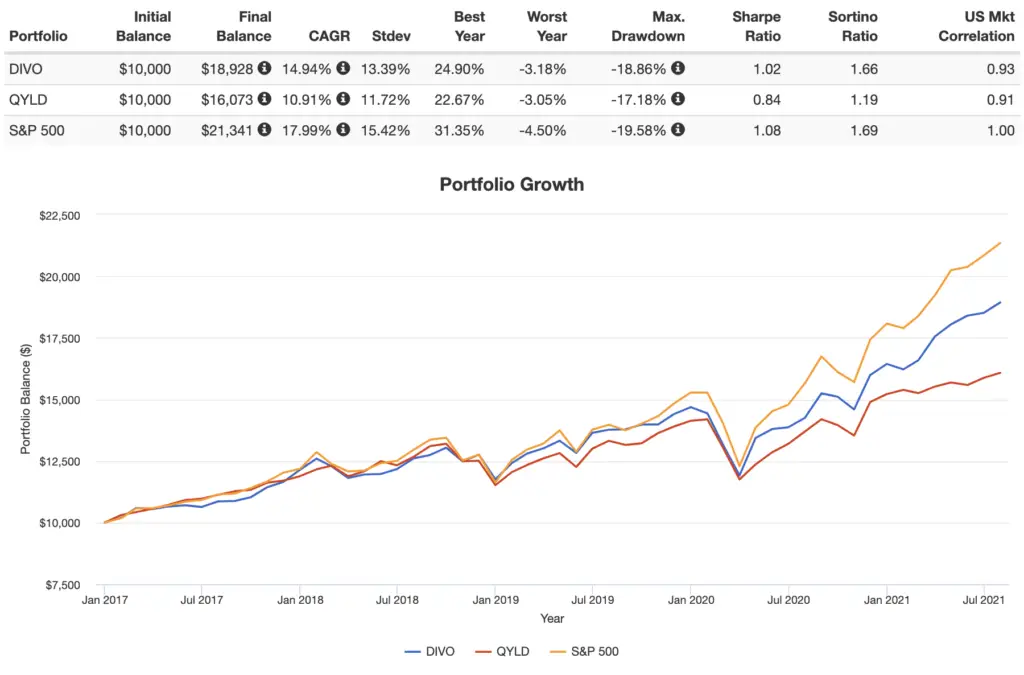

Here's how DIVO has performed versus QYLD and the S&P 500 going back to 2017:

DIVO has outperformed, primarily because it doesn't execute the same volume of call options as QYLD and thus has roughly half the distribution yield. I'll explain this in a second. As a result, DIVO allows for more upside potential of the underlying holdings. DIVO is also a bit cheaper than QYLD.

Both have lagged the S&P 500, even on a risk-adjusted basis.

Is DIVO a Good Investment? Possibly, but Only if You Need Income.

I like that DIVO is using the S&P 500, but I don't like that they're only selecting a handful of stocks from it. This helps DIVO maintain a more consistent high distribution yield, but we would expect stock picking to underperform the market over the long term. I think it would be better – and cheaper – to just hold a representative sample from the index and then sell some covered calls on those stocks.

In my review of QYLD, I noted how its upside potential is severely hindered by its huge, likely-unsustainable yield. DIVO is almost like a QYLD lite, and I think that's a good thing. DIVO only writes covered calls on some (30-60%) of its holdings. This leaves room for capturing more upside of the underlying index when it rallies, which has paid off historically. We would also expect this to be better over the long term, as we expect the market to go up more than it goes down. Granted, this also means DIVO's yield is lower than QYLD's, but total return is ultimately what matters.

For whom is this fund appropriate? DIVO is for the dividend investor who is using yield as regular income that they need to cover expenses, who also desires active management and stock picking. Full disclosure, I am neither of those things.

If you're just planning on reinvesting the fund's distributions, it doesn't make much sense to buy DIVO. If you're bullish on the S&P 500, buy a low-cost S&P 500 index fund like VOO and call it a day. This is especially true in a taxable environment where DIVO's tax drag will be larger, because you're taxed on every distribution, regardless of whether or not you reinvest it. Personally, I'm a fan of simply selling shares as needed for any “income” needed, which should be mathematically preferable anyway if you don't actually need that income on a monthly basis, as it allows you to leave more money in the market longer.

But if income is the concern, a combination of dividend stocks and high-yield bonds may appeal to you and would be cheaper. I think “income” is overrated anyway. I'd be more likely to go with something like SWAN or SPD and just set up an automatic monthly transfer from the brokerage account that sells shares for me; there's my “income.” Again, I'm not a dividend investor anyway, so these types of yield-focused strategies don't appeal to me regardless. I'd rather create my own dividend when I want to.

Also remember that covered calls cap the upside potential of the underlying holdings at the strike price of the option. They're not a free lunch. If the stock rallies, you don't get to fully participate.

Lastly and arguably most importantly, covered calls don't protect the downside. The fund will drop with the underlying stocks. Another covered call fund, NUSI, does offer downside protection by buying protective put options. But there's another way to hedge against a stocks position that existed long before these exotic option strategy funds came about: decrease stocks and add bonds. A traditional 60/40 portfolio has outperformed DIVO historically on a risk-adjusted basis. In fairness, bonds are looking questionable right now at historically low yields and may not provide the same protection in the future that they have in the past, so income investors may have a reason to include at least a small allocation to a covered call fund like DIVO. Only time will tell.

What do you think of DIVO? Let me know in the comments.

Disclosures: I am long VOO in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply