The Rob Arnott Portfolio takes an all-weather approach to maximize diversification and mitigate volatility and risk. Here we'll review its components, performance, and ETFs to use in its implementation.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Who Is Rob Arnott?

Rob Arnott is the founder and chairman of Research Affiliates, a research and asset management firm famous for publishing seminal research and then investing based on that research. He has been one of the most prolific investing authors of his time, with over 130 papers published in financial journals.

Arnott and Research Affiliates are famous for their idea of “fundamental indexing,” or using firms' valuation fundamentals, like earnings and cash flow, as a weighting scheme instead of traditional market cap. They were granted a patent for this index methodology in 2009. Arnott lays out the details of this so-called “smart beta” approach for retail investors in his book The Fundamental Index: A Better Way To Invest. Examples of fundamental index funds include PRF from Invesco and several ETFs from WisdomTree: DGRW, DGRS, and QSY.

You can check out the Research Affiliates model portfolios here.

What Is the Rob Arnott Portfolio?

So first, note that Rob Arnott himself has not explicitly endorsed this portfolio. It has simply made the rounds over the years after he mentioned its components and weightings in an article from 2008 when talking about the arguable suboptimality and expensiveness of hedge funds as a vehicle for most investors. Basically, it was simply used as an example for comparison of performance. I doubt Arnott would actually put his own money into it, and his ideas have almost certainly evolved since its publication with the growing research on equity risk factors, of which he's been a big part.

To get exposure to Arnott's actual research and strategy, you'll want to check out the Research Affiliates model portfolios here.

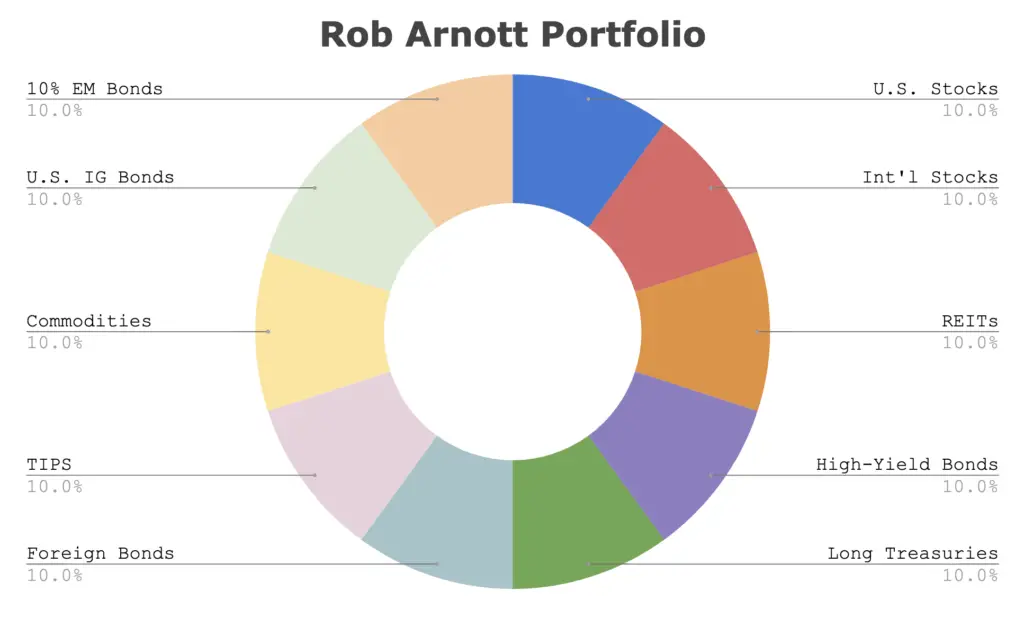

This portfolio is simply an equal weighting of the following assets:

10% Commodities

10% REITs

10% TIPS

10% High-Yield Bonds

10% Long-Term US Treasury Bonds

10% Emerging Markets Bonds

10% Unhedged Foreign Bonds

10% International Stocks

10% U.S. Stocks

10% U.S. Investment-Grade Bonds

At the very least, it is quite a colorful portfolio:

Rob Arnott Portfolio Performance Backtest and Review

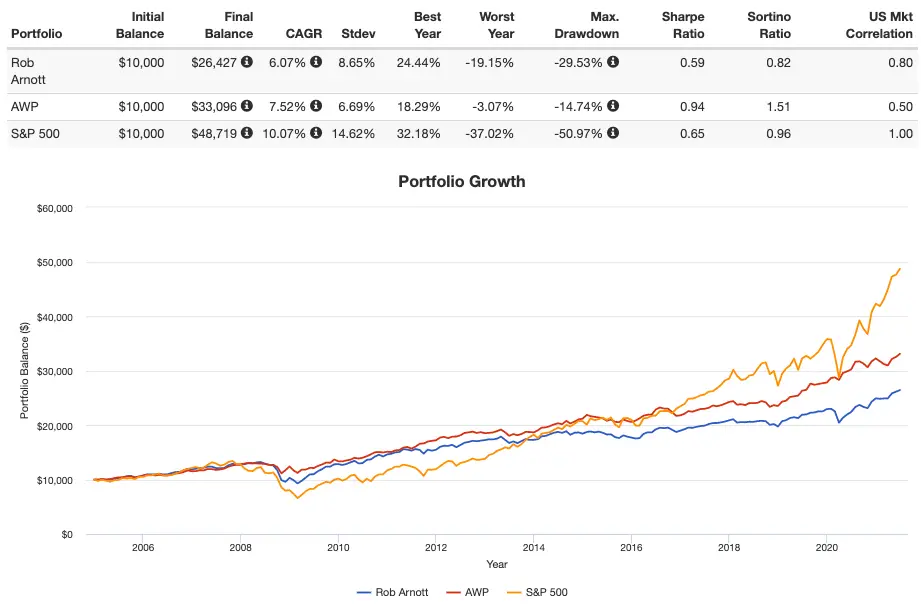

I couldn't get too far with a backtest because this thing calls for some fairly exotic assets like Emerging Markets government bonds and unhedged foreign bonds, but I was able to go back to 2004, through June 2021, comparing it to the famous All Weather Portfolio and the S&P 500:

In short, as was my take on the 7Twelve Portfolio, this appears to be largely a case of diversification for the sake of diversification. But then that was sort of the point in Arnott's original article where this was used as an ad hoc example of delivering modest returns while limiting volatility and risk like a hedge fund would do.

That said, this thing could definitely be simplified. As you can see, the All Weather Portfolio has done a much better job of achieving that goal across the board historically with half the number of assets – greater return, lower volatility, much better worst year, much smaller max drawdown, and of course higher risk-adjusted return. The risk-adjusted return of the Arnott portfolio was even lower than that of the S&P 500!

There are a few reasons for this:

- This portfolio only dedicates 20% to actual equities, half U.S. and half foreign.

- In my opinion, way too much space is being given to assets in what I guess would be an attempt to hedge against inflation, TIPS and commodities, the latter of which I'm not a fan of. I'd also rather use gold over broad commodities.

- We don't need all the different bond funds of varying durations and types. Keep it simple with treasuries. Dalio gets this.

- Using unhedged foreign bonds just seems …weird. This might simply be due to the fact that Arnott is a PIMCO advisor and I believe they had the only product for this asset at that time.

This criticism may sound unfairly harsh, but again, note that Arnott himself would likely never invest in this portfolio. His strategy is much better exemplified by the Research Affiliates Model Portfolios, so go check those out.

Rob Arnott Portfolio ETF Pie for M1 Finance

If for some reason you want to invest in this portfolio, M1 Finance is a great choice of broker with which to do it, because it makes regular rebalancing seamless and easy, has zero transaction fees, and incorporates dynamic rebalancing for new deposits. I wrote a comprehensive review of M1 Finance here.

Using mostly low-cost Vanguard funds, we can construct the Rob Arnott Portfolio like this:

- VTI – 10%

- VXUS – 10%

- VWOB – 10%

- USHY – 10%

- PDBC – 10%

- BND – 10%

- VGLT – 10%

- BWX – 10%

- VNQ – 10%

- SCHP – 10%

You can add the Rob Arnott Portfolio pie to your portfolio on M1 Finance by clicking this link and then clicking “Save to my account.”

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

“If for some reason you want to invest in this portfolio…” this gave me a good chuckle, thank you lol

Unhedged foreign bonds is indeed weird. Is there even a reasonable basis for any investor to invest in that type of product?