SPD offers exposure to U.S. large cap stocks while protecting from severe downturns with put options. I review it here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Introduction – What Is SPD and How Does It Work?

SPD is an ETF from Simplify designed to provide broad equity exposure to U.S. stocks while also offering some downside protection for market crashes. It's called the Simplify US Equity PLUS Downside Convexity ETF. In a nutshell, SPD is holding a basket of U.S. large cap stocks – the S&P 500 Index (the largest 500 U.S. companies) in this case – and then overlaying an actively managed options rolling strategy. This fund launched in late 2020 and has a little over $350 million in assets. It has an expense ratio of 0.29%.

To get its equity exposure, SPD takes 98% of its assets and buys an S&P 500 index fund. Pretty straightforward. Then it takes the remaining 2% and buys cheap, out-of-the-money (OTM) put options on the same index, effectively providing an insurance parachute in the event of an extreme drawdown. That is, when the market crashes, the value of the put options goes up. The options are actively selected and rolled.

Remember, a put option gives the buyer the right, but not the obligation, to buy the underlying security at a specified price (the strike price) within a given time period. The buyer of a put option is hoping the market declines, as that causes the value of the put option to increase.

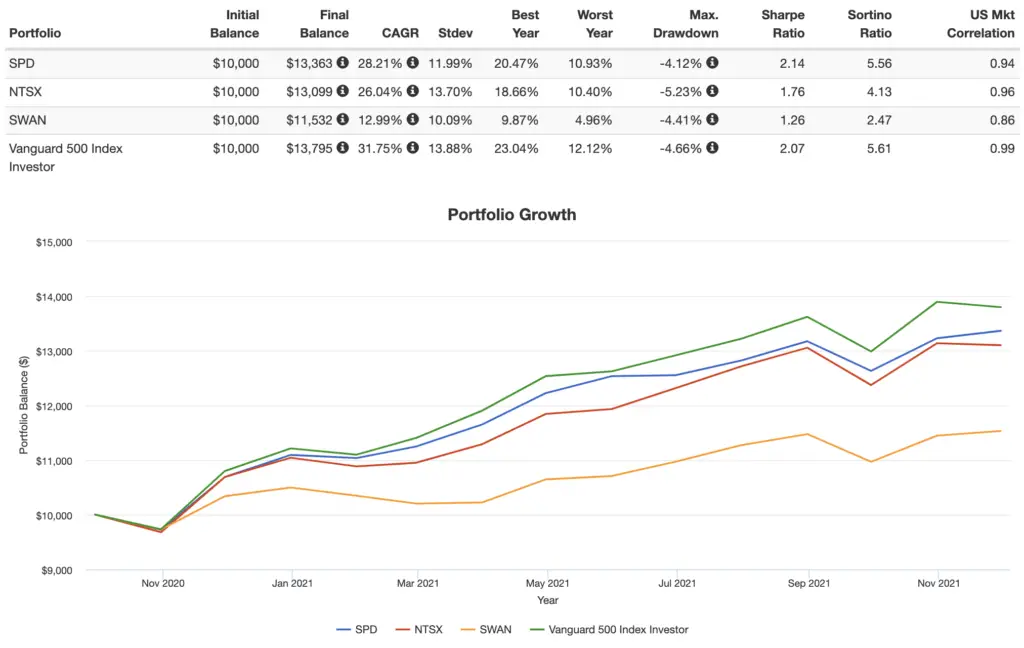

SPD vs. NTSX vs. SWAN vs. S&P 500 – Historical Performance

SPD is roughly in the same family as other multi-asset funds offering downside protection such as NTSX and SWAN, though these funds use treasury bonds to provide that protection, whereas SPD uses put options. I've compared SPD, NTSX, SWAN, and the S&P 500 below. Take this backtest with a handful of salt. Remember, SPD has only been around since September, 2020, which is a shame; it would have been great to see how it behaved just 6 months earlier during the crash in March, 2020.

Note how SPD delivered slightly higher risk-adjusted but lower general returns than the S&P 500. Also note how SPD's volatility and max drawdown were not significantly different from the S&P 500. And we would probably expect that, as only 2% of the funds assets are going to OTM put options and there was not a significant drawdown during the backtested period.

SPD outperformed NTSX and SWAN over the backtested time period because their intermediate treasury bonds suffered during that time. Again, with such a short time period, this backtest shouldn't mean much.

Is SPD a Good Investment? Maybe.

Here's the gist. We would expect SPD to underperform the S&P 500 in a bull, sideways, or even a slightly down market. Specifically, we can estimate that underperformance at about 2%, the cost of the options that expire worthless. Said another way, we're participating in 98% of market beta (market risk) and thus 98% of the market's returns.

We would expect SPD to outperform the S&P 500 in a period with severe drawdowns. In fact, the deeper the drawdown is, the more SPD can profit from it. This relationship is not linear, which is why the word “convexity” is in the name. The backtest above shows a time period with pretty shallow drawdowns, which is why SPD has delivered a slightly higher risk-adjusted but lower general return compared to the S&P 500.

Basically, we're sacrificing 2% exposure to stocks to pay an insurance premium – plus fees – for a policy that will only pay out in an extreme crash. In that sense, SPD is more attractive for short-term and/or risk-averse investors. The long-term investor holding SPD for many years will likely pay more for the premium and fees than the insurance payout is worth. In other words, that insurance would just be a performance drag in an extended bull market. Simplify themselves maintain that this is a “modest drag” that “can be sustained over strategic horizons.”

An important distinction to note is that the put options will only pay off in the event of a severe drawdown. That means a major market crash. SPD isn't going to do much for small corrections. Simplify maintain that extreme market movements will be more normal going forward, emphasizing the need for greater diversification and protection. Further, they suggest that a hedging strategy using derivatives provides “new exposure that can help position portfolios for these new normals in ways traditional assets cannot.”

This may not be untrue. The tails of the S&P 500 have been gradually fattening over the past couple decades. The probability of extreme but seemingly rare market events is called “tail risk,” as they are the tails of a normal probability distribution. Fatter tails means a greater probability/frequency of such extreme events, the negative instances of which are called black swans. SPD aims to hedge against such tail events.

Unfortunately, we're also forced to pay a fee that is 10x that of the very fund that SPD holds for the active management of the 2% of SPD's assets used for the option overlay. In fairness, that fee may be worth the time and effort that would be involved in rolling the OTM put options yourself. For the other 98%, SPD is straightforwardly holding the fund IVV, the popular S&P 500 index fund from iShares that has a tiny fee of 0.03%, which you can go buy yourself. Nothing special going on there. Note that you'd be missing out entirely on small- and mid-cap stocks there, which we would expect to outperform large caps over the long term.

But there's another important argument that may make SPD's options overlay strategy attractive right now. At the time of writing, interest rates and subsequent bond yields are at historic lows, while inflation is very high. This means holding bonds over the short term carries with it an expectation of low or even negative real returns. This unique environment may also impede treasuries' ability to hedge against black swans. I don't try to time the market, but SPD may indeed be a sensible alternative investment for risk-averse investors with a short time horizon.

I have an appreciation for other multi-asset funds for enhanced asset allocation like NTSX and SWAN. The good news is there's no reason why we can't use both NTSX's idea of treasury bonds and SPD's idea of put options. Simplify themselves actually explicitly support this idea, suggesting that this would effectively be “diversifying one's diversifiers.” Simplify advocate for simply replacing one's entire equity position with SPD. Using that and the zero-coupon STRIPS bond fund EDV from Vanguard to roughly approximate NTSX's treasury futures exposure, we can use 90% SPD and 10% EDV to take advantage of both forms of downside protection. Even though these incredibly short backtests don't really mean much, here's how that would have worked out since SPD's inception:

Again, the young accumulator with a long time horizon probably has no need for a fund like SPD, at least until near retirement. I'm reminded of the famous quote from Peter Lynch:

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

In other words, investors sometimes spend too much time worrying about how to protect the downside at the expense of participating in the upside. For a 30+ year investing horizon, the latter, which is the whole reason we're investing in the first place, should be the focus, at least until near the end of the investing horizon. Historically, major crashes of the severity required for SPD to do its magic have only occurred every 7 years on average. If that trend continues, SPD holders may have to sacrifice about 2% per year for those 7 years in between extreme market events, which may add up to a significant drag. 2% compounded over 7 years is about 15%.

That said, we know that investors tend to severely overestimate their tolerance for risk, and I think I prefer SPD over all these new, popular, multi-asset, derivatives-based “income” funds like QYLD, NUSI, DIVO, JEPI, etc. With bonds facing a significant headwind in the near future, SPD may indeed be a valuable addition to the portfolio for the retiree or the investor with a low tolerance for risk, effectively “diversifying your diversifiers,” as Simplify suggests. I'll be curious to see how SPD performs in the next major market crash.

SPD should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

What do you think of SPD? Let me know in the comments.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Disclosures: I am long NTSX and EDV in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Thank you for the e-mail message to read this article, I finally got to it today. I put $100 each, back in June 2021, into SPD, it’s opposite SPUC, the combo SPYC, NTSX, and a couple variations of HedgeFundie just to watch them as my investing journey unfolds. I literally noticed your assessment of how it doesn’t really grow during up or sideways periods. When things start going down, it does too, but not as harshly. For example, up to Christmas and New Year’s, the HedgeFundies and NTSX were looking best. Now in the last 2+ weeks, SPUC, then SPYC, then SPD held up best. I think I agree with you – I’m not going be able to guess & time the ‘black swan’ that makes SPD worth it.

As always, thank you for a well-written article.

Is SPD essentially attempting to replicate the work of Mark Spitznagle’s Universa Hedge Fund in terms of risk mitigation … but for the DIY’r? Would it make sense for a pre-retiree to pair SPD with a fund such as SWAN to reduce Drawdown risk )or perhaps a little more EDV than 10% combined with SPD as you’ve shown?). Thank you for the analysis.

Same idea but to a lesser degree, yes. Yea pairing with bonds would be “diversifying your diversifiers,” as Simplify said.

I’ve held this one for a while about 20% of my money and decided to also add NTSX to be part of that 20% to ensure that if one hedge doesn’t work well at some point, maybe the other one will. SPD relies largely on large changes in volatility causing the options to increase in values. Therefore there are situations where it could fail such as the market slowly going down with volatility not spiking much. Hard and fast crashes are where it will most likely do the best. There are some tools on the simplify site that allow you to simulate the effect volatility will have on the value of the options, you just need to pretend to be someone with a title you might not have when you sign up for an account because they give more information to you then.

It’s not clear to me how much of an upside will only having 2% put options have during a major crash. Looking at Universa’s 2020 investor letter, they recommend their customers to allocate 3.33% of the portfolio to the tail hedge. In March 2020 (during the COVID crash) that hedge returned +3,612%. The YTD CAGR of Universa Tail Hedge (3.33%) + SPX (96.67%) was 11.5%, compared to 7.9% of SPX alone for the periods 03/2008 – 03/2020.

This seems in line with what Mark Spitznagel wrote in some of his earlier essays, where he expected the hedge to grow at least by tenfold (“tenbagger”) in case SPX drops by 15% or more, so you get back 30%+ from your tail hedge, offsetting your losses, and allowing you to “DCA in” to the now cheaper stocks. Over the long term, sustaining small losses due to the hedge is more than made up for by the nonlinear payoff in the major crashes. This is why *over the long term* your CAGR should actually be slightly greater with a proper tail hedge than without one. This is due to volatility drag, as the geometric mean (your CAGR, basically) can be approximated by: arithmetic mean – sigma^2/2, where sigma is the standard deviation (“volatility”). So volatility can really hurt you and make it harder to recover as the drawdowns are steeper than the upturns, and it is it takes more time to recover from them.

I also believe that Universa are doing additional options trading to offset the costs of buying the puts, which reduces the drag even further – something that the passive Simplify fund is not doing.

One last thing, Simplify also have a tail-hedge-only fund called CYA, so you can just buy it in addition to your existing equities portfolio without having to buy their re-packaging of S&P500.

Sounds like Universa is doing something way more advanced because I heavily researched SPD and hold a bit of it, and even in best-case scenario it doesn’t seem like it will do anywhere as well as Universa, but also I don’t meet hedge fund requirements to invest in them.