A Bogleheads 2 Fund Portfolio is a simpler implementation of the popular Bogleheads 4-Fund Portfolio that is globally diversified in stocks and bonds. Here we’ll look at its components, historical performance, and the best ETFs to use for it in 2024.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Bogleheads 2 Fund Portfolio Video

Prefer video? Watch it here:

What Is the Bogleheads 2 Fund Portfolio?

The Bogleheads 2 Fund Portfolio is just a simpler version of the popular Bogleheads 4 Fund Portfolio (that holds global stocks and global bonds), which is just the Bogleheads 3 Fund Portfolio + international bonds.

A 2-fund version of a Boglehead strategy is the least popular of these 3 portfolios, so I'm not going to spend time here going over the benefits of things like indexing and global diversification. If you've landed here, you probably already know those things. If not, go read my post on the Bogleheads 3 Fund Portfolio first and then come back here.

The point of this post is just to show how a Bogleheads 2 Fund Portfolio is the simplest, most agnostic implementation of global indexing for stocks and bonds outside of a target date fund, and it can be implemented with low-cost Vanguard funds. As such, it makes a nice choice for Boglehead purists and minimalists. This is more important than it may seem at first glance, as simplicity in portfolios is extremely valuable psychologically and its benefits are often overlooked.

I'm also not going to go over different asset allocations between stocks and bonds. Remember that there's no set prescription for asset allocation by Boglehead model portfolios, and investors are encouraged to choose their own based on their personal goal(s), time horizon, and risk tolerance. I've got a post covering that here. As such, keeping with the theme of simplicity for the discussion here, I'm going to be using what is arguably a one-size-fits-most allocation of 80/20, meaning 80% stocks and 20% bonds.

Using 2 funds eliminates the need to choose how much money should go to the U.S. and how much money should go to international markets for both stocks and bonds, type(s) of bonds, and bond duration. This approach lets the market decide those allocations, assets, and effective duration based on their relative market cap weights.

As such, this is again the most agnostic, hands-off way to implement this type of Boglehead strategy, which effectively saves the investor a lot of mental effort and mitigates uncertainty and the investor's own biases. Using 2 funds instead of 4 funds also simplifies rebalancing, saving the investor time as well.

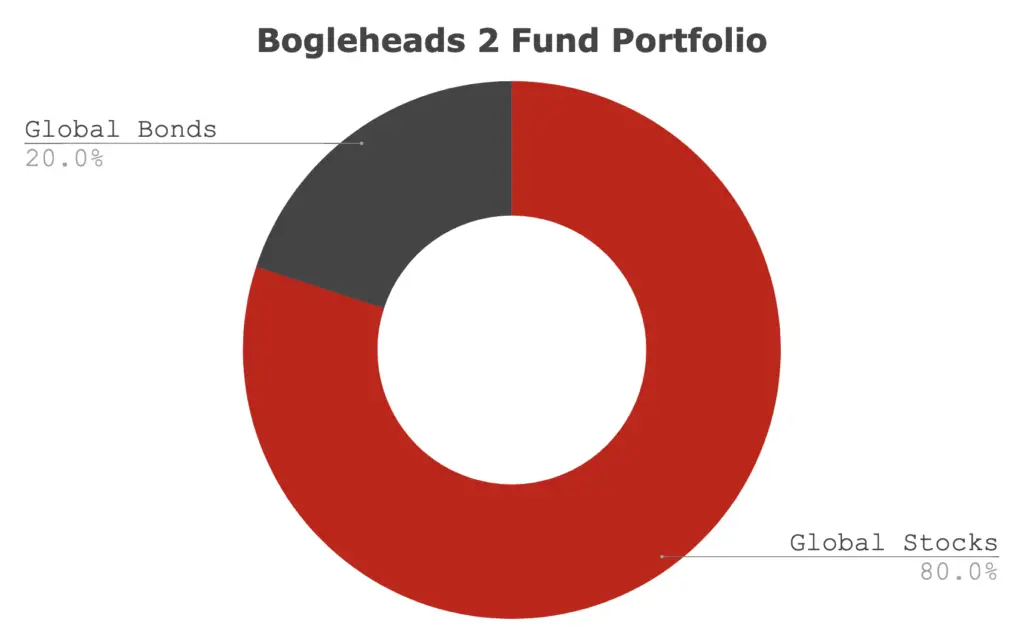

Thus, an 80/20 allocation for the Bogleheads 2 Fund Portfolio is as follows:

- 80% Total World Stock Market

- 20% Total World Bond Market

Bogleheads 2 Fund Portfolio ETF Pies for M1 Finance

We can construct the 80/20 Bogleheads 2 Fund Portfolio using 80% VT, the Vanguard Total World Stock ETF, and 20% BNDW, the Vanguard Total World Bond ETF.

Here's that pie to use on M1 Finance.

M1 Finance is a great choice of broker to implement the Bogleheads 2 Fund Portfolio because it makes regular rebalancing seamless and easy, has zero transaction fees, allows fractional shares, and incorporates dynamic rebalancing for new deposits. I wrote a comprehensive review of M1 Finance here.

Canadian investors can use Questrade, and those outside North America can use eToro.

What do you think of the Bogleheads 2 Fund Portfolio? Let me know in the comments.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Disclosure: None.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply