NUSI is an option collar strategy ETF for the NASDAQ 100 Index designed to manage risk and generate income. But is it a good investment? I review it here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

NUSI ETF Review Video

Prefer video? Watch it here:

Introduction – What Is NUSI and How Does It Work?

Nationwide makes ETFs. This one is called the Nationwide Risk-Managed Income ETF. NUSI is an option collar strategy on the NASDAQ 100 Index, which is comprised of the 100 largest non-financial stocks that trade on the Nasdaq exchange. This fund launched in late 2019 and has over $500 million in assets. It has an expense ratio of 0.68%.

As a brief refresher, covered call writers own the underlying and collect a premium on the option, and the buyer of the call option has the right to buy the underlying at the strike price at or before expiration. For example, if I own a fund like QQQ for the NASDAQ 100 and I think it's going to be relatively flat for the next 30 days or so, I might sell a call option on it, for which I receive cash immediately (called the premium). The buyer of that call option is hoping QQQ goes up. As the seller, I'm hoping it stays flat. Call options are usually sold to generate income in a flat or mild bear market.

An investor buys put options as a direct insurance policy to protect against a crash of the underlying in the near future. In this same example, if I'm bullish on QQQ for the long term but I think it's going to experience a crash in the next 30 days or so, I might buy a put option – in this case called a protective put – to protect the downside in the short term. If QQQ goes down, the value of that put option goes up. It also gives me the right to sell my shares at the strike price at which I bought the option, which may be attractive if the share price falls below that level.

Doing both of these at the same time is known as a collar or protective collar. This is what NUSI does. It's generating immediate income from the premium received for the covered call option and using some of that to fund the purchase of the protective put option, all while holding the underlying NASDAQ 100 index. The rest of the premium is passed on to the investor as a distribution. In a nutshell, we're intentionally capping the upside potential to provide downside protection, thus theoretically keeping things a lot smoother (i.e. lower volatility) than the underlying index, in order to pay “income.”

Nationwide also launched NSPI for the S&P 500, NDJI for the Dow, and NTKI for the Russell 2000 in December 2021.

NUSI vs. QYLD

To talk about NUSI, let's first briefly talk about the older QYLD from Global X, which usually gets brought up in the same conversations. I covered this fund (pun intended) in a separate post here. I raked QYLD over the coals for looking pretty awful from every angle in my humble opinion.

QYLD is just covered calls on the NASDAQ 100. NUSI takes QYLD's covered call strategy and adds the purchase of a protective put. Because of this, NUSI's distribution yield is lower than that of QYLD. Bad news if you're purely chasing yield, but probably good news if you need that income to be stable.

I noted with QYLD that novice investors seemed to be buying it while erroneously thinking it is “safe” or that it “protects the downside.” Neither of those things is true. At least here, NUSI offers a direct hedge against a crash in the form of the protective put option. Its put options are “out of the money,” meaning the strike price is lower than the share price of the underlying.

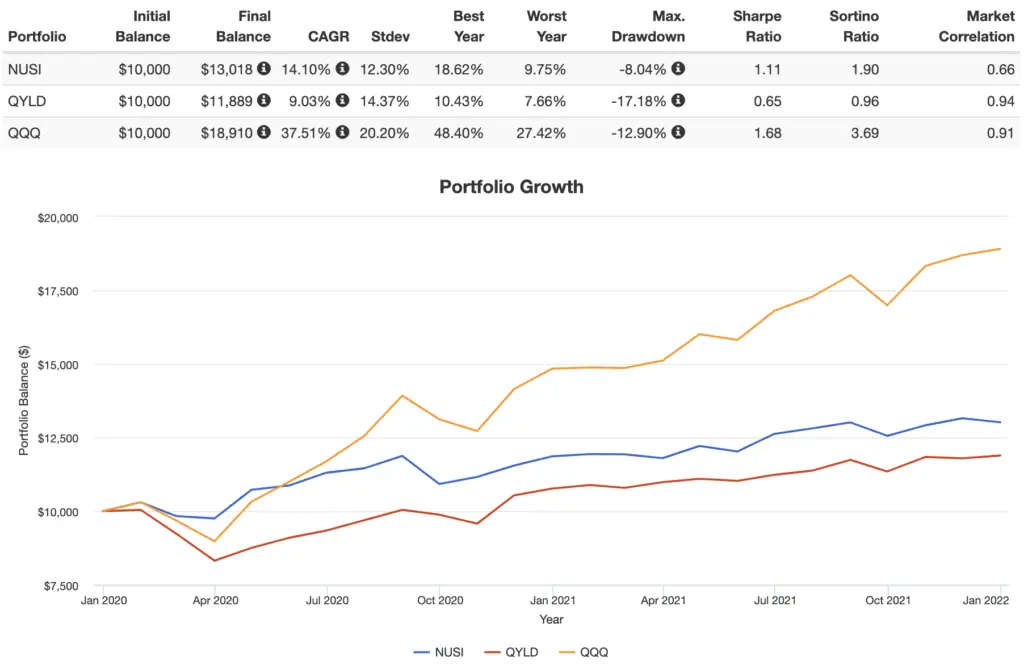

NUSI has beaten QYLD in its short lifespan so far, but both have also severely underperformed the underlying index, even on a risk-adjusted basis:

Which will be the best choice for the future? It's impossible to say. Given the choice between the two, I'd take NUSI for its direct downside protection (which proved particularly helpful in March, 2020) instead of wearing rose-tinted glasses and buying QYLD just for its astronomical, likely-unsustainable yield. Someone on Reddit mentioned holding both of these funds; that doesn't make much sense to me.

Is NUSI a Good Investment?

So is NUSI a good investment? Maybe.

Even though NUSI is all about the options and the income, remember we still own the NASDAQ 100 at the end of the day. We'd expect to get a higher option premium from this more volatile index (compared to, say, the S&P 500), but it is still poorly diversified and is basically a tech index at this point. It is purely large cap growth stocks.

Investors have been chasing recent performance by flocking to NASDAQ 100 funds like QQQ and QQQM simply because the index has beaten the market over the past decade, thanks largely to Big Tech. This recent stellar performance should be irrelevant to NUSI's future income strategy.

Moreover, the U.S. stock market as a whole is already over 1/4 tech at market cap weights, and large cap growth stocks are looking extremely expensive relative to history (and relative to Value). Furthermore, while the valuation spread between Value and Growth has [thankfully] been narrowing over the past year, it is still huge. Because of all this, we've got concentration risk and lower future expected returns with large cap growth stocks.

Only time will tell, and I neither employ nor condone market timing, but now may actually be the worst time to buy Growth and the best time to buy Value. Large value spreads have historically preceded its marked outperformance. My time machine is broken, but I'd argue that's a good reason not to be concentrated in the NASDAQ 100 Index right now. Zooming out even further, it's probably a good idea to diversify geographically as well with international stocks.

Just like with QYLD, we have to acknowledge the fact that you still may very well come out ahead using a plain ol' 60/40 portfolio, which has beaten NUSI on every metric since its inception – volatility, drawdown, and general and risk-adjusted returns. My Neapolitan Portfolio also still beat it on volatility, drawdown, and risk-adjusted return.

As usual, it all comes down to your financial objective. Again, if you're concerned about steady income, these risk metrics like volatility and drawdown should be more important to you than absolute returns. This fund is called the Risk-Managed Income ETF. Those are exactly the two things it does. Those two things are its entire purpose.

But more importantly, do you really need that “income” every month? If so, is there really that much more logistical headache in selling shares as needed versus using the fund's distributions for that income? I'd say probably not, but I'm also not a yield chaser. If you think there is, I also designed a dividend portfolio for income investors here that may appeal to you.

If you plan on reinvesting NUSI's distributions and not using them for your regular expenses, you should probably avoid this fund. This case is exacerbated for NUSI in a taxable account because you're taxed on every distribution, even if you reinvest them. I'm a fan of simply selling shares as needed for any “income” needed, which should be mathematically preferable anyway if you don't actually need that income on a monthly basis, as it allows you to leave more money in the market longer.

Remember too that covered calls cap the upside at the strike price. They're not a free lunch. If the underlying rallies, you don't get to fully participate in that growth. A young, long-term investor is investing in the market because he or she expects it to go up more than it goes down. NUSI is basically a muted version of the underlying. If QQQ skyrockets, NUSI will rise but not as much. If QQQ crashes, NUSI will fall but not as much.

In a flat market, NUSI's lower premium may not be able to cover its intended yield. The fund may even pay more for the put options than it receives for the call options. Don't forget the fund's yield can change. It may prove unsustainable, just like I suspect QYLD's is. A long-term gradual bear market would also be bad for this fund.

So NUSI provides downside protection from put options. Great. But there’s a simpler, cheaper, more tax-efficient solution for volatility and risk reduction that existed long before these options strategy funds came about: add bonds.

The main pro for NUSI is that it doesn't rely on a favorable interest rate environment. The last 40 years or so since 1982 have been very kind to bonds. The future may not – and likely won't – look the same. I think bonds will remain a useful diversifier, but at the time of writing, we're looking at historically low bond yields and low expected returns for the asset class going forward. And this is precisely what makes NUSI much more attractive right now. We're also seeing some above-average inflation. Maybe the classic 60/40 won't beat NUSI in the future; only time will tell.

But remember that ultra-short bonds (called T-bills and known as a “cash equivalent” and literally the “risk-free asset”) are still a decent inflation hedge because they can be rolled so quickly. So we can do what NUSI is trying to do with 50% NASDAQ-100 (QQQM) and 50% cash (T-bills). Here's how that has worked out since NUSI's inception:

Once again, we've easily beaten the complex, expensive option fund with a cheaper, simpler, more tax-efficient solution. Notice the lower volatility, smaller drawdown, and much higher general and risk-adjusted returns of the 50/50 mix.

I've created that pie for M1 Finance here if you're interested. I wrote a comprehensive review of M1 and why it’s great for income investors here.

Conclusion on NUSI

If you need regular monthly income for expenses, hate diversification, hate bonds, and like concentration risk, you'll probably enjoy NUSI.

But if you're young with a long time horizon and a high risk tolerance, if you don't need regular income for expenses, and/or if you plan to just reinvest NUSI's monthly distributions, this fund is almost certainly not a great choice. I fear that too many young, inexperienced investors are not looking much further past the high monthly distribution yield before diving into these expensive, exotic option strategy funds that they likely don't even understand.

But if income is the concern, then again, a more diversified combination of dividend stocks and high-yield bonds may be just as suitable and would be cheaper. I think “income” is overrated anyway. I'd be more likely to go with something like SWAN or SPD and just set up an automatic monthly transfer from the brokerage account that sells shares for me; there's my “income.” But once again, in the interest of full disclosure, I'm not a dividend investor anyway, and I'd rather just sell shares as needed, so these types of yield-focused strategies don't really appeal to me regardless. I'd rather create my own dividend when I want to. That said, I'd definitely take NUSI over QYLD. But you can do the same thing in what I think is a superior way with 50% in the NASDAQ-100 and 50% in T-bills. I've created that pie for M1 Finance here if you're interested. I wrote a comprehensive review of M1 and why it’s great for income investors here.

If you're indecisive, the good news is you don't have to go all in on either path. You could use the classic 60/40 or the 50/50 above for half of the portfolio and NUSI for the other half, for example, which is probably a better strategy than going 100% NUSI anyway. Remember that there's no free lunch outside of diversification. If you are reducing risk with expensive option hedging strategies, you are also accepting lower expected returns. And that may be a perfectly sensible tradeoff for you.

Nationwide also launched NSPI for the S&P 500, NDJI for the Dow, and NTKI for the Russell 2000 in December 2021.

What do you think of NUSI? Let me know in the comments.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

I personally find NUSI to be one of the worst investment products on the market. JEPI and SCHD absolutely smashed NUSI in performance. NUSI even lost more than QYLD yet only yields a fraction comparatively.

Past performance doesn’t indicate future performance. Put options pay off in a large, sudden crash, not a slow bleed like we’ve seen recently.

If one of your goals is to avoid big drawdowns, and interest rates do rise significantly, would it be better to be in T-bills than long term bonds?

(For the simple 50-50 type of portfolio where it’s 50% diversified equities, 50% hedge).

Great question, Emma. Hard to say for certain. T bills would definitely suffer much less from rising rates compared to long treasuries, but all else equal, we would expect long bonds to provide greater protection during stock drawdowns due to their greater volatility, as shown in the backtest here if you click the Drawdowns tab. A good compromise may be intermediate term treasury bonds.

I own a large quantity of SWAN and it has done well for appreciation. On the income side it has done poorly due to the near zero interest on government bills. I like SWAN for the protection it offers in a down market and the appreciation it offered by using options. I am happy the interest is not negative. As a retiree, I do need stable interest income. Social Security is not retirement insurance. My low monthly Social Security income is the result of poor money management by our government. In addition, there are hints Social Security may be cut in years to come to help balance the government’s financial incompetence. Therefore, I am in the hunt for higher monthly income. NUSI seems to be helpful as compared to Vanguard’s High Yield bonds and slightly better than YYY and HNDL that I own. Also,I own RYDL. It is more diversified than QYLD. Yet, QYLD has a seven year proven record of stable high distribution. Still thinking about it. Thanks for the info.

Again, creating your own “income” is the same thing as receiving it as a dividend.

Rant from a recovering theta addict: NUSI’s monthly puts may not offer much help in a protracted bear market (I’m still haunted by memories of my dad buying in 2000 and steadfastly ‘buy and holding’ all the way into the abyss.

I prefer SWAN’s method, but why oh why do they have to hold 10 & 30yr bills?

SWAN’s bond ladder is across all term lengths from 2 to 30 for an effective duration of 10 years.