JPST is an actively managed ETF from J.P. Morgan that holds ultra-short-term debt instruments for the purpose of providing income. I review it here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

JPST Methodology, Yield, and Fees

Think of JPST as being somewhat in between a money market fund, which is a cash equivalent, and a total bond market fund. This ETF from J.P. Morgan provides a higher yield than the former and a lower duration than the latter.

JPST launched in 2017 and has quickly amassed nearly $25 billion, making it the largest actively managed ETF in the world. The managers of the fund, who have decades of experience, select investment-grade bonds with maturities less than 1 year. JPST's effective duration is about 4 months. This makes the fund nimble and adaptable.

JPST has a fee of 0.18%, considerably lower than its competitors. At the time of writing, its 30-day SEC yield is 4.51%.

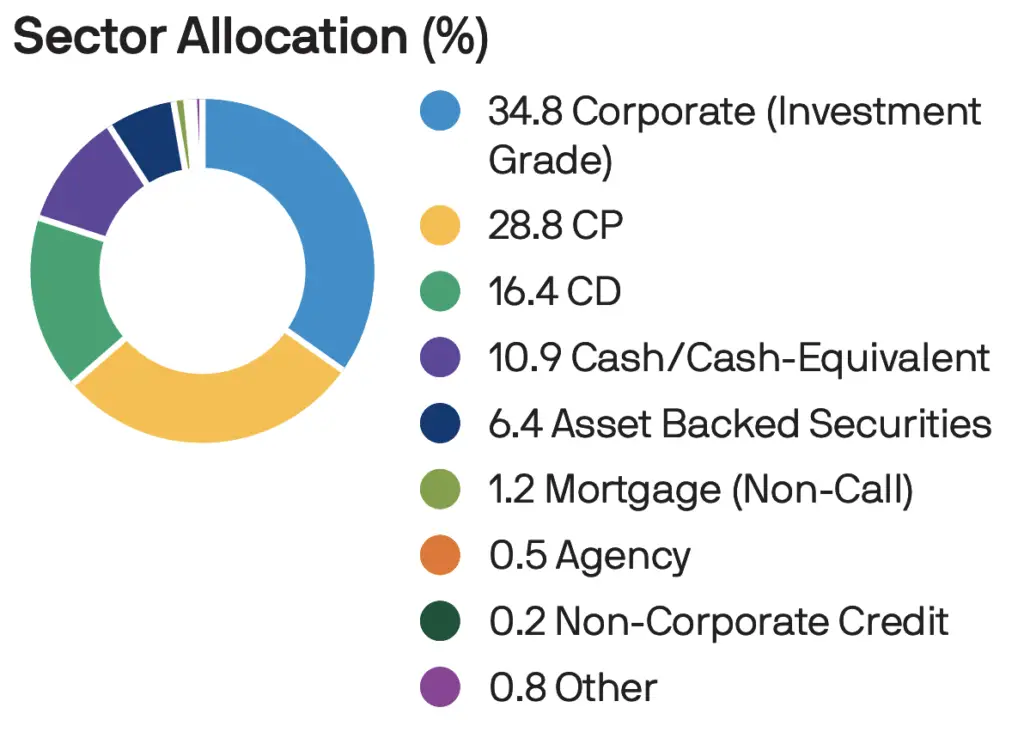

JPST Sector Composition

The fund has about 600 holdings across various ultra-short-term USD-denominated debt instruments including corporate bonds, U.S. Treasury notes, agency-backed securities, and mortgage-related debt. To generate a higher yield, JPST tends to focus on the Financials sector for its corporate bonds. Here's a breakdown of those debt types:

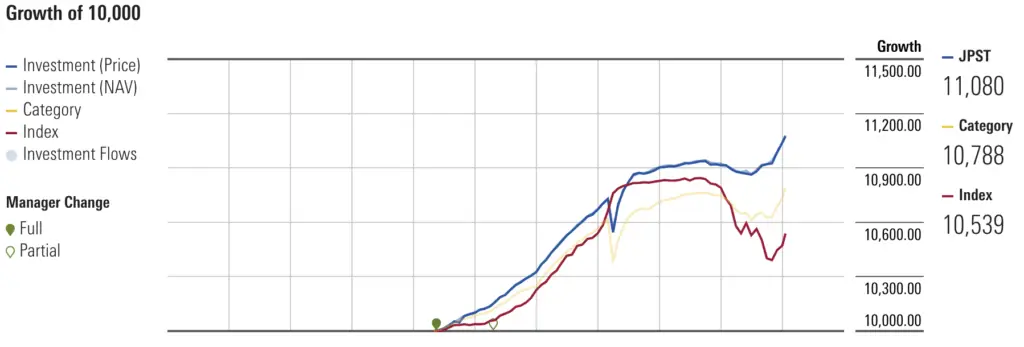

JPST Performance

In terms of performance, JPST fund has also beaten its competitors and its benchmark, the ICE BofAML 3-Month US Treasury Bill Index, by an impressive 50 bps since inception:

Is JPST a Good Investment?

So is JPST a good investment? Maybe.

JPST has proven its ability to provide appreciable income with low volatility during choppy markets or low yield environments and also take advantage of interest rate changes such as the recent Fed rate hikes.

I compared JPST to its closest competitors in a separate post here.

Conveniently, JPST should be available at any major broker, including M1 Finance, which is the one I'm usually suggesting around here.

What do you think of JPST? Do you own it? Let me know in the comments.

Disclosure: None.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply