Ally has offered competitive banking products for a long time. Their acquisition of TradeKing in 2016 made them a serious contender in the investing and securities trading space. Here we'll compare Ally Invest and M1 Finance. I wrote a separate comprehensive review of M1 Finance here if you're interested in seeing the specifics of the platform.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

M1 Finance vs. Ally Invest – Summary Comparison

Contents

M1 Finance vs. Ally Invest – Commissions and Fees

M1 Finance and Ally Invest both offer commission-free trades for stocks and ETF's, and zero account fees, aside from miscellaneous service fees for things like paper statements, outbound account transfers, etc.

Ally Invest does have some commissions for other types of securities:

- Options: $0.50 per contract

- OTC Stocks: $4.95

- CDs: $24.95 per transaction

Ally has long been popular for their high-APY savings account product.

Ally also acquired the famous options-trading platform TradeKing in 2016, making Ally a popular and cost-effective choice for options traders.

M1 Finance vs. Ally Invest – Account Types

M1 Finance offers Individual, Joint, Traditional IRA, Roth IRA, Rollover IRA, SEP IRA, Trust, and Custodial accounts. They currently do not offer SIMPLE IRA, 401(k), Solo 401(k), 529, HSA, or Non-Profit accounts.

Ally Invest offers all of M1's account types plus SIMPLE IRA, and Coverdell accounts.

If you need any of the latter accounts, Ally Invest would be the better choice.

Both M1 and Ally also offer an FDIC-insured checking account. Ally also has money market account and savings account products.

M1 Finance vs. Ally Invest – Investment Products

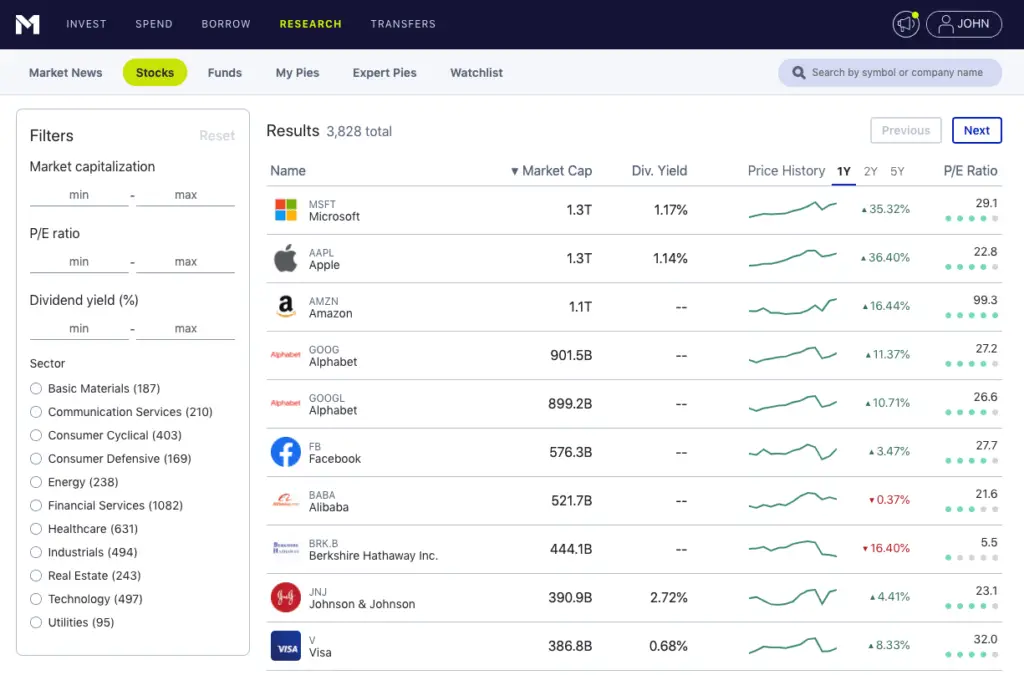

M1 Finance offers most ETF's and individual stocks traded on major exchanges.

Ally Invest offers ETF's, individual stocks, mutual funds, options contracts, over-the-counter (OTC) stocks aka “penny stocks,” and forex. Forex trading requires a separate platform called Ally Invest Forex.

M1 Finance vs. Ally Invest – Margin

Among traditional brokers, Ally Invest actually has a comparatively good margin rate, but M1 Finance still beats it. Margin rates are here.

You can use that cheap margin loan from M1 Finance for whatever you want – major purchases, refinancing higher-interest debt, unexpected expenses, etc.

M1 Finance vs. Ally Invest – Mobile App

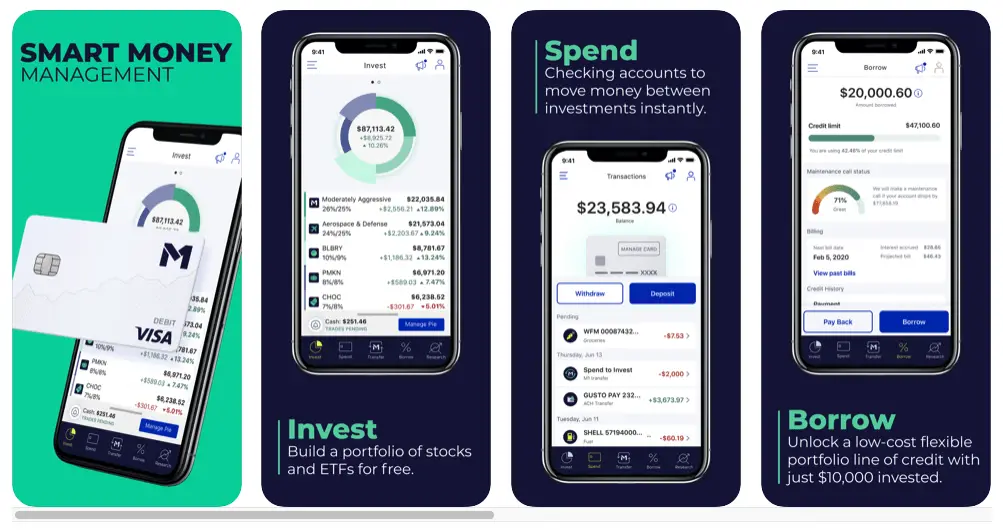

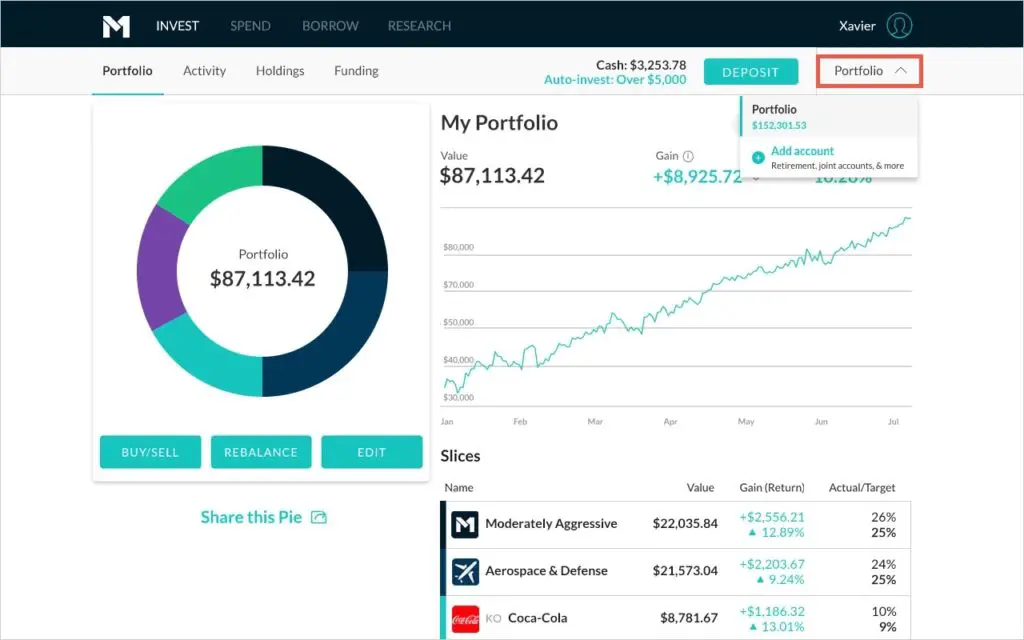

Both M1 Finance and Ally Invest have modern, user-friendly, robust mobile apps for both Apple iOS and Android. Here is M1's app:

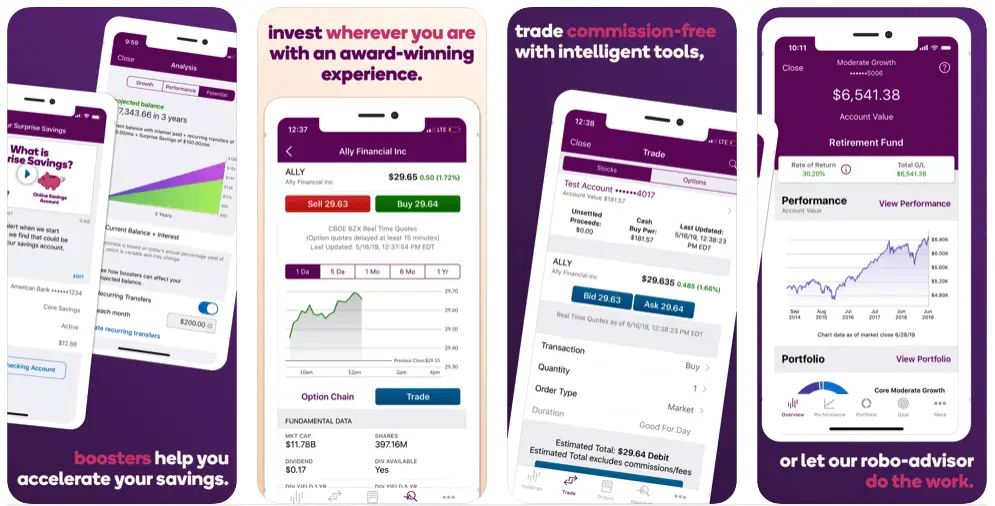

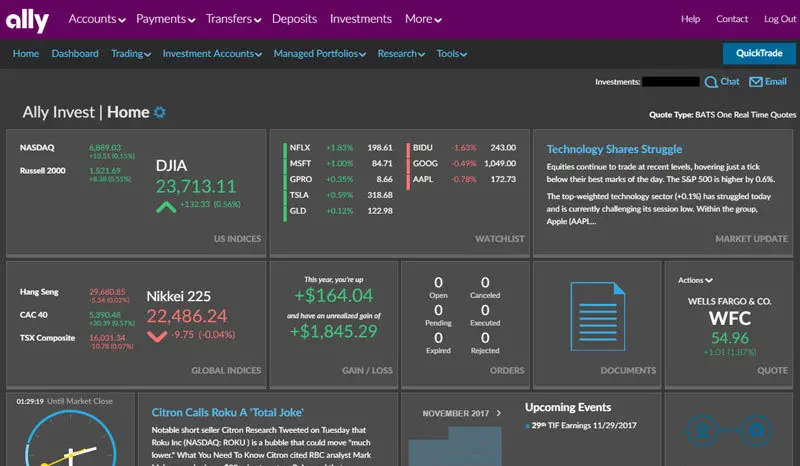

Here are some screenshots from the Ally mobile app:

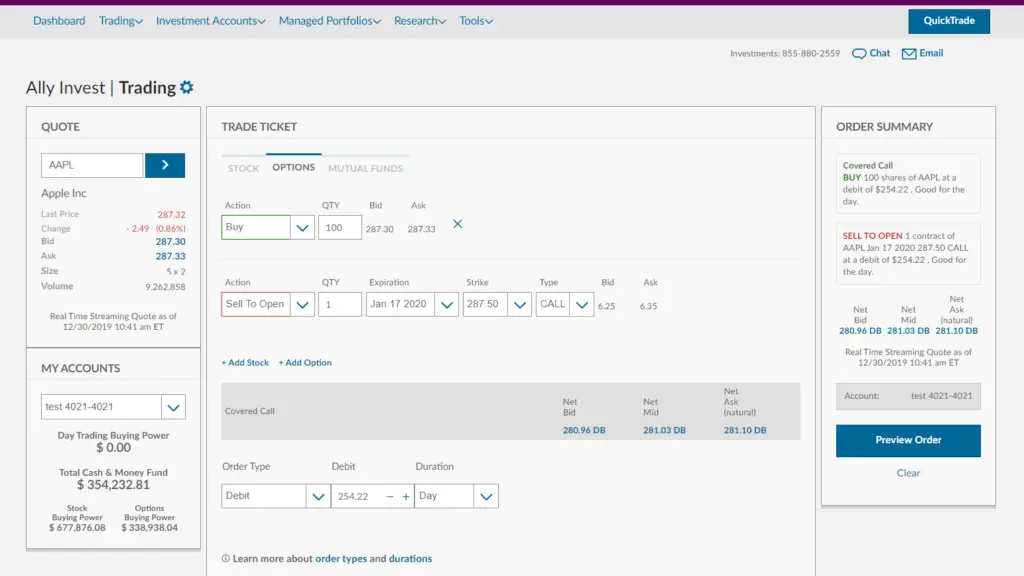

M1 Finance vs. Ally Invest – Interface/Usability

While Ally's mobile app is pretty solid, the Ally Invest desktop web-based interface is still somewhat antiquated. This is especially true for options traders who were absorbed in the TradeKing acquisition, as Ally chose to do away with some of the more robust customization and research tools available on TradeKing. The InvestLIVE platform within Ally Invest may remedy this somewhat, but requires an extra step. Using the mobile app may be preferable, but then you won't have access to most of the research tools available on the desktop view.

I think both the Ally Invest desktop interface and mobile app will definitely be more confusing than M1's interfaces for a novice investor. The Ally Invest “classic” user interface looks like this:

The somewhat more modern Ally InvestLIVE interface looks like this:

The M1 Finance interface is modern, simple, and intuitive with its pie-based visualization. It should be much easier to navigate, especially for novices. It is great for beginner and experienced investors alike:

M1 Finance vs. Ally Invest – Extra Features

As a full trading brokerage, Ally Invest naturally has a few more education and analysis tools than M1 Finance, though perhaps not as many as one might expect from an options trading brokerage. Again, many of the analytical tools from TradeKing were dropped after the acquisition.

Ally Invest obviously has an all-day trading window and order control. Since M1 Finance is built for long-term, buy-and-hold investing, and not for day trading, M1 has a once-daily trading window and no order control.

M1 Finance features “dynamic rebalancing,” a rebalancing feature that automatically directs new deposits to specific assets to maintain your portfolio's target weights. Ally Invest only offers this feature in their automated robo-advisor service called Managed Portfolios, but this limits you to their simplistic pre-built portfolios. I'm not a huge fan of these, as they automatically hold 30% of the portfolio in cash, which is far too conservative for my tastes, especially for a young investor with a long time horizon. If you want a set-and-forget portfolio with M1, they offer pre-built “Model Portfolios.”

M1 Finance offers fractional shares for all investment products, which allows every dollar to work for you and allows you to buy small pieces of high-share-price stocks. This is especially important for beginner investors with a small amount of capital. Ally Invest does not offer fractional shares.

M1 Finance vs. Ally Invest – Summary and Conclusion

- Both M1 Finance and Ally Invest offer zero-commission trades and zero fees for most stocks and ETF's traded on major exchanges. Ally Invest does have commissions on things like options and OTC stocks.

- Ally Invest has a couple more account types than M1 Finance.

- M1 Finance offers most ETF's and individual stocks. Ally Invest adds mutual funds, OTC stocks (“penny stocks”), forex, and options contracts.

- M1 Finance offers much lower margin rates than Ally Invest.

- Ally Invest has a less intuitive desktop user interface that would be more suitable for seasoned investors and traders. M1 Finance has a simple and intuitive desktop interface.

- Both M1 Finance and Ally seem to have great mobile apps.

- Both M1 Finance and Ally offer FDIC-insured checking accounts. Ally also offers savings accounts and money market accounts.

- M1 Finance offers fractional shares on all investment products. Ally Invest does not support fractional shares.

- M1 Finance has automatic rebalancing. The only way to get automatic rebalancing with Ally Invest is via their robo-advisor Managed Portfolios.

- Ally Invest has the typical order control and all-day trading window that one would expect from a traditional brokerage platform. M1 does not offer order control and only uses one trading window per day.

- Ally Invest offers robo-advising and through their Managed Portfolios. I maintain that these portfolios are suboptimal for most investors. M1 Finance offers its pre-built “Model Portfolios” for free. M1 is also probably better if you want to implement a “lazy portfolio” and have it rebalance automatically.

- M1 Finance brings a social aspect to investing, allowing you to share your Custom Pies via a hyperlink.

I think M1 Finance clearly beats Ally Invest on most fronts. If you need access to things like options contracts, a SIMPLE IRA, and/or an all-day trading window, for example, which M1 Finance doesn't provide, you'd obviously need to go with Ally. But then if you're going with a traditional brokerage, I would suggest Charles Schwab is likely a better choice.

If you don't need those things and want access to fractional shares, automatic rebalancing, and cheaper margin, M1 Finance is the better choice. I wrote a separate comprehensive review of M1 Finance here if you're interested in seeing the specifics of the platform.

With traditional brokers like Fidelity and Schwab making strides to attract a younger audience by improving and modernizing their apps and features, even in just the past few months, it's clear that Ally has some catching up to do in my opinion. This is ironic considering Ally as a whole is a much newer brokerage than the likes of Fidelity and Schwab.

I've actually talked to people who have accounts across both brokers – Ally Invest for mutual funds and options trading, and M1 Finance for a taxable account to access extremely cheap margin and “fun” stock picking with fractional shares and dynamic rebalancing.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply