Bill Bernstein used some historical efficient frontiers to establish what a “coward” investor might use to diversify across geographies and asset types. Here I review his proposed Coward's Portfolio and explore some modifications and some ETFs to use for it.

Interested in more Lazy Portfolios? See the full list here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

Who Is Bill Bernstein?

William (Bill) Bernstein is a retired neurologist, financial theorist, and prolific investing author. Bernstein is all about index investing, asset allocation, and diversification. As am I.

He is one of the most prolific investing authors out there. Math/theory nerds like me and armchair investors alike will enjoy and get something from all of his investing-related books:

- The Intelligent Asset Allocator

- If You Can: How Millennials Can Get Rich Slowly

- The Four Pillars of Investing: Lessons for Building a Winning Portfolio

- The Investor's Manifesto: Preparing for Prosperity, Armageddon, and Everything in Between

- Rational Expectations: Asset Allocation for Investing Adults (more advanced; beginners might want to skip this one)

He also designed the No Brainer Portfolio.

What Is the Bernstein Coward's Portfolio?

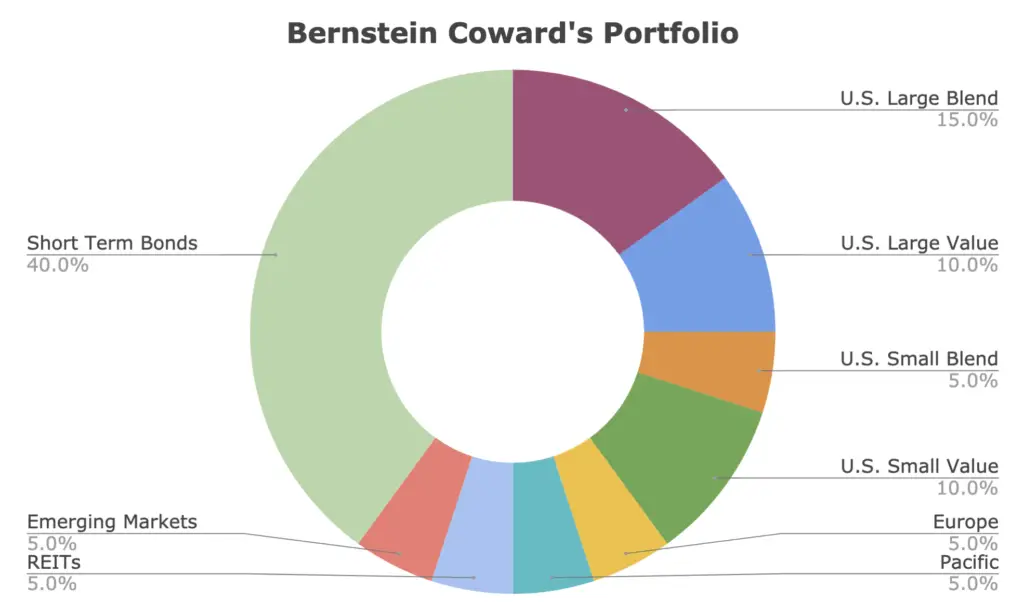

Back in 1996, Bernstein suggested that a “coward” investor would diversify broadly across geographies and asset types to be safer. This makes sense. He used efficient frontiers and – in my opinion – some overfitting to arrive at a slice-and-dice 60/40 portfolio that tilts Size snd Value.

The Bernstein Coward's Portfolio is as follows:

- 15% US Large Cap Blend

- 10% US Large Cap Value

- 5% US Small Cap Blend

- 10% US Small Cap Value

- 5% REITs

- 5% Europe

- 5% Pacific

- 5% Emerging Markets

- 40% Short Term Corporate Bonds

Let's look at the Coward's Portfolio's historical performance and then I'll provide some commentary on it.

Bernstein Coward's Portfolio Performance Backtest

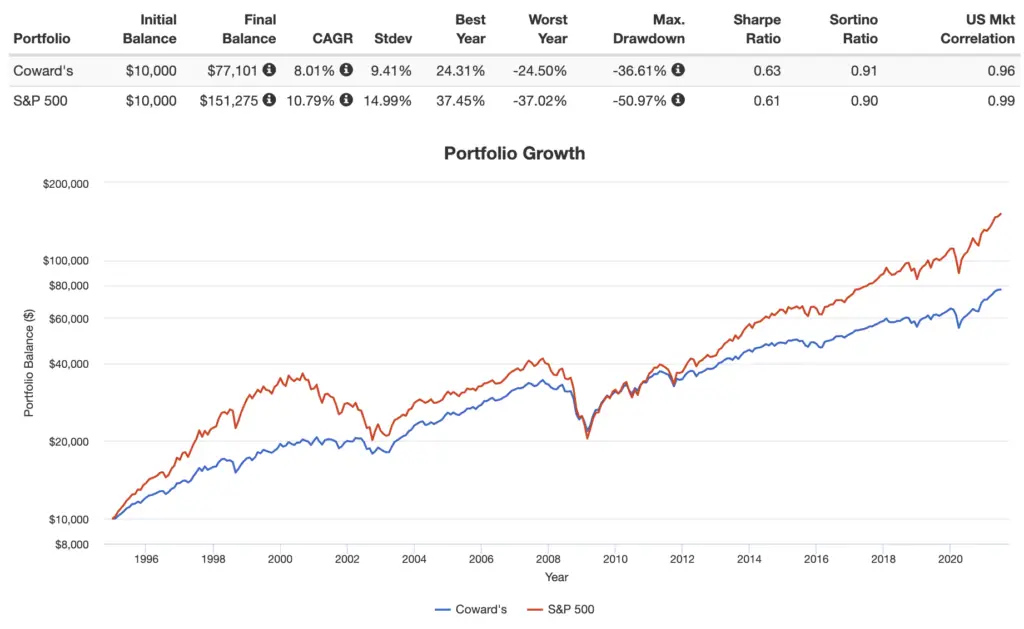

Going back to 1995, here's a comparison of the Bernstein Coward's Portfolio and the S&P 500 through June, 2021:

I don't necessarily have a problem with slicing up the equities, but some of them just feel unnecessary and too specific, e.g. Europe and Pacific. If we're diversifying away from the U.S. core with Emerging Markets, why are we also focusing in specifically on European stocks, which would be highly correlated with U.S. stocks? That narrower exposure is also almost certainly more expensive than a broader ex-US Developed Markets fund.

Another odd thing is that for US large caps, we're using blend as a base and then tilting Value, which is fine, but then in small caps we're weighting small cap value more than small cap blend, in which case what's the point of having the latter at all? That tiny exposure to small cap growth stocks is probably not doing anything for us, especially considering it's been the worst performing segment of the stock market historically.

Also, is the 5% to REITs really doing anything? Probably not.

Again, all this is likely simply the result of overfitting.

So let's pretend we used the Coward's Portfolio since 1995. Compared to the S&P 500, we were able to reduce volatility and drawdowns by about 1/3, but we still got about the same return per unit of risk as the S&P 500, as the Sharpe ratios were almost identical. That is, this portfolio and an S&P 500 index fund had the same efficiency. What gives? Well, I'll give you a hint. About 40% of the Coward's Portfolio is severely dragging down its performance. Can you guess which 40% is the culprit?

It's the short-term corporate bonds! This piece is truly bewildering to me. Bernstein is a smart guy. Much smarter than me. But I have to assume he had some sort of Freudian slip when constructing and publishing the Coward's Portfolio, because how could he forget that treasury bonds are objectively superior to corporate bonds in diversified portfolios and that more volatile assets make demonstrably better diversifiers?! Bernstein was clearly building a well-diversified portfolio for the “coward” investor; why did he stop at the bonds?

First, let's address the term (short, in this case) before moving on to the issuer (corporations here instead of the U.S. government).

There are a couple possibilities for the use of short-term bonds, but both can be immediately explained away. One, he intended the portfolio to be for an investor with a very short time horizon of a couple years max. Since we know bond duration should probably be matched to the investment horizon, the use of short bonds might make sense in this case, except for one glaring problem: an investor with a time horizon of 1-2 years should not be holding 60% stocks. So that explanation's out.

Another, more likely possibility is that Bernstein subscribes to Swedroe‘s position of “taking the risk on the equities side” and being safe with bonds. Brief tangent here… I actually know this is true because Bernstein himself has explicitly said it, citing that bonds keep your money safe for your immediate expenses and if your stocks drop, “your bonds are where your money is.”

Well, no. Your total portfolio is where your money is. This is simply mental accounting, and is like covering one eye during a stock market crash, looking at the short-term bonds, and saying “well at least that piece didn't lose money,” which should strike you as irrational. We're always attempting to optimize the portfolio holistically, not myopically with each asset in isolation. The irony here is that Bernstein should know this better than anyone, as he's written several books on asset allocation. Besides, one should probably already have an emergency fund for immediate expenses anyway.

In the interest of full disclosure, I really enjoy Bernstein's writing style and I've gotten great entertainment from his books, but I fundamentally disagree with him on several other points as well. One, he has a weird aversion to ETFs and prefers mutual funds. I assume he just likes to stick with familiarity since he's older, because his reasons cited for this irrational preference hinge on commissions and spreads, which are immaterial concerns in my opinion, particularly with highly liquid funds that we'd be using here anyway. Secondly, he advocates for dollar cost averaging and says it “boosts long-term returns.” We know this is demonstrably untrue over the long term. Similarly, he suggests market timing to buy more stocks during downturns. This is easier said than done, but more importantly, it requires holding cash as “dry powder” on the sidelines, which we also know is suboptimal on average. In fairness, the robust research on these last points came after most of Bernstein's writings.

So anyway, back to our investigation of this second possible explanation of the short corporate bonds being for safety. Shorter durations are indeed less volatile and less sensitive to interest rate risk. But this argument should be dead too, because we know government bonds don't possess the credit risk, liquidity risk, and default risk of corporate bonds and are thus inarguably safer.

So we know Bernstein prefers short bonds for their myopic safety, but why corporate bonds instead of treasury bonds? The answer is somewhat simple and unsatisfying: Bernstein just likes the higher yield of corporate bonds. That higher yield compensates investors – though not commensurately, as I've shown elsewhere – for their unique inherent risks just mentioned that treasuries don't have. Bernstein's brief statement straight from The Intelligent Asset Allocator is short and sweet in regards to investors' bond choice: “For the tax-sheltered investor, this is a no-brainer – you go with the highest-yielding short-term corporate bond fund.”

Annoyingly, he moves on directly following that statement, as if it is so self-evident that it requires no explanation. However, several chapters back he was talking about seeking assets with the lowest correlation for the maximum diversification benefit. Once again, he must have forgotten that treasuries do that much better than corporates.

To be fair, Bernstein does seem to have changed his stance on this over the years, because he suggests treasury bonds in his later writings, correctly noting that corporate bonds act a lot like their issuers in market crashes. In his words, “keep it short and keep it high quality.” I agree on the latter, but still not on the former. Maybe in 10 years he will have come around on longer durations for fixed income.

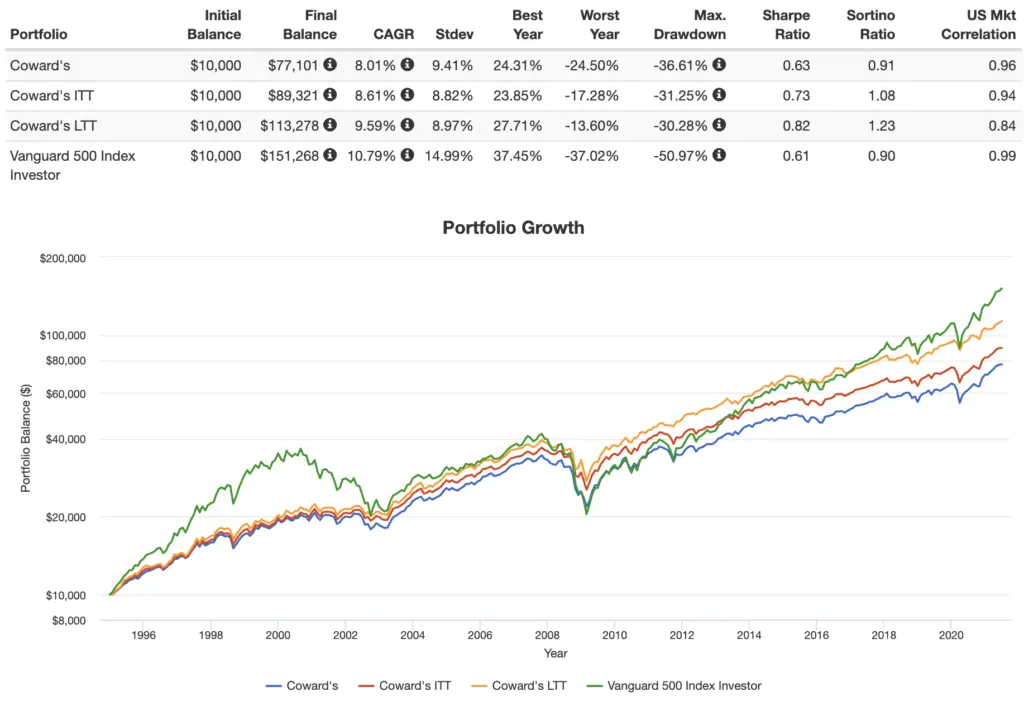

So we've got short-term corporate bonds and we know they're almost certainly not the best choice. Should we just throw our hands up and give up? Nope; let's try grabbing the longer duration treasury bonds from the toolbox. The backtest below has the original Coward's Portfolio that uses short term corporate bonds, and then the one with “ITT” in the name uses intermediate term treasuries, and the one with “LTT” in the name uses long term treasuries:

Now that's more like it. As we'd expect, the one using long treasuries had the smallest drawdown and highest risk-adjusted return. Ironically, this was actually the more “cowardly” approach – giving the bonds more ability to do their job.

As always, I'll include an ETF pie below for the original prescription and for those two additional variations as well.

Bernstein Coward's Portfolio ETF Pie for M1 Finance

M1 Finance is a great choice of broker to implement the Bernstein Coward's Portfolio because it makes regular rebalancing seamless and easy with one click, has zero transaction fees, and incorporates dynamic rebalancing for new deposits. I wrote a comprehensive review of M1 Finance here.

Original – Short Term Corporate Bonds

Again, I definitely would not use this one, but we can construct the original Coward's Portfolio pie with mostly low-cost Vanguard ETFs:

- VOO – 15%

- RPV – 10%

- VB – 5%

- VIOV – 10%

- VNQ – 5%

- VGK – 5%

- VPL – 5%

- VWO – 5%

- VCSH – 40%

You can add this pie to your portfolio on M1 Finance by clicking this link and then clicking “Add to Portfolio.” Investors outside the U.S. can find these ETFs on eToro.

Intermediate Treasury Bonds

Here's the version using intermediate treasuries:

- VOO – 15%

- RPV – 10%

- VB – 5%

- VIOV – 10%

- VNQ – 5%

- VGK – 5%

- VPL – 5%

- VWO – 5%

- VGIT – 40%

Long Treasury Bonds

And here's the version using long treasuries:

- VOO – 15%

- RPV – 10%

- VB – 5%

- VIOV – 10%

- VNQ – 5%

- VGK – 5%

- VPL – 5%

- VWO – 5%

- VGLT – 40%

What do you think of the Coward's Portfolio? Let me know in the comments.

Disclosures: I am long VOO and VWO in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Leave a Reply