PIMCO have been quietly beating the market and doing a version of the famous Hedgefundie Adventure for years with their mutual fund PSLDX. But is it a good investment? I review it here.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I may get. Read more here.

Contents

PSLDX Review Video

Prefer video? Watch it here:

What Is PSLDX?

To talk about PSLDX, let's first talk briefly about the famous Hedgefundie Adventure. Ironically, you're probably more likely to have heard about the latter than the former. If you're not familiar with the strategy, go check it out here. Basically, it takes a traditionally pretty conservative asset allocation of 55/45 stocks to long treasury bonds and levers it up 3x via the funds UPRO and TMF. A guy with the username Hedgefundie proposed the strategy on the Bogleheads forum and it took the internet by storm, which has been cool to see.

But the idea is not really new. PIMCO was already beating the market by doing something similar for over a decade before Hedgefundie came along and made his now-famous post on the Bogleheads forum in early 2019. Their mutual fund PSLDX is roughly 50/50 stocks/bonds levered up 2x for effective 100/100 exposure, and as is the PIMCO way, they're active on the bonds side, with the stocks side linked to the S&P 500 via derivatives. PIMCO call it the StocksPLUS® Long Duration Fund.

It hasn't gotten much attention from retail investors because it is an institutional fund. The fund has nearly $1 billion in assets. Hedgefundie himself described PSLDX as “a strategy that delivers 2x the performance of the S&P in good times but matches the S&P in bad times.”

PSLDX launched in late 2007. I'm glad it didn't end up getting shut down after having to weather the Global Financial Crisis of 2008 soon thereafter. PIMCO maintain that “the fund offers the combined benefit of PIMCO's 40 years of active bond management and two decades of passive, index-linked investment expertise” and that “the fund can serve as a strong core equity choice in an overall portfolio, complementing both fixed income holdings and traditional equity investments.”

PSLDX vs. NTSX vs. HFEA

So basically we've got a real-world proof of concept of the Hedgefundie strategy that's been going on since 2007. Whereas HFEA (Hedgefundie's Excellent Adventure) is 165/135 and NTSX is 90/60, PSLDX sits somewhere in the middle around 100/100. Also note that NTSX uses intermediate bonds, while HFEA and PSLDX use long bonds. HFEA and NTSX only use treasury bonds, but PSLDX's managers are buying a cauldron of U.S. and foreign government and corporate debt securities. So while these 3 strategies are similar, they're also different.

PSLDX has an adjusted expense ratio of 1.01% 0.59%, compared to 0.99% for HFEA and 0.20% for NTSX at the time of writing. Note that PSLDX would be terribly tax-inefficient and should only be held in tax-advantaged space. It pays sizable quarterly dividends and annual capital gains distributions. Its turnover is nearly 200%! Seriously, don't even try.

Update – August 18, 2021 – PSLDX has drastically cut its fee, from 1.01% to 0.59%, making it considerably more attractive now in my opinion.

Risks of PSLDX

Let's talk about some risks and downsides for PSLDX.

First, just like with HFEA (or any stocks/bonds portfolio, really), stocks and bonds crashing in tandem wouldn't be good for the fund. But I'd argue that's unlikely to happen; the Fed has indicated they intend to keep rates low for a while, and interest rates don't have to revert to their mean. I would also submit that just because bonds now have lower expected returns doesn't mean they won't still do their job of mitigating stock market drawdowns. You can find my lengthier rant on bonds and interest rates here.

Secondly, I'd rather see straightforward treasury bonds, as with HFEA and NTSX, due to their reliably lower correlation to stocks and their nature of being the flight-to-safety asset. Credit risk is highly correlated with market risk. I'm not entirely sure why PIMCO seem to love corporate bonds. That said, if you have an active bond portfolio, PIMCO is who you'd want managing it, but there's also the general risk of that active management itself. And of course, they want to earn their fee. I'll talk about a way to DIY a rough replication of PSLDX using just treasury bonds later.

Thirdly, the knee-jerk reaction to the fund's fee is obviously to think it's high at >1%. But remember that fees are relative. Is the exposure and expected return you're getting worth the fee? In this case, I'd say yes. In other words, the fund's performance should make up for its higher fee; it has and more historically. We'll look at historical performance in a second.

Update – August 18, 2021 – PSLDX has drastically cut its fee, from 1.01% to 0.59%, making it considerably more attractive now in my opinion.

Lastly, just to reiterate, this thing is horribly tax-inefficient in all sorts of ways. Don't hold it in taxable. Just don't.

PSLDX Historical Performance vs. the S&P 500, HFEA, and NTSX

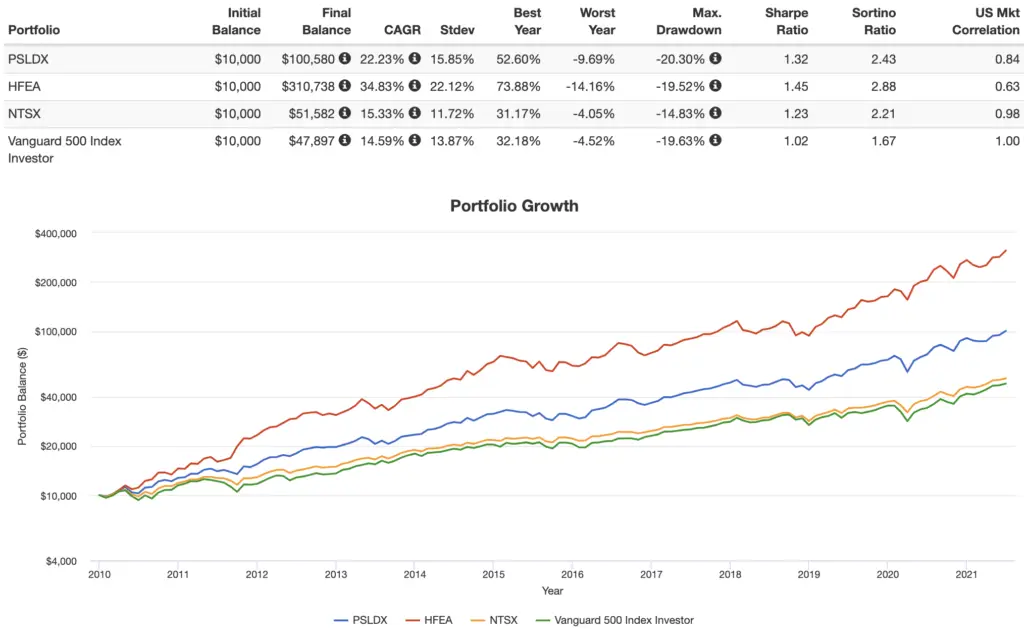

Using the live fund data, we can compare the historical performance of PSLDX, HFEA, NTSX, and the S&P 500 going back to 2009 through 2021:

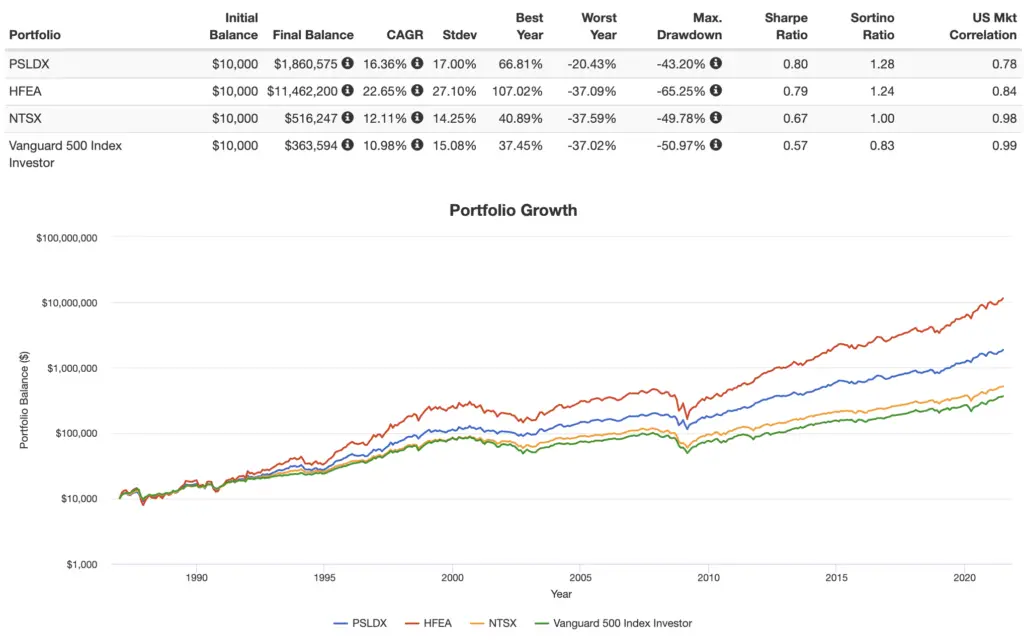

But of course we've basically been in a bull market that entire time (recency bias), and it's only a decade, so it doesn't tell us too much. So we can get a rough idea of the performance of these strategies by using mutual funds and somewhat crudely replicating PSLDX going back to 1986:

So as we'd expect, HFEA won out on total return. But note how Sharpe ratios (risk-adjusted return) are nearly identical for HFEA and PSLDX. This makes sense. Both are using basically the same assets; one is just levering up more. Because of this, HFEA exhibited much greater volatility and a larger max drawdown during the time period. As usual, diversification is our friend when we layer on leverage.

Also notice how PSLDX, NTSX, and the S&P 500 all had pretty similar risk metrics, but the 2 funds beat the index on CAGR. Remember we've also been in a bond bull market during this time since about 1982. With bond yields where they are at the time of writing, the future may look different.

Replicating PSLDX with Leveraged ETFs

We can roughly replicate PSLDX's strategy while conveniently utilizing only treasuries on the bond side with leveraged ETFs via UPRO (3x S&P 500) at 33% and EDV (Vanguard Extended Duration Treasury ETF) at 67%. You'd probably want to rebalance it quarterly.

I've created that pie here for those using M1 Finance.

But also note this is very nearly just a 2x version of the Hedgefundie strategy.

Of course, one of the primary attractions of PSLDX is the ability to set it and forget it, as PIMCO are handling all the logistics for you. So a DIY replication may not be worthwhile for the investor who wants to be completely hands-off.

Is PSLDX a Good Investment?

So is PSLDX a good investment? Maybe.

I think PSLDX is a good solution for someone who wants to implement a milder version of the HFEA while being completely hands-off. Truly set and forget. You would quite literally be letting the pros handle it. You're just paying that relatively high fee for that convenience. But the fee is about the same as the leveraged funds it would require to get the same exposure. That fee has also decreased as of August, 2021, from 1.01% to 0.59%.

Where To Buy PSLDX

Now we come to the topic of where to buy PSLDX. This is probably the section people are most interested in, because this thing has historically been somewhat hard to buy if you're a DIY retail investor. After all, it's supposed to be for institutional investors. That said, the various brokers' requirements seem to have decreased in recent years.

I've personally got PSLDX in an IRA at Ally. If I remember correctly, there was a transaction fee of $10 and a minimum investment of $100. This may have changed since I first bought it.

The following are pieces of info I've gathered from around the web or from calling the broker directly:

- At Vanguard, you're looking at a transaction fee of $20, a minimum initial buy of $25,000, and minimum additional purchases of $1,000.

- TD Ameritrade has no minimum but imposes a $50 transaction fee.

- Firstrade has a $500 minimum and no fee.

- Schwab has a $1,000 minimum and a $50 fee.

- Etrade offers it for a $20 fee and no minimum.

- Interactive Brokers has it for a $25,000 minimum and a $15 fee.

- Fidelity told me that individuals can't buy this fund. Period. But apparently you can transfer the fund into Fidelity if you already own it elsewhere, after which it's $50 for each transaction, so sort of a backdoor way to get it in there. YMMV.

- Check your 401(k) menu for this fund, but odds are it's not there.

What do you think of PSLDX? Let me know in the comments.

Disclosure: I own PSLDX, UPRO, TMF, VOO, and NTSX in my own portfolio.

Interested in more Lazy Portfolios? See the full list here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, this is not financial advice, investing advice, or tax advice. The information on this website is for informational, educational, and entertainment purposes only. Investment products discussed (ETFs, mutual funds, etc.) are for illustrative purposes only. It is not a research report. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. I always attempt to ensure the accuracy of information presented but that accuracy cannot be guaranteed. Do your own due diligence. I mention M1 Finance a lot around here. M1 does not provide investment advice, and this is not an offer or solicitation of an offer, or advice to buy or sell any security, and you are encouraged to consult your personal investment, legal, and tax advisors. Hypothetical examples used, such as historical backtests, do not reflect any specific investments, are for illustrative purposes only, and should not be considered an offer to buy or sell any products. All investing involves risk, including the risk of losing the money you invest. Past performance does not guarantee future results. Opinions are my own and do not represent those of other parties mentioned. Read my lengthier disclaimer here.

Are you nearing or in retirement? Use my link here to get a free holistic financial plan and to take advantage of 25% exclusive savings on financial planning and wealth management services from fiduciary advisors at Retirable to manage your savings, spend smarter, and navigate key decisions.

Hello John,

Thank you for setting up this site and sharing your data and assessment on so many valuable aspects of investing.

Would you mind sharing your opinion on how you assess PSLDX risks as an actively managed fund? On one hand it’s not trying to hand-pick winners, but on the other hand professionals are picking bonds and using derivatives.

Would you lump PSLDX into the same risk category as all other generic actively managed funds? I’m trying to better understand it in relation to the notion that over long periods of time active funds tend to lose to passive ones.

Thank you for your time.

Not much of a risk there compared to truly active funds IMO. No, I would not lump them in the same category.

Great info! Ameritrade will let you do automatic scheduled buys into PSLDX without any fees. For example $100 weekly on Mondays. You have to call to set it up.

Hi John,

Could you comment on the HORRIBLE 6 mo returns on PSLDX and how you foresee this playing out in a riding interest rate environment?

NTSX has faired much better. I’m concerned about the viability of PSLDX and whether it should still be considered as a good place for max total return in a retirement account.

Thanks!

Why would I be concerned with 6 months of performance? As always, stay the course and ignore the short-term noise. I’m in it for the long-term.

@ B Smith –

The answer is that this is a leveraged fund, so it magnifies the market – both up and down. No free lunch, right?

Note that PSLDX has high volatility NAV – it pays to wait until it goes on sale. Opportunities come up every few years to get it at a discount. Like it is right now. Look at the historic NAV without dividends on a site like yahoo finance.

Check back after mid-March 2022, after Fed rate hike around March 15, one of several planned for this year. Will be interesting to see how far this leveraged bond fund dips when rates rise multiple times this year. PSLDX lagging the S&P is a short term situation … I think. As long as we are not in a multi-year S&P500 bear market, and as long as long bonds and stocks dont drag down together, then when the market rises again, if you bought low you you will be pleased. But don’t use all your eggs here, obviously.

Probably making this too complicated, but what are your thoughts on splitting the vti in half and putting in something like avuv or avus?

I read the arguments for diversifying using factor diversification and wondered if there was any merit to diversify across growth vs value and small-cap vs large-cap.

With VTI and UPRO, it already has a ton of exposure to large-cap growth.

That’d work, but this post is about PSLDX, not VTI.

Love your work, thank you for all the great content.

Looking at your “where to buy” section at the end of the post, I was most intrigued by the Firstrade option, given the modest minimum and NTF. However, when looking at opening an account there, it doesn’t seem to be listed in their library of available funds. Wondering how you confirmed its availability at Firstrade when you wrote this up? Did you call the brokerage directly?

Thanks in advance for your time.

Thanks, Chris! I honestly don’t recall because it’s been a while. Some cursory Googling shows me it was mentioned on the Bogleheads forum here and here.

John, is this a fund that you’d say has a “high upside” in a Roth IRA for someone in their early 20’s looking at retiring in thier 60’s?

Yep!

I was able to buy PSLDX at Vanguard in Roth IRA, couple of weeks ago. No issues, but initial purchase minimum 25K. Thanks

Can confirm the fund is still buyable at Firstrade. I opened an IRA and funded. 500 dollar initial buy, 100 dollar increments, no fees!

FYI there is a typo on the page: the third paragraph under “What Is PSLDX” says PSDLX instead of PSLDX.

Oops. Thanks!

I am having a heck of a time purchasing PSLDX in my Vanguard ROTH IRA Brokerage account. It is saying that the ticker symbol is not recognized. Do you have to transact it over the phone? Any other tips?

No experience with buying PSLDX at Vanguard, sorry.

I have bought PSLDX in Vanguard IRA and Roth IRA brokerage accounts. $25K minimum initial purchase. Two possible issues: a typo? Or, you may need to call Vanguard because some older vanguard accounts default to only allow vanguard mutual funds, but a phone call can fix it.

I am curious as to your thoughts about PSTKX and PISIX as leveraged replacements for an SP500 and EAFA fund respectively?. These are two other PIMCO StocksPLUS funds that are somewhat similar to PSLDX.

Not as familiar with those.

Would you please share the holdings and mutual funds that you utilized to simulate the backtests to 1986 for PSLDX and NSTX?

Thank you so much for such an informative site!

Here’s NTSX. Don’t remember what I used for PSLDX off the top of my head. Will circle back if I have time.

Hello!

Thank you for all of your time and effort on these posts. I appreciate how much is drawn from letting the data speak for itself.

Any plans on doing an article on the international flavor PISIX? It seems this has beaten VXUS by a good margin since its inception, and may be good for safe but leveraged international exposure.

I would be curious to see your take on this fund.

Thanks again!

In this article, you have the max drawdown of the HDEA portfolio as -65%. But the max drawdown mentioned in your other article (https://www.optimizedportfolio.com/hedgefundie-adventure/) has -49% as the max drawdown. Why is this?

Probably the rough approximation used here versus the actual simulation data used on the HFEA post. Also perhaps different time periods.

This article opened my eyes to PSLDX. I’m retired and so using it for two purposes in my IRA……#1. is for growth fund, and #2 is for additional income when desired by simply turning off “reinvest” to let dividends/cap gains go to cash because on an average this pays far more income than dividend stocks. Am I missing something here, do you see anything wrong with my using this in the way that I am??

Sounds good to me.

BTW, I’ve investigated trying to acquire PSLDX, and it can’t be bought or added to using Merrill Lynch Edge. They can hold it if you transfer it in, and you can DRIP it from there but not add to the position.

In addition, although the author is holding it in an Ally IRA, I contacted Ally and got the following reply from one of their support reps:

“I was able to conduct some research on PSLDX and see that we do not have the ability to allow for purchases of this fund. If you are a holder of this mutual fund already we can accept it via a transfer.”

So no go on Ally and PSLDX at the moment. I’m still investigating the other options listed to see what current policy is.

Interesting. Thanks for the info. I just logged in to my Ally account and I can still place a buy order for the fund, so maybe talk to someone else or just create an account and check for yourself.

I have invested in PSLDX since 2014. First through a TD Ameritrade cash account, which I then moved to a TDA IRA (2016), after realizing the tax inefficiency. I have now been able to get my 401K provider to add it as a “special” and that has allowed me to increase my investment in it – which is now considerable.

I feel the truly outstanding performance days of PSLDX (over the S&P) are past, because the bond market .now faces the negative interest rate barrier or the rising interest rate wall, but I am still comfortable with its “slower” future. However, I noted your liking for treasuries, and I am having difficulty in understanding that as a long term strategy. From where I sit, if I have a 30 year corporate/treasury bond mix I have a pretty much guaranteed 4+% return over the next 20 years – no matter what the nominal interest rates do in the intervening years. That way with PSLDX I can hope for S&P returns plus 85% of the 4+% long bond return if I hold for the long term. If on the other hand I am into treasuries (NTSX) that return from today is more like 60% of <1.8% long term. .

Can you tell me where I have it mixed up?

Thanks for the comment, Doug. You seem to be viewing the assets in isolation, rather than viewing the portfolio/strategy holistically. Not sure if you’ve seen them already, but I talked about treasuries being preferable alongside stocks here and then delved into bonds and interest rates a bit here.

You are of course quite correct. That concept makes my portfolio badly short treasuries.

It would seem from your article(s) on NTSX that some direct 500 equity swap to NTSX might offer a smart solution.

HI John

Nice article. I appreciate all the work that you have put in this article. Is “Replicating PSLDX” that you personally created, ok to hold in taxable account since its using treasuries only? Also is holding HFEA in a taxable account a good idea?

I was also curious if there is an easier way to know when you update article instead of clicking on each of them to see if there is any new updates.

Thank you for all that you do. I have become a better investor because of you. Pat.

Thanks, Pat. In terms of tax efficiency, none are ideal (except for NTSX), but from least to most tax-efficient it would probably be PSLDX > HFEA > PSLDX replication > MotoTrojan HFEA variant using EDV > NTSX. Hope this helps. Granted, I don’t even know that a broker would even let you buy PSLDX in taxable. As I noted on the HFEA page, using a broker like M1 with the auto rebalancing really helps with the LETFs in taxable because new deposits going to the underweight asset can do the rebalancing for you – at least initially – instead of having to incur taxes from selling.

Regarding knowing about updates, on my to-do list is to get better about sending out emails when new posts go up or when major updates happen to one. So far I’ve slacked on that and I also haven’t really wanted to annoy people unnecessarily with emails. So I’d say just sign up for that in the footer if you want to get on that list. I’d also likely post the same on Facebook and Twitter.

John – Great website and awesome details. I feel like stealing when reading your articles for free. Let me know if you have a link to donate/pay like Wikipedia.

I do not have a tax advantaged/sheltered account. I only have a taxable account. Also, I want to dollar cost average into PSLDX. Since the transaction fees are high at the big brokerages, my choices is to go with the replication suggested here (25% of 4 ETFs) at M1 and dollar cost average weekly or monthly. M1 has two types of re-balancing

Option 1 – automatic dynamic re-balancing where more new money goes into the underweight portion of the 4 ETF portfolio

Option 2 – We can do a manual re-balance buy hitting the re-balance button – this triggers a sells and buys to get back to the 25/25/25/25 breakdown for the 4 ETFs

My first question is, when you suggest re-balancing every 3 months – is it the Automatic Dynamic Re-balancing ( Option 1 above) or the Manual Re-balancing (Option 2 above).

My second question is – will this M1 re-balance strategy with the replicated ETFs (to replicate PSLDX) work and offer the tax efficiency like a tax advantaged account or it it not worth it.

The other option I have as I need dollar cost averaging in a taxable account, and also avoid the responsibility of re-balancing is to go with just NTSX ETF which is available at M1. Granted, performance won’t be as good as PSLDX but saves me

A – the hassle/pressure of re-balancing

B – and maybe give me tax efficiency in a taxable account.

C – better downside protection than PSLDX as NTSX is leveraged.

Kindly let me know .

Thanks for the kind words! No donations, but if you’re planning on buying anything on Amazon, you can click through one of those links and I’ll get a small cut and it won’t cost you anything extra.

Quarterly rebalance would be manual. Auto rebalancing is great until the new deposits aren’t large enough to balance things (great problem to have because it means you’ve had major growth).

Yes, I was going to say you’d probably be better suited with NTSX or the Mototrojan variant of Hedgefundie’s strategy that uses EDV.

Thanks John, I will be sure to go to Amazon thru your website.

Is the MotoTrojan HFEA variant using EDV with Manual Rebalance also tax efficient – asking as I have no choice but a taxable account and dollar cost average.

I will set reminder to do Manual Rebalance 1st of the month each quarter.

The MT variant would be comparatively more tax efficient than the regular HFEA, yes. But still ideally let the new deposits do the rebalancing for you to avoid taxes as much as possible. Or just use NTSX and put some margin on it.

Thanks John, will be sure to go thru your website to Amazon. I wish we had access to your expertise when I started out.

One thing I forgot to mention is my style of investing. As I do not have too much capital, I am a dollar cost average $100 or $200 every week and buy and hold kind of investor for really long term (10/15/20 years). Knowing this would you still suggest the below –

1 – 100% NTSX in taxable account

or

2 – Mototrojan variant of Hedgefundie’s in taxable account (doing the manual re-balance on M1 every quarter)

Do you have a backtest comparing these two? I want to minimize taxes and better downside protection.

NTSX with margin might be the most tax efficient way to go. I don’t have a backtest comparing those. You should be able to throw them into PV.

Did the expense of PSLDX go down? I’m seeing 0.61. I could have sworn it was over 1% and this article says the same. Can someone else confirm this? This is very significant.

Yes. I updated the article to reflect the new, lower ER. Your browser cache may still be serving the old page.

Trying to understand why you advise not to hold in a taxable account. The rebalancing is done by the fund managers so what are the tax consequences for just buy and hold?

Tax implications from turnover, rebalancing, distributions, etc. pass through to the investor.

If I own a fund like PSLDX, should I consider the bond portion of that fund as part of my desired stock/bond allocation? Or because it is leveraged should I not consider it part of my target allocation?

Sort of a philosophical question, and a good one, with no easy answer. I think I’d include the bond portion, but maybe with a grain of salt (lower % than what it really is) simply because PIMCO seem to prefer corporate bonds. Also probably depends on how much of the portfolio PSLDX is taking up.

Would self replicating it come with rebalancing overhead ? or can i leave the allocation as-is ?

i am trying to go hands-free and hence debating if i eat the PSLDX ER or self-replicate.

Would definitely require rebalancing.

Hi John

Excellent article, I wanted to ask you, if I invested half my portfolio value which is $1 Mil in PSLDX would it be wise.

Thanks Vinny! I can’t provide personalized advice, and you’d have to decide if that idea would fit your personal time horizon, risk tolerance, and objective(s), so I can’t really say whether or not that would be “wise.” Also depends on what the rest of the portfolio looks like. Consider consulting a professional for an hour or so to get their thoughts.

PSLDX is a quarterly dividend, correct? So does it really matter when I buy it? Just buy before the ex dividend date like any other dividend stock?

Looking to put 100k or so into it in a Roth acct.

Correct. Doesn’t matter when you buy any stock or fund.

If I’m a non us investor with an IBKR account (No capital gains/bond income tax) trying to decide between PSLDX or replicating it with the ETFs suggested here. What would be your thoughts, regarding pros vs cons between these two choices?

Thanks for the great article!

Depends on views on treasuries vs. corporate bonds and how truly hands-off you want to be.

45% QLD / 55% TYD beats PSLDX and with lower drawdown.

As does 45% UPRO / 55% TYD.

(Quarterly rebalancing, of course)

Ok. What’s your point? Those are both completely different from PSLDX and its intended exposure. Moreover, we can always construct a portfolio that looks better in a backtest.

Does M1 allow PSLDX?

Nope. No mutual funds at M1.

I would replicate PSLDX with 25/25/25/25 SPY/UPRO/TLT/TMF, which should have much less risk of fund closure and about half the ER.

Was thinking the same thing. Might do that. Thanks for the suggestion.

Hi, how about 43/57 UPRO/EDV. Does that also replicate PSLDX?

No.

Why TLT over VGLT?

Different indexes and thus different durations. TLT and TMF use the same index.

What are your thoughts about UBT’s tiny AUM? (Roughly $50 million.) Is there a case to be made for instead using TMF + cash to hit the treasury exposure?

Possibly a case to be made for that. Potential risk would be fund closure, in which case ProShares would notify you beforehand.

Chris, ended up making that switch to the more liquid funds.